Summary:

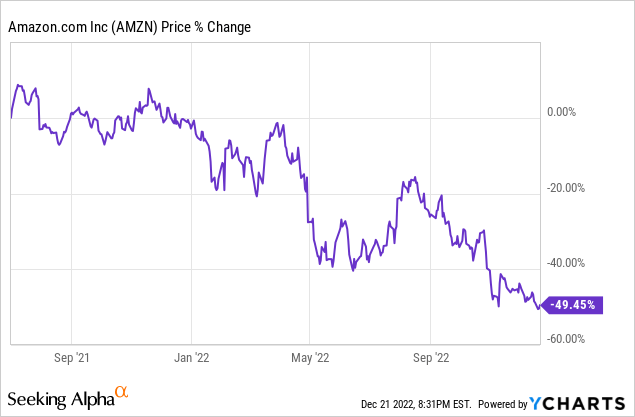

- The chart would suggest retail and AWS are doing horrendous, but don’t confuse share price with fundamentals.

- Negative sentiment for Amazon has snowballed these past few months.

- Right before our eyes, we have seen analysts and investors flip-flop as to which metrics they use to value the company. Expect them to flip back in 2023.

Kevin Winter/Getty Images Entertainment

You may assume Andy Jassy (above) should not be smiling. Having been CEO of Amazon (NASDAQ:AMZN) for a little over a year now, he has seen the share price get cut in half (and then some) since taking over the reins from Jeff Bezos.

Okay, so that’s share price. What about the underlying business?

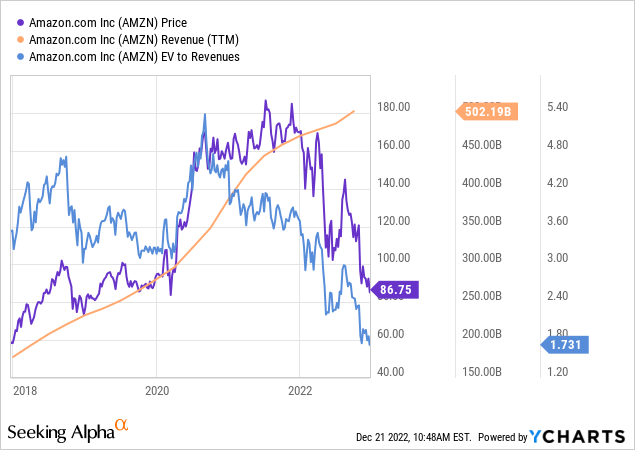

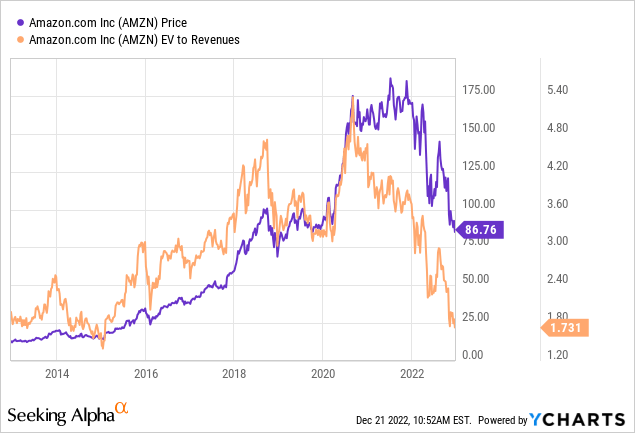

North of $500B on a TTM basis, revenue has never been higher. Yet the share price is back to what it was 4 to 5 years ago, which is why I chose a 5 year chart above. You can see back then, the EV/sales was over double what it is today. Meaning, it’s over 50% cheaper today on that metric. In fact, you have to go out 10 years to find it cheaper:

So yes, in late 2014 to early 2015, you could have scooped up the stock at today’s valuation. Yet that era is an apples-to-oranges comparison.

Back then, almost all revenue came from retail, which is a very low margin business; a low to mid single-digits percentage.

