Disney Proxy Vote: The Court Is Now In Session For Shareholders

Summary:

- The Walt Disney Company holders will be subject to a proxy fight between management and the dissident Trian Group led by Nelson Peltz.

- Media/entertainment associates believe the Trian case is strong, but management is expected to prevail due to a “too big to fail” attitude.

- Both sides have not presented strong cases, leading to a potential hung jury verdict. Disney shares may rise regardless of the outcome.

Atlantide Phototravel/The Image Bank Unreleased via Getty Images

Above: All that remains of him is a statue per se, but is he content or as some assert, spinning in his cryogenic grave?

Premise: Over the next two months, The Walt Disney Company (NYSE:DIS) shareholders will be subject to a massive tsunami of soliciting DIS management vs. the dissident Trian Group led by billionaire investor Nelson Peltz. The proxy fight will end in a polling on April 3rd. Our research of 100 proxy fight outcomes shows management prevailing 52% of the time vs. 34% for dissidents and 13% ties.

(According to a WSJ report, the contenders expect to spend $70m pleading their cases to holders, an indication that neither is expecting a walk-in victory).

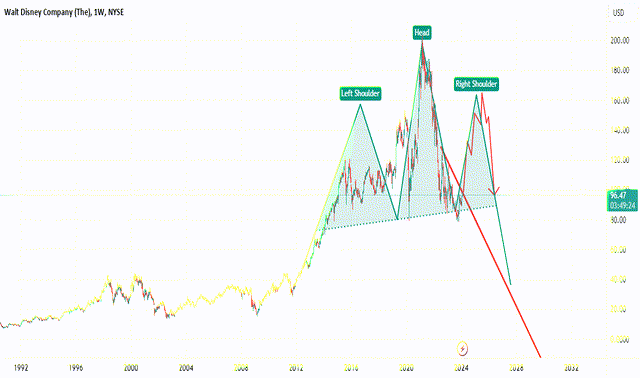

Above: A forward projection to 2026 could go the wrong way.

We floated these numbers with media/entertainment associates who have deep insight into the industry through decades of C-suite experience. Of six people on our panel, five believe the Trian case is very strong. Yet they expect a combination of long die-hard DIS pom pom twirlers plus most holders who feel the margin of safety is not materially threatened will support the management slate.

There is a funny joker in the deck nonetheless: How big will the final margin of victory be? If it turns out that CEO Bob Iger’s slate just edged through on a slither, that means we can expect further battles ahead. An overall thumping of Peltz would discourage new dissidents long term.

Our suspicion now is that while we do see prevailing issues that could open a pathway for victory by Peltz and his groups, we are probably facing something of a too-big-to-fail attitude keeping CEO Iger and his board in their seats.

That is why we present our view of the fight in the form of a courtroom case where both sides are presented and the jury-the holders big and small-get to decide who wins. We don’t presume any expertise. That is above our pay grade. However, our purpose is to try to break down the case for and against DIS management which holders will hear weighing in over the next two months.

We understand that both sides can assemble phalanxes of eyeshade guys to either dazzle or scare the pants off the big holders and hedgies as they make their rounds. But the thesis of the case is not to be found in numbers or metrics per se. It is in a judgement as to whether the in situ management has the vision and capability to sail this massive ship to safe harbor in an ocean rocked with rogue waves and swells. That or whether their track record to date has demonstrably proven otherwise-as Peltz asserts.

First, we appraise the foundation of the dispute in the simplest terms, i.e., the price of the shares since the high and the reasons for their precipitous fall. Then we will attempt to present the core arguments of both sides and leave to readers the judgement of which one-or neither—wins their votes.

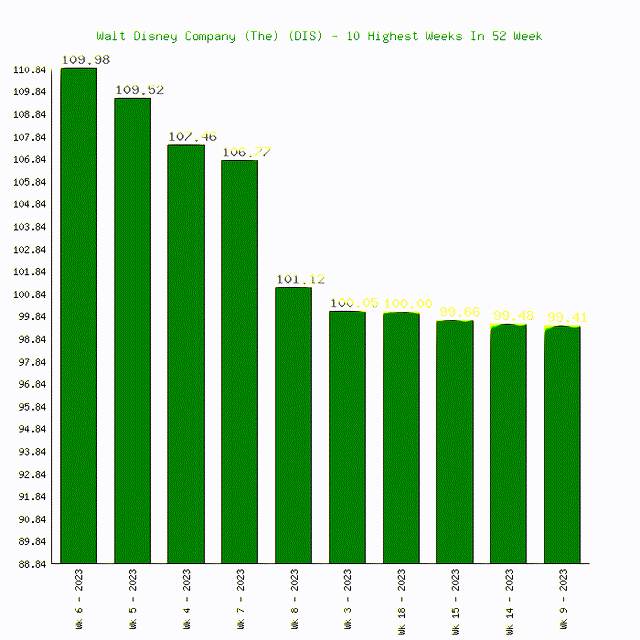

Above: Ten highest weeks of DIS trading last year.

The Trian/activist case-bottom line

Because of the poor performance of company management and its board, DIS stock has fallen from a March 8th, 2021 high of $201.50 to a price at writing of $99. 14. This, they say, is unacceptable given the facts.

Even after a fairly positive Q1 2024 performance, the shares ticked up a bit on a strong earnings beat ($1.01 estimated vs. $1.22 achieved) The results included a sharp reduction in streaming losses, but essentially flat revenue., over $500m in cost savings made toward the $7.5b goal, experience segment up 7%, sports up 4% but entertainment down 7%. In after-hours trading, the gain fell back a little, ending in $98.75 at our last look. Even if the stock ticks back over $100 short term, it is still over 50% below its high, Peltz forces will assert.

