Summary:

- After reporting a blowout quarter, Nvidia Corporation stock is popping higher toward its all-time highs in the after-hours session – reversing this week’s pre-ER losses.

- Powered by insatiable demand for its AI GPU chips, Nvidia’s Data Center business quintupled y/y to $18.4B! Further, management issued strong guidance for Q1 FY2025.

- During Q4, Nvidia’s non-GAAP gross margin expanded by 200 bps, and its quarterly free cash flow jumped to $11.2B in Q4 2023.

- While Nvidia’s business is going from strength to strength in the era of AI, the stock has experienced a vertical move-up in recent weeks.

- With Nvidia Corporation shares sitting at $721 in after-hours, is it a buy, sell, or hold? Read on to find out!

Bloomberg/Bloomberg via Getty Images

Brief Review Of Nvidia’s Q4 2023 Report

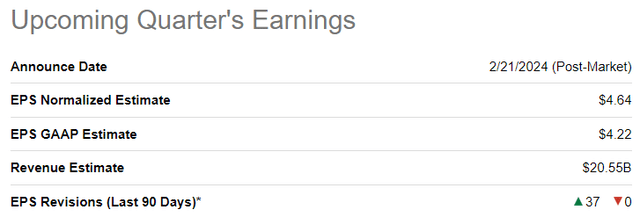

Going into its Q3 FY2024 earnings report, NVIDIA Corporation (NASDAQ:NVDA) was projected to deliver revenues and Normalized EPS of $20.55B [up +239% y/y, estimate range: $19.96B to $23.11B] and $464 [up +427% y/y, estimate range: $4.33 to $5.44], respectively.

