Summary:

- Merck & Co. is likely to positively surprise the market on February 1, 2024 (estimated Q4 FY2023 release date), according to the findings of my analysis.

- The company’s Q3 performance exceeded expectations, driven by strong sales in the Oncology and Vaccines businesses, particularly the success of Keytruda.

- Merck’s strategic collaborations and pipeline developments contribute to a positive outlook, with significant revenue growth expected in the next few years. It might not be priced in yet.

- I calculate Merck’s equity value at ~$468.91 billion by the end of 2025. This means an upside potential of around 55.7% over the next two years.

- The implied volatility for MRK is low at its 76th percentile, indicating a potentially favorable setup for upcoming earnings. I rate the stock as a ‘Buy’ right before the Q4 release.

Erik S. Lesser

Thesis

In today’s article, I highlight the latest financials and corporate events of Merck & Co (NYSE:MRK), a global pharmaceutical company with a market cap of $300 billion and a focus on healthcare solutions, which is likely to positively surprise the market on February 1, 2024 (estimated Q4 FY2023 release date), according to the findings of my analysis.

The Company And Q3 Recap

Founded in 1891 and headquartered in Rahway, New Jersey, Merck & Co. operates worldwide, dividing its business into 2 main segments: Pharmaceutical and Animal Health.

In the Pharmaceutical segment, Merck develops and provides a wide range of human health pharmaceutical products, including treatments for oncology, hospital acute care, immunology, neuroscience, virology, cardiovascular issues, and diabetes. Additionally, they are a leading player in the vaccine business, offering preventive vaccines for pediatric, adolescent, and adult populations.

The Animal Health segment focuses on veterinary pharmaceuticals, vaccines, health management solutions, and digitally connected identification and monitoring products.

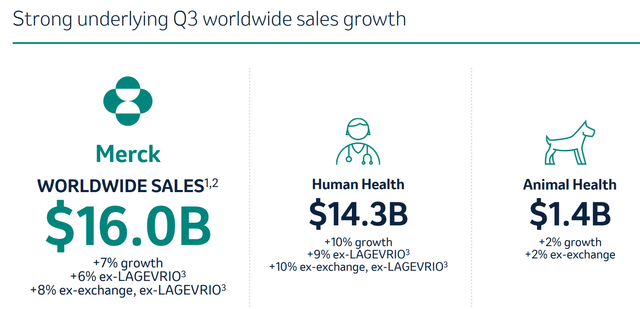

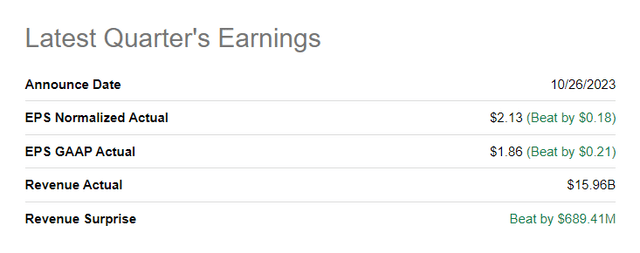

Merck’s Q3 2023 financial results, unveiled on October 26, 2023, showcased a robust performance that outpaced consensus expectations: the adjusted EPS of $2.13 (+15.14% YoY) surpassed forecasts by $0.18, while the top-line of $15.96 billion beat the consensus by ~4.5%:

The GAAP net income stood at $4.75 billion or $1.86 per share, demonstrating substantial growth compared to the previous year’s figures of $3.25 billion and $1.28 per share. The positive financial outcomes were largely attributed to the company’s thriving Oncology and Vaccines businesses, contributing to worldwide sales reaching $15.96 billion, reflecting a 7% reported and 9% operational increase. The success was driven by key products like Keytruda, Gardasil, and Lagevrio, with Keytruda alone accounting for 40% of Q3 revenue.

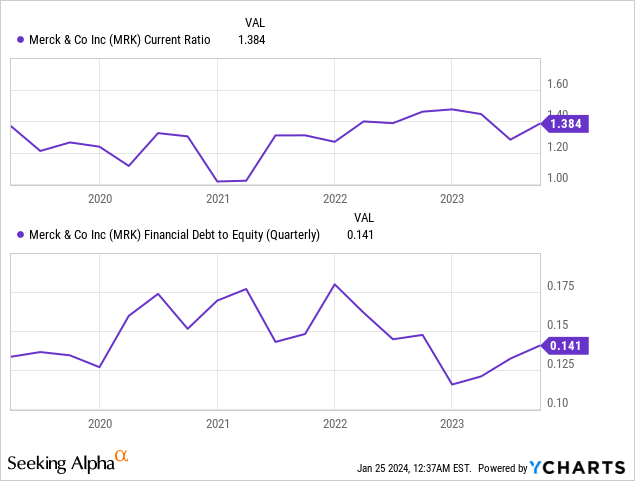

At the same time, the company has maintained the strength of its balance sheet: The current ratio is well above 1 and the debt-to-equity ratio is still quite low at 0.141, although it has increased somewhat recently.

