Summary:

- American Airlines’ Q4 revenue dropped while full-year earnings surged, showing strong execution.

- The company continues to deleverage, reducing debt by $11.4 billion since its peak in 2021.

- AAL expects up to 9% profit margins in 2024, but managing costs and protecting yield will be a challenge.

Bruce Bennett

American Airlines (NASDAQ:AAL) is one of the airline stocks that I have a hold rating on. I quite like where the company is heading focusing its business operations and improving its balance sheet. At the same time, however, it does seem that while the standard message that management has that they are tracking well on their targets and the AAdvantage member program is bringing in a bigger share of the revenues, the margins that American Airlines produces continue to trail that of United Airlines (UAL) and Delta Air Lines (DAL).

In this report, I will be analyzing the most recent results, analyze the guidance for 2024, and update my price target for American Airlines stock.

American Airlines Revenue Falls In Q4 But Full-Year Earnings Surge

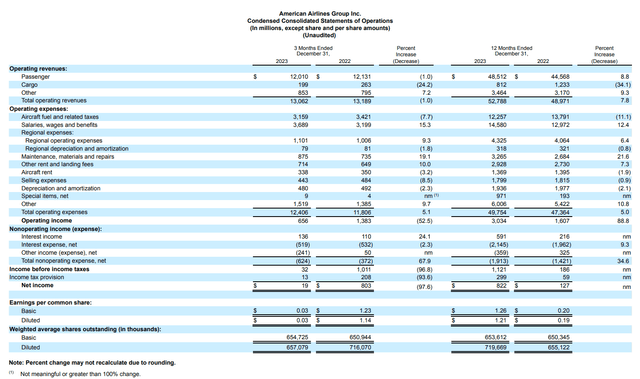

When looking at the Q4 results, we already see a big difference compared to United and that is that revenue dropped on a 5.8% expansion in capacity. Total cost rose 5.1% during the quarter with operating income declining from $1,383 million to $656 million driven by $127 million lower revenues, a $490 million increase in salaries, wages, and benefits as well as higher maintenance costs and regional expenses. Fed through to EBIT level, barely anything of the profit remained in Q4.

For the full year, revenues increased 7.8% on a 6.7% increase in capacity, so that is still appreciable growth in revenues and passenger revenues even grew 8.8%. Total costs grew 5% and cost ex-fuel increased by around 12%. So, overall, we do see an increase in profitability but we are also seeing the higher cost basis trickling through. Nevertheless, adjusted unit costs excluding fuel were up just 2.5 which is similar to what we see United Airlines reporting. So, while American’s Q4 results were not all that impressive to me, the full-year earnings did show strong execution.

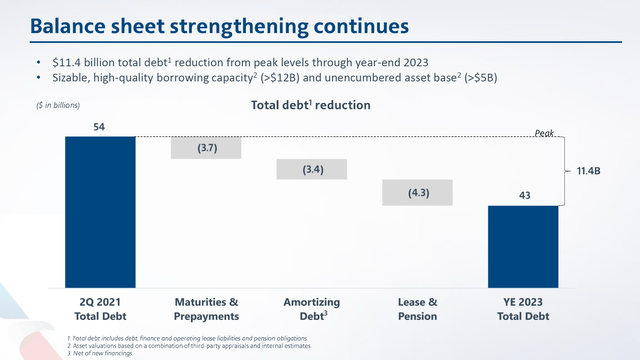

American Airlines Continues Deleveraging Path

One thing that I certainly do like is the continued deleveraging. In total, since the peak in 2021, debt has come down by $11.4 billion including net debt reductions of nearly $3 billion in 2023. That is the kind of cash deployment I deem to be prudent.

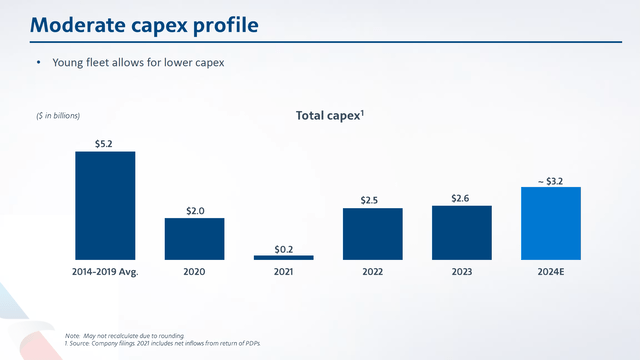

Furthermore, the 2024 CapEx levels are elevated compared to the prior two years but they still stand at a significantly lower level compared to the 2014-2019 average. So, 2024 will not be a year of huge changes in fleet size but more of increasing utilization to drive value and the company expects utilization to improve by 2 to 4 percent and drive $400 million in cost savings due to the use of digital solutions.

