Capital One Announces Deal To Acquire Discover Financial – Why We Like The Transaction

Summary:

- Capital One announced an all-stock deal to acquire Discover Financial, offering a 26.6% premium for DFS shareholders.

- The deal is expected to close in late 2024 or early 2025, with Discover holding 40% of the combined company.

- Capital One expects 15% earnings accretion in 2027 and on the call emphasized the value of owning Discover’s Pulse network.

- We consider both names to be solid compounders that can grow EPS in the double-digit range through the cycle.

- Given the move higher in DFS’s stock price and deal risk, we may consider swapping some DFS shares for COF.

Joe Raedle/Getty Images News

Background: We originally purchased Discover in 2019 and doubled down during the pandemic. Our most recent update was here. We called DFS a buy below $90 and considered it a value-priced compounder for the long run.

Yesterday, Capital One Financial (NYSE:COF), a name Buffett started buying in Q1 last year, announced a deal to acquire Discover Financial Services (NYSE:DFS) in an all-stock transaction.

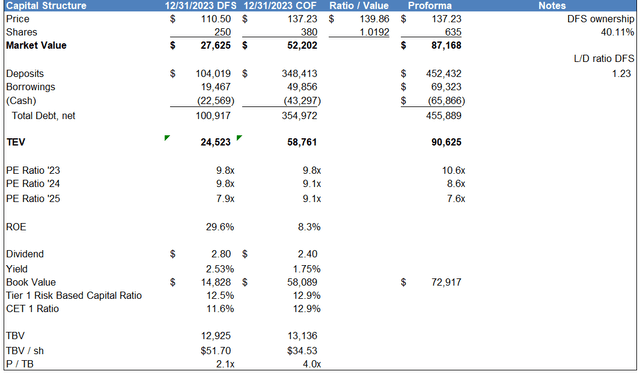

DFS shareholders will receive 1.0192 shares of COF per share of Discover that they own. Based on Friday’s closing price, the deal is a 26.6% premium for DFS shareholders.

The deal is expected to close in late 2024 or early 2025, with Discover to hold 40% of the combined company.

COF IR

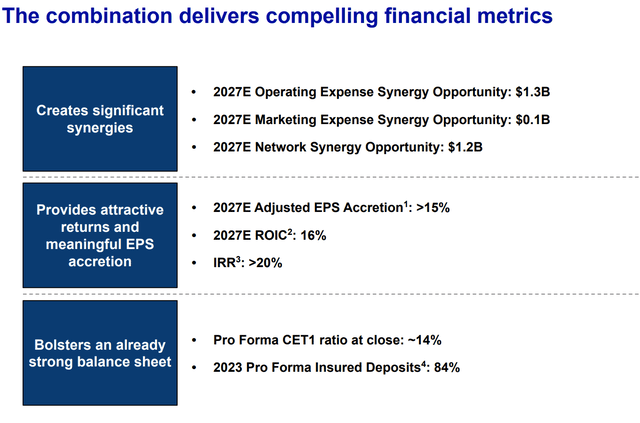

A stock deal means that the combined balance sheet will remain solid. The press release says that the combined company will have a 14% CET 1 capital ratio upon closing. 84% of their deposits will be FDIC insured. This would be a pretty good depositary franchise.

The big question mark is whether a combined COF/DFS will have any synergies. Per management, Capital One is expecting 15% earnings accretion in 2027 and commented on the call that they are expecting “double-digit” accretion in 2026.

That is based on total anticipated synergies (pre-tax) of $2.7 billion. It sounded like management expected this on a run rate basis by the end of 2026.

COF IR

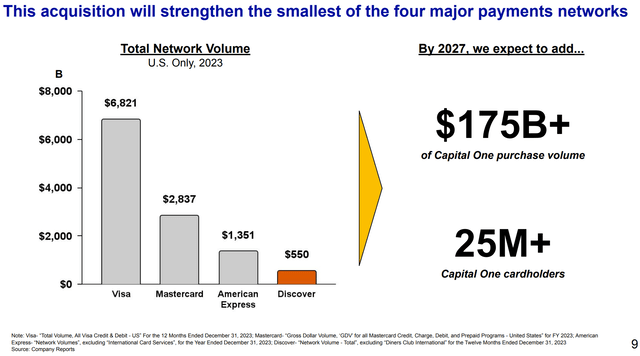

Also on the call, Capital One management stressed the value of owning the network (in this case, Discover’s Pulse network). We consider Visa (V) and Mastercard (MA) to be two of the greatest business models on the planet, with giant moats, huge margins (67% on an EBIT basis), structural growth tailwinds, and low capital intensity.

COF IR

As an aside, we consider Visa or MC to be “must own” stocks for any long-term growth portfolio (and have been long for almost a decade now). We also are big fans of fintech names, given growth tailwinds as the world moves more and more to digital transacting, reasonable valuations, and high margins.

Scaling the Pulse network certainly adds a lot of value to both merchants and consumers.