Keytruda continued to be a stellar performer for Merck, with a reported revenue of $6.34 billion in Q3, marking a remarkable 17% growth in constant currency. The FDA’s recent approval of Keytruda for treating patients with locally advanced unresectable or metastatic biliary tract cancer and resectable non-small cell lung cancer (NSCLC) further solidified its position in the market.

According to FMI, the global biliary tract cancers treatment market was expected to garner a market value of $3.2 billion in 2023 and is set to accumulate a market value of $4.74 billion by registering a CAGR of 4% in the forecast period 2023 to 2033. Additionally, Mordor Intelligence estimates that the NSCLC market will register a CAGR of 9.5% during the next 5 years. Therefore, in my opinion, MRK has at least a favorable background for its future development in this direction and perhaps even a kind of lever for its market share expansion (until Keytruda loses exclusivity).

According to the management’s Q3 commentary, the expansion of Keytruda’s indications within the European Union, particularly for adjuvant treatment in adults with NSCLC and as a first-line treatment for advanced gastric or gastroesophageal junction adenocarcinoma, showcased the drug’s global significance. While Keytruda’s success was a pivotal factor in Merck’s strong Q3 performance, the company is strategically preparing for the impending loss of Keytruda’s marketing exclusivity in the U.S. and Europe in 2028, emphasizing its commitment to innovation and growth through internal development, M&A, and partnerships.

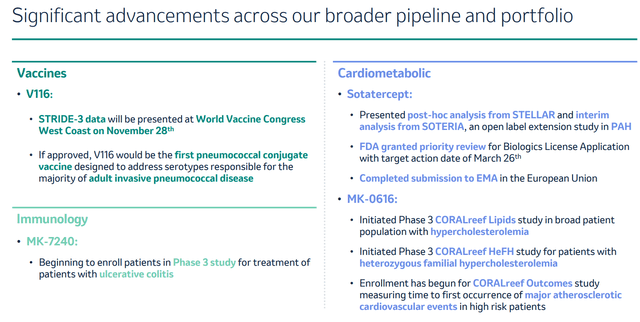

In addition to Keytruda, Merck’s diversified portfolio demonstrated promising developments. In October 2023, the company received positive CHMP opinions for Prevymis, indicating its potential approval for preventing cytomegalovirus (CMV) disease in high-risk adult kidney transplant recipients. Further, the FDA granted Priority Review for sotatercept, a treatment for Pulmonary Arterial Hypertension (PAH), with a target action date set for March 26, 2024. If approved, sotatercept would be a first-in-class medication for the rare and progressive disease.

The acceptance and Priority Review of the supplemental new drug application (SNDA) for Welireg in treating advanced renal cell carcinoma (RCC) added another dimension to Merck’s pipeline. The expanded indication for Ervebo, the Ebola Zaire vaccine, in the EU and the FDA’s approval for children aged 1 year and older enhanced Merck’s capabilities in addressing public health challenges.

The company’s strategic collaborations, such as the global venture with Daiichi Sankyo for three antibody-drug conjugates (ADCs), demonstrated its commitment to partnerships with the potential for substantial commercial revenue.

How Might All This Affect Q4 Earnings?

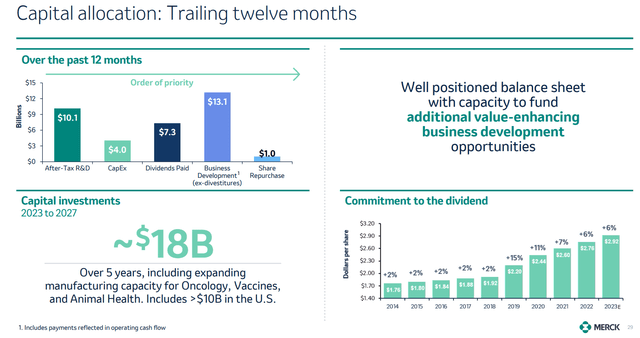

In many ways thanks to the strategic collaboration with Daiichi, MRK raised its full-year revenue guidance to a range of $59.7 to $60.2 billion, reflecting strong double-digit underlying year-over-year revenue growth of 11% to 12%. Operating expenses are estimated between $39.8 to $40.4 billion, including $5.5 billion for the Daiichi collaboration. The full-year tax rate is expected to be between 39% and 40%, with an underlying tax rate of approximately 14.5% to 15.5%. The company anticipates an EPS of $1.33 to $1.38, reflecting an increase from business strength, offset by a foreign exchange headwind. According to MRK’s CFO commentary, the company remains focused on investments, dividend commitments, and business development to ensure sustained growth and value delivery to stakeholders.

