Summary:

- Today, I’d like to take a fresh look at NIO’s growth prospects in the current “China oversold” reality. Maybe NIO has just bottomed out? Read on.

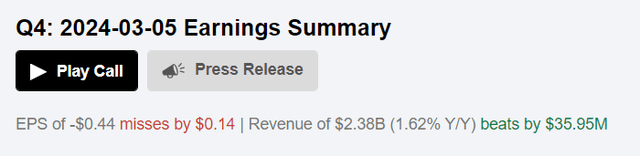

- NIO reported for Q4 FY2023, beating the quarterly consensus estimates regarding sales (surprise of 1.54%), but missing on the bottom line (surprise of -47.38%).

- NIO’s success in terms of gross profit still has a weak leverage effect on EBITDA and net profit. Also, NIO’s China BEV market share is likely to get smaller soon.

- But from what I see, the NIO stock price has priced in most of the negatives surrounding the company. A mean reversion is highly likely, in my view.

- So despite NIO’s current financial challenges, I believe the stock has a strong likelihood of recovery in the short to medium term.

MARHARYTA MARKO/iStock via Getty Images

Introduction

If you have been following me on Seeking Alpha long enough, you might remember my conviction that the risks in Chinese assets (especially in equities) are too high. This opinion formed in my mind back in 2021 when I published my first article on Alibaba Group (BABA). At that time, I advised everyone not to buy the stock’s dips, pointing out the problems of the Chinese economy, the political system, and the legal peculiarities of the now well-known VIE structure.

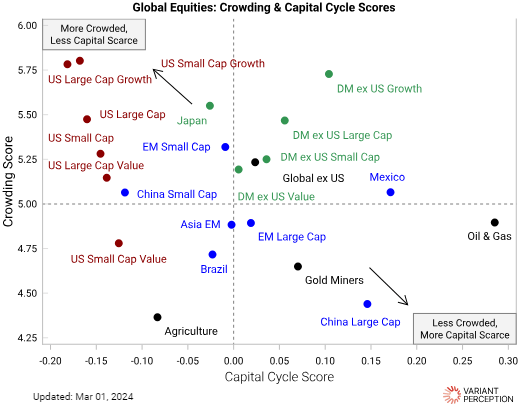

However, the massive exit of institutional investors from their Chinese holdings has led to a massive underweighting. According to Variant Perception (shared by Brandon Beylo on X), Chinese large caps as an asset class are now one of the least crowded things in the global capital market.

Shared by @marketplunger1 on X

Against this oversold backdrop, financial theory advises speculators to look for stocks with a high beta to the market – which is why my eye once again fell on NIO Inc. (NYSE:NIO).

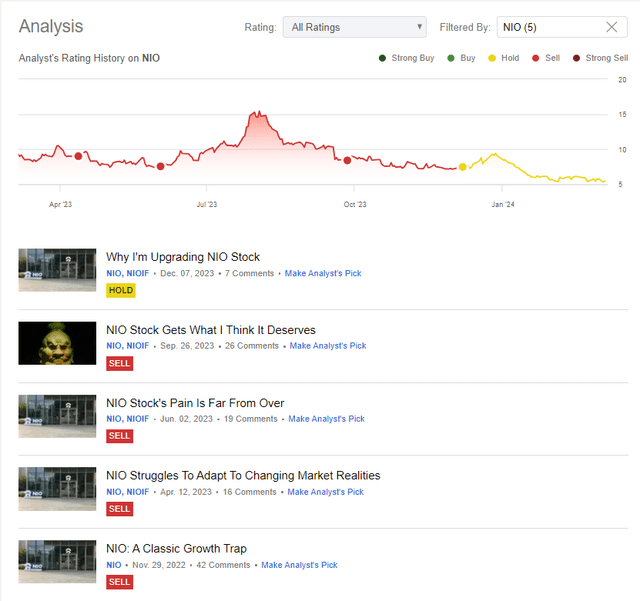

I’ve been covering NIO here on Seeking Alpha since November 2022. I started with a “Sell” rating and kept it until September 2023, repeatedly pointing out the increasing competition in the industry and the potential challenges in generating profits in the foreseeable future. But already in December 2023, I withdrew my bearish rating and upgraded the stock to “Hold”, aka “Neutral”. Since then, the stock price has risen for a few days, but then fell again, only to fall further and test the price level of the IPO:

Seeking Alpha, author’s NIO coverage

Since a whole quarter has passed since my last update on the stock, I would like to take a fresh look at NIO’s growth prospects in the current “China oversold” reality. Maybe NIO has just bottomed out? Let’s try to find out.