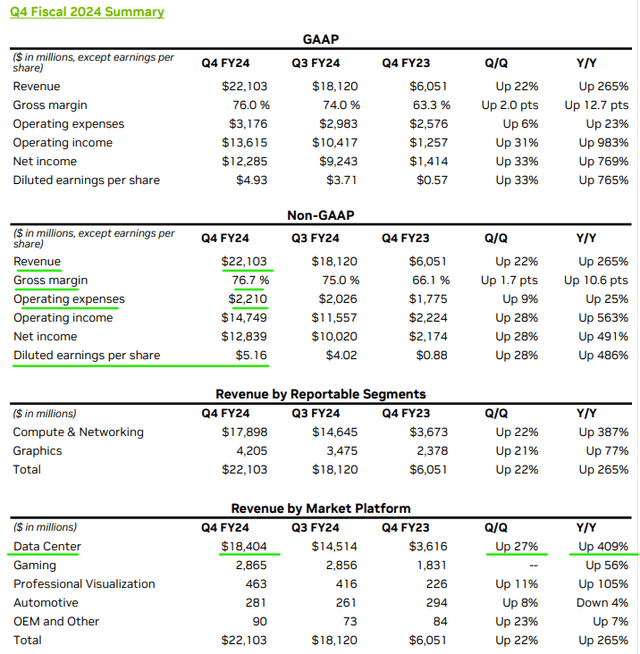

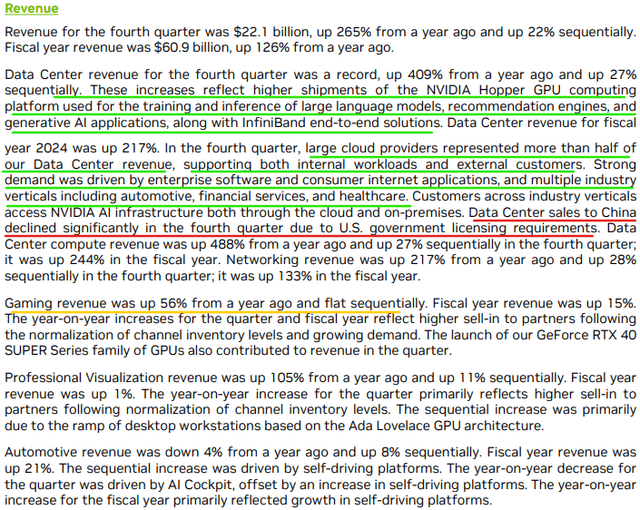

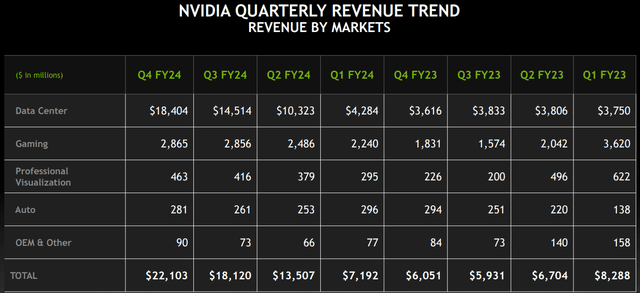

For Q4 FY2024, Nvidia soared beyond top and bottom lines expectations, with revenues and non-GAAP EPS coming in at $22.1B [up +265% y/y] (vs. est. $20.6B) and $5.16 [up +486% y/y] (vs. est. $4.64), respectively. As with previous quarters, the top line outperformance at Nvidia was driven primarily by its Data Center segment, which is currently experiencing insatiable generative AI-induced demand for NVDA’s AI GPU chips:

In Q4 FY2024, Nvidia’s Data Center revenue reached yet another record high – growing to $18.4B (+409% y/y and +27% q/q) [vs. est. of $17B] as large cloud infrastructure providers (primary customers), tech startups, and enterprise customers race to implement generative AI and large language models [LLMs] across their businesses, causing sort of a gold rush for NVDA’s AI GPUs.

Here’s what Jensen Huang, Nvidia’s CEO, had to say in the Q4 ’23 release:

Accelerated computing and generative AI have hit the tipping point. Demand is surging worldwide across companies, industries and nations.. Our Data Center platform is powered by increasingly diverse drivers — demand for data processing, training and inference from large cloud-service providers and GPU-specialized ones, as well as from enterprise software and consumer internet companies. Vertical industries — led by auto, financial services and healthcare — are now at a multibillion-dollar level.

NVIDIA RTX, introduced less than six years ago, is now a massive PC platform for generative AI, enjoyed by 100 million gamers and creators. The year ahead will bring major new product cycles with exceptional innovations to help propel our industry forward. Come join us at next month’s GTC, where we and our rich ecosystem will reveal the exciting future ahead

With cloud hyperscalers – Amazon (AMZN), Microsoft (MSFT) and Alphabet (GOOGL) – guiding for an acceleration in AI Capex spending in their quarterly reports last month, I don’t think Nvidia’s strong performance in data center is all that surprising.

With $18.4B of its $22.1B quarterly revenue coming from the data center business, Nvidia is primarily a data-centric business. In my view, Gaming, Professional Visualization and Auto segments are no longer needle movers. That said, I am happy to see strong growth with these segments, too.

In Q4, Nvidia’s Professional Visualization and Auto business segments showed positive sequential q/q growth, and while Gaming revenues were flat q/q, they were up +56% y/y. From a growth standpoint, Nvidia is firing on all cylinders!

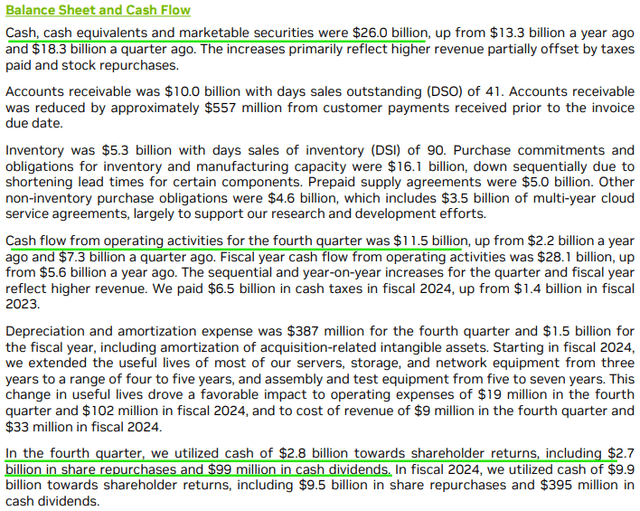

On the margin front, Nvidia’s non-GAAP gross margin expanded to 76.7%, up 200 bps over Q3 FY2024 and up 1,270 bps over Q4 FY2023. With its vast first-mover advantage in AI, Nvidia’s hardware + CUDA software ecosystem is enabling tremendous pricing power. This is, in effect, driving a massive AI windfall with the ongoing margin expansion powering Nvidia’s quarterly free cash flow generation higher in combination with explosive top line growth.

