Summary:

- Airbnb is expected to report strong growth in revenue and earnings for Q4 2023, with a 14% YoY increase in revenue.

- Key data points to watch include bookings growth compared to Q4 2022, trends in average length of stay, and average daily rates.

- As I discuss in this article, each of these data points helps us determine what’s in store for Airbnb this year.

- A macroeconomic analysis of the travel sector suggests the comeback of Asia will be the key determinant of Airbnb’s growth in 2024. Investors need to evaluate how Airbnb is positioning itself for success in this challenging market.

- I am not bearish on the prospects for Airbnb – I remain long – but a downgrade seems a rational move given my expectations for Airbnb’s financial performance this year.

SOPA Images/LightRocket via Getty Images

Last November, after analyzing deal activity in the leisure sector, tensions in the Middle East, and the continued impact of inflation, I warned investors that Airbnb, Inc. (NASDAQ:ABNB) may have reached a short-term peak in demand. This, however, did not stop me from maintaining my buy rating for Airbnb as I thought the company was cheaply valued given the long runway for growth enjoyed by the company and its potential for market share gains. ABNB stock has gained just over 20% since then.

With Airbnb set to report Q4 2023 earnings tomorrow, I revisited my thesis for the company. My findings indicate travel demand will normalize this year after a couple of years of strong growth. This doesn’t mean the travel sector is in any danger of a collapse – far from it – but I am downgrading ABNB to hold ahead of the Q4 earnings print.

Airbnb’s Q4 Earnings Will Shed Light On What’s In Store For 2024

Airbnb is expected to report strong growth in revenue and earnings when the company reports its financial performance for the fourth quarter of 2023. The Zacks consensus EPS estimate for Q4 is 69 cents, which would mark a notable improvement from the EPS of 48 cents reported in Q4 2022. Revenue is expected to hit $2.16 billion, growing 14% YoY.

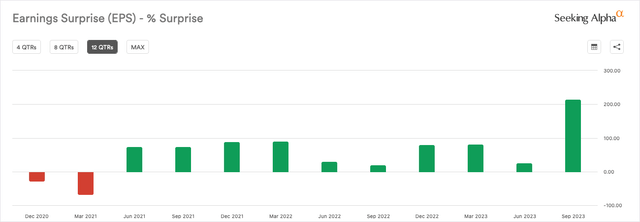

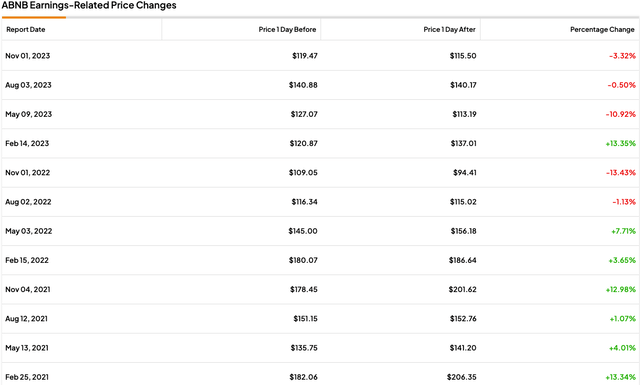

Airbnb has consistently topped Wall Street estimates for earnings in the last 12 quarters, but the market reaction, as you can see from Exhibit 2, has been mixed. Management’s commentary on future booking trends and cost control measures will likely be the driving forces behind ABNB stock post-earnings tomorrow.

Exhibit 1: Quarterly earnings surprise history

Exhibit 2: ABNB earnings-related price changes

More than revenue and earnings growth, I will be paying close attention to a few other data points to understand what 2024 holds for Airbnb.

- Bookings growth compared to Q4 2022, which was an exceptionally strong quarter: this will give us an idea of whether travel demand can sustain growth – at least at a moderate pace – in 2024.

- Trends in the average length of stay: this should give us an indication of whether long-term stays are still the driving force behind revenue/earnings growth. Understanding this will be crucial to determining how profitable Airbnb will be in 2024 amid changing macroeconomic conditions that can have a direct impact on long-term bookings.