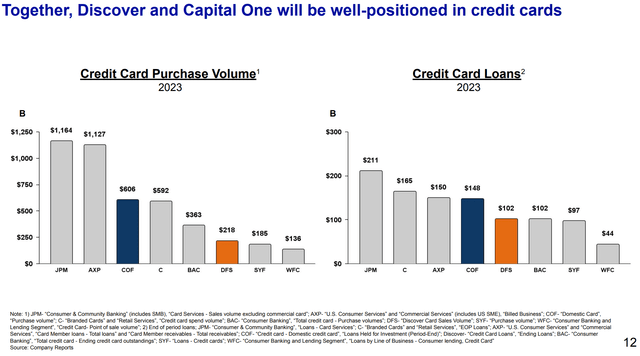

As for their core businesses of making credit card and consumer loans, the merged entity will become the largest card lender in the US and the third largest one in card purchase volumes. This is US data.

COF IR

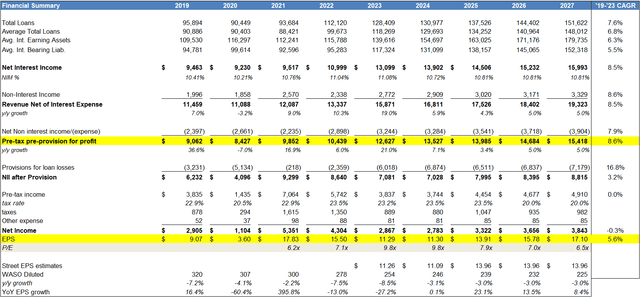

Below is each company’s capital structure and a proforma combined version.

Author spreadsheet, company financials

We have sliced and diced Discover’s numbers many times over the years, and while loan loss provisions are elevated now, these will likely peak in mid-2024 and start to come down in the second half of 2025.

Based on guidance and the macro picture, this is our latest income statement model and projections for DFS.

Author spreadsheet, company financials

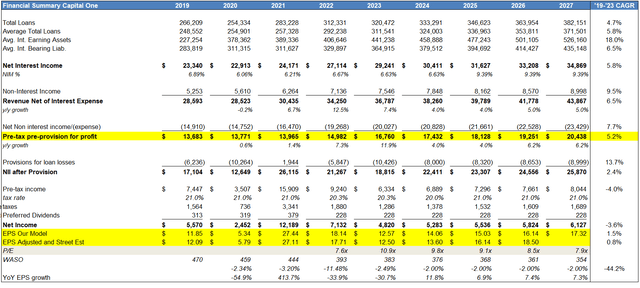

We also modeled a preliminary one for Capital One, mostly based on Street estimates and historical growth in pre-tax, pre-provision earnings.

Author spreadsheet, company financials

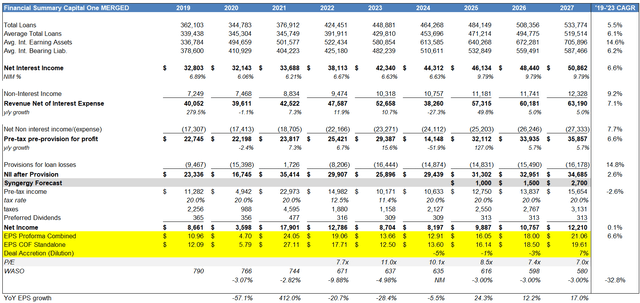

Combined, we came up with this.

Author spreadsheet, company financials

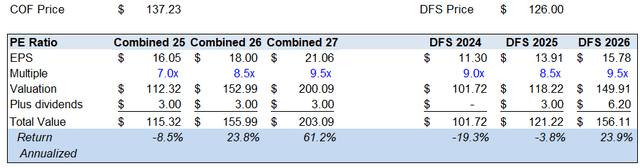

So, to cut to the chase, we anticipated slightly lower growth in net income for each company and find the merger to be slightly dilutive in 2025. While management anticipates 10% accretion in 2026, we modeled the combined company more conservatively, with slight dilution until 2027.

Note above the Synergy Forecast line above. We took management at their word and ramped up synergies from 2025 to 2027. Overall, we estimate 7% earnings accretion in 2027, but it could be a lot better.

Given the volatility in earnings, a recession or any number of other factors could impact earnings in a given year. Our EPS figure, $19.61 in EPS in 2027 jumping to $21.06 on a combined basis, could be quite different from reality.

Valuation

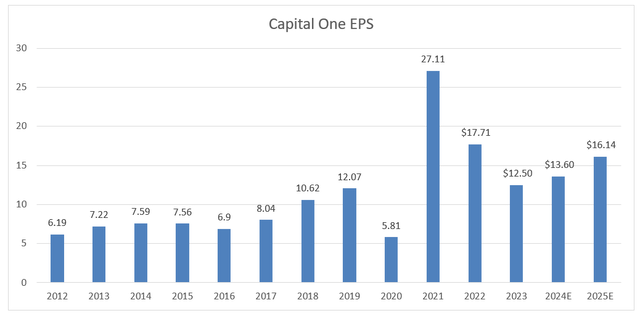

While the deal is quite transformative for both companies, DFS should be a higher valued name. They have compounded EPS by 9.8% annually from 2012 to 2023. COF, with a lot more earnings volatility, has compounded EPS by 6.6% in that same 11-year period. Of course, this says nothing about future growth, and really nobody can guess with any sort of accuracy how growth shakes out (especially as these companies are cyclical).