Today, Amazon Web Services (known as AWS) is approaching one-fifth of the company’s revenue. At year end it should produce around $80B TTM sales with operating income of $24B, assuming margins stay around 30%.

When you consider this, you realize the stock is significantly cheaper when comparing to the almost all retail operation of 2014/2015.

A kingdom without its king?

Going back to Jassy, it has been said that Bezos left when the company was at its pinnacle. Perfect timing which is quite common for founder-led companies.

Perhaps. Or perhaps Bezos, who at the time was the richest man on earth, decided that 27 years of his life working that job was enough.

Given how much of his net worth is on the line, I don’t think he would have walked away if he didn’t have the utmost confidence in his successor. Nor would Jassy, the brainchild behind AWS and a 20-year company veteran, accept a compensation package which is almost entirely based on stock performance. If you don’t win, he loses.

The 2021 headlines touting a $214M pay package sound rich, until you realize it’s stretched over 10 years and the cash component is only $175k annually. The rest is stock and it vests between 2023 and 2031. Furthermore, 80% of it doesn’t vest until the last 5 years.

But wait, remember what the share price was when he took over; about double.

To be worth anywhere near that headline number, he needs to get it back there, and then some.

To earn more than that ~$20M/year, which is actually low on a relative basis for a CEO of such a massive company, he needs the share price substantially higher in the coming years. Given this 54-year-old’s ultra-competitive streak, you can bet the same ingenuity he used to create AWS will be used to reward shareholders, himself included.

Valuation; it’s cheap on revenue, but the PE is sky high!

That has been the mantra of Amazon bears and skeptics for more than a couple decades. However, compared to recent history, it has reached a fever pitch. You may have noticed that many of the same bulls who touted the stock on P/S or EV/sales have thrown that metric out the window, and now only murmur PE.

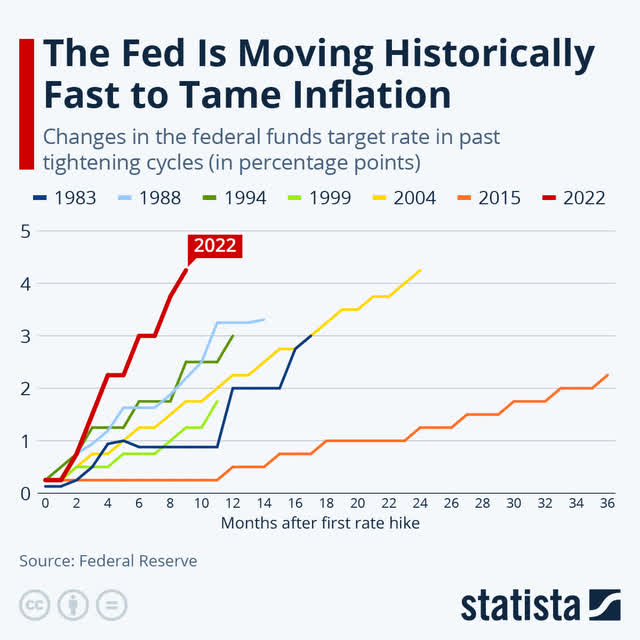

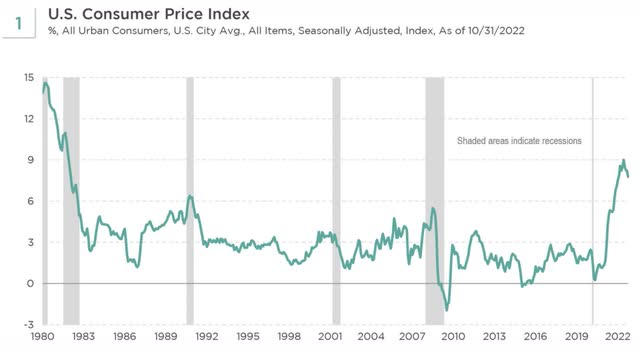

On the surface it makes sense. We go years at a zero interest rate policy and now have a federal funds rate approaching 5%, by far the most rapid tightening in history.