- Average daily rates: this is the most reliable indicator of pricing power and should give us an indication of Airbnb’s competitive positioning in the leisure market.

- The success of cost control measures: with concerns growing over the sustainability of the post-Covid travel boom, Airbnb will have to depend on cost control methods to boost margins. Progress on this front can be considered a major green flag.

The Travel Rebound – Continued Recovery Or Potential Slowdown?

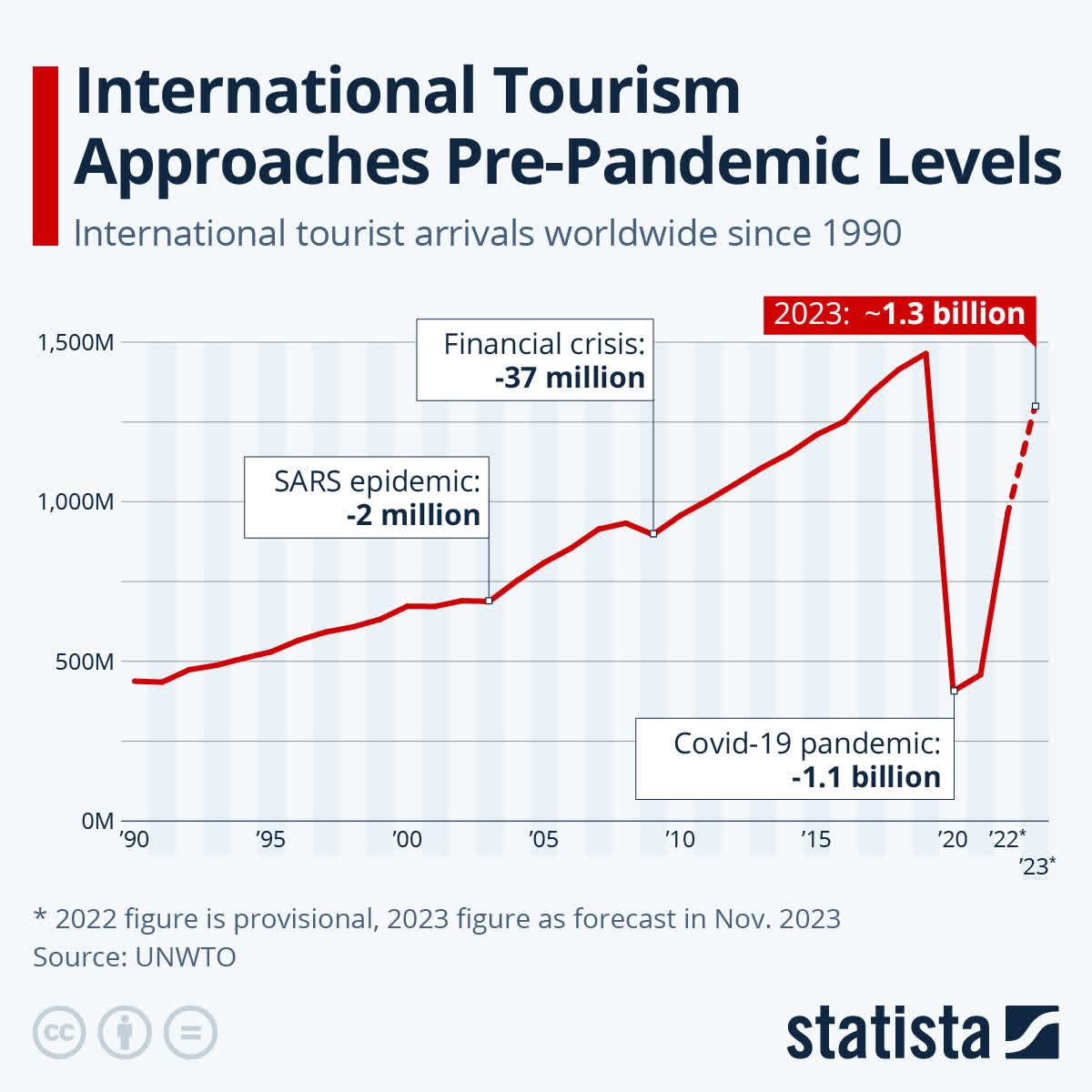

2023 was a strong year for the travel sector. Projections from Statista show that international tourist arrivals reached 90% of pre-pandemic levels last year, signifying the notable comeback of this beaten-down sector.

