Summary:

- Today, we will consider Airbnb through a few different lenses.

- We will start with a consideration of Airbnb through the lens of the great Peter Lynch’s favorite kind of businesses.

- We will then consider the business through the lens of its vectors for growth, such as its expansion into international markets.

- And we will conclude with a consideration of the business’ valuation.

- In short, while I don’t love Airbnb stock at these levels, I think investors will do alright buying here.

stockcam

Fast Growers & Boring Markets

I recently shared an excerpt from Peter Lynch’s One Up On Wall Street, in which he shared his favorite type of company, which he referred to as “Fast Growers.”

The Fast Growers

These are among my favorite investments: small, aggressive new enterprises that grow at 20 to 25 percent a year. If you choose wisely, this is the land of the 10- to 40-baggers, and even the 200-baggers. With a small portfolio, one or two of these can make a career.

A fast-growing company doesn’t necessarily have to belong to a fast-growing industry. As a matter of fact, I’d rather it didn’t, as you’ll see in Chapter 8. All it needs is the room to expand within a slow-growing industry. Beer is a slow-growing industry, but Anheuser-Busch has been a fast grower by taking over market share, and enticing drinkers of rival brands to switch to theirs. The hotel business grows at only 2 percent a year, but Marriott was able to grow 20 percent by capturing a larger segment of that market over the last decade.

The same thing happened to Taco Bell in the fast-food business, Wal-Mart in the general store business, and The Gap in the retail clothing business. These upstart enterprises learned to succeed in one place, then to duplicate the winning formula over and over, mall by mall, city by city. The expansion into new markets results in the phenomenal acceleration in earnings that drives the stock price to giddy heights.

One Up On Wall Street by Peter Lynch (Must Read if you’re taking this investing journey with me)

As I mentioned recently, you likely drew parallels between the companies we own and the companies that Mr. Lynch cited in the above quote.

From Chipotle’s likeness to Taco Bell (Brian Niccol was the former CEO of Taco Bell!) to Airbnb’s likeness to Marriott, we’ve (as in you, my reader, and me) come to own the modern equivalents of some of Mr. Lynch’s favorite companies, which were some of the most successful companies of the 21st century.

Over the last decade, Airbnb (NASDAQ:ABNB), like Marriott, has captured market share rapidly within an existing, low-growth, and mature industry, growing at 20% to 30%+ in the process.

But, while Airbnb is a lot like the Marriott’s and La Quinta Inn’s of bygone eras, it is no longer a “Fast Grower,” so to speak, which is why I waited over two years following its IPO to begin buying the stock at $88/share.

Today, I will explore this train of thought with you. That is, I will elaborate the central bear thesis that’s been in my mind for Airbnb, which, in short, has been its valuation relative to its growth.

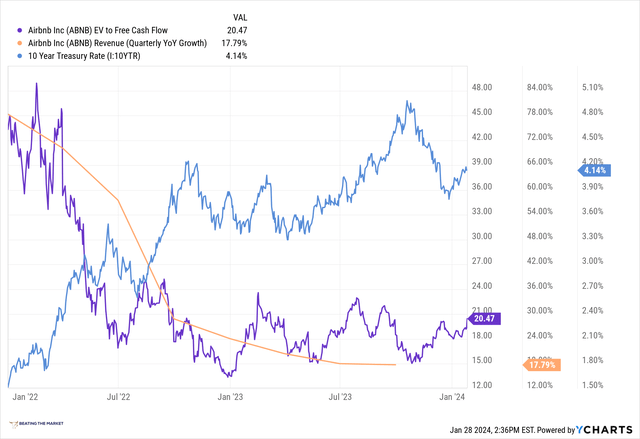

Airbnb’s EV/FCF Multiple, The 10 Year Treasury Yield, And Airbnb’s Growth Rate

The Evolution Of Airbnb: From Fast Grower To Stalwart Enterprise (With 10%+ Growth)

Airbnb has experienced a fascinating evolution over the last decade, evolving in the following manner:

- Hypergrowth private company, expanding sales from $0 to $5B from 2010 to 2020

- In the midst of the lockdowns, Airbnb restructured its operations and began producing exceptional profitability. It went from generating $0 in free cash flow to 40%+ free cash flow margins in the span of a couple years. (San Francisco companies should take note!!)

- From 2021 to 2022, it experienced solid growth alongside solid profitability, albeit at elevated valuations and resumed elevated growth

- Today, Airbnb is effectively a value stock, with a ~10% annualized sales growth and a 5% free cash flow yield, which suggests that growth may decline further from here.