So yes, it make sense that the discount rate used to value equities – especially high growth equities – has also changed dramatically. Their future returns must be weighed against risk-free Treasuries, which now have some yield.

Powell makes the Volcker tightening era, when inflation peaked at 14%, look slow in comparison. That is, when you consider the starting FFR and the multiple of which it was increased.

Historically when the Fed has gotten serious about fighting inflation, as Volcker finally did, it has reversed rather quickly. This is despite the fact that at that time, just like now, no one can fathom inflation returning to significantly lower levels.

Macroband, Macrobond, Bureau of Labor Statistics

It’s possible that this time is different, but we also all know that’s one of the most dangerous phrases in investment lingo.

If this time isn’t different, and inflation does subside, risk-assets should be re-rated. Does that mean bubblicious Covid multiples? Nope. But remember, Amazon is far below that. It’s trading at an EV/sales multiple it touched only briefly within the last decade, and that was before the cash cow of AWS took off.

Okay, okay, you still want to argue PE. Fair enough.

It’s foolish to think of Amazon as a startup because let’s face it, they are old and grey for a tech company. However, they still act like a startup, just as Jeff Bezos promised they would in his now famous “day one” 1997 shareholder letter. Financially, this means they plow their earnings back into growth. That is why Amazon has (and always has had) a ridiculous looking PE and razor-thin profit margins.

Or in the case of recent quarters, what looks like negative or near negative earnings, due to factoring in mark-to-market valuations of their investments – e.g. Rivian (RIVN). They haven’t even lost money on their Rivian investment. Since the stock is down, they just have to record a paper-loss on its valuation. In April, that’s why I wrote a piece titled Get Ready For Amazon’s Worst Quarter In History. Of course since then, even more paper losses.

Yes, it always looks like Amazon has miniscule operating margins, but when you add back the R&D spending – which is reinvestment in growing the company – you start to realize their operating margin hovers around 10% rather consistently. If you re-calculated their PE throughout the years by adding back R&D to earnings, you would get PEs which are not the crazy 50-120x.

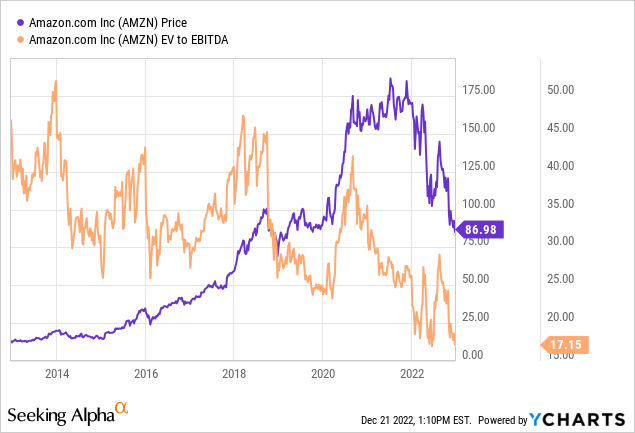

To see this, let’s take a look at their EBITDA. As a reminder, that’s earnings before interest, taxes, depreciation, and amortization. Their heavy R&D spend means they’re taking a lot of depreciation and amortization. In addition to suppressing earnings, that also suppresses taxes since there’s lower taxable income.

About 17x EBITDA, a far cry from the 76 PE currently being reported. As you see this is dirt cheap relative to the last ten years. Typically, that multiple is more along the lines of high 20s to mid 30s.

Amazon vs. big tech

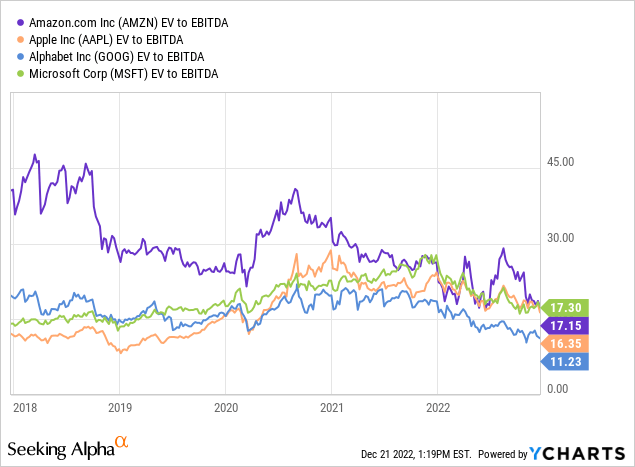

No, Amazon is not the cheapest on EV/EBITDA. The point here is to show its valuation is right in line with the cohort, despite the perception of it being extremely expensive versus Apple (AAPL) and Microsoft (MSFT).

