Summary:

- The market misprices Amazon’s earnings and sales potential.

- Amazon is not oversold, technically, but the chart setup is increasingly bearish.

- AWS has substantial operating income potential going forward.

4kodiak/iStock Unreleased via Getty Images

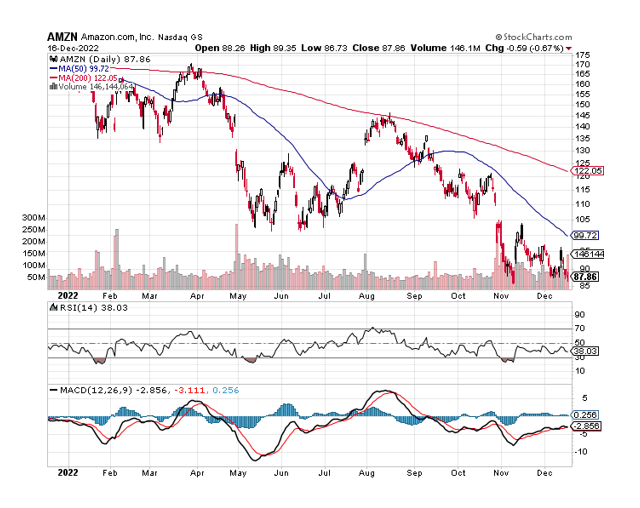

Amazon.com Inc. (NASDAQ:AMZN) has been in an extended down channel since August, and the stock appears poised to challenge its previous 52-week low in the near term.

I believe that the market has become too afraid to touch Amazon following a weak sales forecast for 4Q-22, and that a potential drop to a new 52-week low should be viewed as a buying opportunity (and as a Christmas gift).

Amazon is a true economic heavyweight, with multiple businesses that generate billions of dollars in operating and net income each quarter.

Furthermore, Amazon’s stock trades at an absurd valuation, despite the fact that AWS is an industry leader in its field.

Given Amazon’s exorbitant valuation and the negative market sentiment toward AMZN, I believe investors should become greedy.

The Technical Setup In The Short-Term Is Very Bearish

Amazon is in a downward spiral, and even the company’s strong third-quarter results were insufficient to propel Amazon’s stock into a higher market valuation.

In terms of Amazon’s chart situation, three bearish indicators have appeared since August:

- The stock price fell through the 50-day moving average in September, accelerating the stock’s downward momentum;

- The stock ‘gapped down’ following the 3Q-22 report and failed to recover in time; and

- The stock immediately fell to new lows following earnings and failed to ‘gap-close’ in the months that followed.

Moving Averages (Stockcharts.com)

Furthermore, Amazon is trading near its 52-week low and may soon fall to a new one, which I believe would represent a highly appealing buying opportunity for investors.

Why Does Amazon Trade At 52-Week Lows And Why Is The Company Valued So Lowly?

The primary reason for Amazon’s stock decline this year is the repricing of Amazon’s growth prospects in an increasingly sluggish economy. Investors simply do not expect Amazon to deliver double-digit sales growth, resulting in a 47% valuation cut.

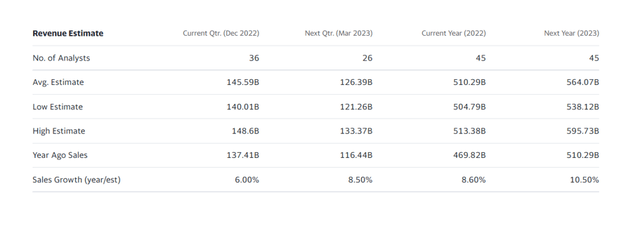

Amazon achieved 22% YoY sales growth in 2021, aided by pandemic tailwinds, but the company will be lucky to achieve a little more than a third of this rate in 2022. The market currently forecasts only 8.60% YoY sales growth in 2022, and the outlook for 2023 is not much better: the average estimate for 2023 forecasts only about 10.50% YoY sales growth.

Revenue Estimate (Yahoo Finance)

A number of factors are influencing the market’s assessment of Amazon’s growth prospects. Obviously, the pandemic provided a significant boost to Amazon’s eCommerce business, but these tailwinds have faded in 2022.

Furthermore, Amazon is heavily investing in the future, particularly in its cloud business, AWS, and other areas of its business such as global fulfillment center capabilities and Amazon Prime expansion.

