Summary:

- Although accounts growth is slowing for PayPal, key metrics are still indicating platform strength.

- Engagement remained high in Q3’22 and transactions per active accounts are growing.

- Free cash flow resilience could prove to be an asset for an upcoming recession.

bombuscreative

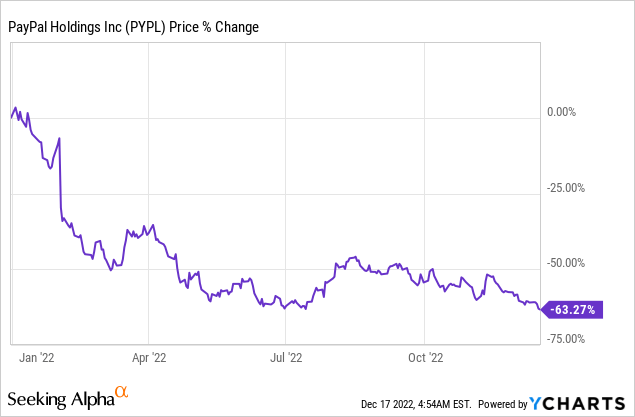

PayPal (NASDAQ:PYPL) has been through the wringer in 2022 with shares declining 63% year to date. The reasons for the decline are manifold and include a post-pandemic slowdown, PayPal’s lowered guidance for FY 2022 regarding customer accounts as well as a stronger USD which is making business overseas less profitable for US companies. Additionally, investors are concerned about an economic slowdown as well as high inflation which is weighing on consumer spending. However, I believe PayPal is a solid FinTech bet on growing transaction volumes given the enormous size of PayPal’s ecosystem and the firm’s strong free cash flow represents deep recession value for investors!

Despite growth concerns, PayPal’s key metrics are still trending up

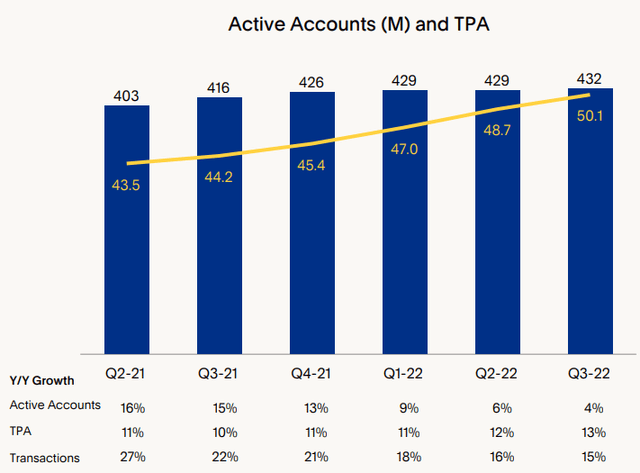

PayPal’s share price doesn’t indicate this, but PayPal is still growing at a healthy rate. The company saw its net new active accounts grow by 2.9M year over year in Q3’22 to a record 432M while customer engagement trends also remained widely positive.

Customer engagement can be measured through the number of transactions the average account conducts to either receive money or pay for goods and services. PayPal’s number of transactions — which also is a key metric to highlight growth in Total Payment volume — has been in a steady upswing throughout the pandemic, and it is still growing: transactions rose 13% year over year to a record 50.1 per active account in Q3’22. So while it is becoming more of a challenge to acquire new customers, the existing customers using PayPal (or Venmo) are transacting at a higher rate. The yellow trend line in the chart below shows the resilience and constancy of this growth even after the pandemic ended.

Strong customer engagement trends as well as healthy customer acquisition rates are key to PayPal’s long-term success as a digital payment platform. Now, PayPal did experience a slowdown in the number of customers it is drawing into its ecosystem after the pandemic and the company did lower its net new active account (FY 2022) target from 20M at the beginning of the year to 8-10M (guidance as of Q3’22). But the company is still signing on a fairly large amount of new accounts: 2.9M in Q3’22 and 5.7M in the first nine months of the year.

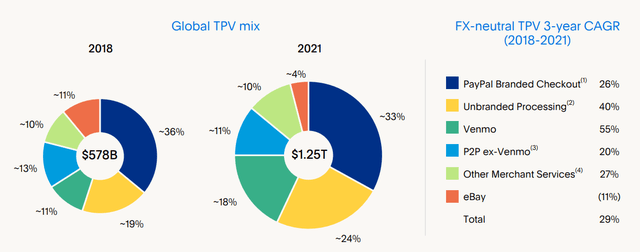

To understand PayPal’s key sources of growth, we can look at a breakdown of PayPal’s Total Payment Volume metric. This metric shows the total amount of dollars that is processed through the platform… which in Q3’22 was $337B, showing 9% year over year growth. About a third of PayPal’s Total Payment Volume (based on FY 2021 figures) comes from PayPal’s branded check-out function that many merchants use on their websites to facilitate a quick and easy check-out process. Unbranded processing accounted for 24% of Total Payment Volume while Venmo is a key source of growth for PayPal: the Venmo share of Total Payment Volume increased from 11% in FY 2018 to 18% in FY 2021 and Venmo is by far the fastest-growing business within PayPal (55% 3-year CAGR rate). Accelerating adoption of the Venmo digital wallet is likely to be key source of growth for PayPal going forward as well.