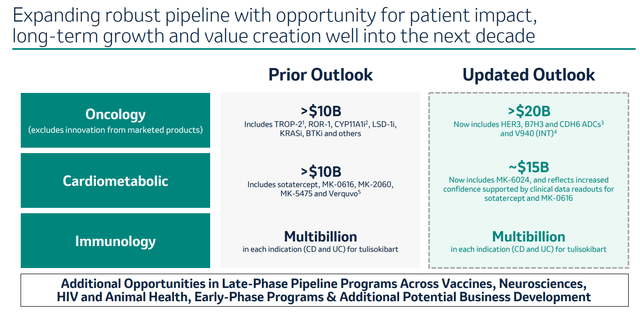

During the recent J.P. Morgan Healthcare Conference, Merck’s CEO Robert M. Davis discussed the company’s evolving narrative, shifting from being centered around key products like KEYTRUDA and GARDASIL to becoming a story of growth driven by new product launches. With notable launches expected in 2024, the company sees multibillion-dollar opportunities ahead, which should contribute to Merck’s sustained growth well into the next decade. Based on these expectations, management has significantly raised its outlook:

MRK’s slides on the recent JPM conference

And investors couldn’t help but like it – at least that’s what the momentum of the MRK stock following the Q3 earnings call and the JPM conference shows:

Seeking Alpha, MRK

I definitely like management’s updated outlook and Merck’s approach to shareholder returns, but analysts at Goldman Sachs (January 24, 2024 – proprietary source) doubt that the updated guidance is currently properly reflected in MRK’s stock price. They express high confidence in Merck’s end-of-decade revenue trajectory, attributing it to astute business development efforts, operational execution, and consistent pipeline progress.

And indeed, the increasing penetration of earlier-line treatment settings is expected to drive the next phase of Keytruda’s growth, accounting for 50% of overall product growth through FY2025. At the same time, the Gardasil vaccine is expected to register continued strong growth, supported by supply chain improvements and its broad opportunity set across geographies, ages, and genders. Gardasil’s growth is likely to be more moderate than the impressive levels seen last year. In conjunction with the success of Keytruda, however, MRK’s rather modest EPS consensus forecasts could be revised upwards, which will be a very good reason for further growth in the stock price.

In addition to the above reasons for being positive regarding upcoming Q4 earnings, Goldman Sachs expects timely FDA approvals for both sotatercept and V116 based on positive data reported in FY2023. If management hints during the earnings call about the impending FDA approval, this could clearly be a promising catalyst for growth.

But in many ways, the stock’s reserves of strength and direction of movement after the Q4 release will depend on MRK’s current valuation levels. Perhaps the potential growth is already reflected in the price? Let’s find out together.

The Valuation

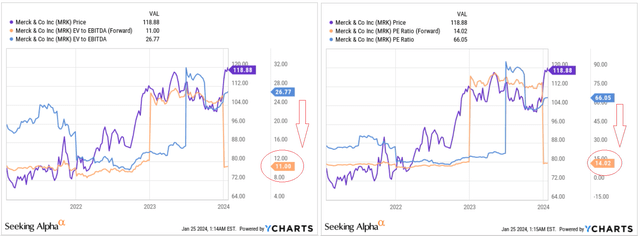

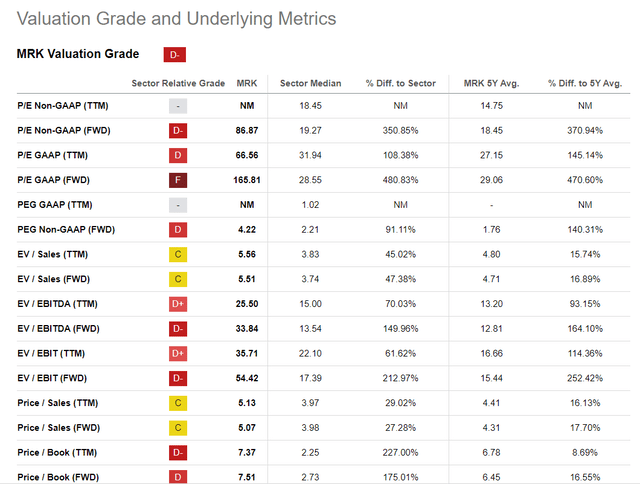

According to Seeking Alpha’s Quant System, MRK has a rating of “D-“, which is relatively weak compared to the median of the healthcare sector.

