Summary:

- With a profitability grade of A+ and rated as a Strong Buy, Comcast seems attractive as an investment.

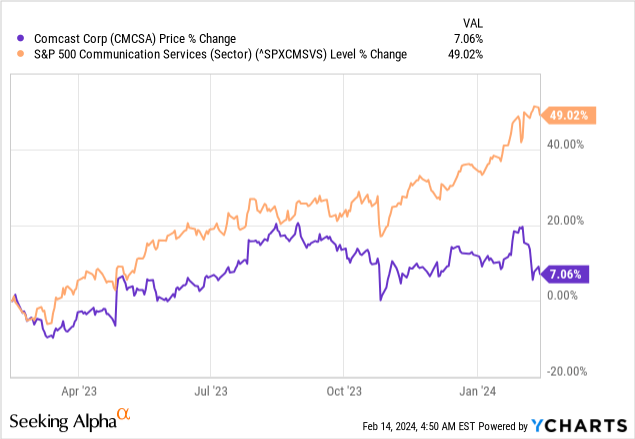

- However, its underperformance relative to the S&P 500 Communications services sector indicates that investors seem to have some reserve about the company’s prospects.

- The problem is wireless subscriber numbers not growing fast enough to offset the losses in cable, in turn leading to revenue stagnation.

- The solution most probably calls for more capital expenditure which would in turn impact free cash flow and profits.

- Worse, for a company with a high debt load, spending more money could see an impact on the amount of capital returned to shareholders.

SOPA Images/LightRocket via Getty Images

Comcast (NASDAQ:CMCSA) enjoys a profitability grade of A+ with a free cash flow margin dwarfing the median for the Communications services sector by over 140%. Its stock has been rated as a Strong Buy by Quant. However, trading at less than $42, it has delivered gains of only 7% in the last year while the S&P 500 Communications Services Sector is up by more than 49%.

Therefore, the objective of this thesis is to uncover the underlying reasons for this underperformance and assess whether this is a buy, especially after the company posted positive financial results for fiscal 2023 when it managed to beat both the top line and bottom line.

For this purpose, fully aware that the company’s studio group has ranked number one at the box office with blockbusters such as Super Mario or Oppenheimer just to name a few, I will focus on its main revenue-generating and most profitable Connectivity and Platforms business.

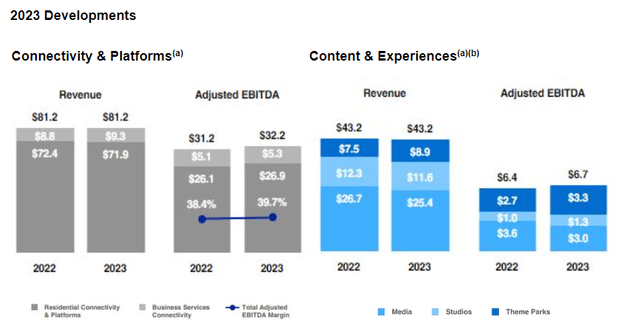

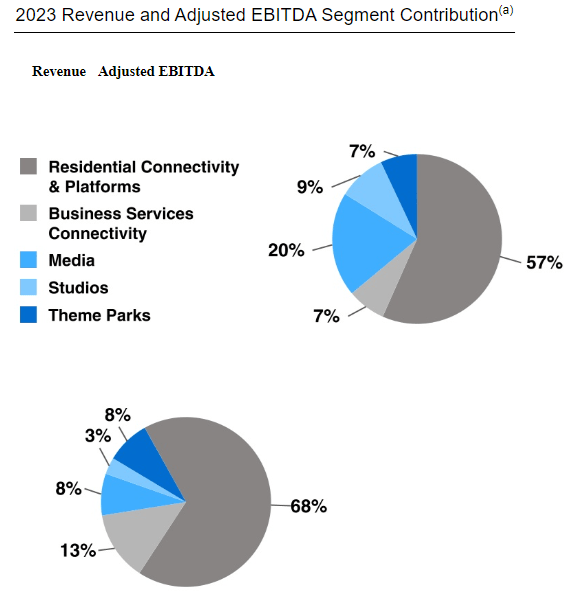

Connectivity Is Highly Profitable but Has A Growth Problem

In this respect, this remains primarily a communications play with connectivity for residential and business customers each contributing 57% and 7% of overall revenues for FY-2023 as pictured below. Together, these two segments which are grouped as Connectivity and Platforms contributed 64% of sales but, tellingly, generated 81% (68+13) of the total EBITDA. Then, there are the media, studios, and theme park segments grouped as Content and Experience which together contributed 36% of overall sales and 19% to EBITDA. This means that connectivity is highly profitable.

SEC Filing (seekingalpha.com)

Looking at growth, while connectivity revenue for 2023 amounting to $81.2 billion remained the same as in 2022 (chart below), adjusted EBITDA rose by 1.3% (39.7-38.4) which shows that Comcast’s strategy to focus on profitable broadband subscribers or those who are willing to pay for performance is positive.