And in the vein of this last point, today, we will examine whether the market is justified in valuing Airbnb in such a relatively depressed manner. A 5% free cash flow yield is fairly substantial, and Airbnb’s peers, such as Hilton Worldwide (HLT), trade at valuations that are much more expensive than this.

Frankly, I don’t know who is buying Hilton or Marriott at their current valuations, as, if Airbnb’s annualized return could be debated starting with a yield 5% and a long runway for growth with founder-led innovation to boot, then I have no idea how these return profiles of these two could be justified, excepting a continuation of hyperinflation in our economic system.

Distillation

Ultimately, the essence of the thesis is whether Airbnb will grow at 10% or 12.5% or 15% annualized over the next decade. I’ve walked through Airbnb’s various moats with you ad nauseam at this point, and, after those exercises, we can be confident that the company possesses competitive advantages that will defend its 40%+ free cash flow margins and brand in its respective markets.

These moats will also likely afford it the robust growth it’s continued to experience in international markets.

That said, it’s still worth discussing where annualized sales growth will land over the next 10 years.

At 10%, Airbnb likely won’t generate very robust, marketing beating returns. That is, at 10% annualized growth, as I will demonstrate towards the end of this review, Airbnb will generate returns that just modestly outperform the S&P 500 Index (SPY).

At 12.5%, its returns are much more attractive.

And at 15%, Airbnb would generate truly exceptional returns.

Frankly, I believe CEO Brian Chesky believes that Airbnb could compound sales growth at 15% for the next 10 years based on the thesis that he’s laid out, the details of which I will share with you later on today.

With these ideas as our platform, before we conduct our valuation exercise, we will start by examining the vectors via which Airbnb may grow at the aforementioned rates in the decade ahead.

I have distilled these vectors in the following manner:

- Supply growth

- International expansion

- New Products

- Long Term Rentals growth

Supply Growth

If you think about how big Airbnb is, for every person who stays in Airbnb, approximately 9 people every night stay in a hotel or about 9 bookings. The hotels are about an order magnitude bigger.

In order to continue growing at elevated rates, Airbnb must continue to bring supply onto its network, whereby it shifts the above-illustrated ratio in its favor to a greater degree.

In past reviews, I’ve delineated how supply of homes on the Airbnb platform drives network effects for Airbnb, so I will not focus on this dynamic today.

That said, Airbnb has been adding supply at an incredible clip:

Now during the quarter, we saw a number of positive business highlights. First, we have added nearly 1 million active listings this year. Our supply grew 19% in Q3 compared to a year ago. We once again saw double-digit supply growth across all regions with the highest growth in regions with the highest demand. Urban and non-urban supply increased at nearly the same rate and we saw relatively similar supply growth among individual professional hosts with the majority of new listings exclusive to Airbnb.

Brian Chesky, CEO, Q3 2023 Airbnb Earnings Call

Supply growth ultimately drives nights booked, which, of course, drives sales growth and free cash flow growth.

Justin Post: Supply is up 19%. How do you think about that as a leading indicator for room night growth? And how do you maybe accelerate night growth to capture that?

David Stephenson: I do think that the strength of 19% listings growth is a great leading indicator of what we’re capable of growing over time. As I said earlier, the overall growth of Airbnb since 2019, nights growth has been actually relatively in line with the total growth of supply. And I’m really bullish that we can get more supply coming on, which will also drive down actual prices because the more supply that comes on board, maybe back to your first question, the more likelihood that we can actually bring prices down in the market or at least moderate them…

So, I’m really bullish on our overall growth. It’s been great to see the strength of our listings growth this year.

Q3 2023 Airbnb Earnings Call

In the review I hyperlinked a moment ago, I shared that supply has been the central issue in retaining my personal patronage of the platform, so I believe management when they state that accelerating supply will equate to accelerating nights booked, which will equate to accelerating sales ultimately.

So this growth was heartening in terms of determining the rate at which Airbnb will grow in the 10 years ahead. It represents the value for one variable in the equation of how fast Airbnb will grow on an annualized basis in the decade ahead.

Let’s now turn to international growth.

International Growth

On Airbnb’s Q3 2023 earnings call, CEO Brian Chesky was asked repeatedly as to whether Airbnb could reaccelerate growth, which, as we know quite well by now, is necessary for investors at these levels (roughly $150/share) in order to generate a sufficient return for the risk one assumes in purchasing Airbnb.

Again, as an aside, I don’t know how anyone is making the annualized returns of Marriott (20x+ ev/fcf) and Hilton (35x+ ev/fcf) make sense at their respective valuations, especially considering where we’re at in the rate hiking cycle.