Nelson Peltz predictably was unimpressed with the 1Q24 results, “We’ve seen this movie before,” he told reporters.

- The performance is promising but does not really move the needle that DIS has truly turned the corner as advertised by management. Some responses have been positive, others continue to believe Iger is whistling past the cemetery.

- DIS assets are underperforming due to poor allocation of capital in many of its operating units.

- Two of the DIS directors targeted have no experience or background in the businesses in which DIS operates and should be replaced by Peltz and his associate.

- Peltz asserts that if he and his associate were part of the board they could bring a new level of insights to DIS challenges which presumably could evolve to a better allocation of assets and improved operating performance. This would drive the stock price much closer to where it deserves to be given the magnificent asset base of DIS. There have been no specifics supporting Trian assertions yet linking a poor board to stock performance.

Note 1: Investors who bought $1,000 worth of DIS shares 20 years ago would have $4,500 today (adjusting for inflation reduces that by $900). If these investors had instead bought the S&P 500 (SP500), their investment today would be worth $5,900 (Reduced for inflation ~$1,000 less). So, betting the S&P 500 would have superior returns-not that much, but better.

Note 2: DIS shares during the period, of course, took a massive hit in 2020 Covid results which could distort the comparative here. The S&P 500 was also bruised, but the Covid impact was spread among companies for whom Covid was either a plus or flat, not a devastating blow as it was to the media segment.

Dividends count, of course, everyone loves them. In its 1Q24 release, DIS announced a dividend of $0.45 with an implied promise of more to come. It’s a bone thrown at holders to produce a pothole for activists. Annual yield is now 0.31%, so keep the pom poms in the closet a while longer. Yet annualized it beats the CD’s now under 2%.

DIS management’s response and dismissal of dissidents’ claims

- Macro industry challenges must share blame for the damage inflicted on all industry participants in the sector. DIS management has endured facing these challenges with structural and policy changes that will enable it to reconstitute and thrive in the years ahead with its current plan:

- DIS will reduce average production costs on filmed and TV entertainment for both theatrical and streaming releases.

- DIS is already finding partners to bring into ESPN. They will contribute customer bases, equity, and possible bundling deals to share the spiraling costs of sports rights.

DIS buys into the video games sector with a $1.5b investment in EPIC games owner of blockbuster Fortnite. The theory being that DIS content applied to EPIC game platforms brings the company IP into the mainstream of the game business. Reorganizing the segments into three more efficient units entertainment, sports and experiences. This will shorten the span of control, produce more efficient operations and improve margins across the board.

Issues neither side has dealt with candidly so far that investors are entitled to know before they vote

What is management’s specific pathway to a dramatic reduction on DIS’s long-term debt of ~$46b? Aside from cost cutting, where will speedy debt reduction come from?

How is the round trip (2020-2022) to the CEO chair ridden by ex-CEO Bob Chapek not indicative of a management with no visible succession plan or a defined Iger departure?

Iger has yet to candidly confront the DEI and woke issues in terms of sharing management belief in the degree to which these cultural issues have contributed to poor $ outcomes of shows. Thus far, generalities about “politics” don’t make the cut for far too many holders, according to our panel.

Thus far, DIS moves have not yet made the case for keeping the company whole rather than restructuring with division sales or spinoffs as a better path to value recovery and debt cutting.

Trian has not produced anything more than its contention that the stock has taken a dive because management and the board have yet to produce a plan that it sees can ignite the stock to move back to previous highs. They need to address specifics in those areas they see wanting.

Trian has yet to lay out a specific set of goals they would push for as board members that could result in a faster recovery of valuations for DIS shares.

Summation: Our verdict: A hung jury possible

Both sides have not as yet put forth their best cases with sufficient proof of their merit against the other.

The issues here are far deeper and more linked to the macro climate in which DIS operates, its responses to date, and the underlying presumption that they need do no more for holders than point with pride at short-term results. Iger is still peddling nostrums about the business long past their sale date.

There is a pattern in the DIS strategy to date we can see: pad existing verticals with “partners” like the Epic move. One must ask why at this late date, in a sector over 50 years old, does DIS suddenly awaken to its possibilities? Clearly, decades ago DIS failed in a weak attempt at that market. What’s different about the EPIC deal? Shareholders would like to know.

Trian may echo the sentiments of a mass of holders for sure, but thus far it has not viewed with alarm to specific policies and failures. It needs to show management and board blindness to the new world of media. It needs to identify the melting ice cubes and propose real change that promises results showing in the recovery of the share prices.

Given the paucity of substance in both the DIS and activist cases, it is probably a hung jury verdict we can see coming. That would be a win by management, but a hefty percentage of dissent votes would be enough to keep the issues cauldron boiling. If that happens, expect more rounds to come ahead. Meanwhile, DIS shares should sustain a bit of a spike here for a while, but activists will remain unimpressed.

Interestingly, The Walt Disney Company shares can rise on a victory for either camp. For Disney, it’s seen a boost for stability, for Trian a clear open pathway for Mr. Market to get mischievous about the DIS shakeup that could involve bigger changes than now exist and move the shares on intimations of transactions or stock in play.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

The House Edge is widely recognized as the only marketplace service on the casino/gaming/online sports betting sectors, researched, written and available to SA readers by Howard Jay Klein, a 30 year c-suite veteran of the gaming industry. His inside out information and on the ground know how benefits from this unique perspective and his network of friends, former associates and colleagues in the industry contribute to a viewpoint has consistently produced superior returns. The House Edge consistently outperforms many standard analyst guidance with top returns.

According to TipRanks, Klein rates among the top 100 gaming analysts out of a global total of 10,000.