Summary:

- Accenture is a prominent company in the IT sector known for its resilience and adaptability in a dynamic industry.

- The company has seen significant sales and EPS growth over the past decade, driven by strategic acquisitions and cost optimization.

- While Accenture has opportunities for growth, its high valuation raises concerns about investment attractiveness, making it a HOLD.

JHVEPhoto

Introduction

In the rapidly evolving landscape of the IT (information technology) sector, companies focusing on innovation and strategic growth tend to succeed. This sector, desirable for its resilience and adaptability in economic shifts, is often chosen by investors seeking robust and future-proof investments. Accenture (NYSE:ACN), a global professional services and consulting giant, emerges as a prominent company. Accenture is renowned for its vast services, from strategy and consulting to digital transformation and technology. In this analysis, I explore why Accenture, mainly due to its high valuation, is a HOLD.

Accenture’s position in the technology sector is not just about its size or revenue but about its ability to constantly reinvent itself in a highly dynamic industry, adapt to new tech, and, more than that, offer tech improvement to low-tech companies. The company has successfully navigated various technological eras, consistently emerging as a leader in new digital frontiers. This resilience and adaptability make it an interesting investment in a constantly evolving sector.

Seeking Alpha’s company overview shows that:

Accenture is a professional services company that provides strategy, consulting, as well as technology, and operation services worldwide. The company offers application services, including agile transformation, DevOps, application modernization, enterprise architecture, software, and quality engineering, data management, intelligent automation comprising robotic process automation, natural language processing, and virtual agents, and application management services, as well as software engineering services, strategy and consulting services, data and analytics strategy, data discovery and augmentation, data management and beyond, data democratization, and industrialized solutions comprising turnkey analytics and artificial intelligence (AI) solutions, and more.

Fundamentals

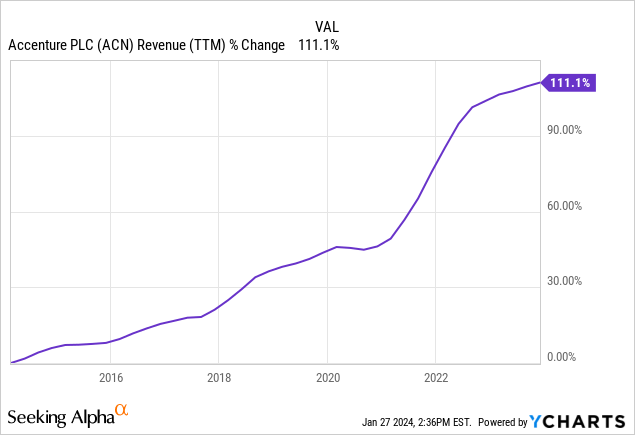

Over the past decade, Accenture’s sales have seen a significant increase of 111%, proof of its robust organic growth strategies and targeted acquisitions. The company has integrated over 30 companies during this period, focusing on enhancing its value proposition in critical areas such as cloud, sustainability, digital transformation, and cybersecurity. The acquisition may not be meaningful to the top line, yet the new capabilities allow the company to maintain and accelerate growth. Seeking Alpha shows analysts anticipate a continued annual sales growth rate of approximately 6.5% in the medium term.

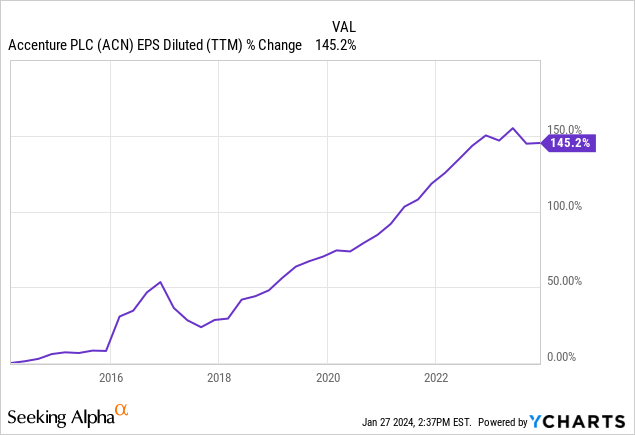

Accenture’s EPS (earnings per share) has seen an impressive surge of 145% over the same period, resulting from strategic sales growth and margin expansion achieved through scalability and cost optimization. The acquisitions mentioned in the previous paragraphs allowed the company to expand its offering and make it more unique and a one-stop shop for tech needs so the company could increase prices and margins. Seeking Alpha shows analysts anticipate a continued annual EPS growth rate of approximately 9% in the medium term.