Exhibit 3: International tourist arrivals

Statista

Moving into 2024, projections point to a deceleration in revenue growth, which should not come as a surprise. The travel sector went from too cold in 2020 to too hot in 2023, and normalcy is likely to prevail in 2024 with travel demand set to face challenges in the form of continued tensions in different parts of the world and elevated inflation in almost all key regions finding its way into consumer wallets.

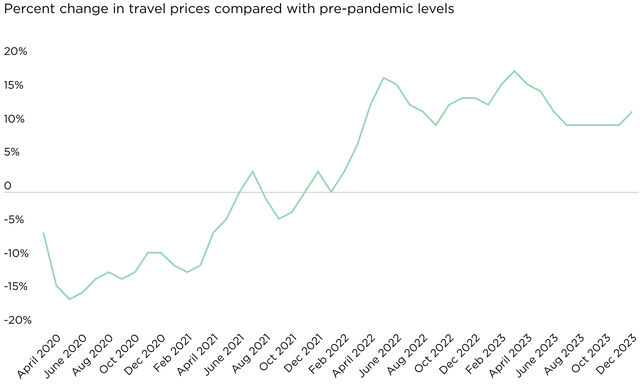

On the brighter side, travel inflation steadily eased in the second half of 2023, which is a good sign. A continuation of this trend should boost travelers’ confidence going into 2024.

Exhibit 4: NerdWallet Travel Price Index

NerdWallet, in its Travel Price Index, includes a few different data points.

- Airfare

- Car rentals

- Food away from home

- Hotels

- Movies, theatres, and concerts

The below table illustrates how these prices have behaved in December 2023 compared to November.

| Variable | MoM change |

| Airfare | -5.4% |

| Car rentals | -4.8% |

| Food away from home | 0.3% |

| Hotels | -1.3% |

| Movies, theatres, and concerts | 1% |

Source: NerdWallet

Based on these trends, I expect 2024 to be another year of growth for the travel sector, but I believe a deceleration of growth will be unavoidable given that revenge travel will lose its steam as normalcy prevails.

Airbnb investors, in my opinion, should pay close attention to two key developments in 2024.

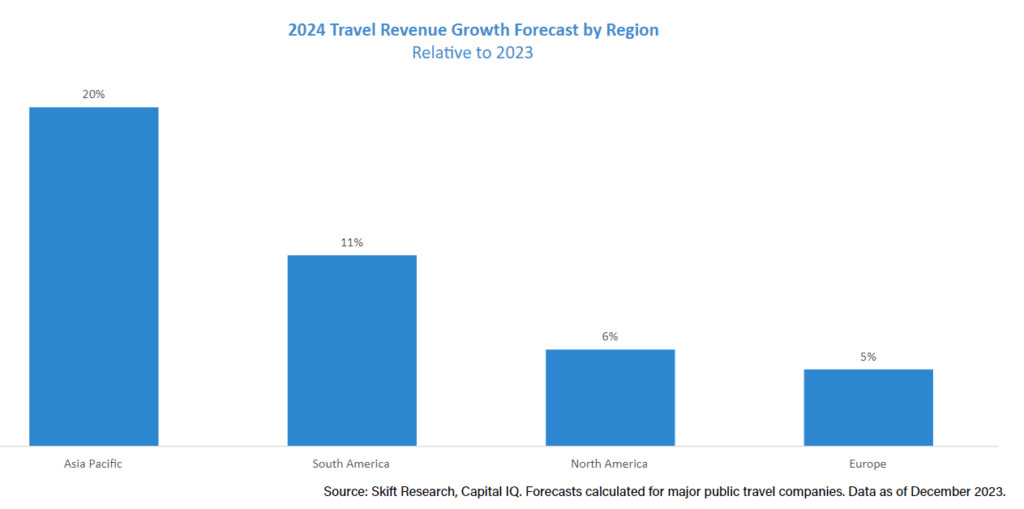

First, the strong rebound expected in Asia will have a direct impact on Airbnb’s earnings. According to Skift Research, the Asia Pacific region will be – by far – the fastest-growing travel market in 2024 as this region comes out of Covid restrictions fully.

