Summary:

- Driven by record revenue of ~$53B for the full year 2023, American Airlines is a top Quant-rated airline stock, exhibiting solid investment fundamentals, improving price performance, and upward EPS revisions.

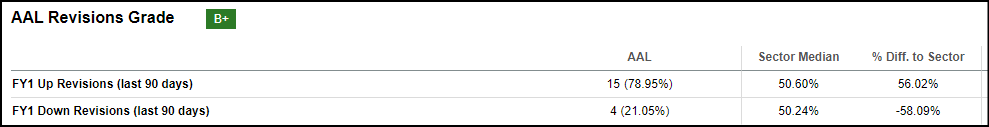

- AAL beat Q4 earnings and guidance that impressed Wall Street, and has 15 upward earning revisions in the last 90 days.

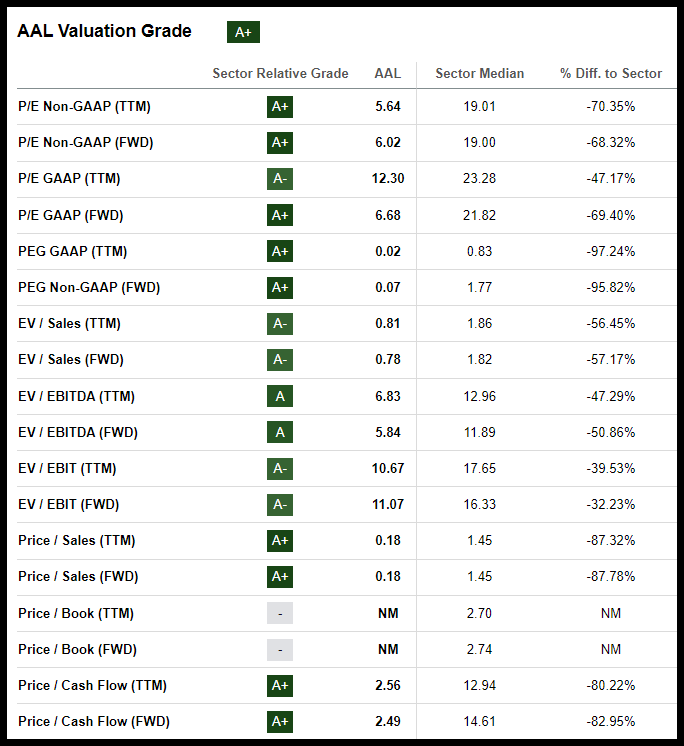

- The stock price is trading at attractive forward metrics, including 6x earnings and 2.5x cash flow. Profit growth trends are impressive, marked by forward EPS growth at a staggering 85%.

- This article dissects some underlying metrics behind strong Quant Factors that explain why American Airlines is a quant-rated Strong Buy recommendation.

Joe Raedle

Presenting its best-ever fourth quarter and record profitability of nearly $53B for the full year 2023, American Airlines Group Inc. (NASDAQ:AAL) is flying-high as a top growth and value stock. AAL gained momentum after reporting earnings results and guidance that impressed Wall Street in January. AAL’s fundamentals, especially its Quant valuation and growth grades, improving momentum and upward EPS revisions, highlight the stock as a Strong Buy.

American Airlines Group Inc. (AAL)

-

Market Capitalization: $9.74B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 2/12/24): 9 out of 651