One of Mr. Chesky’s central contentions in the debate as to whether Airbnb could reaccelerate its growth has been Airbnb’s international opportunity, which it has really not penetrated yet. We’ve discussed often in the past that Airbnb still has a long runway for growth internationally, and it is a globally recognized brand due to its association with social media (such as fancy Instagram photos at luxe abodes in the UAE).

Next is international. Even though we’re in 220 countries in the region, there’s only a couple of countries where we even have penetration at rivals of United States. And those countries are Canada, Australia and France. After that, U.K. a little bit, it really starts to tip down.

And so we have like massive, massive opportunity and just by bringing Airbnb’s playbook to these other countries. Obviously, Germany, but not just Germany, like actually the entirety of Northern Europe, Eastern Europe, and even Italy and Spain, basically every country but France and U.K., they are at a step change lower penetration.

Latin America is a completely new market for us, emerging. Asia Pacific, I would argue it’s a completely new market. We can be adding huge amounts of growth just by our expansion playbook.

Brian Chesky, CEO, Q3 2023 Airbnb Earnings Call

So there’s still a long runway for Airbnb, though its current valuation totally rejects this notion at present.

On the subject of international expansion, later on the call, Mr. Chesky remarked,

And we’re seeing significant growth in Asia Pacific markets such as Taiwan, Thailand and Indonesia, all experiencing year-over-year nights growth above 30% on an origin basis.

…

Following the success, we’ve seen in recent quarters in Germany and Brazil, Korea has now become one of our fastest growing countries compared to 2019 with gross nights booked 54% higher than they were in Q3 2019 on origin basis. As international travel continues to recover, we’re building greater momentum for Airbnb in underpenetrated markets.

Brian Chesky, CEO, Q3 2023 Airbnb Earnings Call

Again, there’s certainly a great deal of growth still ahead for Airbnb in international markets, as the data Mr. Chesky shared illustrates, and this will drive sales growth.

To close this section, I found one final exchange particularly insightful as it relates to Airbnb’s international growth.

Mark Mahaney: You talked about some of these improvements you’ve seen in markets like Germany, Brazil, and Korea. Could you just spend a little bit more time on that opportunity going forward? And is it the expectation now that Germany and Brazil are already optimized, you just keep optimizing other ones? Or will this take a while to add to monetize those?

Brian Chesky: Let’s first talk about international expansion. So it’s a great question. And as everyone on this call is probably aware, Airbnb is in 220 countries in the region. So on the one hand, we’re one of the most global like companies in all of travel. We’re a truly global travel network. At the same time, Mark, what we’ve seen is that our penetration in the United States is significantly higher than our penetration in many other countries. And we think there’s a huge amount of growth if we could just get Airbnb to even a fraction of the percentage of penetration that we have in the United States.

So last year, we decided to roll out this updated playbook. We rolled it out in Germany and Brazil. It’s kind of a four-pronged approach and involves some product optimization, PR, local marketing and just general optimizations on the ground in these regions. And what we’ve seen is Brazil is now double the size as it was pre-pandemic. We rolled that same playbook out to Korea. It’s now 54% higher than it was before. But what I would say is we’ve just scratched the surface of what we can do in Germany, Brazil and Korea. I think those markets are on a good trajectory. They could be significantly larger and we’re now looking at Japan and India, China, around Asia Pacific.

We have some optimizations in Southeast Asia, continual growth in Mexico. There’s a number of other countries in addition to a number of areas in Europe where we think we can see a lot more growth.

So I think the next 24 months, we’re going to see a major acceleration in our penetration in a lot of these markets. There’s about a dozen, dozen half markets around the world, as you know, have large tourism opportunities and we’re really focused on that. And that’s going to be one of our biggest near-term expansion opportunities.

Q3 2023 Airbnb Earnings Call

To close this section, these ideas are essential to our “underwriting the assumptions” I will share with you in just a moment when we conduct our Airbnb valuation exercise.

Product Evolution: A Path To Growth Acceleration

When I think about Airbnb, Microsoft (MSFT) or Amazon (AMZN) comes to my mind.

Like Microsoft, for instance, Airbnb has an extremely dominant market position, acting as the main source of travel accommodations for many, myself included.

And I believe, like Microsoft of a bygone era, most, including myself, cannot fully appreciate what Airbnb will look like in 20 years, granted Mr. Chesky continues to evolve the platform as he believes he can. It’s noteworthy that he is very young at just 42 years old, so we will likely have him at the helm of Airbnb, driving innovation, for decades to come.