Also, while it may not have the absolute lowest EV/EBITDA of the group, it definitely does have the lowest relative to the multiples each has historically traded at.

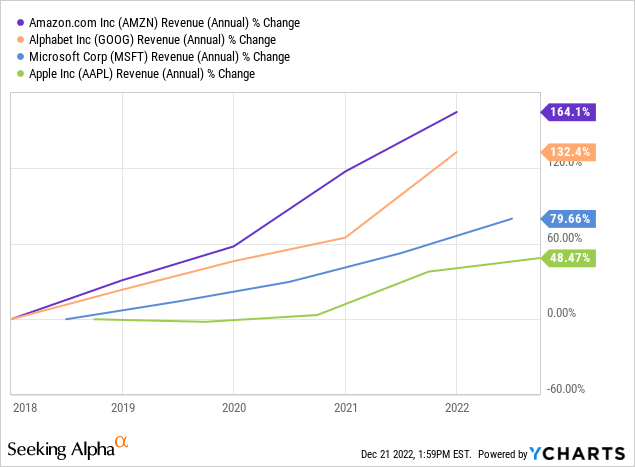

Yet, it shouldn’t trade at or below the same EV/EBITDA multiple of the group, given Amazon’s superior growth:

Perception is that Amazon’s growth has come to a halt. This is half-true. There was a pull-forward effect from the pandemic. This makes the 2022 numbers look lackluster year-over-year.

Amazon has been adjusting for the fact that some of us are no longer getting 100% of our groceries/necessities delivered (like I did for 2 straight years) and that we’re back to in-person shopping. However, that doesn’t change the long term trajectory of ecommerce, which is continued increased market share. It’s more like a return to the trend line now, after an upward blip caused by Covid. The most recent Black Friday weekend demonstrated this.

But remember, Amazon’s share price is back to levels last seen over 3 years ago, before Covid. Yet, its sales are almost 2x higher!

Risks to consider

To be clear, there are plenty of risks which may turn my thesis upside down. Some macro, some company specific.

1. Recession

If it happens next year, it will be the most telegraphed recession in history. As such, there’s not much more to say on this. Obviously, consumer discretionary (like retail) and business spending (like cloud) could experience lower than projected growth.

2. Inflation

If I am wrong on inflation and it doesn’t subside, then the tech wreck isn’t going to turn around. In fact, it could get worse next year.

While high inflation adversely affects most industries and companies, it will likely hurt high growth companies such as Amazon even more. Because if inflation doesn’t go down, neither will rates.

3. Competition

Let’s break this down into two parts; retail and cloud.

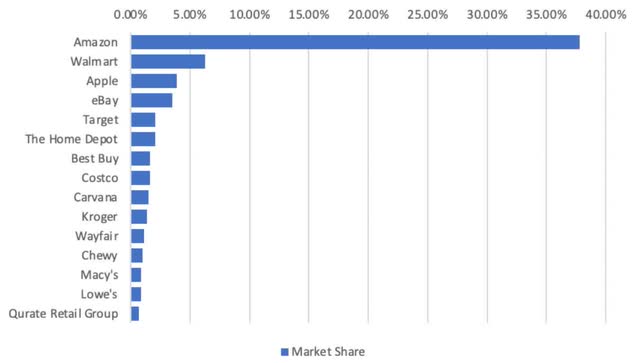

As you already know, Amazon is the king of ecommerce:

US ecommerce market share, June 2022 (Statista)

Those at the top always have the biggest targets on their back. No doubt Amazon will continue to face increasing competition from the likes of Walmart (WMT), Shopify (SHOP), and perhaps even Coupang (CPNG) if/when they make it to the states.