However, despite having beaten analysts’ topline estimates for 2023, the overall revenue growth rate of 0.12% remains nearly 95% below the median for the sector. Along the same lines, revenue growth for Connectivity and Content stagnating at $81.2 billion is cause for concern.

Digging deeper, according to data from Inside Towers Intelligence, the company is continuing to lose cable broadband customers with 66K leaving the company last year. This compares to net additions of 263K in 2022 and 1.4M in 2021, all in a process called cord cutting as I detail later.

On the other hand, its wireless broadband (Xfinity Mobile) added 1.3 million subscribers, or a 24% YoY surge. However, since these double-digit gains could not offset revenue losses in cable, this suggests the company is not growing fast enough, possibly because of the highly competitive environment.

Cord Cutting and the Competition

In this respect, the internet broadband market has been traditionally dominated by cable companies or cablecos like Comcast and Charter (CHTR) Communications with its Spectrum brand. Initially operating as cable TV providers with their networks extending to most American homes in urban regions, it was natural for them to venture into Internet services provisioning. This was done through bundling of TV and internet product plans and was working very well till the advent of fiber optics followed by fifth-generation wireless.

In this respect, fixed line telcos like Verizon (VZ) and AT&T (T) who initially relied on copper have been transforming their network by laying vast stretches of fiber that extend to premises, be it homes or businesses. This process which has been key to the digital transformation trend has also received impetus through government subsidies, especially in certain rural regions where provisioning of high-speed internet through extending of fiber is deemed as costly.

As a result of these alternative technologies coming to the fore, more and more people have been canceling their decade-long cable contracts in a process called cord-cutting. Now, to address this problem, both Comcast and Charter also offer mobile telephony services including 4G and 5G data, and for this purpose, Comcast has an MVNO or mobile virtual network operator agreement with Verizon for using its wireless infrastructure.

However, the problem for Comcast is that the 1.3 million wireless accounts it added last year, are far below the 2.5 million added by Charter, who also managed to deliver revenue growth of 1% for fiscal year 2023 ending in December. Now, even if the 1.3 million addition is a high figure and the company has exceeded the $1 billion quarterly revenue mark, the number being far below Charter’s somewhat cast doubts about how fast Comcast could evolve its wireless services into a multi-billion-dollar revenue business as stated earlier.

The Need for Injecting Additional Capital Expenses Can Impact Free Cash Flow

Thinking aloud, the strategy to offer 5G using Verizon’s infrastructure is not sustainable over the long term as the telco also offers mobile service directly to subscribers, and, as such, remains a competitor. In case it drastically reduces its retail pricing these could dangerously approach the wholesale pricing Comcast benefits from.

As a solution, the cableco has been actively investing to complement its nationwide 5G cellular network service with millions of Wi-Fi hotspots. These hotspots are in turn made possible through the setting up of small cells based on CRBS or Citizens Broadband Radio Service which is a radio frequency it has acquired from the FCC at the tune of $500 million. In other words, the company is using Verizon’s physical wireless network but at the same time enhancing coverage through hotspots built on top of its cable plants.

To be realistic, this value-add strategy while resulting in more customer contracts is not working rapidly enough to alter the topline in Comcast’s favor. At the same time, the company has to spend money for DOCSIS 4.0, which comprises upgrading Xfinity’s mostly hybrid cable and fiber-based network to 100% fiber using multi-gigabit connectivity. Still, in light of the fiercely competitive U.S. market, where it suffers from churn due to cord-cutting, while its cableco competitor is growing its mobile footprint faster, Comcast may need to spend more capital, namely to accelerate the pace at which it pushes multi-gigabit fiber to homes.

This idea of spending more is also voiced out by the company’s President Mike Cavanagh during Q4’s earnings call when he said:

I’ll just note that while our capex intensity at connectivity and platforms has been around 10% for the past few years, this is not a specific internal target for us, rather it’s an output. Our teams are going as fast as possible; however, if for example, we have an opportunity to accelerate further our growth in homes passed at accretive economics, then we’d welcome that opportunity”.

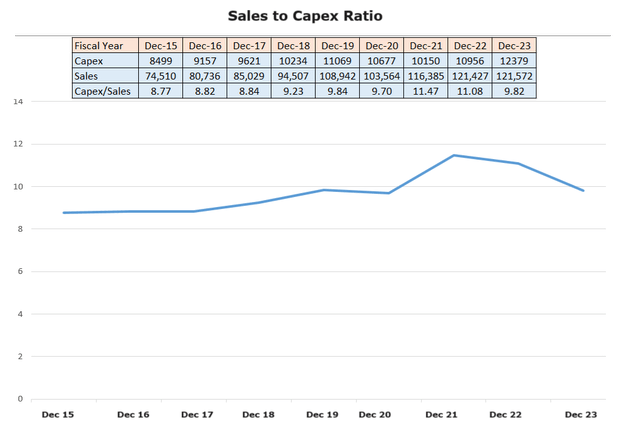

To further justify the need to spend more, I extracted the annual sales from the income statement, and, after dividing these by the capital expenditures, I obtained the Sales-to-capex ratio. The chart below shows that these increased gradually till reaching a peak in fiscal 2021 before trending lower. Thus, after generating sales of $9.82 for each dollar of Capex spent compared to $11.47, Comcast may have reached a point where it has to spend more to generate growth.