To wit:

Eric Sheridan: Brian, in a number of interviews in the quarter, you talked about potential for product roadmap over the longer term, different products that could probably expand elements of the platform, car rentals, maybe even long-term apartment rentals. How do you think about product evolution that’s being offered to the consumers on the platform and thinking about investing behind those initiatives?

Brian Chesky: To your point, Eric, I think we are now getting ready to re-expand Airbnb beyond its core. It was always our intention to do much more than just short-term housing for travelers. We’re always intended to do more of that. So we’re working on making Airbnb more of an extensible platform. And I think, ultimately, there are actually quite literally dozens of services, guests and hosts that we could build on top of the Airbnb system. I think a lot of it comes down to making the platform extensible so we can offer these services. I think at the end of the day, we’re really thinking about are a couple of big ideas. First, I think that we are thinking about generative AI as an opportunity to reimagine much of our product category and product catalog. So if you think about how you can sell a lot of different types of products and new offerings, generative AI could be really, really powerful. It can match you in a way you’ve never seen before.

So imagine Airbnb being almost like the ultimate travel agent as an app. We think this can unlock opportunities that we’ve never seen. Additionally to that, there’s a lot of opportunities on both the guests side and the host side. And so we’re going to be thinking through a lot of this. So you’ll see hopefully some updates in the coming years.

Q3 2023 Airbnb Earnings Call

In the same way investors, in the 1990s, couldn’t have foreseen Microsoft becoming one of the most successful social media platforms on earth (LinkedIn) or one of the largest cloud computing platforms on earth (Azure), I believe it’s difficult for investors to foresee what Airbnb will ultimately become over the next 10, 20, and 30 years. And this evolution will serve to accelerate growth for the company, atop the acceleration it will experience from international expansion.

We have one more vector for growth to discuss.

Long-Term Rentals

In addition to supply growth domestically, international expansion, and product evolution, I believe Airbnb’s Long Term Rentals business will continue to grow in the years and decades ahead.

As I’ve noted in the past, I’ve personally experimented with the platform, and I’ve found that it is far superior, from a user experience perspective, to the traditional long term rental model.

So the last thing I’d say is monthly stays. We obviously announced a bunch of updates on monthly stays, including you can pay by bank, we lowered fees after 3 months, we have the whole new really cool interface and stays for 3 months or longer are now growing nearly 20% year-over-year. So those are just 3 things we’ve seen. I think what we’ve learned is like as we listen to customers, we adapt quickly, we can drive incremental growth.

Brian Chesky, CEO, Q3 2023 Airbnb Earnings Call

I believe the ease and convenience associated with booking a long term rental on the Airbnb platform will draw renters to the platform, which should, in turn, draw supply, and so on and so forth, creating network effects over time.

For both the renter and the landlord, there’s greater trust due to the profile verification and rating system that Airbnb has developed (which other platforms do not have). Additionally, there’s no need for credit or background checks. It’s simply vastly easier to book a long term rental using Airbnb than it is to book one via the traditional route.

In short, I believe this could be a substantial business for Airbnb as these network effects develop.

Valuation

As I’ve noted, Airbnb’s future growth rate is the question market associated with the thesis, which will ultimately determine the degree to which it’s a good buy at these levels for those interested in materially outperforming the market.

I think, no matter how you slice it, if you’re buying Airbnb here, you’ll do alright.

The question is “how alright will we do.”

With this in mind, I have found Mr. Chesky’s growth theses, which I shared with you today, convincing, and I do believe Airbnb is the type of company that could substantially evolve over time, especially in light of Mr. Chesky’s youth and level of motivation.

Lee Horowitz: Can you maybe take a step back and help us better understand how you think that maybe Airbnb may be a little bit different than prior ratios that we’ve seen and could perhaps sustain sort of that double-digit revenue cadence over a longer period of time than what we’re used to in the market?

Brian Chesky: Yes, I think that — as I said before, I think we’re only scratching the surface to how this company becomes. And I absolutely think that we can get to really solid double-digit revenue growth for many, many years to come. And there’s 3 things that I’d point out. The first is our core business. I think our core business could be significantly larger than it is today, even if we didn’t do anything new. And the reason I believe this is the following: I believe that almost every single person who stays in a hotel could stay in Airbnb is, number one, they knew about all the benefits of Airbnb and number two, we made sure that our service was sufficiently reliable to be an alternative.

