Summary:

- Capital One is set to acquire Discover Financial Services in an all-stock transaction valued at $35.3 billion.

- The deal is expected to create significant synergies and combine Capital One’s scale and credit cards with Discover Financial Services’ global payments network.

- Shareholders who believe the transaction will be completed should consider investing in Discover Financial Services for potential returns.

Wasan Tita

February 20th was a very big day for shareholders of both Capital One (NYSE:COF) and Discover Financial Services (NYSE:DFS). Although shares of Capital One inched up by only 0.1%, shares of Discover Financial Services skyrocketed, closing up 12.6% for the day. These moves higher were driven by news that Capital One will be acquiring Discover Financial Services in an all-stock transaction valued at $35.3 billion. Assuming all goes according to plan, this maneuver is slated to create significant synergies for the combined enterprise. However, I would even argue that without the synergies, the deal is logical.

As for investors, this does lead to a couple of interesting questions. The most important of all is what they should do with their units. For those who believe that the transaction will fall through, selling out of Discover Financial Services shares now might make the most sense and for those who own Capital One, holding on to units would also make sense. But for those who believe that the transaction will be completed, and who believe that Capital One is a quality company worth investing into, piling into Discover Financial Services is the logical way to go.

A fascinating deal

According to the press release issued by Capital One on February 19th, after the market closed, the company had reached an agreement to acquire Discover Financial Services in an all-stock deal. In exchange for each share of Discover Financial Services that somebody owns, they will receive 1.0192 shares of Capital One. The management teams of both companies believe that the transaction will be completed either late this year or early next year. It does require regulatory approvals as well as approval by shareholders from both firms. The regulatory side of the equation would be particularly interesting and is likely what is causing the uncertainty regarding the close of the transaction. But assuming it goes through according to plan, current shareholders of Capital One will own 60% of the combined business, while the remaining 40% will be owned by holders of Discover Financial Services.

In the words of the management teams of both firms, as shown in the investor presentation released in relation to the deal, this maneuver will combine Capital One’s scale and credit cards and banking with Discover Financial Services’ vertically integrated global payments network. Some context is definitely warranted here. For those who don’t know, Discover Financial Services’ products operate in over 200 countries and territories across the globe. Their global network consists of 70 million merchant acceptance points and touches on 1.8 million global ATMs or other cash access points. Globally, there’s an estimated 305 million cardholders that use the firm’s network.

Capital One

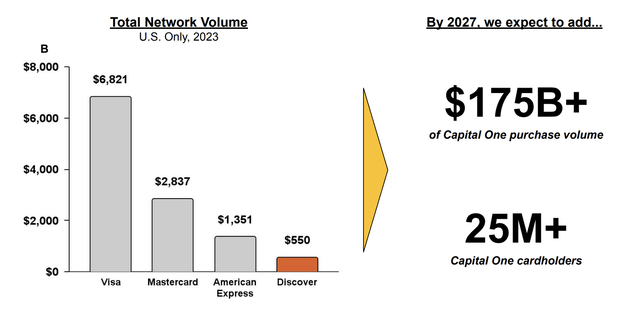

As large as this makes Discover Financial Services, the company is quite small compared to the other players out there. When you focus solely on the U.S. market alone, Visa (V) is the behemoth, with estimated network volume of $6.82 trillion in 2023. Mastercard (MA) is a distant second place with $2.84 trillion. This is followed up by American Express (AXP), long a favorite investment of Warren Buffett, with $1.35 trillion. Even compared to the distant third place that is American Express, Discover Financial Services is quite small. Using 2023 figures, its network had about $550 billion worth of volume last year.

Capital One

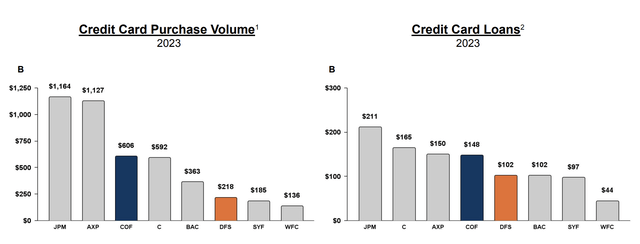

The hope, according to the management team at Capital One, is that it can add over $175 billion of purchase volume to Discover Financial Services’ network by 2027, with over 25 million Capital One cardholders coming onto it. But that won’t be all that Capital One brings to the table. The company is well known for providing credit cards that offer cash back, travel incentives, and other things. They engage in co-branding initiatives and even cater to small businesses. When it comes to the 2023 fiscal year alone, Capital One’s credit card purchase volume was a hefty $606 billion. That’s well above the $218 billion from Discover Financial Services. And when it comes to credit card loans, the $148 billion that Capital One issued in 2023 was a bit larger than the $102 billion issued by Discover Financial Services.

