Summary:

- Altria Group is expected to announce declining revenue, profits, and adjusted profits for the final quarter of its 2023 fiscal year.

- The company’s market share continues to decline, and unless there is robust growth in recent initiatives, a pessimistic outlook may be warranted.

- Investors should pay attention to revenue, profits, and cash flows, as well as the company’s smokeless products like NJOY, to gauge potential growth.

Mario Tama

In the next couple of days, the management team at tobacco giant Altria Group (NYSE:MO) is expected to announce financial results covering the final quarter of the company’s 2023 fiscal year. Leading up to that time, analysts have rather dour expectations. Revenue, profits, and adjusted profits are all expected to decline year over year. If history is to repeat itself, we might actually see certain cash flow metrics improve. But the overall trend of financials outside of that is rather discouraging. Up to this point, cash flows have remained robust enough to guarantee the distribution. I don’t see any risk of that changing in the near term. However, the continued loss of market share for the business is discouraging. So unless management can show robust growth in some of its more recent initiatives, a more pessimistic outlook might be warranted.

This might come as a surprise to those who follow my work on the company. The last article that I published about it, which came out in October of 2023, called the company an attractive opportunity leading into third quarter earnings. I acknowledged in that article that the business would likely experience continued pain. And sure enough, that is what came to pass. Revenue, adjusted profits, and some cash flow metrics actually worsened year over year. Market share continued to plunge during this time as well. But management remains optimistic about what the future holds.

Fast forward to today, and shares of the company are still attractively priced. But at some point, the bleeding needs to stop. So long as cash flows remain robust, the company can pay out its rather lofty distribution that currently equates to a yield of 9.75%. But even with that yield, shares continue to underperform. Since I wrote about the company last October, with the distribution included, shares have seen downside of 2.7%. That compares to the 17% rise seen by the S&P 500. Given this underperformance, not to mention the weaknesses anticipated and the continued decline in market share, I am downgrading the company from a ‘buy’ to a ‘hold’ until we can see some more robust figures come out.

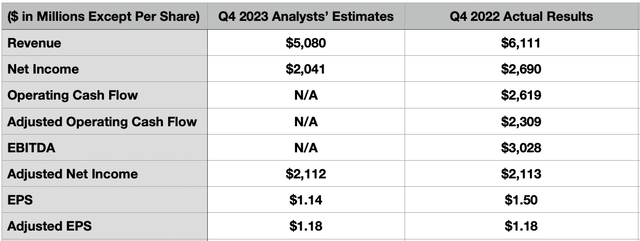

Keep an eye on headline items

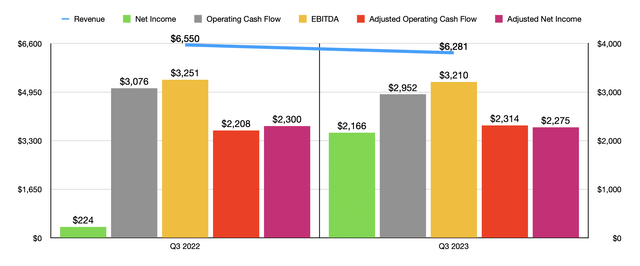

The first thing that investors should be paying attention to when management reports results before the market opens on February 1st would be revenue, profits, and cash flows. Analysts currently believe that sales will come in at $5.08 billion. If this comes to fruition, it would represent a 16.9% drop and sales compared to the $6.11 billion reported one year earlier. To be perfectly honest, this drop does seem a bit excessive. The decline from the third quarter of 2022 to the third quarter of 2023 was a more modest 4.1%. And for the first nine months of 2023 relative to the same time one year earlier, it was 2.5%.

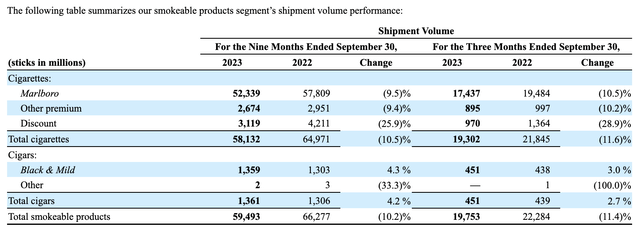

Regardless of what the outcome is, there’s almost a guarantee that the firm will see a decline in volume associated with cigarettes. In the third quarter, total volumes shipped came out to 19.30 billion sticks. That was 11.6% lower than the 21.85 billion sticks reported in the third quarter of 2022. This year over year decline was even worse than the 10.5% drop seen in the first nine months of 2023 relative to the same time one year earlier. Cigar volumes might increase. But at just 451 million sticks in the third quarter, they are more or less a rounding error for the business.