Q4 FY2023 Financials And Corporate Developments

On March 05, 2024, NIO reported for Q4 FY2023, beating the quarterly consensus estimates regarding sales (surprise of 1.54%), but missing on the bottom line (surprise of -47.38%).

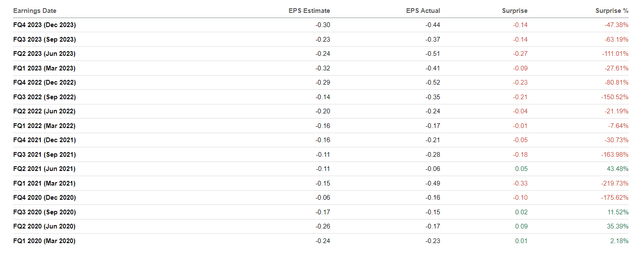

As so often in previous quarters, NIO struggled to improve its bottom line dynamics. A look at the following table shows that NIO has been struggling with this development since the third quarter of the 2021 financial year, i.e. 10 quarters in a row:

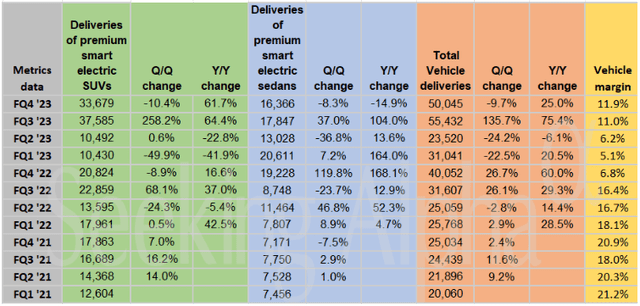

In Q4 FY2023 NIO witnessed a remarkable surge in vehicle deliveries, tallying an impressive 50,045 units (+25% YoY), comprising 33,679 premium smart electric SUVs (+61.7% YoY) and 16,366 premium smart electric sedans (-14.9% YoY). Despite this general YoY growth, the QoQ dynamic was again negative:

However, it’s worth noting that NIO’s gross margin improved by 90 basis points quarter-on-quarter to 11.9%. This is due to the fact that Q4 vehicle sales increased by 4.6% QoQ amid production costs only increasing by 2.6%. In view of the difficult competition for consumers in the Chinese market, I consider this margin expansion to be a very positive sign.

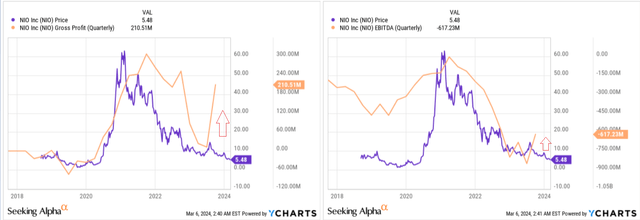

If we look at the current recovery in gross profit over a longer period of time, we see that NIO’s success in terms of gross profit still has a weak leverage effect on EBITDA and net profit.

As of December 31, 2023, NIO’s coffers boasted a robust $8.1 billion in cash and cash equivalents, restricted cash, short-term investments, and long-term time deposits – that’s about 83% of the company’s market cap today. Despite this, I do not believe that NIO can be described as a cheap stock: The company is generating heavy losses that, while no longer growing, are still a serious headwind for shareholders as the company is forced to attract additional liquidity. In December they got another $2.2 billion strategic investment from CYVN Holdings. NIO shareholders are fortunate that the company is turning to large investors – the transaction is taking place over-the-counter (OTC), without the intense pressure that could come from public dilution.

But there’s no way around raising capital if the company wants to grow – this is the aim of the management’s latest efforts. During the annual “Nio Day” on December 23, 2023, NIO unveiled the Smart Electric Executive flagship NIO ET9, a new NT3 platform and a self-developed chip. In addition, NIO is further expanding its battery swap network and plans to set up 1000 new battery swap stations and 20,000 chargers by the end of 2024, according to the latest earnings call transcript. I think these developments should drive further growth in NIO’s sales.

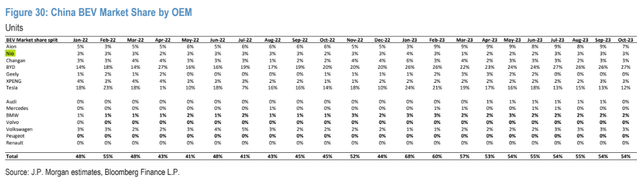

According to JPMorgan data from November last year (proprietary source), NIO had a 3% share of the total Chinese BEV market.