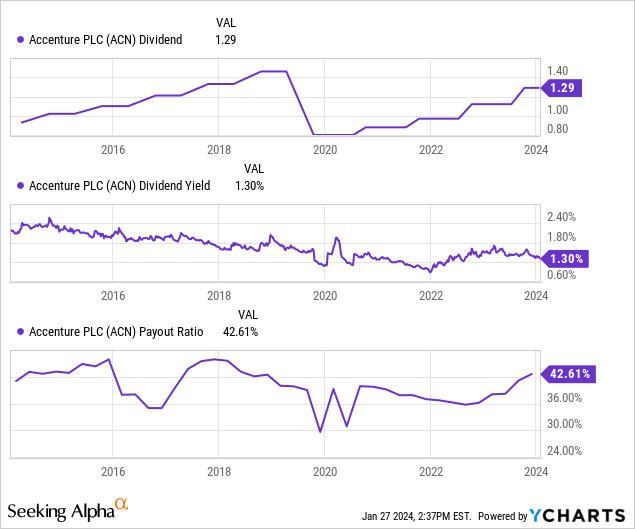

The company’s dividend history is also impressive, as it is on its way to becoming a dividend aristocrat. The company offers a streak of 18 years without dividend reduction. The recent transition from semi-annual to quarterly dividend payments may have appeared as a decline in dividend graphs, but it’s misleading. In September 2023, shareholders enjoyed a 15% increase. With a payout ratio of 42%, the dividend yield stands at 1.3%, suggesting a sustainable, safe dividend. Still, in the future, dividend growth will likely be closely aligned with the EPS growth of 7-9%.

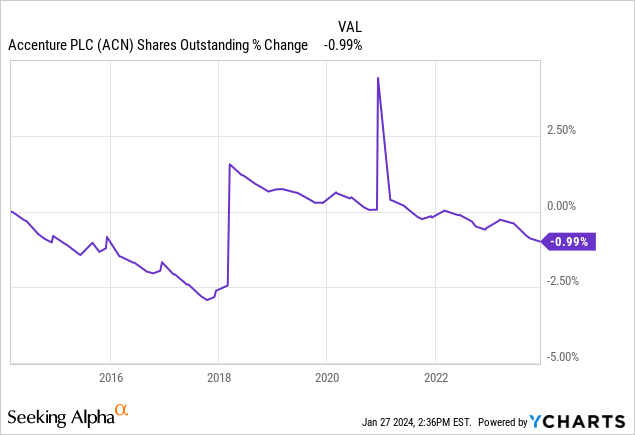

Accenture has maintained a conservative buyback approach, focusing primarily on counteracting dilution. Over the last decade, the share count has decreased by a modest 1%. This strategy reflects the company’s capital allocation, which focuses on dividends and spends very little on buybacks despite its ability to support EPS growth in the long term. This strategy makes sense, especially considering the relatively high valuation of its shares.

Valuation

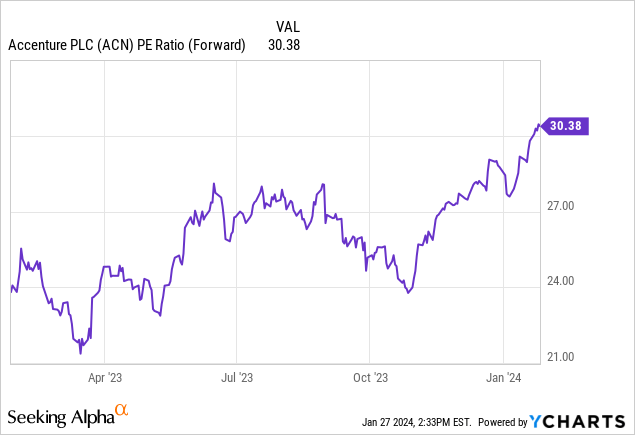

Accenture’s current P/E ratio, based on 2024 EPS estimates, is at 30, the highest observed in the last twelve months. Given the company’s annual growth rate of 9%, this valuation poses a challenge to justify. While reflective of its market stature, the premium pricing of Accenture’s shares raises questions about investment attractiveness at these levels. I find it very hard to justify such a premium with such a decent, yet not extraordinary, growth rate.

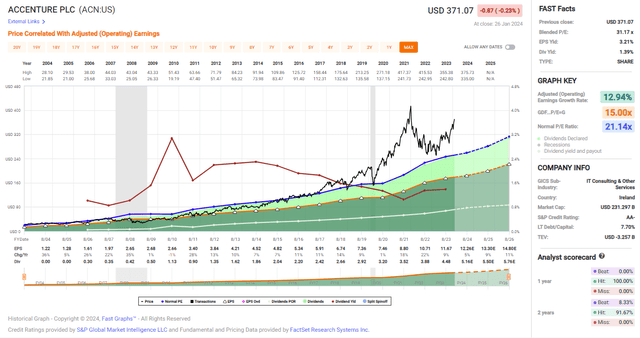

The graph below from Fast Graphs also implies that Accenture appears expensive compared to its historical averages. Over the past 20 years, the company’s average P/E ratio was 21, significantly lower than the current 30. This massive gap is further highlighted by the shift from an average growth rate of 13% to the current 9%, indicating a scenario of higher valuation coupled with slower growth. Investors are willing to give Accenture a significant premium, while the fundamentals do not justify it.