Seeking Alpha, MRK’s Valuation Grades

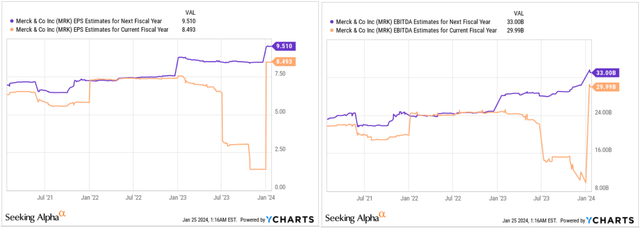

On closer inspection, however, we see that MRK’s multiples are so expensive today because a strong increase in EBITDA and EPS is expected in FY2025:

YCharts, the author’s compilation

The forward valuation multiples therefore do not support the thesis that the MRK stock is expensive. If an investor buys the MRK stock today and does not want to sell it for at least the next few years, the prospective total returns look huge if the current consensus estimates are at least somewhat close to the truth.

When we talk about the near future, we should think about what EV/EBITDA multiple we can consider “fair” concerning MRK. The sector mean today is 13.54x, but Merck is the giant that deserves a premium due to its size. I think 15x would be appropriate. With a projected EBITDA of $33 billion in FY2025 and net debt of ~$26 billion today, the implied equity value should be ~$468.91 billion by the end of 2025. This means an upside potential of around 55.7% over the next two years.

But the upside I calculated above is a medium-term target. Anything can happen in the next 2 years.

So is it worth buying the MRK stock a few days before the scheduled Q4 report?

The answer depends on your investment horizon. If your goal is to hold MRK for the next 2-3 years, I think you can buy now. If you want to wait for more attractive prices, it may be worth waiting. Why? Because MRK could disappoint with its Q4 results. First, in recent conferences, management has already raised market expectations for future growth rates. Therefore, it might be difficult for Merck to surprise investors with something in its Q4 earnings release. This may lead to profit-taking by speculators. Secondly, pay attention to the priced-in EPS expectations for FY2023: They are at the upper end of the guided range and exceed the median range by $0.025 or ~1.84%. This means that the market is paying a kind of premium to management’s mid-range forecasts, which increases the risk of an earnings miss this time.

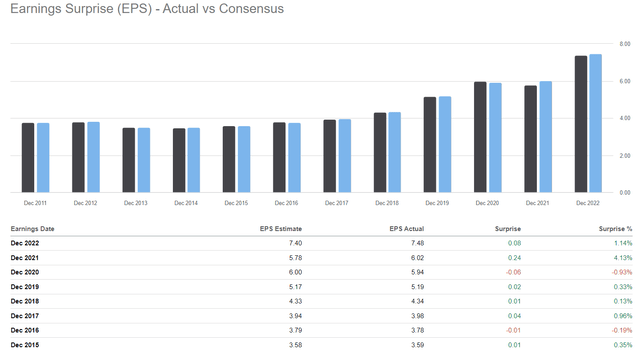

In the last 8 years, MRK has only missed the EPS consensus twice, but that does not mean that the risk of missing it this time is low.

Seeking Alpha, MRK’s EPS surprises

General Risks

I want to note, that investing in Merck & Co. carries inherent risks common to the pharmaceutical industry. First off, the company faces substantial uncertainties related to its drug pipeline, including the outcomes of clinical trials, regulatory approvals, and market performance of key products like KEYTRUDA.

Patent expirations pose a threat, potentially leading to generic competition and revenue decline. Moreover, Merck’s heavy reliance on a few key products, susceptibility to research and development setbacks, and vulnerability to global health crises underscore the multifaceted nature of risks associated with investing in this pharmaceutical giant.

Conclusion

Despite the additional risk that MRK will not be able to beat its estimates for the fourth quarter and financial year 2023, I believe that the company, with its strong pipeline, solid financial position, and favorable valuation, is also very well positioned in the medium term if we look beyond this year. I therefore rate the stock as a ‘Buy’ this time, assuming continuation of its outperformance in the next 2 years.

If we return to the approaching Q4, I would like to note the forecast of Goldman Sachs, but this time from options experts:

The implied volatility for MRK is relatively low at its 76th percentile, indicating a potentially favorable setup for upcoming earnings. The put-call skew is in its 16th percentile, suggesting bullish positioning by options investors.

Source: GS (proprietary data), paraphrased by the author

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MRK over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!