But, Street estimates show both names growing EPS in the low double-digit range on average over the next couple of years.

Below is Capital One’s reported adjusted EPS over time.

Author spreadsheet, company financials

Today, pre-deal anyway, both names trade at 9.8x forward 2024 estimates.

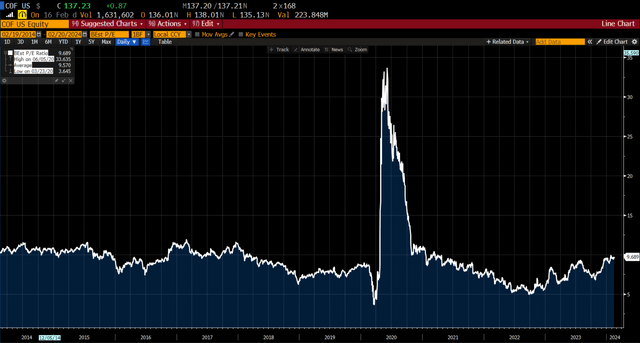

Below is COF on a forward P/E basis dating back to 2014.

Bloomberg

We continue to believe that these are 10-12x stocks but will accept their fate as uber-value names at 9.6x forward earnings. Pre-pandemic, COF often traded in the 10-12x range, at least until 2019 when it dropped to 7x.

This is our valuation on a combined basis, looking out to 2026.

Author spreadsheet, company financials

With respect to regulatory approvals, that could end up being a political football. As there are probably hundreds of card issuers and really only four networks, and since COF does not own a network, we see decent odds that regulators won’t fight this. They may want another network with more scale that can compete with the big three. That said, lots of deals have been shut down that seemed likely to close in the past couple of years.

So, we’ll call this a 50-50 probability of passing and let the merger arb experts weigh in.

In prior notes, our view was that fair value was 10x $14 in EPS at DFS in 12-24 months, or $140. At $125ish, we might consider selling 1/3 of our position and swapping that into COF (which is around $131 pre-market, off $6).

But overall, at 10x earnings, with Buffett a holder of Capital One shares, we view the combined business as likely to continue to be a Compounder.

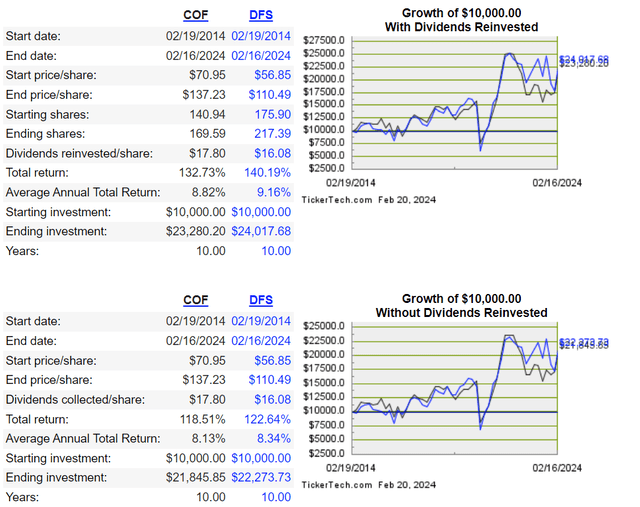

Dividend Channel website

The above illustrates that COF and DFS have both generated over 8% annual returns for shareholders over the past decade. While lumpy and cyclical, both names generate tons of free cash flow each year and buy back a lot of stock. Over the past four years, DFS has repurchased 21% of its shares outstanding and COF has repurchased 18% of its shares.

Conclusion

For anyone with a multi-year perspective (and willing to own DFS standalone), we like the merger and potential here. Near term economic headwinds and normalizing delinquencies could be near term problems, but a 7-8% growth rate business (on pre-tax, pre-provision basis), generating 16% ROEs at 10x earnings seems attractive to us (and was to Buffett).

Holding here, might sell a few DFS shares to buy a few COF shares. That offers some hedge in the event that regulators squelch this deal.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DFS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Long various maturities of DFS bonds and may swap DFS shares for COF

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thanks for reading! We look for high-quality stocks trading at attractive valuations in our Marketplace service entitled Cash Flow Compounders: The Best Stocks in the World. Our focus is high return on equity, high free cash flow stocks with a proven track record in compounding earnings at higher than market rates. There we provide in depth research, with 2-4 new, high-quality ideas per month. My picks going back to 2011 have produced just under 30% annual returns, putting me well within the top 1% of bloggers (TipRanks). Sign up for a free 2-week trial to get my latest ideas!