Opportunities

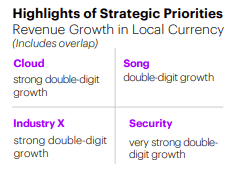

Accenture’s strategic focus on expanding its digital and cloud capabilities is the most critical growth avenue with the most significant growth potential. While cloud migration and computing have been with us for a decade already, these areas are still growing at a double-digit rate. Accenture is a leading player in helping organizations with it. Moreover, as businesses increasingly move towards digital platforms, the demand for cybersecurity and digital transformation expertise is expected to rise. This strategic focus aligns well with Accenture’s core competencies and strategic acquisitions in these areas.

“Our competitive advantage really is our investment capacity that allows us to pivot to higher areas of growth. And we can do that and invest through every cycle, and you’ve seen us do that. And I really think that is clearly a differentiator for us.”

(KC McClure – Chief Financial Officer, Q1 2024 Conference call)

Accenture

Another area of opportunity lies in Accenture’s commitment to sustainability. Integrating sustainability services into its consulting practices meets the growing demand for eco-friendly business solutions and aligns with global environmental goals. This positions Accenture at the forefront of sustainable business practices, a crucial differentiator in the modern corporate world. Accenture can expand its one-stop shop with another field of expertise becoming more critical, especially in the tech business, where ESG is well observed.

“Today’s rapid acceleration to digital presents us with a breakthrough opportunity to create a more sustainable future.”

(Julie Sweet, Chair and Chief Executive Officer)

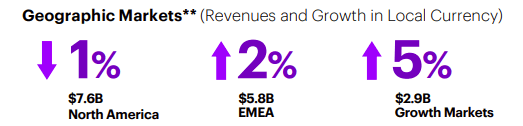

Lastly, Accenture’s geographical and industry diversification underpins its growth strategy. By not relying on a single market or sector, the company mitigates risks associated with market fluctuations, ensuring a steady growth trajectory across diverse economic conditions. The company operates across every continent. Thus, it can reduce weakness in North America. Its business is focused in North America and Europe. It helps both pure tech companies and financial giants like the Spanish BBVA bank and McDonald’s, where it leverages tech to improve services. It does so by acquiring companies worldwide to expand its reach and offering. Today, the majority of its business comes from outside North America.

“We help leaders such as BBVA, a global financial services group, to stay ahead of the curve by continuing to reinvent its business model with GenAI.”

(Julie Sweet, Chair and Chief Executive Officer, Q1 2024 Conference call)

Accenture

Risks

One of the primary risks facing Accenture relates to economic uncertainties. Businesses may tighten budgets in an environment of global financial volatility, potentially impacting consulting and technology projects. This could reduce demand for Accenture’s services, particularly in industries or regions experiencing economic downturns. Projects like cloud migration that later will require more cyber investments may be delayed, thus postponing revenues for the company in the short term when business uncertainty is high.

“A little trouble in the line. Okay. Is that there – as we have lower discretionary spend, that does impact the conversion (from bookings to revenues), but we have factored that all into our guidance.”

(KC McClure, Chief Financial Officer, Q1 2024 Conference call)

Another risk is the intense competition in the technology consulting sector. As more companies enter this space, Accenture faces the challenge of maintaining its market leadership and differentiating its services in a crowded market. This competition could impact pricing, profit margins, and market share. If once Accenture was the sole leader of this realm, today we see many consulting firms such as McKinsey and Deloitte active in the realm, as can be seen in the McKinsey Cloud offering.

Lastly, the rapid pace of technological change poses a risk. Accenture must constantly adapt and invest in new technologies and skills to remain relevant. Failure to keep pace with technological advancements could result in losing a competitive edge. The company knows its needs and is on track to assimilate more acquisitions. However, this is a hazardous strategy. The company must keep executing M&A well, incorporate outside knowledge into its corporate knowledge base, and leverage it to increase sales, as the acquisitions are not accretive to revenues or EPS.

“Our competitive advantage really is our investment capacity that allows us to pivot to higher areas of growth. And we can do that and invest through every cycle, and you’ve seen us do that. And I really think that is clearly a differentiator for us.”

(Julie Sweet, Chair and Chief Executive Officer, Q1 2024 Conference call)

Conclusions

In conclusion, Accenture stands out as a leading company in the technology consulting sector, demonstrated by its impressive track record in sales and EPS growth, commitment to dividends, and strategic acquisitions. The company’s focus on digital transformation, cloud computing, and sustainability aligns well with current and future market trends, providing substantial growth opportunities. Its global footprint and diverse industry focus further enhance its resilience and growth prospects.

However, as reflected in the P/E ratio and Fast Graphs analysis, the current high valuation and the risks posed by economic uncertainties, competitive pressures, and the need for continuous technological adaptation suggest caution. The combination of these factors leads to a HOLD recommendation for Accenture. While the company exhibits strong fundamentals and clear growth opportunities, the high valuation doesn’t leave enough margin of safety to deal with the risks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.