Capital One

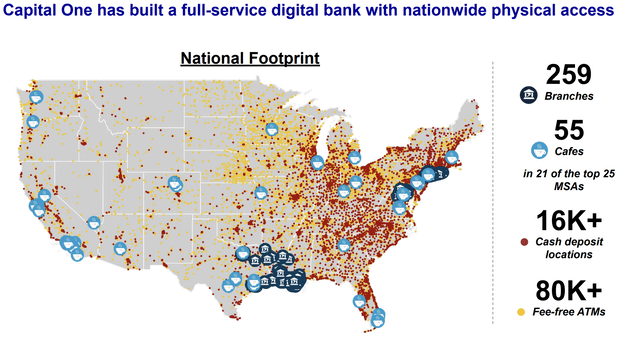

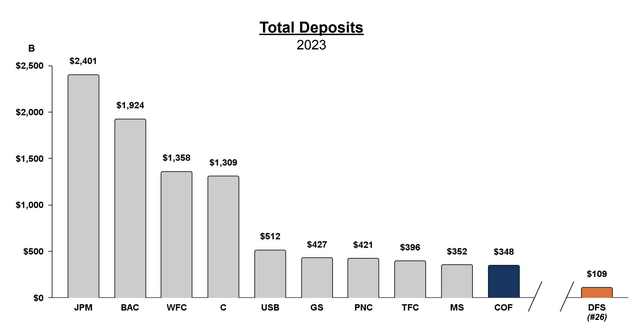

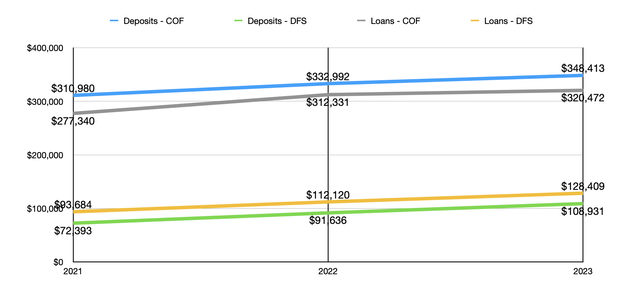

Outside of the cards that it offers, Capital One also has a rather large physical footprint. The company has 259 banking branches spread across the US. This is on top of 55 cafes. It boasts over 16,000 cash deposit locations and access to over 80,000 fee free ATMs. In terms of overall deposits, Capital One claims to be the 10th largest bank in the US, with $348 billion in deposits. The $109 billion of deposits that Discover Financial Services brings to the table would, all else being the same, push the combined company into the number six spot.

Capital One

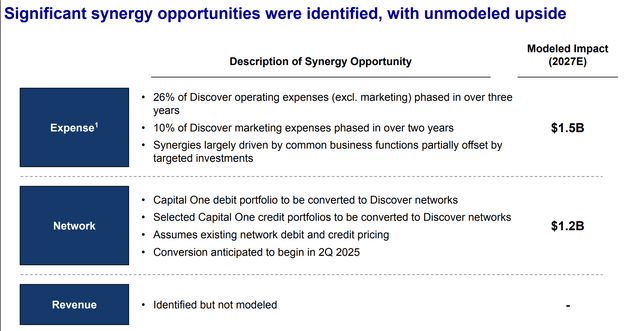

In addition to being a larger enterprise, the management teams of both firms believe that significant synergies can be realized. By 2027, it’s expected that the combined firm will cut costs by $2.7 billion on an annualized base aspirin $1.5 billion of this would be on the expense side of the equation with marketing and operating synergies. But another $1.2 billion will involve network synergies. Of course, these synergies will not occur without some significant expenditures. Management expects to incur about $2.8 billion in costs, on a pre-tax basis, over the first two years following the completion of the transaction.

Capital One

Usually when a transaction like this is announced, shares of the company being acquired for a premium shoot up while the shares of the company making the purchase drop. But every so often, both rise. This is because the market believes that the benefit to each business is worth the premium being paid for the firm that’s being purchased. There are a couple of different ways that I would whether or not this transaction makes sense. First, I ignore the synergy component. If the transaction makes sense without the synergies, which are not guaranteed to come to fruition, then it definitely makes sense with any synergies that might be realized.

