Summary:

- Amazon is the last big tech company I own and I plan to hold shares as long as high margin segments like AWS and advertising continue to perform.

- I cover the Q3 results for AWS and talk about a potential spinoff.

- Shares are attractive today with a price/cash flow multiple of 18.5x. This is well below the average multiple of 27.2x.

- A couple of risks to keep an eye on for the stock is weakness in the economy and/or the stock market.

- The buyback program could be a sign of more capital return to come, but it is currently outweighed by the stock-based compensation.

Noah Berger/Getty Images Entertainment

I have written three articles on Amazon (NASDAQ:AMZN) in 2022. In each article, I mentioned Amazon Web Services, which is the crown jewel operating segment of the company. Today I want to dig deeper on AWS and its valuation. I also want to get into the idea of a potential spin off of AWS, which seems to be a frequent topic of discussion for Amazon investors.

Investment Thesis

Amazon is the last big tech stock I own, and I plan to own it for a long time. As I have said in past articles, as long as the higher margin segments of AWS and advertising continue to post solid results, I plan to own the stock. Today I will be focusing in on AWS as an operating segment and the oft-discussed topic of spinning off AWS. The valuation is attractive today at 18.5x cash flow, which is well below the average multiple. There are risks to the bullish thesis, with the most obvious being a weakening economy and stock market. I am a fan of Amazon’s buyback program, even if it isn’t large enough to offset the company’s stock-based compensation. Overall, I like the risk/reward proposition for Amazon investors, especially those that have a long-term time horizon.

Amazon Web Services

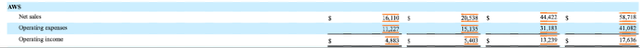

One of the first things I notice every time I have skimmed an Amazon 10-K or 10-Q in the last couple years is the consistently impressive numbers posted by AWS. It has two of the biggest keys that I look for in any business (or segment), which are revenue growth and impressive operating margins. Below are the results for AWS, with Q3 on the left and the first nine months of 2022 on the right.

The revenue growth has continued at an impressive rate, no small feat for an operating segment the size of AWS. Q3 revenue grew over 27%, with the first nine months posting 32% growth compared to 2021. While I’m not an expert on cloud computing and the technological side of things, I’m of the opinion that the revenue growth can continue for a while, even if it won’t top 20% forever.

Not only is revenue growing, but the operating income of the segment has continued to grow as well. The income growth for Q3 was just over 10%, which isn’t quite as impressive as the growth in the first nine months. Operating income grew over 33% for the first nine months of 2022. The operating margin has been pretty consistent as well, despite a slight decline in Q3. Margins went from just over 30% in Q3 2021 to 26% this year, but they were basically flat for the first nine months of the year (29.8% in 2021 to 30% in 2022).

I will be watching to see if the weaker Q3 results carry over into future quarters, but 27% revenue growth, 10% operating income growth, and 26% operating margins is nothing to sneeze at, even if it is a slight decline from previous quarters. I have seen several arguments for a spinoff of AWS as a way to unlock value for shareholders. I have mixed feelings about a potential spinoff, but I have started to change my mind on the topic in recent quarters as the ecommerce segment has struggled with margins.

An AWS Spinoff?

I have seen at least a couple articles with the opinion that investors buying Amazon at the current valuation is the equivalent of buying AWS and getting the other segments for free. While I think this is probably an oversimplification, it is definitely food for thought. I was against a spinoff a couple years ago when I bought shares, but I am starting to come around to the idea that it could benefit shareholders. A spinoff of AWS would almost certainly trade at a materially higher valuation due to the impressive growth and margin profile of the business compared to Amazon’s other segments.

If you assume that Q4 revenues will be similar to the first nine months of the year, that would put AWS revenues near $80B and operating income near $24B if margins stick around 30%. It’s hard to assign a multiple to a business that has become an important part of the internet infrastructure here in North America, but the consistent growth of revenue and operating income means it would certainly deserve a premium multiple. For example, if you used a 25x multiple on earnings, that would put the market cap of AWS at $600B, and that doesn’t even factor in the assets on the balance sheet or the other segments.