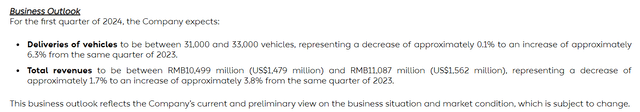

However, according to CnEVPost, the NIO had only 2.1% at the end of 2023. Most likely, this share will become even smaller, as NIO’s management expects total sales of $1,479 to 1,562 million (-2% YoY in the mid-range) and an annual decline in deliveries of ~0.1%.

For many, this was bad news, but in addition to the obvious negatives, immediately after the publication of the report and the announcement of this guidance, we saw a rise in NIO’s stock price after an attempt to go deeper:

TrendSpider Software, NIO, daily

I think the stock has already absorbed almost all of the negativity that has fallen on it following the report and management comments. Most likely those who saw the Q1 forecast decided to close their positions, but there’s a very strong buyer waiting near the IPO price level who did not let the price fall.

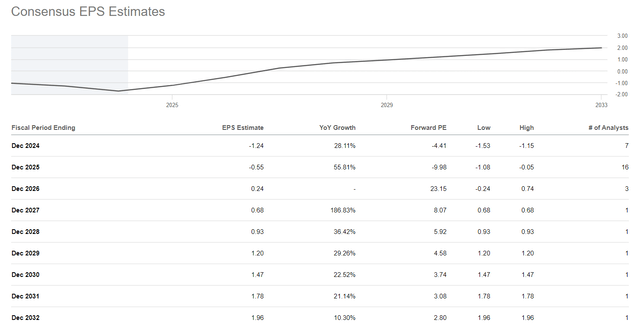

I would hazard a guess that we are seeing a local bottom in NIO stock against the general backdrop of heavily oversold Chinese equities. Yes, deliveries will decline, although margins are growing, the company is still far from profitability and NIO’s market share in China is falling. But Mr. Market already seems to know that. Wall Street is forecasting two more years of losses for NIO, with the first positive earnings per share expected in fiscal 2026 at an implied price-to-earnings ratio of 23.15x. That’s a lot for a car company, but given the company’s luxury niche, this multiple is perhaps almost fair. It’s worth noting that NIO’s implied long-term P/E ratios (based on today’s consensus) now appear quite low, unlike the last few times I looked at the company.

I anticipate that the growth initiatives I described above, as well as NIO’s entry into the European market, will give the stock another dose of market hope – this scenario, if realized, will give stock speculators the opportunity to make tens of percent on the potential mean reversion.

NIO Is A Speculative Stock Right Now

First of all, it is worth mentioning that NIO is operating in a very competitive environment where market saturation is going very fast. Sales of BEVs are increasing worldwide, but this growth cannot continue forever: At some point, manufacturers will have to lower prices and fight for buyers, who are becoming increasingly choosy in the face of the abundance of new models. NIO has a special position here – the luxury segment is logically less price-elastic. But other luxury brands are not sleeping either: even Bentley is now pushing for full electrification by 2030, not to mention other representatives of the world’s leading car manufacturers. NIO will have to fight against them, although its financial possibilities remain very limited.

Speaking of finances: We also can’t ignore the stagnation in growth and relatively slow margin expansion we’ve seen in recent quarters. Until the company has proven that it is able to beat forecasts and cover its CAPEX and overall development costs through its own FCF, too much uncertainty remains to recommend NIO as a long-term investment.

Therefore, I would like to make an important clarification on my today’s rating: As I cover NIO on a quarterly basis, my rating today is only valid until my next update, which is scheduled for next quarter. NIO is a speculative idea for me today.

Final Thoughts

I very rarely give speculative ideas here on Seeking Alpha, but the way I see NIO’s price performance after the announcement of the quarterly results, the probability of a recovery rally in the coming weeks is very high. These are not just my conclusions based on technical analysis: I am trying to understand price behavior through the prisms of fundamentals. We know that China is oversold (relative to other regions and asset classes in general), and we know that NIO’s first-quarter guided numbers were weaker than many expected. But the stock price has not fallen. Why? Most likely because a) there is a strong buyer near the IPO price level, and b) the market has already priced in most of the negatives. Based on the consensus forecasts, we see that everyone already knows that NIO will not make profits for another two years. However, the P/E ratio is expected to fall to < 6x in FY 2028, which is very low. Despite NIO’s difficult financial situation, I think the chances of a short- to medium-term recovery of the stock are quite high today.

Today I rate NIO as a speculative “Buy” (however, this rating may change in the other direction in 3-4 months, so stay tuned).

Thanks for reading!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in NIO over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!