Summary:

- Johnson & Johnson selected a vaccine to take to Phase 3.

- Another rival amyloid beta antibody could appear on the market next year.

- The antibodies are limited by safety restrictions which don’t involve Johnson & Johnson’s candidates.

Ildar Abulkhanov/iStock via Getty Images

November was a fateful month in the Alzheimer’s disease (or AD) field, as gantenerumab from Roche (OTCQX:RHHBY) bowed out with twin readout failures on the 14th, slowing cognitive decline relative to placebo by only 8% in GRADUATE I and by 6% in GRADUATE II after two years based on Clinical Dementia Rating-Sum of Boxes (CDR-SB) scores. On the opposite corner, Eisai (OTCPK:ESALY) and Biogen (BIIB) celebrated the publication on the 29th of full data from the Clarity AD trial in the New England Journal of Medicine (NEJM), with lecanemab reducing decline on the same CDR-SB scale by 27% versus placebo over 18 months. Lecanemab could clinch FDA approval on January 6, joining Biogen’s Aduhelm (aducanumab) as the only AD treatments directed at the underlying pathology of the disease, according to one of the two major schools of thought. All of these disease-modifying immunotherapies target amyloid beta plaques in the brain.

On the 30th, Johnson & Johnson (NYSE:JNJ), the world’s largest ($465 billion) healthcare products company, doubled down in the direction, selecting ACI-35.030, an anti-phosphorylated-Tau (pTau) vaccine candidate, to join its anti-tau antibody, JNJ-63733657, in further development. Long-term JNJ investors should see this as another plus.

Amyloid Hypothesis

In AD, there is abnormal cleavage of amyloid precursor protein into amyloid beta (Aβ) fragments 39 to 43 amino acids in size. The common Aβ42 is well-known to interact with numerous substances within the brain to form amyloid plaques (or senile plaques). A rarer Aβ43 cleavage product has been found to be highly neurotoxic and induces more amyloid products than shorter fragments. Aduhelm’s mechanism of action (significant reduction of Aβ in the cerebral cortex) supports the amyloid hypothesis, but its value remains unclear as far as efficacy, safety, cost effectiveness, or as a market leader. In two of the pivotal trials that were terminated early due to the futility of meeting the primary endpoint, only the high-dose arm (6 or 10 mg/kg) of EMERGE showed a modest statistically significant benefit of 22% vs. placebo on the CDR-SB (p=0.0120). Furthermore, patients on high-dose Aduhelm developed amyloid-related imaging abnormalities (or ARIA) 40% of the time compared to 10% for placebo subjects.

The FDA controversially approved Aduhelm in July 2021 for the highest dose regimen. Its counterpart, the European Medicines Agency, rejected the marketing authorization application (or MAA) for Aduhelm almost a year ago on December 16. At least 4 deaths were registered in the FDA’s adverse event reporting system (FAERS) database in 2021 out of an estimated patient population of 427. The earliest patient to pass away was also diagnosed with ARIA.

Biogen withdrew its MAA in April and abandoned further Aduhelm rollout to other countries, choosing to prioritize lecanemab. However, there have already been two fatalities linked to lecanemab. These are in addition to the six reported from the lecanemab group in the NEJM article, versus 7 in the placebo group; none of these deaths occurred with ARIA or attributed by the investigators to lecanemab. In comparison, there were zero deaths in Aduhelm clinical trials, but the drug doesn’t have much of a first-mover advantage and hasn’t gotten acceptance in the U.S.

Since its approval, Aduhelm has earned $6.5 million in sales. This is despite a price reduction for 2022 to an average yearly cost of around $28,000. Another factor in the paltry sum is that on April 7, the Centers for Medicare and Medicaid Services restricted Aduhelm coverage only for randomized, controlled trials (RCTs). The decision affects the whole class of anti-Aβ antibodies, including lecanemab.

Tau/Neurofibrillary Tangles Hypothesis

Tau is a microtubule protein in neurons that stabilizes the microtubular assembly. Normally, there is a balance of phosphorylated and dephosphorylated tau. In AD, upregulation of microtubule-associated kinases and downregulation of tau phosphatases cause hyperphosphorylation of tau that results in insoluble double-helical filaments. These, in turn, led to the formation of protein complexes/clumps known as neurofibrillary tangles (NFTs). These NFTs result in neuronal degeneration, and after the death of the affected cells they cause more damage when they are released extracellularly.

The most clinically-advanced tau immunotherapy is Axon Neuroscience’s AADvac1, which is only immunogenic against tau Axon Peptide 108 epitope. The Phase 2 ADAMANT trial found no statistically significant differences on the CDR-SB, although the company did try post-hoc to define a certain subgroup on which the vaccine slowed cognitive decline by a relative 32%.

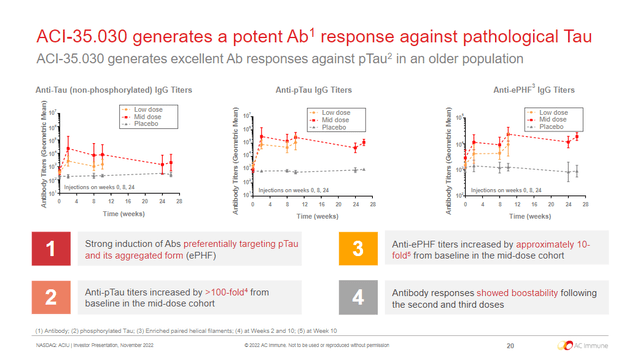

In contrast, ACI-35.030, developed in partnership with AC Immune (ACIU), was highlighted at the 2022 Clinical Trials on Alzheimer’s Disease conference on November 30 as having (see abstact OC-1):

“broad epitope coverage as binding occurred across the [phosphorylated tau (pTau)] sequences tested and importantly, without end terminal specificity.”

In the Phase 1b/2a multicenter, double-blind RCT, NCT04445831, all participants demonstrated dose-dependent IgG response after the 1st injection against tau and enriched paired helical filaments (Figure 1). The IgG also preferentially targeted pTau. There were no responders, defined as higher than a pretreatment value multiplied by a threshold factor (>~2x), from the placebo group. Hopefully, these qualities will help lead to better success than AADvac1 in future trials.

Figure 1. ACI-35.030 interim Phase 1b/2a results

AC Immune Investor Presentation

Takeaways

While there are at least 10 vaccines in the clinic directed towards Aβ, only two are anti-tau. With JNJ’s backing, ACI-35.030 may pull ahead of AADvac1, for which there has been no activity since last year. To conclude, ACI-35.030 could be a great asset for JNJ. Meanwhile, JNJ-63733657 is in a Phase 2 study lasting until 2025. Johnson & Johnson stock itself is a decent buy for its B+ rated dividend (2.49% yield), A+ rated profitability on $23.8 billion revenue in Q3, and as a defensive healthcare stock in this bear market.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.