-

Quant Industry Ranking (as of 2/12/24): 2 out of 27

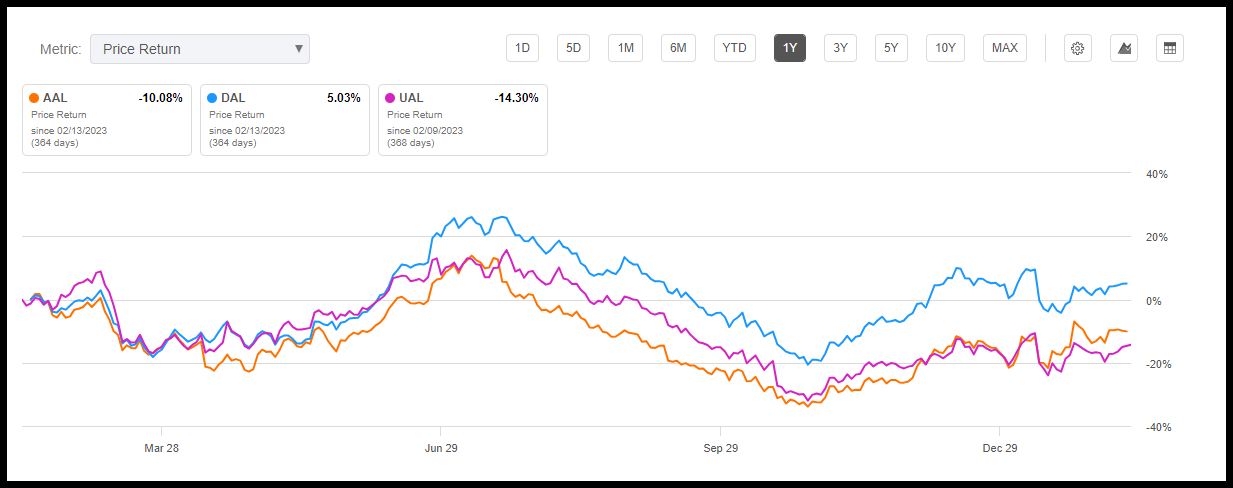

AAL is one of SA’s top quant-rated airline stocks and among the top ten in the Industrial sector. Although the stock is down nearly 10% in the past year, underperforming U.S.-based rival Delta Airlines, it is outperforming United Airlines. In the past three months, AAL is up 26%, Delta + 21%, and UAL + 14%.

AAL vs. 1Y Price Performance (SA Premium)

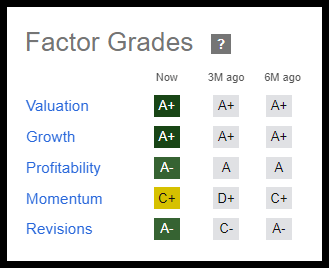

AAL tops its chief U.S. rivals with a 4.89 Quant Rating, largely driven by solid valuation and growth metrics that underpin top-notch SA Factor Grades. AAL also differentiates itself in Momentum and EPS Revisions.

SA Quant Ratings are objective, data-driven, unemotional evaluations of each stock based on company financial statements, price performance, and analyst estimates. SA gathers over 100 metrics for each stock and grades them versus the sector median across five factors: Value, Growth, Profitability, Momentum, and EPS Revisions. The first three Factor Grades aim to identify mispriced securities, and the other two address timeliness. Hence, the overall Quant Rating aims to provide a single snapshot that’s potentially actionable for both short-term and long-term investors.

A’s in Valuation, Growth, and Profitability are key drivers of AAL’s Strong Buy quant rating. EPS Revisions are at an A-, and although Momentum is at a C+, AAL is up 26% in the past three months, beating the sector by more than 70%.

AAL Quant Factor Grades (SA Premium)

AAL EPS Revisions & Momentum

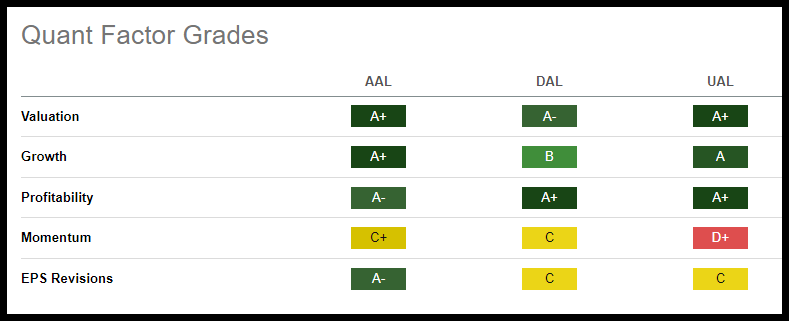

Industry rivals also showcase strong fundamentals, but AAL has begun distancing itself in the Momentum and EPS revision categories.