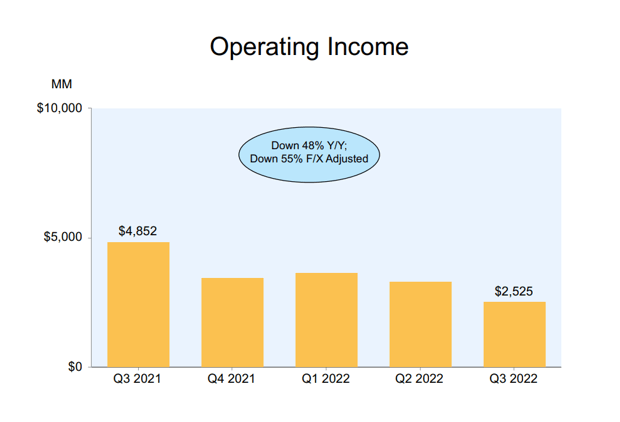

Changes in foreign exchange rates have also harmed Amazon’s business this year, resulting in a significant drop in operating income. Amazon’s operating income fell 48% (but 55% in forex-adjusted terms) to $2.5 billion in 3Q-22. The very weak forecast for 4Q-22, which implies sales growth of only 2% to 8%, added to the uncertainty.

Operating Income (Amazon.com Inc)

While Amazon’s operating income fell in 2022 due to a broader slowdown in the global economy and other challenges, Amazon provides investors with something that many other eCommerce brands do not: it is extremely profitable.

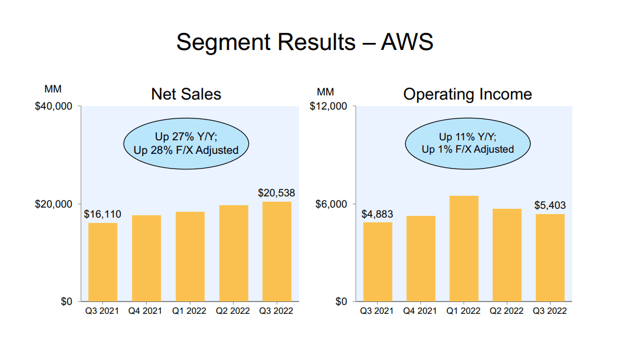

Amazon’s operating income totaled $2.5 billion in 3Q-22, with AWS contributing $5.4 billion in operating income. In short, AWS is now responsible for Amazon’s entire performance. Net sales in the AWS segment increased 27% YoY to $20.5 billion (28% in currency-adjusted terms).

AWS’s trajectory is extremely encouraging, and the company is a market leader in its field. Investors can and should expect AWS to deliver solid business results in the future because it has a strong market position to exploit and AWS’s scalability is a key asset for Amazon, especially during a recession.

Segment Results – AWS (Amazon.com Inc)

What Investors Are Paying

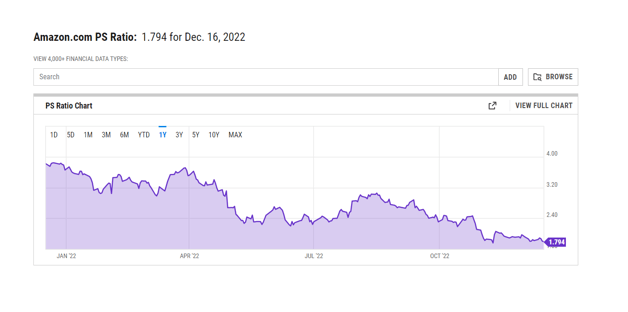

Amazon’s growth currently has the lowest price tag since November, when the stock fell to its 2022 low. With a $510.3 billion average sales assumption, an investment in Amazon costs investors 1.8x sales. This multiple appears to be quite low, given that Amazon traded at twice this multiple just six months ago.

I also believe Amazon is undervalued in this market because it is expected to earn approximately $12 billion in net income this year on an annualized basis.

PS Ratio (YCharts)

Why Amazon Might See A Lower Valuation (Risks)

Amazon is a large retail company that is therefore vulnerable to the economy’s cyclical swings, but AWS should not be. AWS is experiencing strong growth as a result of persistent product demand from the corporate sector, and I believe Amazon is currently valued as if AWS did not exist.

I believe Amazon’s valuation includes a very high margin of safety for the world’s most innovative eCommerce company, but there are some risks associated with currency headwinds, lower margins, and high operating costs.

My Conclusion

In my opinion, the market is completely wrong about Amazon’s future growth prospects. I believe the market has gone insane by valuing Amazon at a sales multiple of 1.8x, despite the fact that the company generates massive operating profits, particularly from the AWS business line.

Amazon’s down channel, in my opinion, has been largely driven by concerns about the company’s sales growth, particularly the 4Q-22 outlook, which I believe investors continue to overreact to.

Yes, Amazon’s growth is slowing, but it has never paid to bet against Amazon in the last twenty years, and I find it difficult to believe that a company with a quarterly net income of ~$3 billion is losing its edge.

Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.