In Q4 FY2024, Nvidia’s quarterly free cash flow jumped to +$11.2B in Q4 2023 (up from $1.7B a year ago). Despite Nvidia returning $2.8B to shareholders via buybacks ($2.7B) and dividends ($99M) during Q4, the semiconductor giant’s fortress-like balance sheet keeps getting stronger, with cash and short-term investments position rising to $26B.

While Nvidia’s balance sheet is robust, I would personally like NVDA to raise some capital at current valuation to bolster its cash position and bring it in line with a level that resembles other $1.8T companies. The semiconductor industry is cyclical by nature, and I want Nvidia to have a massive cash hoard that can allow the company to keep growing through an industry downturn.

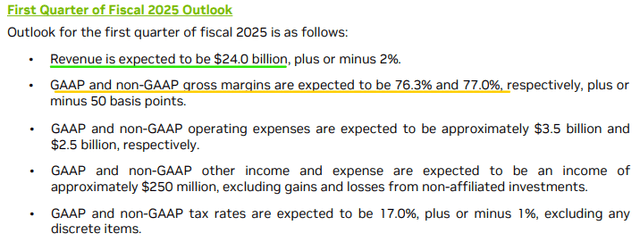

For Q1 FY2025, Nvidia’s management is guiding for revenues of $24B (vs. street estimates of $22B), which means the astronomical growth will continue next quarter. That said, Nvidia margin expansion is set for a slowdown, with non-GAAP operating margins for Q1 projected to rise to 77% (+30 bps q/q).

Despite a significant decline in data center revenues from China, demand in other geographies more than made up for the loss of revenue in Q4. The guidance for Q1 FY2025 indicates that this will be the case in the near term. That said, doubts about the sustainability of this AI chip demand spike (and subsequent supply crunch) are likely to persist in the upcoming weeks, months, and quarters.

At the World Government Summit in Dubai, Jensen Huang recently upped his data center opportunity from $1T to $2T:

There’s about $1T worth of installed base of data centers around the world. And over the course of the next four or five years, we’ll have $2T worth of data centers that will be powering software around the world, and all of it’s going to be accelerated.

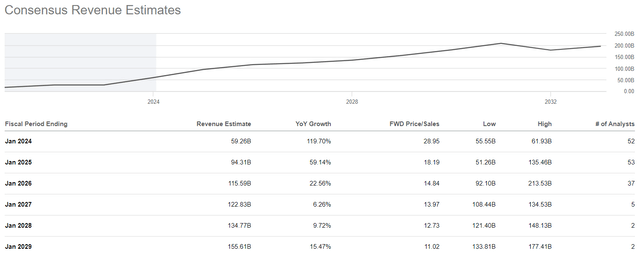

In my view, the long-term opportunity for Nvidia is massive [TAM: >$300B]. Given CUDA’s dominance, Nvidia is likely to keep enjoying the lion’s share of the data center market for years to come. According to consensus street estimates, Nvidia is projected to grow sales at a 21% CAGR from 2023-28.