Chart built using data from (seekingalpha.com)

On the flip side, increasing Capex may reduce FCF in case there is a delay in generating cash from operations which is generally the case in the telecom industry where returns take time to materialize. Now, assuming the company increases Capex by 14% which is the amount by which it has decreased from Dec-21 to Dec-23 or ((9.82-11.47)/11.47 as per the above table), then FCF could decrease by 14%.

Possible Profitability and Shareholder Return Impacts Given the Debt Level

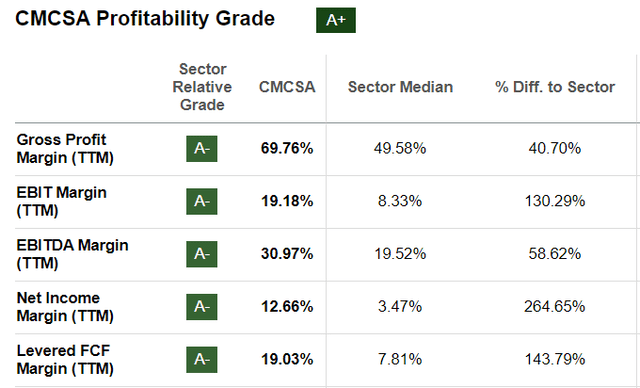

Now, in case revenues stay the same, the free cash flow margin could suffer from a 14% reduction. Now, subtracting 14% from the current value of 19% equals an FCF of 5%, or lower than the sector median as shown below. This could mean relinquishing the A profitability grade, which is precisely one of the factors for Quant’s very bullish position. Now, the 14% figure is just an estimate but shows how spending for growth can impact margins.

Profitability metrics (seekingalpha.com)

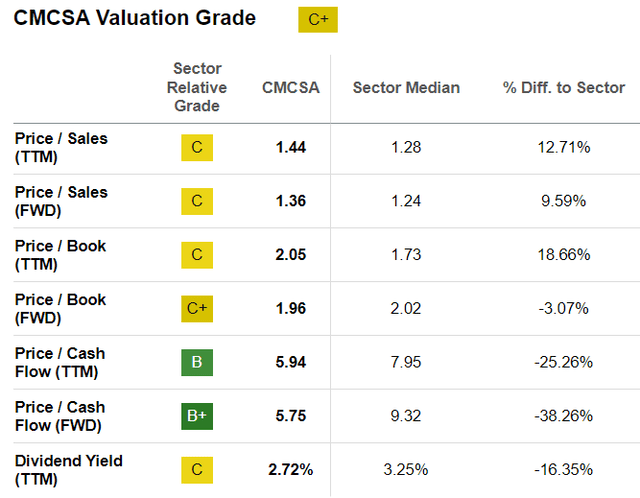

Pursuing further, with only $6.2 billion of cash in the balance sheet against $103.7 billion of debt, the company policy to grow dividends and perform stock buyback could be put into question. For this matter, $11 billion of share repurchases were done last year and $4.8 billion were paid to shareholders as dividends, with the company consecutively increasing distributions for the 16th consecutive year. Now, faced with the prospect of a dividend yield of 2.72% which is already below the communications sector’s 3.25% not growing further in case the management decides to spend the money on investments, income-seeking investors may not want to invest.

Also, at a forward price to sales of 1.36x, the company is not trading at a meaningful discount relative to the sector median, which is the reason for my Hold position.

Valuation metrics (seekingalpha.com)

At the same time, interest rates remain high, and, with inflation turning out higher than expected in January there is less probability of a rate cut in the first half of the year. This means that borrowing-wise, the management will likely stay prudent in avoiding the current net leverage of 2.3 times moving higher than the target of 2.4 times.

In these conditions, it is preferable to wait for precise insights into how the management will stimulate growth in the profitable connectivity business without meaningfully impacting FCF. Moreover, there have been some good results in the Content and Experience business as Peacock, the streaming service enjoyed a 57% surge in Q4 on a YoY basis in turn benefiting media which was up by 3%. Also, the studio segment gained in strength, by 4.3% YoY during the same period. Finally, these are positives but deserve to be monitored for the longer term for sustainability.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ, T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is an investment thesis and is intended for informational purposes. Investors are kindly requested to do additional research before investing.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.