Summary:

- Unity Software Inc. investors saw Unity fall into a bear market after a significant recovery from its November 2023 lows.

- The company is undergoing strategic changes, including a new CEO and a 25% reduction in headcount.

- Unity’s future challenges may be reflected in the weak sentiments toward the gaming industry, but its partnership with Apple’s Vision Pro headset could drive new growth opportunities.

- I argue why Unity’s recent price action suggests it could bottom out heading into its fourth-quarter earnings release.

- Unity investors considering buying more shares should capitalize on the recent bear market plunge before the rest of the market realizes it.

Maria Korneeva/Moment via Getty Images

Unity Software Inc. (NYSE:U) investors experienced a significant recovery from its November 2023 lows before it petered out in late December. Despite that, U still managed to outperform the S&P 500 (SPX) (SPY) significantly since my previous upgrade in late November. As a result, I believe it should be clear that U investors have seen the worst in the stock’s decline as it hit rock bottom late last year.

The company is still undergoing strategic changes, including a new CEO on board. In addition, Unity has also recently announced a notable 25% reduction in its headcount as the company pivots toward a more disciplined and sustainable growth strategy. Notwithstanding the commitment to improve its operating leverage, Unity couldn’t provide more clarity over the scope of the improvement in early January. Accordingly, management stressed that it could not “accurately estimate the costs and charges associated with the job reduction” at that time. Consequently, with Unity Software scheduled to report its fourth-quarter earnings release on February 26, investors are urged to pay attention to an improved outlook, which I assessed the market has likely reflected.

Why? While Unity is renowned for being the platform leader in the creation of real-time 3D content, the cuts suggest that the gaming industry is still undergoing its growth normalization. Tencent’s (OTCPK:TCEHY) Riot Games decided to reduce 11% of its global headcount recently, adding to the negative sentiments. As a result, I believe U’s almost 30% bear market decline from its late December highs is likely a reflection of weak sentiments on the gaming industry. It could suggest that Unity might continue to face more challenges in 2024, even as it executes its transformation.

Notwithstanding the near-term caution, I believe it’s also crucial to understand that Unity could chart a new growth vector with the recent retail launch of Apple’s (AAPL) Vision Pro mixed reality headset. Unity is one of the principal partners in helping Apple shape its nascent Vision Pro ecosystem, providing developers with a trusted platform to build their apps. As a result, Unity believes the company is well-poised to help developers “deliver groundbreaking spatial computing experiences for Apple Vision Pro.”

Deepwater Asset Management highlighted that the growth momentum in Vision Pro will likely not move the needle in the near term. Despite that, it could become one of Apple’s most successful devices outside the iPhone, suggesting a massive transformation at stake. The Wall Street Journal also highlighted in a recent piece that Vision Pro could transform the workplace, bolstering Unity’s opportunities beyond gaming and leveraging Apple’s world-class consumer ecosystem.

U is valued at a forward EBITDA multiple of 26.8x, above its SaaS peers’ median of 23.1x (according to S&P Cap IQ data). With a best-in-class “A+” growth grade relative to its tech sector (XLK) peers, Unity Bulls will likely point to the metric to justify its growth premium. Analysts’ estimates suggest that Unity’s adjusted EPS could improve by 44.3% in 2024, underpinning its high-growth momentum. As a result, I gleaned that analysts and investors will likely be keen to assess the boost driven by its recent job reduction in its ability to lift its guidance. As the company didn’t provide clarity in early January, some level of pessimism is likely priced into its recent pullback, providing another opportunity for investors to add more exposure.

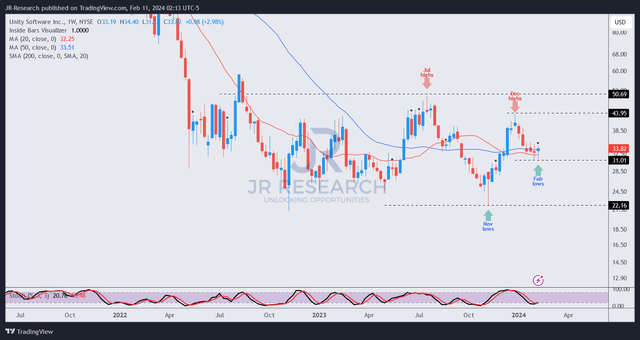

U price chart (weekly, medium-term) (TradingView)

Furthermore, U’s price action analysis corroborates my conviction that dip-buyers have returned over the past three to four weeks. However, it’s lacking a more robust bear trap signal (similar to the one in November) that could have bolstered the strength of its buying sentiments.

Notwithstanding the caution, I assessed that U isn’t valued at a steep growth premium after the recent bear market, corroborated by constructive price action. As a result, I gleaned that it’s still reasonable for me to maintain my bullish bias, albeit with a reduction from my previous Strong Buy thesis.

Dip-buyers who have the conviction that management could offer more robust 2024 guidance can consider capitalizing on its recent base to buy more shares ahead of its earnings release.

Rating: Downgraded to Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!