AAL Quant Factor Grades vs. Peers (SA Premium)

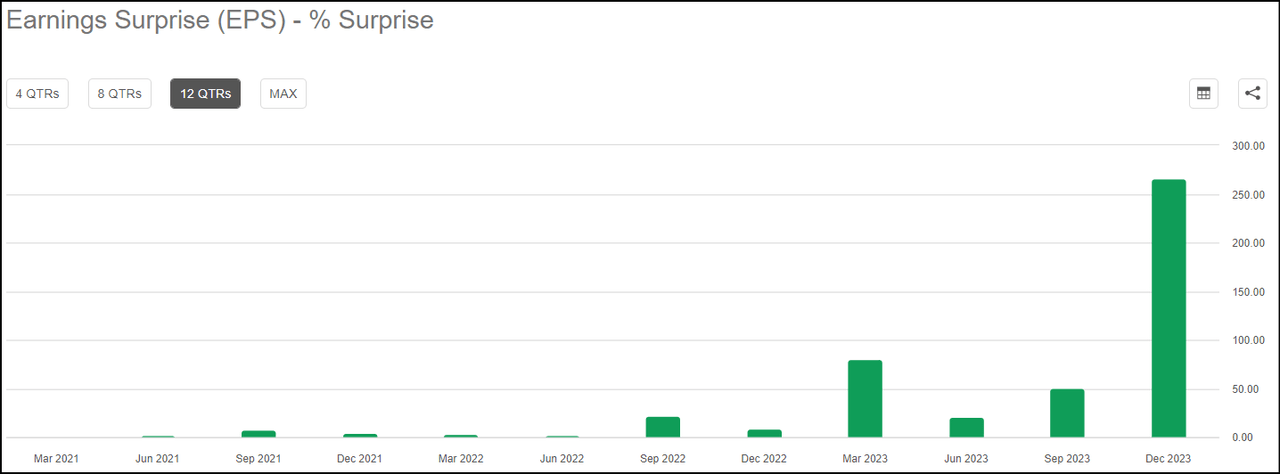

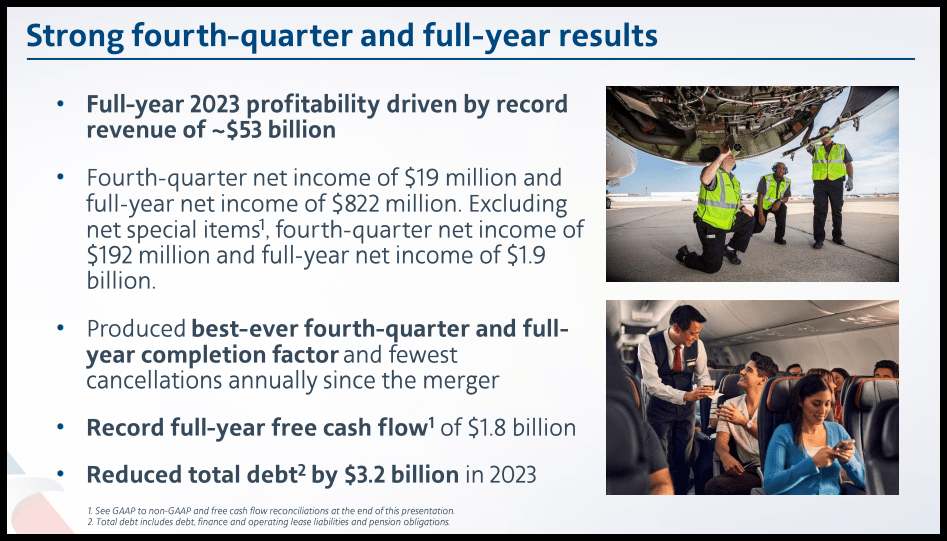

AAL gained momentum after beating quarterly and annual earnings expectations on January 25th. AAL reported a record full-year revenue of $53 billion, the best-ever completion factor, and on-time departures. AAL EPS of $0.29 beat by $0.21 and revenue of $13.06 billion beat by $9.71 million. The EPS beat marked the 15th straight quarter of positive earnings surprise.

AAL Earnings Surprises (SA Premium)

Citigroup upgraded AAL to a Buy, citing its diversified revenue stream, demand for premium cabin offerings, deleveraging focus, low capex, and strong guidance. Morgan Stanley analyst Ravi Shanker upgraded the stock in early January after a “decent holiday season.” The analyst also cited American Airlines’ operational resiliency, cost containment, and that it may soon be the “cleanest” story in the U.S. airlines industry. American Airlines has a fortuitous mix of Boeing and Airbus aircraft and avoided the fallout from the FAA grounding 737-9 MAX airplanes over quality and safety issues. The FY24 consensus EPS estimate ahead of the earnings call was around $2.18 and is now at $2.47. The FY24 EPS target has been revised upward by almost 15% in the past three months. AAL has seen 15 upward earnings revisions in the past 90 days, which is significant as the earnings targets impact AAL’s forward growth and valuation metrics.