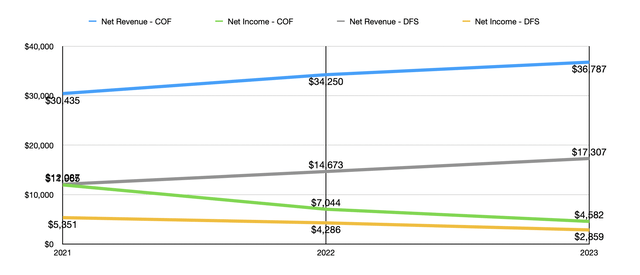

Author – SEC EDGAR Data

To understand whether or not the companies make sense together, we should first understand what they look like apart. In the chart above, you can see revenue and profits generated by both companies for the 2021 through 2023 fiscal years. The first thing I would like to point out is that, while revenue has increased across the board, profits have declined for both enterprises. There are many different working parts here that help to explain this. For instance, a growth in deposits at each institution, combined with higher interest rates that have to be paid to the depositors in order to attract their capital to said institutions, caused a higher cost structure for the companies. In addition to this, they both saw a rise in the provision for credit losses. As an example, Capital One reported an increase in this cost category from $5.85 billion in 2022 to $10.43 billion in 2023. By comparison, Discover Financial Services saw a near tripling in its provision from around $2.36 billion to $6.02 billion.

Author – SEC EDGAR Data

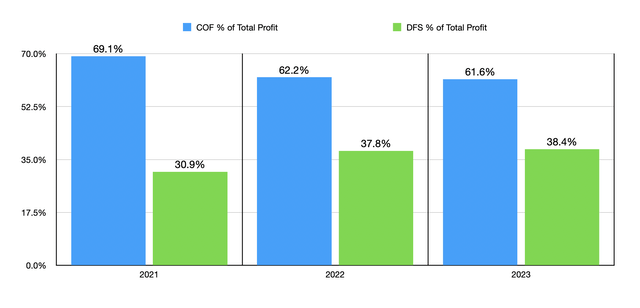

Prior to the pandemic, the economy was what you would consider normal. But with significant uncertainty during the economy, companies in this space recognized large provisions that were driven by a net allowance build because of worse economic conditions and what management calls credit normalization. What I did find out, however, is that even if you compare their net profits to one another, you do end up with a scenario where the 60/40 split in ownership for the combined companies makes sense. For instance, Capital One’s owners get a 60% ownership of the combined firm. Meanwhile, the company itself brings 61.6% of all profits to the combined firm based on 2023 results. This number for 2022 is slightly higher at 62.2%.

Author – SEC EDGAR Data

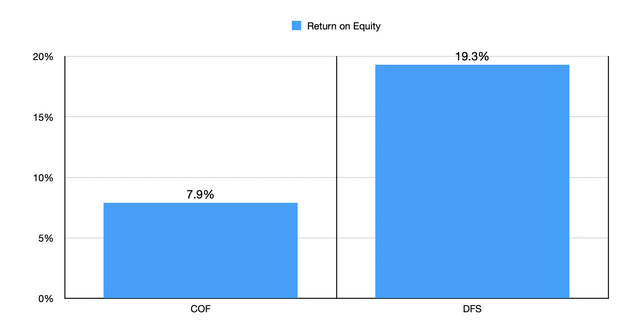

Another way to look at the picture is through the net assets that the institutions bring. In this case, the data does look very much tilted in favor of shareholders in Discover Financial Services. I say this because, using the results from 2023, Capital One gets only 60% of the combined firm while bringing 79.7% of the shareholders’ equity to the table. However, when you consider that the return on equity for Capital One is only 7.9% compared to the 19.3% boosted by Discover Financial Services, the picture suddenly makes sense. Yes, Capital One might be allocating a disproportionate amount of net assets. But those assets are far less productive than what Discover Financial Services brings to the table on a dollar-for-dollar basis.

Author – SEC EDGAR Data

Takeaway

Based on the data provided, I must say that I am in favor of this transaction. Even without synergies, the deal seems to be at least fair. The companies bring a proportional amount of profitability to the table. Capital One does bring a disproportionate amount of net assets. But those assets are less productive than what Discover Financial Services brings. The increased size from the two enterprises and the differences in what they do and how they operate means that significant synergies probably will be realized.

Of course, there are some big unknowns. The biggest one is what regulators will do or say. The combined company will still be significantly smaller than some of its peers. Normally, this would make me feel comfortable about the transaction going through. However, regulators have been on a tear lately as they seek to cut back on mergers and acquisitions that might be considered anti-competitive. What I can say is that those who believe the deal will go through and who are bullish about both firms should definitely consider Discover Financial Services as their primary candidate. Given where shares of Capital One are trading at this moment, the spread between the implied buyout price and the current share price for Discover Financial Services is still 12.5%. Even if it takes a year for the transaction to be completed, that’s not a bad return, especially considering how much uncertainty there is in the broader market.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights is an exclusive community of investors who have a taste for oil and natural gas firms. Our main interest is on cash flow and the value and growth prospects that generate the strongest potential for investors. You get access to a 50+ stock model account, in-depth cash flow analyses of E&P firms, and a Live Chat where members can share their knowledge and experiences with one another. Sign up now and your first two weeks are free!