Summary:

- 3M recently settled its class action lawsuits involving the use of PFAS and combat earplugs.

- These settlements could improve public perception and lead to increased investment and investor confidence.

- MMM’s current valuation is attractive, with a high dividend yield and favorable topline metrics.

- I am also optimistic about the recovery of its profitability in the near future.

jetcityimage

3M lawsuit

The goal of this article is to argue for a bullish thesis on 3M Company stock (NYSE:MMM). My argument will be mainly built upon two factors. The first one involves the settlement of its class action lawsuits. And the second one involves the attractive valuation and thus return potential created by its recent stock price dips.

For readers unfamiliar with the background. I will start with a summary of 3M’s PFAS and earplug settlement. MMM recently settled a PFAS (”forever chemicals”) class action suit and plans to pay $10.3 billion to public water systems over the next 13 years. The payment will be used to compensate U.S. public water providers for costs associated with PFAS contamination, including filtration systems and testing. It also recently agreed to a $6 billion settlement to resolve the Combat Arms Earplugs case, which will be paid over six years. The payments will be used to compensate US military service members and veterans who claim hearing loss due to allegedly defective Combat Arms Earplugs.

I view these settlements as positive catalysts for 3M stock prices. For the earplug settlement, I anticipate a very high participation rate from the claimants. The company reported that the participation rate exceeded a milestone of 98% early in January. These settlements could also improve the public’s perception of 3M’s environmental responsibility, potentially leading to increased investment and investor confidence. In terms of financial performance, 3M has been hard hit by the related legal expenses in recent quarters. However, with 3M’s restructuring plan and cost management plan, I am optimistic that the company can return to profitability next year, as further elaborated in the next section.

3M Dividend

Mostly due to the pressure from the lawsuits, MMM’s stock prices have been under pressure in the past 1~2 years. As such, the stock is now attractively valued. Due to the legal expenses and restructuring costs, the company registered steep losses in recent quarters. As such, the usual P/E ratio does not apply here.

Fortunately, in 3M’s case (a dividend champion), its dividend yield serves as an alternative and reliable valuation metric. As seen in the figure below, MMM is currently yielding 6.55%. This level is among the highest levels in at least 10 years and far exceeds its historical norms (which lie in a range of 2.0% to 4.5% most of the time).

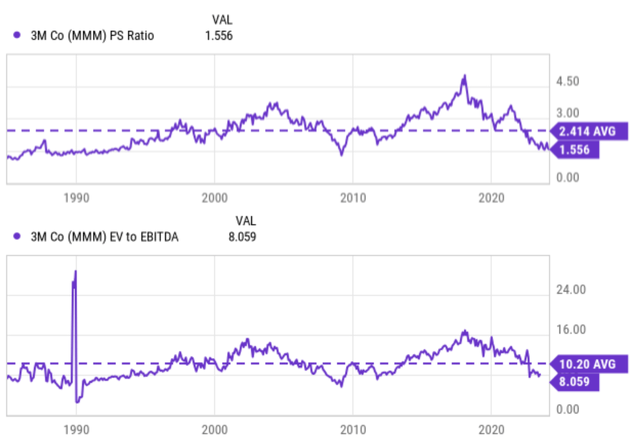

Next, MMM’s current valuation is also extremely attractive by other topline metrics such as P/S ratio (see the second chart below) and EV/EBITDA ratios (see the third chart below).

3M Stock Forecast

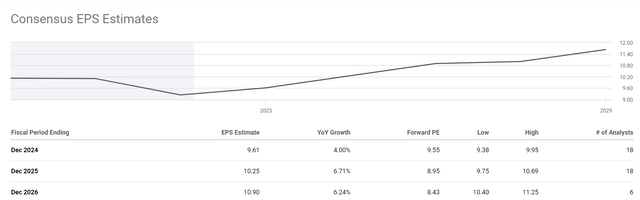

As mentioned earlier, I am optimistic that 3M can return to profitability in the near future. The chart below summarizes consensus estimate of 3M’s earnings in the next few years. As seen, for FY 2024, the consensus estimate of its EPS is $9.61. And for FY 2025, the figure rises to $10.25, which is a 6.71% increase year-over-year. Looking further out to 2026, the projected EPS is $10.90, which is a 6.24% increase year-over-year.

I see good reasons to agree with such projections. 3M has implemented various cost-cutting measures like restructuring, workforce reductions, and streamlining operations. These initiatives aim to improve efficiency and potentially boost margins, leading to higher profitability. 3M has been divesting non-core businesses to focus on its core markets with higher growth potential, such as healthcare, safety and security, and electronics. This strategic shift could lead to increased profitability in areas where they excel.

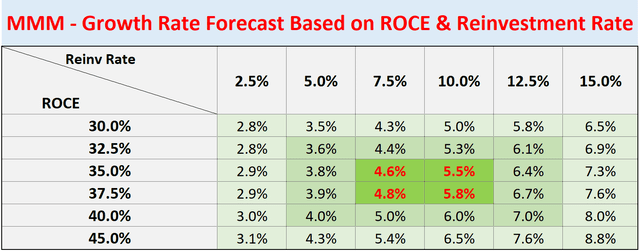

Finally, if we expand our horizontal a bit beyond its immediate troubles, the company has been maintaining quite robust ROCE (return on capital employed) and also reinvestment rate. My analysis shows that the ROCE of MMM has been on average about 37.5% in the past 10 years and the reinvestment rate has been on average 7.5%. As such, the organic growth rate (which is the product of ROCE and reinvestment rate) should be in the range of 4.6% to 5.8%, quite consistent with the consensus projections.

Other risks and final thoughts

On the downside, a few risks are worth mentioning. First, the exact amount for its legal settlement could end up higher than the current figures depending on future testing. Second, the ongoing supply chain disruptions could impact 3M’s ability to efficiently produce and deliver products. Furthermore, these disruptions could worsen with the ongoing geopolitical and trade wars.

All told, I think the positives far outweigh the negatives. To recap, the positives include the clarity created by the settlement of class action lawsuits, the attractive valuation created by the price corrections, and also its profitability recovery potential. In particular, its current dividend yield is among the highest levels in at least ten years and its FW P/E is in the single digits only.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If you share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat the S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.