Walmart+ vs. Prime is a well-known duel, but what if Shopify bought FedEx (FDX) or vice-versa? Then their merchants could operate as a collective and offer a compelling fulfillment alternative. Of course, we can speculate all day about the future but often times, the biggest threat comes out of left field.

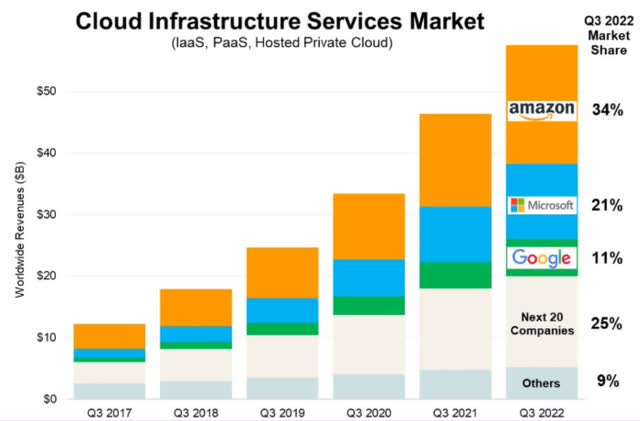

Contrast that to cloud, where the biggest competitors will most likely not be a surprise. This is because dependable, scalable, and geographically diverse cloud hosting requires massive scale. Not something a startup can supplant that quickly.

Q3 market share of top 3 cloud infrastructure companies (2017-2022) (Synergy Research Group)

It’s not retail – but rather cloud – where Amazon faces formidable competitors in the present. Microsoft Azure and Google (GOOG) Cloud will give AWS a run for its money. As long as the pie continues to grow, each can be quite successful.

Some estimates peg the global cloud computing market to grow at a 19.9% CAGR between now and 2029. That’s $484B to $1.71B. If that doesn’t pan out and such estimates are grossly exaggerated, this will be a big problem for not just Amazon, but also their two biggest competitors.

4. Antitrust

This is both a risk and benefit, depending on how it would playout (if it does).

While there is much disagreement as to the valuation of Amazon as a whole, most seem to agree it would be worth more broken up. So far the company has been steadfast on being against this. Lawmakers may feel differently.

As I detailed earlier this year, based on some metrics and peers, AWS alone may be worth more than the current market cap of the company in the near future. An involuntary breakup may benefit shareholders in unlocking value.

On the flip side, the retail operation – as well as other bets like Prime Video – may not have been so successful, if they didn’t have AWS profits to subsidize them along the way. Without AWS, retail may have a difficult time offering a better value proposition vs. competitors.

5. Solar storm or major war

Yes, this may seem a bit out there, but I am someone who is constantly pre-occupied with black swans.

Are you familiar with the Carrington Event? It took place in 1859 and was the largest solar storm in recent history. Fortunately, this happened before electricity was widespread. Back then it was mostly used for telegraphs and this storm “only” took down half of telegraph stations in the US. If such an event happened today, it could lead to years of power outages.

Carrington-sized solar storms take place every few centuries, with estimates ranging from every 150 to 500 years. A 2019 study proposes the odds of the next happening before 2029 of being “only” 1.9%. I emphasize only because a 1 in 50 chance is still quite high, relative to what it would mean for society.

While the grid is rebuilt, companies like Generac (GNRC) and Emerson Electric (EMR) might thrive, but companies like Amazon not so much. In fact if something were to bankrupt Amazon in the foreseeable future, I can think of no other event that could do so aside from this, or a major war.

Even if it were a milder storm, the adversity Amazon would experience could be immense.

However I don’t want to go down the doomsday trail. The fact is that if another Carrington Event happened in our lifetimes, we will have far bigger problems than investments. Like food, shelter in winter, healthcare, you name it… they’re all more important than net worth, which won’t matter in a time like that. Don’t invest for the end of the world, because it only happens once.

