Summary:

- I am skeptical about Unity Software’s ability to achieve the touted $1 billion EBITDA in 2024, prompting a revision to a sell rating.

- Unity, currently navigating a “show-me” narrative, faces immediate challenges, including a product portfolio assessment and potential workforce reductions.

- Unity’s valuation as a growth stock, coupled with significant debt, raises doubts about reaching the EBITDA target, making the stock less appealing.

Sundry Photography

Investment Thesis

Unity Software (NYSE:U) will report its Q4 2023 results on Monday, February 26th after the close. This is a business that I assert has now been put down as a “show-me” story.

And as such, I don’t believe this stock offers investors a positive risk-reward. At the core of the bull thesis, it’s that Unity can guided for close to $1 billion of EBITDA in 2024. And yet, for my part, I struggle to see that as a realistic scenario.

Therefore, I’m once more downwards revising this stock to a sell.

Rapid Recap

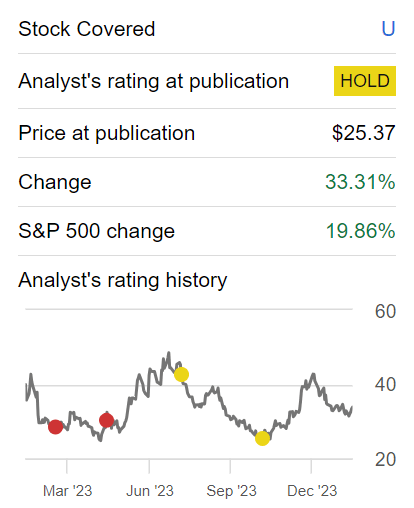

Back in October, I wrote a neutral analysis on Unity, where I said:

I know that stocks never move in straight lines. Even though I continue to believe that Unity is overvalued, as I’ve done for a long time, I also know that the stock in the near term is pricing in a lot of pessimism. Consequently, it doesn’t bode well for me to now issue a sell rating, as I recognize that the stock is now negatively charged.

Author’s work on U

As you can see above, since I stated that I believed the stock was too negatively charged, the stock jumped 33% y/y. But now that tempers have moderated, looking again at Unity, I believe that this stock is once again primed to disappoint investors.

Unity’s Near-Term Prospects

Unity’s interim CEO Jim Whitehurst declares that Unity is in a period of transition and bound to be smaller and yet more nimble. The company aims to position itself as the trusted leader in fostering a community of creators building on its technology. Over the next three to five years, Unity envisions becoming an indispensable partner for game creators, facilitating the development, operation, and profitability of their creations. With a focus on the gaming market, Unity plans to secure a leadership role by providing technology that is not only relevant to enterprises but also serves as the default choice for individuals and enterprises engaging with 3D content. By concentrating on core competencies, building strong partnerships, and emphasizing community engagement, Unity aims to tap into a vast market in the gaming industry, delivering a profitable business.

However, Unity faces near-term challenges, particularly in the context of a comprehensive assessment of its product portfolio. The company acknowledges the need for intervention to align products with customer needs and enhance revenue growth.

As part of this evaluation, Unity anticipates making changes to its product portfolio, including a potentially further reduction in its workforce.

Striking a delicate balance between maintaining market share, adjusting pricing strategies, and effectively implementing necessary changes poses a challenge, and positions Unity as a “show-me” story. Therefore, I don’t believe investors will be willing to continue paying a large premium for a stock that offers such uncertain prospects.

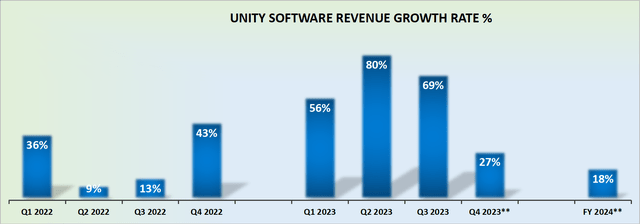

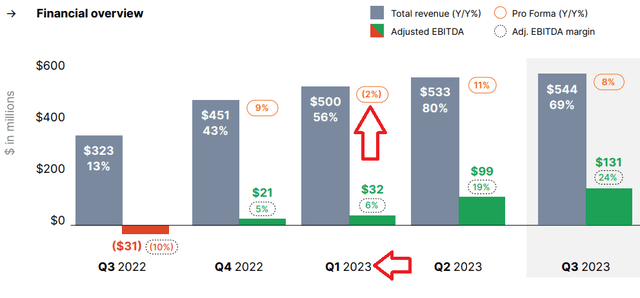

Revenue Growth Rates Are Going to Decelerate

Essentially, the problem facing Unity is that its revenue growth rates need careful interpretation due to the impact of the IronSource acquisition. Unity’s Q3 2023 pro forma revenue growth rates were up 8% y/y. Therefore, this means that Q4 2023 will have one final strong “as-reported, inorganic” strong quarter of revenue growth rates before 2024 guidance is provided.

For my part, I struggle to see Unity guiding for higher than 18% CAGR for the year ahead. Why?

Because Q1 2024 will have an easy comparable figure to go up against, where Unity’s pro forma growth rates were down 2% y/y in the same quarter a year ago. But as we move forward beyond Q1 2024, Unity’s quarterly growth rates will start to rapidly progress towards the low teens CAGR.

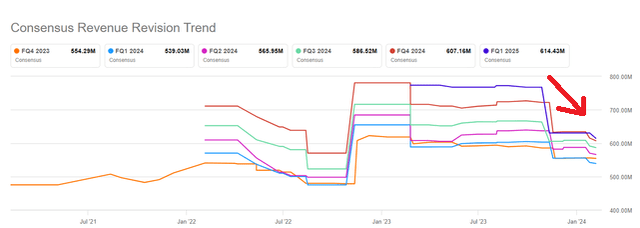

As you can see in the graphic above, this is a consideration that has started to be acknowledged by the sell-side too. As close followers of my work will know, I strongly recommend avoiding investing in companies where the sell-side is downwards revising estimates on your stock.

You end up in a battleground stock, where all your emotions get exposed as you regularly read of reputable analyst firms reducing their price target on your stock. And Unity goes from being a favorite to a show-me story.

U Stock Valuation – 14x 2024 EBITDA

The problem gets further complicated because Unity is still being priced as a growth stock. And given that it’s a favorite amongst the “growth crowd”, therefore it is priced as a growth stock.

But the fact of the matter is that Unity carries too much debt. More specifically, Unity carries $1.2 billion of net debt. Even though Unity continues to assert that it will reach $1 billion of EBITDA in 2024, I find it difficult to see how that’s going to take place.

Consequently, I’m reducing the target for Unity in 2024 to $900 million EBITDA from $1 billion. However, even then, that would still be around 140% higher relative to where 2023 is expected to end at. Can Unity increase its underlying profitability so substantially in 2024?

On the surface, I recognize that paying approximately 14x forward EBITDA appears cheaply priced. But at the same time, with so many moving parts and so much uncertainty, together with a significant amount of debt, I believe that all together, this stock is best avoided.

The Bottom Line

As I assess Unity Software’s near-term outlook, skepticism arises regarding its ability to achieve close to $1 billion EBITDA in 2024, a key element of the bullish thesis.

Recent challenges, including a comprehensive product portfolio assessment and potential workforce reductions, present immediate hurdles.

The intricacies of balancing market share, pricing adjustments, and implementing necessary changes may deter investors from paying a premium for uncertain prospects.

Furthermore, Unity’s valuation raises further doubts. While the forward EBITDA multiple seems reasonable at around 14x, the uncertainties facing Unity’s stock provide investors with an unfavorable risk reward.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.