AAL Earnings Revisions (SA Premium)

AAL Stock Valuation & Growth

Based on multiple quant valuation metrics, AAL looks relatively inexpensive and is trading at a mere 6x forward earnings vs. a sector median of over 19x. AAL is trading at 2.5x forward cash flow vs. 14x for the sector. EV/EBITDA ratio (FWD) is at 5.8x vs. the sector’s 11x, and EV/EBIT (FWD) is at 11x vs. the sector’s 16x. Forward P/E growth (PEG) is .07x, about 95% below the sector.

AAL Valuation Grade (SA Premium)

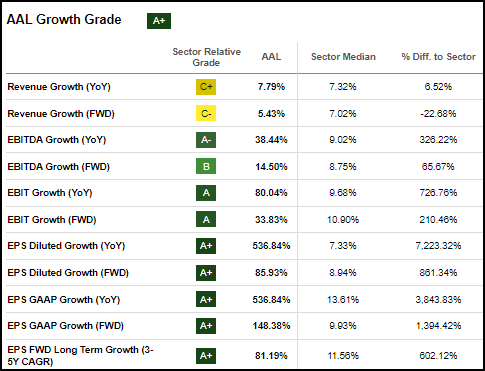

AAL’s top-line YoY is close to the sector median, EPS diluted YoY growth was over 500%, and EBIT growth was +80%. Forward EPS diluted growth is at 85%, over 800% vs. the sector median of about 9% and significantly above DAL (+31%) and UAL (+66%).

AAL Growth Grade (SA Premium)

AAL also looks solid compared to the sector in forward long-term EPS growth (over 80% vs. 11.5%) and EBIT growth (33% vs. 11%).

AAL Q4 & FY2023 Results (Investor Presentation)

Possessing one of the youngest fleets among U.S. major airlines to help reduce fuel and maintenance costs, AAL has decreased its capital expenditures, and is expanding margins. With the demand for air travel recovering from the pandemic, AAL had been able to expand capacity for rapid growth, but there are still risks to consider.

Risks

The airline industry tends to be cyclical, given travel demand is subject to overall economic activity. Geopolitical risks like war or pandemics can disrupt travel or affect commodity prices that impact the fuel market. Natural disasters and weather can create disruptions. Investors should keep an eye on balance sheet issues indicated by a low Altman Z score and negative shareholder equity vs. other U.S. airlines. AAL expects to reduce total debt by roughly $13 billion from peak levels in 2021, over 85% of the way towards the airline’s $15 billion total debt reduction target. AAL profit margins lag behind industry rivals but, as noted, expectations are high for robust bottom-line growth.

Concluding Summary: Value, Growth, EPS Revisions Drive AAL Strong Buy

AAL is a top quant-rated airline stock and among the top 10 in the Industrials sector. Driven by solid valuation and growth metrics, AAL is trading at a mere 6x earnings and 2.5x free cash flow with forward EPS and operating margin growth metrics crushing the sector. The stock has gained momentum recently after beating Wall Street earnings and guidance expectations, and its FY24 EPS target has been revised upward by about 15% in the past 90 days, with 15 upward revisions. These solid investment fundamentals and trends such as improved price performance and higher earnings targets, are key reasons AAL is a quant Strong Buy recommendation. Check out more of SA’s Top Value Stock Screener for investors looking for the best value stocks. Alternatively, Alpha Picks might be ideal if you’re interested in two monthly stock picks of the top ‘strong buy’ quant stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given that any particular security, portfolio, transaction or investment strategy is suitable for any specific person. The author is not advising you personally concerning the nature, potential, value or suitability of any particular security or other matter. You alone are solely responsible for determining whether any investment, security or strategy, or any product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. Steven Cress is the Head of Quantitative Strategy at Seeking Alpha. Any views or opinions expressed herein may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank.

I am Steven Cress, Head of Quantitative Strategies at Seeking Alpha. I manage the quant ratings and factor grades on stocks and ETFs in Seeking Alpha Premium. I also lead Alpha Picks, which selects the two most attractive stocks to buy each month, and also determines when to sell them.