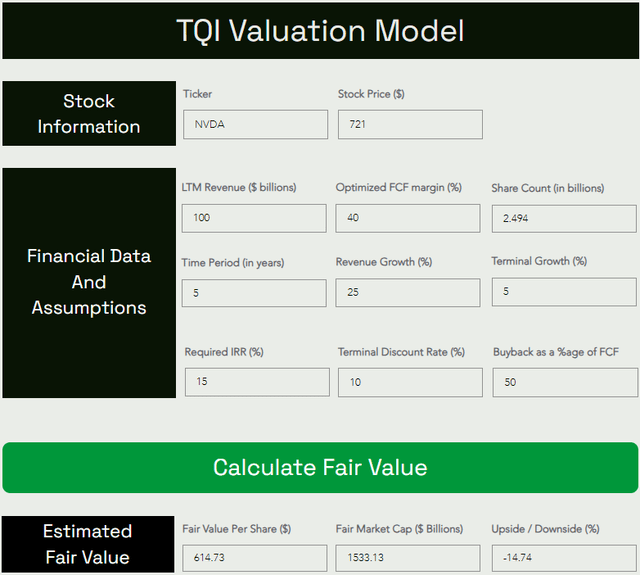

With nearly all of its major customers (cloud hyper scalers, i.e., Microsoft, Amazon, and Google) developing in-house custom AI chips, doubts regarding the sustainability of Nvidia growth and margins are likely to linger on for a while to come. Today, Nvidia is miles ahead of the competition and the only obviously clear beneficiary of the breakthroughs in generative AI. While revenue growth visibility is still low, I am upgrading the revenue base in my model to $100B (FY2025E) and assuming above consensus top-line growth of 20% CAGR from 2024-2029. Let’s see if NVDA stock is a buy, sell, or hold at $721 per share (+7% in after-hours):

Nvidia’s Fair Value And Expected Returns

In light of yet another blowout quarter and positive management commentary for FY2025, I think Nvidia Corporation could now clock $100B (up from $80-90B est.) in revenue over the next twelve months. Given the seismic jump in near-term sales growth, we will be building the model based on a forward revenue estimate and then discounting the fair value output from the model to get a current fair value estimate. Unlike crypto, I believe AI is the real deal, which is why I think a 20-30% CAGR growth for Nvidia (beyond 2024) is plausible (aggressive but certainly plausible).

Given Nvidia’s incredible pricing power and looming shift to a high-margin software business, I believe that steady-state free cash flow (“FCF”) margins for NVDA could be as high as 40-50%. All other assumptions are relatively straightforward. Please let me know if you have any questions via the comments section.

Here’s my updated valuation model for Nvidia:

TQI Valuation Model (TQIG.org)

Applying a 15% discount to this 2025 fair value estimate, we get a current fair value estimate of ~$522.5 per share for NVDA stock. With Nvidia stock trading at ~$721 per share (at the time of writing), I think NVDA’s stock price is well ahead of its skis at this moment in time.

Last quarter, my fair value estimate was at $444 at a time when the stock was at $495, and we did start a small tracker position in TQI’s GARP portfolio. However, the stock has virtually gone up vertically in the last three months, and I don’t see a margin of safety for Nvidia Corporation here due to somewhat generous assumptions for long-term margins and sales growth.

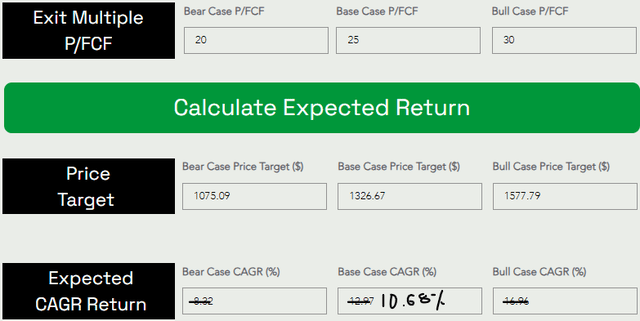

Assuming a base case exit multiple of 25x P/FCF, I can see Nvidia rising to $1,326 per share by 2029. This price target translates to a 6-year expected CAGR return of 10.68% from current levels.

TQI Valuation Model (TQIG.org)

Despite using generous assumptions for future growth and margins, NVDA’s expected CAGR returns fall short of my investment hurdle rate of 15%. Hence, I am still not a buyer here. Now, if you’re willing to accept lower returns for owning a high-quality company like Nvidia, be my guest and buy here.