If you split the business apart, it would be a tough decision for me to hold onto the remaining pieces of the business outside of AWS. The advertising segment is a high margin segment that has been growing quickly and taking market share from big advertisers like Google (GOOG) (GOOGL) and Meta Platforms (META). The advertising segment ties in well with the ecommerce and streaming businesses, but the ecommerce and physical store segments are not as attractive as investment opportunities in my opinion. The margins aren’t as good, and they will require continued capex to stay competitive.

Valuation

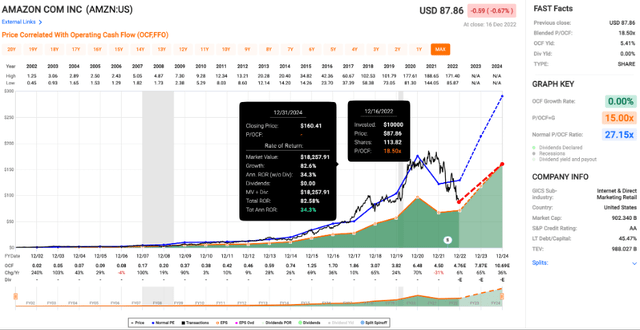

Amazon has always looked expensive, but that hasn’t stopped the stock from providing impressive long-term returns for investors. Shares have slumped more recently and are down almost 50% YTD, which is a buying opportunity in my opinion. I prefer to use operating cash flows to value Amazon, which can be lumpy due to capex cycles in some of the segments.

Price/Cash Flow (fastgraphs.com)

Amazon has typically traded at a cash flow multiple just above 27x. Shares are well below that today at a price/cash flow of 18.5x. Cash flow decreased in 2021 and 2022, but estimates are projecting that cash flow per share will more than double by the end of 2024. If the estimates turn out to be accurate, shares will likely trade at a much higher price in a couple years. Assuming a 15x multiple will put shares around $160. If we get some multiple expansion in the next couple years, shares could easily trade above $200.

Potential Risks

I see a couple risks with the bullish thesis that could lead to weaker cash flow growth and/or returns moving forward. If the economy hits a rough patch in the next couple years (which is entirely possible), it will be hard for Amazon to double its cash flow per share. The other thing that could impact returns is weaker overall stock market. I covered passive fund flows in a recent article on Apple (AAPL), and the same problem impacts Amazon to a lesser degree.

The company has benefited from continued inflows into index funds and other ETFs and mutual funds. It’s not as heavily weighted as Apple, Microsoft (MSFT), or Google, but Amazon still accounts for 2.5% of the S&P 500 index. The inflows from the last decade that went directly into shares of big tech companies and boosted share prices will have the same effect in reverse. Selling of these funds will create more selling pressure on the larger companies than the smaller ones.

Buybacks

One of the other things of note for shareholders is Amazon’s buyback program. I like buybacks, especially the programs that are done at reasonable valuations. One caveat worth mentioning with Amazon’s buyback program is that it won’t offset stock-based compensation (just over $14B in the first nine months of 2022), so it won’t lead to a shrinking share count. It will offset some of the dilution from the stock-based compensation. In the first nine months of 2022, the company bought back 46.2M shares worth $6B (average price just under $130). They had $6.1B remaining at the end of Q3, and I would expect the company to get more aggressive with buybacks in Q4 as the share price has continued to fall.

Conclusion

Over the last couple years, I have reworked my investing strategy to fit my long-term goals. Amazon is one of my longest held positions, and I plan to hold shares for years to come as long as important segments like AWS continue to perform. AWS in particular has consistently posted impressive results complete with revenue and income growth and wide margins.

The idea of an AWS spinoff seems to come up occasionally, and I am starting to warm up to the idea. The other segments don’t have the impressive results or margins of AWS, and a potential spinoff would allow me to sell the parts of the business that haven’t performed as well. Either way, I think we are seeing a buying opportunity today with Amazon shares. At 18.5x cash flows, shares are well below the average multiple above 27x.

There are some risks to the bull case which could lead to weaker returns for investors, primarily a weak economy and weak stock market. I do like Amazon’s buyback program, which could be a sign of more capital returns to come, even if it doesn’t currently offset the company’s stock-based compensation. With shares of Amazon down almost 50%, now might be an opportune time to add to a position in the company or start a new one. Drawdowns like this don’t happen often, and with shares trading at the same price as they were over four years ago, Amazon could be worth a closer look for long-term investors.

Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.