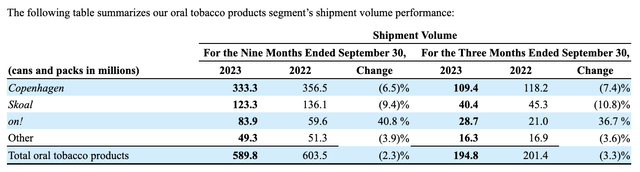

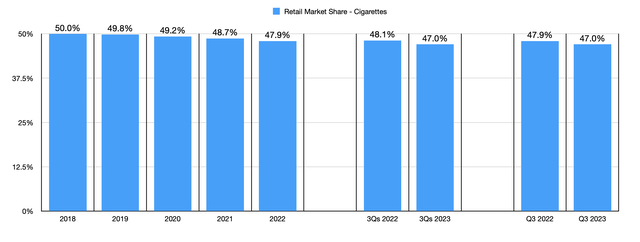

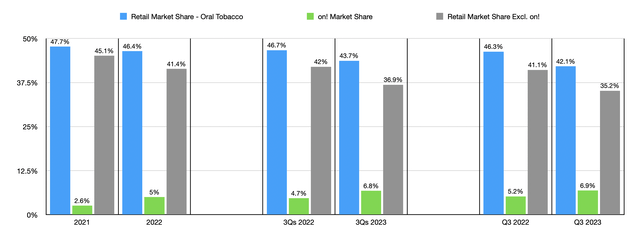

It is true that many markets for the tobacco industry are in a state of decline. But Altria Group is suffering more than most. Its retail market share as of the end of the third quarter was 47%. This was down from the 47.9% seen one year earlier. In fact, if you look at the chart below, you can see how the market share has gradually declined over the past several quarters. As a note, this covers only the cigarettes for the company. But in the chart below that, you can also see a similar decline in market share associated with oral tobacco products. This is a much smaller part of the company by comparison. But shipment volumes have been plunging. In the most recent quarter, they totaled 194.8 million cans or packs. That’s down 3.3% from the 201.4 million cans or packs reported a year before that. Even that data is a little deceptive though. That’s because, included in that group, is on!, which is an oral nicotine pouch the thief business sells. It reported sales in the third quarter of 2023 of 28.7 million units. That’s 36.7% above the 21 million reported one year earlier. If we remove that from the equation, oral tobacco product volumes dropped 7.9% year over year, with market share dropping from 41.1% to 35.2%.

Author – SEC EDGAR Data Author – SEC EDGAR Data

If we are going to see growth, another area that investors should look at involves the company’s smokeless products like NJOY. Management paid $2.75 billion for this business in 2023. On top of this, they could end up paying additional funds depending on growth. The goal that management had set was to reach 70,000 stores for the NJOY ACE to be sold at by the end of 2023. By the end of the third quarter, they had reached 42,000 stores and had achieved 7.5 million pod sales in the span of only three months. They still believed then that the 70,000 store count target was possible, which would mean that the product would be available at outlets and convenience channels that account for 70% of e-vapor volume and 55% of cigarette volume across the US.

Moving to the bottom line, the current expectation by analysts would be net profits of $1.14 per share, with adjusted profits of $1.18 per share. This would translate to net income of $2.04 billion and adjusted profits of $2.11 billion. By comparison, these figures at the end of 2022 totaled $2.69 billion and $2.11 billion, respectively. No other guidance was given when it came to profitability metrics. But as you can see in the table above, I put not only the revenue and profit figures, but also certain cash flow metrics that investors should be paying attention to for when the company does report.

