Summary:

- Apple has started to gradually decouple from China to mitigate the geopolitical risks.

- It’s too soon to talk about a full decoupling, but the latest developments indicate that Apple is unlikely to stop diversifying its supply chains anytime soon.

- As globalization unravels, this article highlights the challenges that Apple could face as it tries to avoid becoming the next casualty of the possible upcoming Sino-American confrontation.

Nikada/iStock Unreleased via Getty Images

Even though Tim Cook has been publicly praising the CCP in the past, while Apple (NASDAQ:AAPL) even restricted the use of Airdrop during the recent protests of Chinese citizens against Beijing, behind the scenes the company’s management is actively diversifying the supply chains in order to mitigate the risks of relying too much on China as globalization unravels. Back in July, I wrote an article on Apple in which I highlighted the company’s vulnerabilities in China and how Beijing is using some of them to leverage its relationship with the most valuable company in the world and the U.S. in particular.

Since that time, Apple has undertaken several notable relocations, which could help it to ease some of the risks. First of all, the company has expanded its presence in Vietnam, and India, and continues to look for new partners in the Southeast Asian region where it could utilize low-wage labor to ensure that its margins are not severely affected when moving some of the supply chains to new countries.

Secondly, Tim Cook’s recent statement inside the new chip factory of Taiwanese company TSMC (TSM) in Arizona about the production of Apple-designed chips there starting from 2024 also makes it possible for the company to mitigate risks that are associated with Beijing’s potential invasion of Taiwan in the future.

While it’s too soon to talk about full decoupling from China, as Apple continues to heavily rely on production within the country to this day, the latest developments indicate that the company is finally taking the threats that come from China seriously. Even though investors could see some of the company’s costs rising in the foreseeable future, the diversification of supply chains ensures that Apple is able to survive and thrive in case of a further confrontation between Beijing and Washington.

As Apple diversifies, this article aims at highlighting the potential challenges that the company could face and how it could affect its performance in years to come.

The New Geopolitical Reality

In the last two years, Apple has been slowly decreasing its reliance on China. If in 2020, the company’s exposure to the country’s supply chains was 42%, then in 2021 that percentage decreased to 35.9%. Even though that’s not enough to mitigate any major geopolitical disruptions, even such a decrease indicates that the company’s management and Tim Cook in particular, who started building the existing supply chains during the Steve Jobs era, understands that it’s no longer safe to over-rely on China in our current day and age no more.

One of the reasons for that is the inability to predict the direction in which Beijing will take the country. In one of my articles on Alibaba (BABA), I’ve already explained how the sacking of market reformists from the Standing Committee along with Xi Jinping, who has been reelected for an unprecedented third term as the General Secretary of the CCP, against the West makes China an unreliable partner for foreigners. Add to this the fact that the latest decision of the Biden administration to apply new export controls on advanced chips to China and a subsequent decision of Beijing to request opening a panel at the WTO against the U.S. have reignited the ongoing trade war and it becomes obvious that the improvement of Sino-American relations won’t happen anytime soon. We already see that the U.S. manufacturing orders from China are now down 40%, which is a sign that things won’t return to what we know as normal anytime soon.

The good news is that it appears that Apple is on its way to mitigating some of the risks of Beijing’s foreign and domestic policy at the same time. Considering that there’s constantly a possibility that Beijing decides to invade Taiwan by the end of this decade, it made sense for Apple’s foundry partner TSMC to start building a plant in a safe location such as Arizona where the disruptions to its production of chips would be minimal. The appearance of Tim Cook along with President Biden earlier this month during the ‘tool-in’ ceremony of the upcoming TSMC plant in Arizona and the announcement of the production of Apple’s chips on American soil starting in 2024 is a good way to ensure that the company’s advanced chips won’t be hostages to Beijing’s foreign policy in the future.

At the same time, the Wall Street Journal recently reported that after the latest protests against the zero-Covid policy in Zhengzhou, which primarily affected the production of iPhones, Apple accelerated the process of looking for ways to outsource its production to other countries such as India and Vietnam. While the process is still ongoing, the analysts at JPMorgan (JPM) believe that by 2025 every fourth iPhone will be made in India, which is a sign that Apple started to take the risks of overexposing the production to a single country more seriously in recent months and finally is moving in the right direction after years of complacency.

The biggest upside in all of this is that with close to $50 billion in cash reserves and a decent debt profile, Apple could afford to move its production to other countries, which can’t be said the same about other smaller businesses that are in the same position as the Cupertino-based tech giant.

The Upcoming Challenges

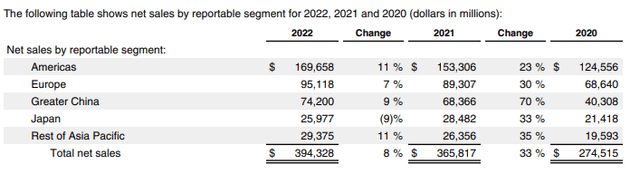

While it makes sense for Apple to decrease its overexposure to China and mitigate some of the geopolitical risks, the company nevertheless is unlikely to fully decouple from the country anytime soon. The first major reason for it is the fact that China has become its third biggest consumer market after the Americas and Europe. Out of the $394.3 billion in net sales that Apple generated in FY22, $74.2 billion came from China. A potential loss of such a big consumer market in case of a potential direct confrontation between Beijing and Washington is certainly going to hurt.