Exhibit 5: 2024 travel revenue growth by region

Skift Research

Airbnb, in recent quarters, has shifted its focus to making the most of the expected travel boom in Asia. This is an encouraging development. The company management has remarked on a localized approach to tackle the Asian markets by tailoring the Airbnb experience to the preferences of the Asian market. As an investor, I need more concrete examples of what the company is doing today to achieve this objective, so I will look forward to management commentary on this front tomorrow.

I would welcome it if Airbnb were to discuss its progress in the below areas.

- Partnerships with local travel agencies and hospitality services providers to increase visibility in Asia.

- The development of in-app multi-lingual support to address the language barriers that may arise in Asian markets.

- Integrating local payment systems into Airbnb’s ecosystem to offer the Asian markets a more personalized, familiar experience.

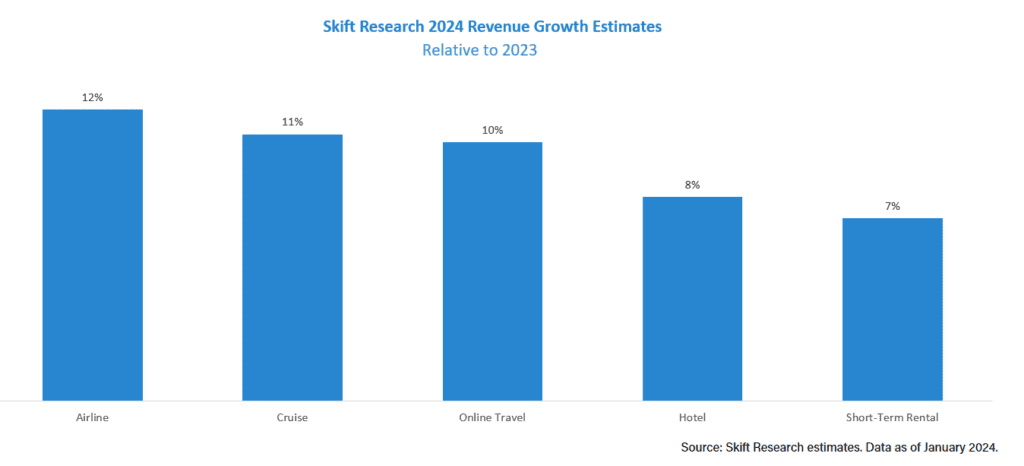

Second, the short-term rental market is expected to perform the worst among the main travel sectors, which may lead to lackluster gains for ABNB in the year ahead. Airbnb investors, therefore, will have to diversify their portfolios to gain exposure to some other travel categories such as airlines and cruise travel.

Exhibit 6: 2024 revenue growth estimates by sector

Skift Research

For Airbnb, I believe 2024 will mark an increase in marketing costs while it tries to navigate rising competition. With a revenue deceleration on the cards, a notable increase in marketing costs may impact operating margins, which is a risk that I am closely monitoring.

Takeaway

Airbnb, at a forward P/E of 18, does not seem expensively valued given expectations for double-digital annual revenue growth in the next five years. However, I believe 2024 will prove to be a year in which the travel industry will get closer to more normalized growth following a year of exponential growth, which may deter investors from investing in ABNB. I remain bullish on the long-term prospects for Airbnb, but based on normalizing expectations for growth in 2024, I am downgrading ABNB to a hold rating ahead of Q4 earnings.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABNB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Unlock Alpha Returns With Our Comprehensive Investment Suite

Beat Billions offers a wide range of tools and resources to help you achieve superior investment returns. Our team of expert analysts uncovers undercovered and thinly followed stocks to supercharge your investment returns.

- Access our model portfolios and receive actionable ideas to build a successful portfolio.

- Join our community of like-minded investors and exchange ideas to maximize your investment potential.

- Keep track of the real-time activities of investing gurus.

Don’t miss out on our launch discount – act now to secure your subscription and start supercharging your portfolio!