Q3 2023 Airbnb Earnings Call

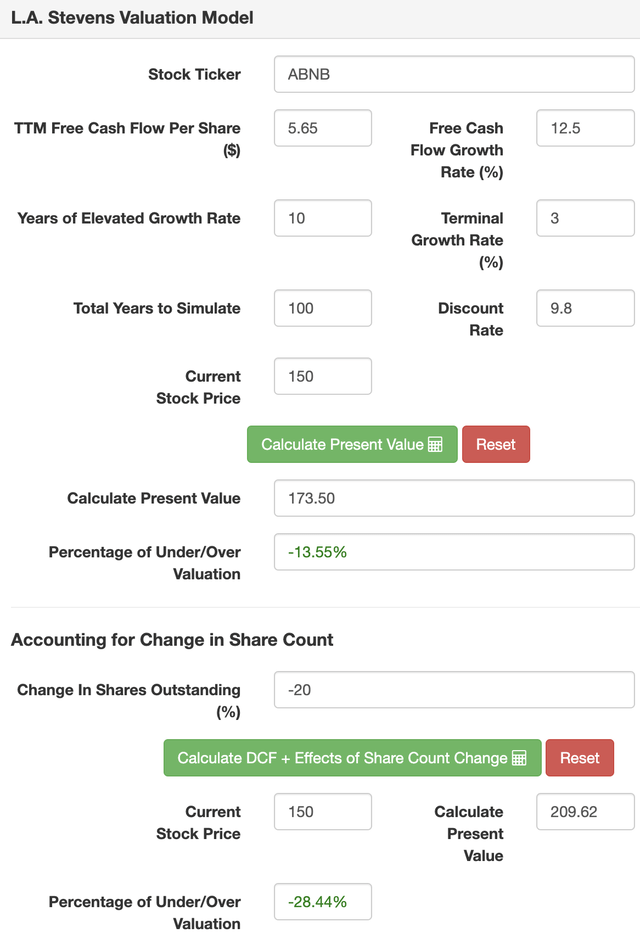

With all of the ideas presented today in mind, here are my assumptions for my valuation.

Assumptions:

|

TTM Sales [A] |

$9.6 billion |

|

Potential Free Cash Flow Margin [B] |

40% |

|

Average diluted shares outstanding [C] |

680 million |

|

Free cash flow per share [ D = (A * B) / C ] |

$5 |

|

Free cash flow per share growth rate (conservative) |

12.5% |

|

Terminal growth rate |

3% |

|

Years of elevated growth |

10 |

|

Total years to stimulate |

100 |

|

Discount Rate (Our “Next Best Alternative”) |

9.8% |

And the results:

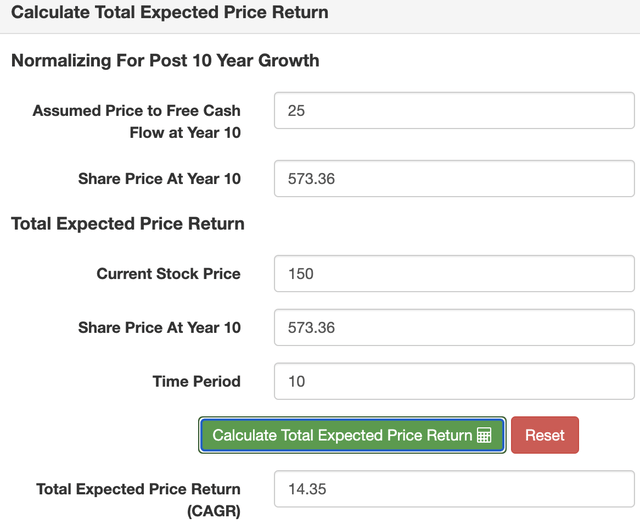

And, below, we can see the total expected returns from the above assumptions:

As you can see, we will generate about a 14.5% annualized return using 12.5% annualized growth rate and a 20% reduction in shares outstanding.

I believe both of these are entirely achievable; however, if Airbnb does not grow at 12.5%, and instead grows at 10% over the next 10 years, then returns will be approximately in line with the S&P 500 Index (SPY) (i.e., the market).

But I’m inclined to believe Mr. Chesky’s thesis. I think Airbnb has incredible competitive advantages, principal among which is its brand moat and the viral nature thereof. I think it will have a fairly easy time expanding internationally, and there’s a high likelihood that Airbnb becomes something more akin to Microsoft, as opposed to Marriott, over time in its evolutionary journey.

With Q4 2023 earnings just around the corner, I will be watching for the business’ ability to sustain elevated growth in line with the valuation exercise shared just above.

Ultimately, top line growth is the key uncertain factor for me, and this is contingent on management’s ability to execute.

In short, I continue to like buying Airbnb at these levels and lower and a bit higher!

Thank you for reading, and have a great day.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABNB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.