Summary:

- Nvidia Corporation reported strong Q4 earnings with excellent revenue growth and record-high earnings per share.

- Data center business performance drove most of the growth, while other segments saw slower growth rates.

- Nvidia guidance for the current quarter suggests continued growth, but at a slower pace, leading to some potential disappointment for uber-bullish investors.

I-HWA CHENG/AFP via Getty Images

Article Thesis

Nvidia Corporation (NASDAQ:NVDA) reported its quarterly earnings results on Wednesday afternoon. The company beat estimates on both lines, while Nvidia’s guidance for the current quarter implies further business growth (although a somewhat slowing growth rate). The market liked the company’s results, and while the valuation remains high, the underlying performance is compelling for sure.

Past Coverage

I have covered Nvidia Corporation in the past, where I gave Bullish/Buy and Neutral/Hold ratings, such as this article where I argued that it was time to be greedy (shares are up 300% since then). Most recently, I covered Nvidia last November when the company reported its Q3 results. In that article, I gave the company a Hold rating, arguing that growth was excellent but that there was no guarantee that growth would remain this strong going forward. In this article, I will focus on Nvidia’s Q4 earnings to update my thesis.

What Happened?

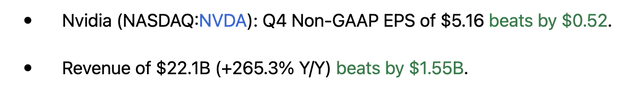

NVIDIA Corporation announced its Q4 earnings results on Wednesday, following the market’s close. The headline results can be seen in the following screenshot:

NVIDIA results (Seeking Alpha)

The company showed excellent revenue growth on a year-over-year basis, but that hardly was a surprise — after all, the comparison was rather easy as the AI impact wasn’t large during the previous year’s fourth quarter. Revenues grew strongly on a sequential basis as well, although that was also expected by the market. Nvidia’s quarterly revenues of $22.1 billion were up by a little more than 20% quarter-to-quarter, which is very strong. On the other hand, a quarterly growth rate in the 20% range means that annual revenue growth will not be 200%+ going forward. For most investors, this won’t be a surprise, however, as no company can grow its revenues by hundreds of percentage points per year for a long time — that’s a mathematical impossibility.

Nvidia’s earnings performance was strong, with earnings per share hitting a new record high during the fourth quarter — up by 28% sequentially. This was largely driven by revenue growth, as margins didn’t expand as much as they did in the past. But since margins were already very high during the third quarter, that was to be expected — even for a company like Nvidia, there’s an upper limit when it comes to profit margins. Gross margins were up 170 base points sequentially while operating margins expanded by 290 base points compared to the previous quarter. The margins performance was thus strong, but margin growth isn’t as explosive compared to some of the recent quarters — which had to be expected, of course.

The market reacted positively to these results at the time of writing, as shares are up 6%, although below the recent all-time high. It can be expected that shares will be volatile in the near term as the market and analyst community digest the company’s results.

Nvidia: Strong Operational Performance

Delving into the results, we unsurprisingly see that growth largely rested on the data center business performance. Data center revenues expanded by 409% year over year and by 27% sequentially, whereas other product lines such as gaming and automotive saw sequential growth rates of 0% and 8%, respectively. Due to the fact that the large AI impact is mainly felt in the data center space, this isn’t surprising, but some may still see this as a bit of a headwind — with overall business growth largely being reliant on the data center performance, a slowdown in that space would hurt the overall company-wide growth rate substantially. If growth were more equally distributed across Nvidia’s different segments, the company would arguably be more resilient versus a downturn in a single end market such as data centers.

AI remains a focus area for many companies, with high-profile introductions such as OpenAI’s new text-to-video platform. Not surprisingly, many tech companies continue to invest in AI hardware, including Alphabet (GOOG, GOOGL), Meta Platforms (META), and so on. At least for now, the data center business will thus continue to expand, although Nvidia’s guidance for the current quarter (Q1) implies that growth continues to slow down. Compared to many other companies, growth will remain excellent, but it looks like investors will come to terms with the fact that even for Nvidia, growth will not remain at extreme levels forever.

The company guides for revenues of around $24.0 billion for the current quarter, which would be up by around $1.9 billion, or 8.6%, compared to the fourth quarter — for which we just got the report. While a sequential growth rate in the high single digits is highly compelling, it implies an annualized growth rate of a little less than 40% (calculated via 1.086^4). That beats the growth rate of many other companies, including the peer group average in the Magnificent 7 group. However, an annual growth rate of around 40% is not nearly as strong as Nvidia’s growth over the last year, thus those investors that had anticipated Nvidia would continue to experience explosive growth might be disappointed.

Current analyst expectations see a revenue total of $94 billion during the current year, which seems very much achievable based on Nvidia’s guidance for the current year. In fact, Nvidia has a good chance of beating that estimate, I believe, as a $94 billion annual revenue result pencils out to $23.5 billion quarterly — slightly less than the guidance for the first quarter. If Nvidia continues to grow its business during the Q2-Q4 period, it will outperform expectations rather easily (although there is no guarantee for ongoing business growth on a sequential basis during the current year).

The margin guidance for the current quarter is pretty much in line with the just-reported quarter, as Nvidia forecasts that its adjusted gross margin will come in at 77% — up just 30 base points quarter-to-quarter, versus an increase of around 6x that magnitude in the previous quarter. This is aligned with my belief that Nvidia is coming close to hitting the margin peak — the margin can’t expand endlessly, and further margin growth will be harder and harder to come by.

Is Nvidia A Good Investment?

Nvidia’s products are in very high demand right now and the company’s fundamentals look excellent, with high margins, high returns on capital, and a strong balance sheet.

That being said, we don’t know how much the market for Nvidia’s AI data center chips will grow going forward — and that is the major source of growth for now. We also don’t know what competition will look like a year or two years from now — other chip companies such as Advanced Micro Devices (AMD) want to expand their market share and might be successful.

When we take the earnings per share estimate for Nvidia for the current fiscal year at face value — $21.51 — we get to an earnings multiple of 34x at the current after-hours share price. If Nvidia were to grow at a strong pace in the coming years, that wouldn’t be outrageous at all. Compared to some other Magnificent 7 stocks, Nvidia also looks attractive — Tesla (TSLA) trades at 61x forward earnings, has way weaker business growth, and faces margin pressures, while Apple (AAPL) is barely growing its revenues at all and still trades at 28x net profits. I believe that Nvidia, which is way cheaper than Tesla and only around 20% more expensive than Apple, is a better investment than these two.

On the other hand, an earnings multiple of more than 30x could still turn out to be somewhat high if growth were to slow down meaningfully. Whether Nvidia is a good buy close to all-time highs thus depends a lot on what one thinks about the longer-term outlook for AI chips. Will market growth remain compelling beyond 2024? In that case, Nvidia could be easily worth the $1.8 trillion it is valued at right now. Will growth slow down in or after 2024, e.g., due to a potential recession? In that case, paying more than 30x this year’s earnings and around 19x to 20x this year’s sales could be too much.

I wouldn’t short Nvidia at all, but I think that buying right here has some risks. I congratulate everyone who bought at lower prices and will wait for a potential buying opportunity — with Nvidia shares being quite volatile, I and others could get a better entry point in the future.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!