This is my highest conviction, risk-adjusted bet for 2023

Some people collect things. I collect stocks. I like to buy and not sell. With such an addiction, I have over 150 positions. As such, none have a high weighting. Yes, I am aware this is diworsification but for me, it’s joy, because there are just so many companies I enjoy owning for the long run. Especially those whose products and services I use.

Every year or two, there is usually one high conviction stock. I can’t say I go all-in because even my biggest positions are still a small weighting overall. However, these “all-in” buys are often 3-5x the weight than that of each of my next 5-10 largest.

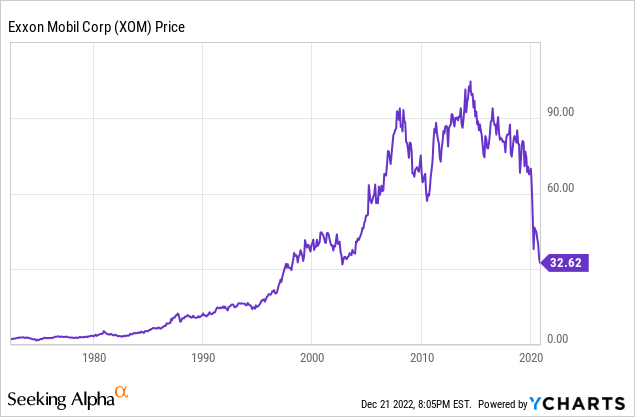

During Covid I bought a lot, including many names at the Covid lows, but none with such conviction as Exxon Mobil (XOM). Prior to the pandemic, I only had 300 shares. I thought I was genius for building up a position of 7,000 shares at a cost basis averaging $53.

Then the price dropped to $32 and change.

In other words, my genius buy dropped another 40%.

Of course I felt like a depressed idiot, but I did not waver from my long term conviction. My only fury was that I overpaid way more than what I could have gotten it for. Think of how many shares I could have bought at $32 with that same amount!

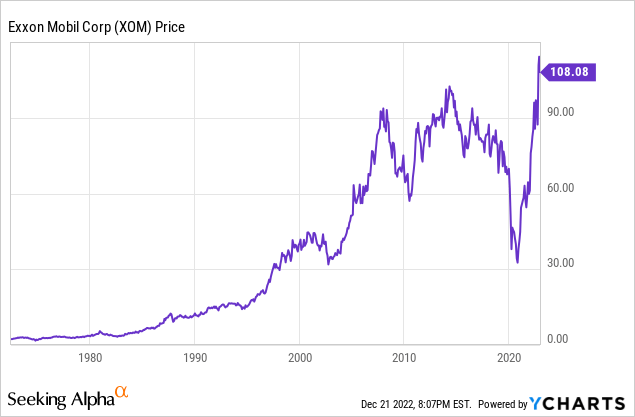

Even with my timing being terrible, in the long run it still worked out.

Did I buy this falling knife the bottom? Not even close. But I am still sitting on more than a double and that’s excluding the near 7% yield on cost, which I have very much enjoyed these past couple years. Meanwhile, all the green energy names people told me I needed to buy instead are near their Covid lows, or worse.

My timing of going all-in on Amazon this year feels similar. Obviously my timing was far from perfect. But my conviction now, despite the share price of Amazon continuing to drop, is no less than that of Exxon in 2020 and 2021.

Only time will tell if my conviction is right or wrong, but I have been playing the falling knife game for over two decades now. What I can conclude is this; I usually buy too early, but it usually doesn’t matter in the long run.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Disclosure: I/we have a beneficial long position in the shares of AMZN, GOOG, WMT, CPNG, FDX, SHOP, GNRC, XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not a financial advisor. This article is general information and for entertainment purposes only. It should not be construed as being investment advice. Please do your own due diligence regarding any security directly or indirectly mentioned in this article. You should also seek advice from a financial advisor before making any investment decisions. A Buy, Sell, or Hold rating in this article does not constitute a Buy, Sell, or Hold recommendation.