Considering that the Pentagon in its latest National Security Strategy report noted that China is the only competitor that has the intent and capacity to reshape the global order, it becomes obvious that a potential direct confrontation in the future is more than possible whether we or Apple like it or not.

Apple’s Sales by Region (Apple)

However, even if we assume that the worst that could happen is simply a major decoupling of China and the U.S. from each other, Apple would nevertheless is more than likely to take a major financial hit even from such an outcome.

One of the main reasons for it is the fact that there’s no guarantee that Apple would be able to keep its margins and expenses at the current levels if it outsources most of its production to other countries. A few years ago, a Chinese expert Doug Guthrie, who has been hired by Apple to help the company navigate within China, came to the conclusion that neither India nor Vietnam are viable replacements due to a bureaucracy that made it complicated to build infrastructure and production plants.

It’s been a few years since he came to such a conclusion, so there’s a chance that things have improved and Apple nevertheless manages to relocate the production without significantly hurting its margins or increasing its expenses. However, what we do know though is that it’s more than likely that Apple would continue to postpone the release of future products such as its own electric car until it mitigates a significant portion of the geopolitical risks.

Another problem that the company is facing is the inability to significantly accelerate the outsourcing of production to other countries. Bloomberg estimates that it would take 8 years to outsource only 10% of its production capacity, which is likely to be too late for it to avoid becoming a casualty of a possible upcoming economic Sino-American confrontation, as a potential escalation of the ongoing trade war would more than likely impact its revenues and inflate the costs.

Let’s not forget that back in 2019, Apple managed to dodge some of the tariffs only due to the trade agreement between China and the U.S., which nevertheless hasn’t fully ended a trade war at that time. With Sino-American relations being at historically low levels, the possibility of having a similar agreement in case of further escalation remains dim.

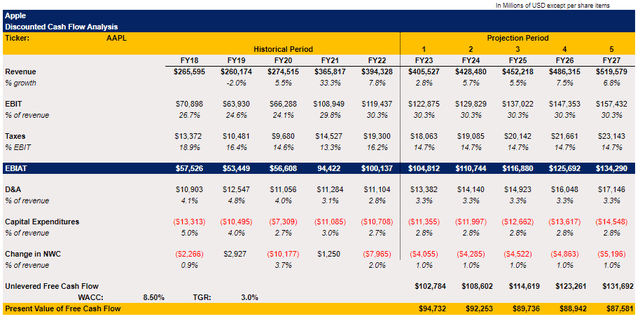

With all of this in mind, it becomes clear that Apple is more than likely to face tough following years as it tries to mitigate all the geopolitical risks at once. To figure out whether Apple’s shares have any upside given the latest developments, I’ve updated my DCF model, which could be seen below.

In the base case scenario, the top-line growth assumptions are in-line with the street estimates, while most other assumptions are either averages of previous years or in-line with the latest reported period. As for the change in net working capital, it represents only 1% of revenues in the following years solely due to the fact that in previous years it fluctuated much and can’t be fully predicted going forward. The terminal growth rate in the model remained at 3%, while WACC has been increased to 8.5% due to the rising interest rates.

Apple’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

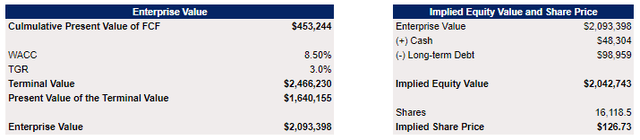

The model shows that under normal conditions, Apple’s implied fair value is $126.73 per share, which represents a downside from the current levels. While such a price is below the consensus price of $172.51 per share, it’s nevertheless above the lowest street price target of $118 per share. At the same time, Seeking Alpha’s Quant system gives Apple an F rating for valuation.

Apple’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

Considering that this is a base case scenario where Apple’s operations are not disrupted, it’s safe to say that any downsides that come with the relocation of production or any risks that could materialize due to Beijing’s domestic or foreign policy have all the chances to negatively affect the company’s valuation even more.

The Bottom Line

In the last couple of decades, Apple has become one of the biggest beneficiaries of globalization, as the high-tech chip designs of Silicon Valley coupled with the low-wage labor of China made it possible for the company to disrupt several industries, enrich its shareholders, and become the most valuable company in the world along the way. As globalization unravels, Apple is racing against time to decrease its exposure from China in order to mitigate any major geopolitical risks, secure its supply chains, and ensure its own survival in case the relations between Beijing and Washington deteriorate even more and lead to a potential direct confrontation in the future.

Only time will tell whether Apple would succeed in its endeavor, as the decoupling from China creates not only opportunities but its own challenges as well. However, there’s no doubt that the sooner Apple stops over-relying on a single party, the better the chances that it would be able to stay afloat and not be too exposed to the changing geopolitical landscape.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Bohdan Kucheriavyi and/or BlackSquare Capital is/are not a financial/investment advisor, broker, or dealer. He’s/It’s/They’re solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Brave New World Awaits You

The world is in disarray and it’s time to build a portfolio that will weather all the systemic shocks that will come your way. BlackSquare Capital offers you exactly that! No matter whether you are a beginner or a professional investor, this service aims at giving you all the necessary tools and ideas to either build from scratch or expand your own portfolio to tackle the current unpredictability of the markets and minimize the downside that comes with volatility and uncertainty. Sign up for a free 14-day trial today and see if it’s worth it for you!