Please note: Nvidia is clearly winning big in the era of Gen AI; however, this initial-stage demand growth jump could yet prove to be temporary in nature. Yes, Nvidia is trading at just ~30-35x forward P/E, but margins could be peaking here, too (at least for the short term). With all of its major customers building AI chips in-house (potential risk to revenues and margins), I see a genuine lack of a margin of safety here.

Concluding Thoughts: Is NVDA Stock A Buy, Sell, Or Hold After Q2 Earnings?

From a fundamental standpoint, Nvidia’s business is firing on all cylinders, with astronomical growth stemming from GenAI-induced demand for its AI GPUs. In my view, Nvidia Corporation remains the most obvious “picks and shovels” play in the AI gold rush. That said, a lot of future success is already baked into Nvidia’s current stock price, and the long-term risk/reward doesn’t justify allocation of fresh capital right now.

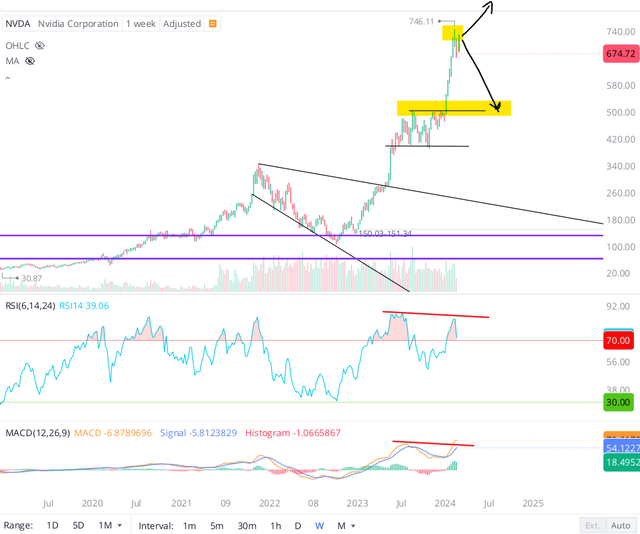

Technically, Nvidia’s stock is firmly in the overbought territory (RSI >70). While I understand that stocks can stay overbought for long periods of time, and that momentum can carry NVDA to unimaginable levels, the divergence between price and momentum indicators (RSI and MACD) is concerning.

Given Nvidia’s robust financial performance and management’s optimistic outlook, I don’t think investors (institutional or retail) are going to be in any hurry to race toward the exit doors here. However, vertical moves like the one we see in NVDA tend to get retraced, but only time will reveal the truth here.

Now, I have sounded like a broken record, but I have to say this again –

Nvidia Corporation is a great company with market-leading products and arguably the best CEO in the semiconductor industry. However, the price we’re being asked to pay for Nvidia is too steep, in my opinion. In a zero-interest rate world, investors can afford to be valuation agnostic; however, we are no longer operating in such an environment, with the FED still pulling liquidity out of financial markets and a bank credit tightening cycle in effect after multiple bank failures.

Despite running the risk of missing out on further gains in NVDA stock, I choose to remain on the sidelines here. FYI, I have been wrong about NVDA stock in the past, and I could be wrong again. While Nvidia is performing exceptionally right now, the current price tag leaves little to no margin of safety for a long-term investor.

Source: “Nvidia Q3 Review: I Was Wrong, But I’m Staying On The Sidelines.”

With persistent doubts over sustainability of Nvidia’s revenue growth and margins (pricing power) heading into a potential economic downturn (hard landing), I cannot justify allocating capital to Nvidia here. Due to unfavorable risk/reward and sheer lack of a margin of safety, I am going to stick to the sidelines on Nvidia Corporation stock so close to its all-time highs.

Key Takeaway: I continue to rate Nvidia Corporation stock “Neutral/Hold” at $721 per share.

Thanks for reading, and happy investing! Please share your thoughts, questions, or concerns in the comments section below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are you looking to upgrade your investing operations?

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why we designed our investing group – “The Quantamental Investor” – to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.

At TQI, we are pursuing bold, active investing with proactive risk management to navigate this highly uncertain macroeconomic environment. Join our investing community and take control of your financial future today.