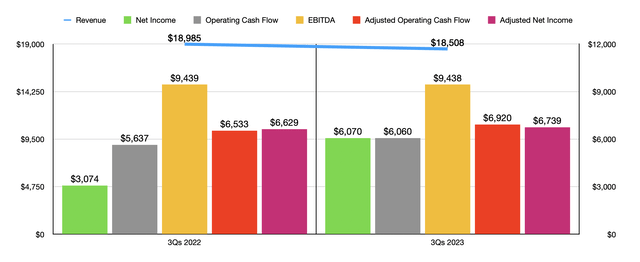

Speaking of cash flow, a big reason why investors buy shares of Altria Group is for the distribution. Like I said already, its current yield is 9.75%. That is incredibly high for a publicly traded business. The good news is that the distribution is almost certainly stable for now. Take, as an example, the first nine months of 2023. Management reported adjusted operating cash flow of $6.92 billion. They paid $732 million out in the form of stock buybacks and paid out $5.04 billion toward common stock. Excluding the stock buybacks, the firm needed only 72.8% of its adjusted operating cash flow to cover these outlays. If we include the stock buybacks, this rises to 83.4%. It would be fair to point out that capital expenditures should also be factored in. But during the first nine months of 2023, the business only required $143 million on this front. That’s 2.1% of all adjusted operating cash flow. So even if we strip this out, the distribution is solid.

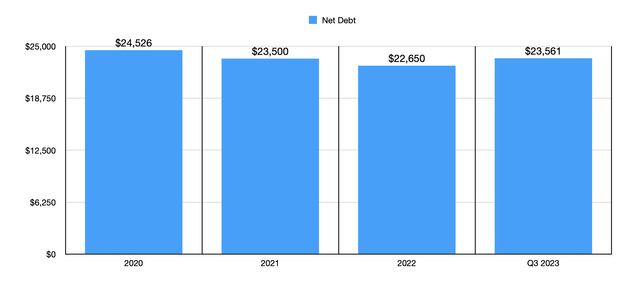

This does bring to mind one other item that would be important for investors to take a close look at. And that would be debt. From 2020 through 2022, net debt at the business had dropped from $24.53 billion to $22.65 billion. This is great to see. But by the third quarter of 2023, because of acquisition based activities that were only partially offset by other proceeds such as the sale of its IQOS System commercialization rights that brought in $1.70 billion, net debt had risen to $23.56 billion. Based on my own estimates for this year, EBITDA should be somewhere around $12.53 billion. That implies a net leverage ratio of only 1.88. That’s far from dangerous territory. But with the company’s core markets in decline, it may not be a bad idea to continue pushing overall debt lower.

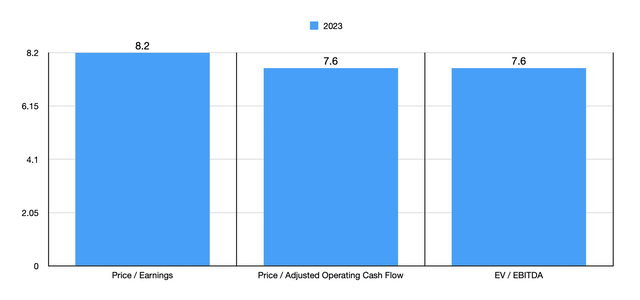

At this time, I am feeling a bit pessimistic on matters myself. Although there are some bright spots that have the potential to shine through, the continued drop in market share and forecasted weakness from analysts is discouraging. The company does have some nice long-term catalysts, but these still account for only a small portion of the overall pie. The distribution is fine, but it won’t be forever if something doesn’t change. The good news is that, based on 2023 estimates, and as shown in the chart below, shares do look attractively priced. But sometimes, a company deserves to trade on the cheap.

Takeaway

On a personal level, I have never liked tobacco companies. Tobacco consumption has claimed the lives of all four of my grandparents, as well as aunts, uncles, and other family members. I have a dear friend who is likely to succumb to it in the future as well. But when it comes to investing, personal feelings should not matter. Last year, because of the growth initiatives for the business and the robust cash flows the firm was generating, I was bullish enough on the enterprise to rate it a ‘buy’. But with 2024 now here and continued weakness in some very important areas, not to mention continued expected weakness moving forward, I believe that a more cautious approach is warranted. So because of that, I’m downgrading the stock to a ‘hold’ for now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights is an exclusive community of investors who have a taste for oil and natural gas firms. Our main interest is on cash flow and the value and growth prospects that generate the strongest potential for investors. You get access to a 50+ stock model account, in-depth cash flow analyses of E&P firms, and a Live Chat where members can share their knowledge and experiences with one another. Sign up now and your first two weeks are free!