Free cash flow and capital allocation priorities for 2023

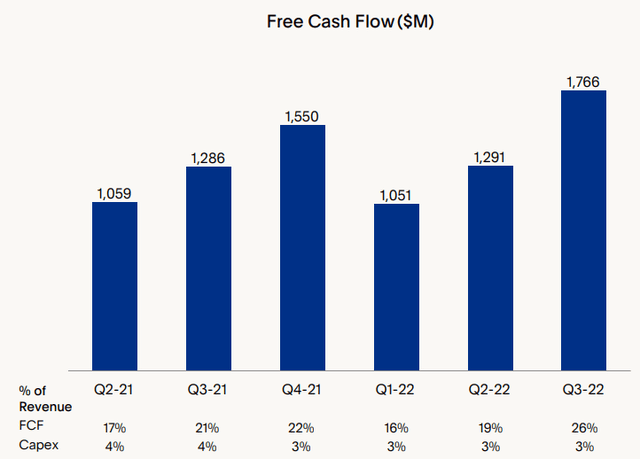

One key asset that PayPal has that other FinTechs don’t is the size of its payment platform which was comprised of 432M active accounts at the end of the September-quarter. Of those accounts, 35M were active merchants that are using PayPal for their commercial purposes and tend to have above average transaction volumes. The size and reach of PayPal’s platform gives the company a huge competitive advantage over other rivals (especially in a recession) and results in a significant amount of free cash flow that the digital payment company collects each quarter.

PayPal earned a total of $5.66B in free cash flow in the last year and an average of $1.4B a quarter while consistently maintaining (free cash flow) margins of at least 16%. I believe this free cash flow is becoming more valuable during a recession and maybe should be a key reason for investors to consider PayPal.

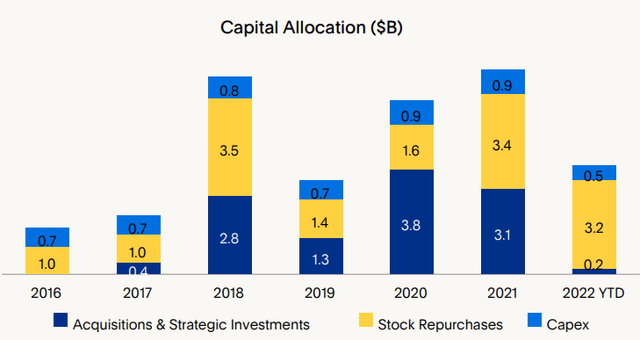

Going forward, a large part of this free cash flow is going to be returned to shareholders which could help stabilize PayPal’s stock price and, possibly, push shares of PayPal into a new up-leg. PayPal has already started to ramp up its share repurchases — which I believe is a good use of capital considering how much PayPal’s shares have dropped this year — in the first nine months of the year: the firm spent $3.2B (78%) of its free cash flow in the first nine months of 2022 on stock buybacks, almost as much as PayPal spent on buybacks in the entire previous year. Heading into FY 2023, I believe PayPal will continue to spend the majority of its free cash flow on stock repurchases.

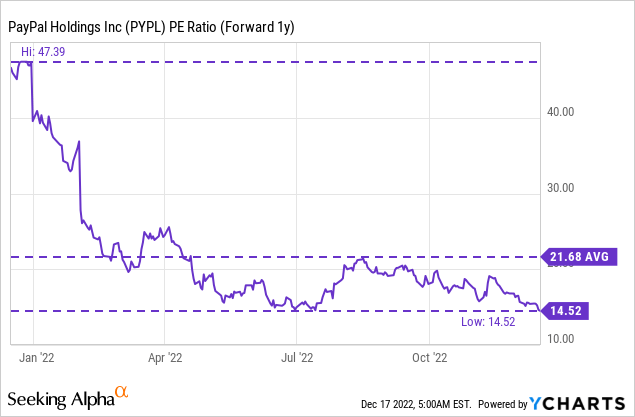

PayPal’s valuation

PayPal’s 63% decline in valuation this year has made the company very attractive from a valuation point of view: shares of PayPal trade at 15.8 X (forward) free cash flow, assuming a free cash flow estimate of $5B in FY 2023 (based on company guidance). Some may argue that the valuation is really not that low, but I would disagree by pointing to the long-term value of PayPal’s moat (large, growing payment platform with unparalleled size and reach) and significant free cash flow strength. PayPal’s P/E ratio is 14.5 X which is about 33% below its 1-year average.

Risks with PayPal

The biggest risk for PayPal, as I see it, is a slowdown in net new active account growth. Acquiring new customers is an important driver of Total Payment Volume and revenue growth, although engagement is an important contributor to grow as well. A key catalyst for PayPal’s shares in 2023 could be the full-year guidance: a continual slowdown in revenue and customer account growth may hurt continue to hurt the stock. What would change my mind about PayPal is if the company were to experience an unforeseen drop in free cash flow (margins).

Final thoughts

I believe PayPal is a top recession play for investors as the company’s key metrics such as Total Payment Volume and transactions per active account continue to be in a healthy long-term uptrend. Engagement figures remained solid in Q3’22 as well and the company’s large size and reach are key advantages for PayPal that could support strong free cash flow during a recession. PayPal has a lot of potential in the e-Commerce market in the long term and if the company can maintain high free cash flow margins in the future (partly through growing Venmo adoption), then PayPal could be a strong investment for a recession!

Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.