American Airlines Guides For Up to 9% Margins in 2024

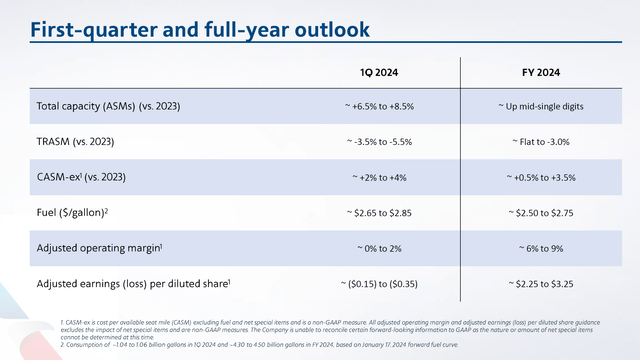

For the first quarter, American Airlines sees capacity growth of 6.5 to 8.5 percent but its TRASM will be subdued and while one would rather not see TRASM dip, if we look at the strong demand the past two years, then it is difficult to continue setting new highs in TRASM. Demand is without doubt still there, but more and more industry constraints to supply are dissolving and that also softens the TRASM somewhat. Unit costs are expected to be up 2 to 4 percent and that is not odd either given the higher costs we are seeing for salaries and wages. All in all, the company expects to break even or a 2% profit margin for the first quarter and that is realistic. The first quarter is never a strong quarter for travel, so looking at the full year is somewhat more meaningful to judge against.

Capacity is expected to be up mid-single digits and we see that both the unit revenues and unit cost excluding fuel will be slightly worse to flat and that is really what will be the challenge for American Airlines in 2024: managing costs while also protecting yield as much as possible. Putting it simply, it means that American Airlines or its competitors should be unwise to throw in capacity on the market as the pricing strength could buckle under the load of additional capacity. So, a prudent approach is required and when executed correctly, the company expects 6 to 9 percent profit margins. At the mid-point, American Airlines is guiding at stable margins which I believe shows that preserving profitability could be a challenge.

American Airlines Stock Can Fly Higher

Previously, I had a hold rating on American Airlines stock and I was not unhappy with that rating. The stock price, however, developed positively with a 32% appreciation compared to a 14% gain for the broader market and it shows that sometimes panic selling with lock you in losses rather than market outperforming recoveries.

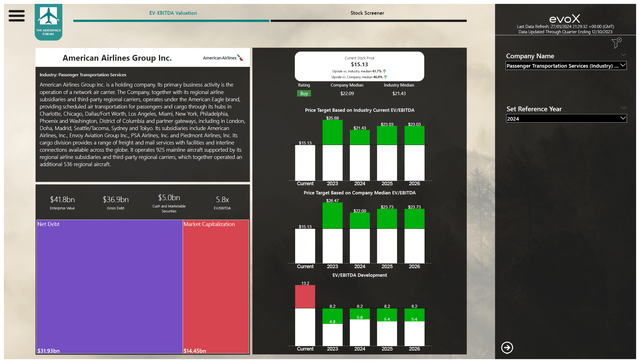

I have processed the balance sheet data for American Airlines as well as the forward projections and based on those projections I believe that American Airlines stock has room to climb even higher. I would put the upside at roughly 40% with a $21.45 price target and a buy rating.

Conclusion: American Airlines Guides Ahead Of Expectations And Upside Exists

There is no doubt that the execution path is going to be challenging for airlines in 2024 and American Airlines is not among the top margin performers, I also don’t expect the company to be there but I certainly do like the balance sheet recovery and expect that a prudent approach as we are seeing now will eventually result in higher value for shareholders. As a result, I am upgrading American Airlines stock to buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.