Summary:

- Box’s Q4 earnings results have proven the mainstream thinking wrong, with a re-acceleration in billings growth rates.

- The bull case for Box includes a major TAM, attractive cross-sell opportunities, AI advantages, and steady profit margin growth.

- The company is guiding to 5% y/y revenue growth in FY25 alongside ~3 points of operating margin expansion. It is refocusing its hiring efforts to Poland to reduce expenses.

- The stock remains quite cheap at <4x forward revenue.

ngkaki/iStock Editorial via Getty Images

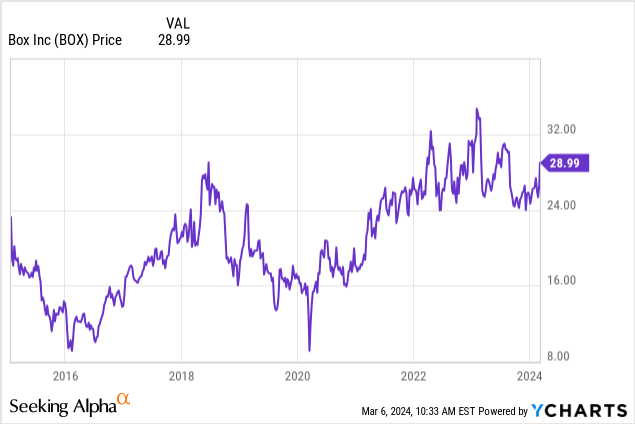

We’re now well through the Q4 earnings season, and so far, it has proven to be quite a volatile one, with many growth stocks sliding or jumping sharply on quarterly releases. Notably, there have been upside surprises in many stocks that have been thought to be “dead money,” including Box (NYSE:BOX).

Box, the cloud storage software company, has been in a growth rut for years. With file storage being a saturated market plus the omnipresent competition from Dropbox (DBX) and Google Drive, the common sentiment is that Box has nowhere to go: but Q4 results, which demonstrated a re-acceleration in billings growth rates, have proven the mainstream thinking wrong.

The bull case for Box, revisited

I last wrote a bullish article on Box in December, when the stock was trading in the low $20s. Though the stock has advanced more than 20% since then, with gains picking up after Box’s Q4 earnings release, I remain stoutly bullish on Box’s prospects for the remainder of the year. Box is the exact kind of stock I want to fit into my portfolio eat this exact moment: with a very expensive S&P 500 and many tech stocks that, in my view, are ripe for a correction, Box offers downside protection in its very modest valuations plus its ever-expanding profit margins.

We also have to remember that for Box, AI is not just a buzzword, but a capability it has been instilling into its product stack for years. Box’s AI goal is to help customers “unlock the power of enterprise content” – its tools can help users quickly search across thousands of documents, summarize them, and even generate new content.

Here is a refresher for investors as to the core tenets of the bull case for Box:

- Major $74 billion TAM as Box continues to expand its product portfolio. Despite competition, Box cites a massive $74 billion market across storage, content collaboration, and data security. That’s a big enough space for multiple incumbents and also suggests Box is only currently ~2% penetrated into this overall market. Recent portfolio additions like Box Sign have greatly expanded Box’s potential.

- Multi-product strategy is driving attractive cross-sell. More than two-thirds of Box’s new deal bookings come from Box Suites customers who are purchasing more than one Box product. Additions like Box Sign continue to pave the way for incremental revenue growth.

- Founder-led. Though many Silicon Valley startups have been passed over from their founders to professional CEOs, Box remains led by its co-founders Aaron Levie and Dylan Smith as CEO and CFO, respectively.

- Best-in-breed for enterprise users. Of all of its well-known competitors, Box is the only company that is enterprise-focused. The company touts its security features plus advanced capabilities like Box Skills as key distinguishers versus the likes of Dropbox.

- Steady upward march in profit margins. Box expects to hit a 27% pro forma operating margin in FY25, up from 24% in FY24. Cross-sell and current customer expansion will drive top-line efficiencies, while the company’s ongoing move to public cloud servers will drive gross margin expansion.

The core risk to Box, of course, is saturation in the storage market. The need to upload and store files online and in the cloud has been omnipresent for years, and the market is already cornered by the three incumbents: Box, Dropbox, and Google Drive.

There are two opportunities and offsets to this, however. The first is the fact that Box has always maintained its best-in-class reputation for enterprise customers (though both of its competitors offer business packages, Box has long maintained its credential for being the most secure and advanced). As file storage becomes more commoditized and buyers select vendors based on AI and value-added feature sets, Box is set to gain market share, in my view. The second is growing data needs overall, which should continue to emphasize the importance of a robust and scalable storage strategy.

Q4 download

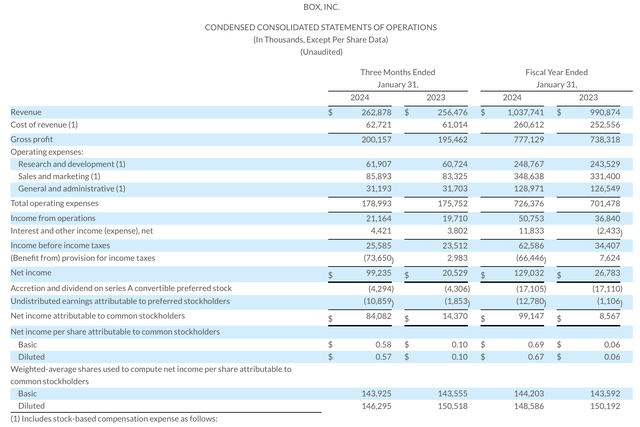

Let’s now go through Box’s latest quarterly results in greater detail. The Q4 earnings summary is shown below:

Box Q4 results (Box Q4 earnings deck)

Box’s revenue grew 2.5% y/y to $262.9 million, ahead of Wall Street’s expectations by a hair. Note that FX continues to be a headwind for Box, which notes that revenue growth on a constant-currency basis would have been 4% y/y.

The company notes that macro conditions have started to stabilize, helping to remove pressure from limited IT budgets being the cause of deal slippage. Also within the quarter, Box announced a new integration with Microsoft Azure’s OpenAI, further burnishing Box’s credentials as the most enterprise-grade and AI-ready storage offering on the market.

Here is helpful commentary from founder and CEO Aaron Levie’s prepared remarks on the Q4 earnings call on the company’s sales priorities for the current year:

As we look ahead to FY’25 and beyond, and as we enter this new chapter as a platform to power intelligent workflows around content, we will leverage our go-to-market motion to bring new solutions to customers, add new pricing models and packages to drive further upsell and extend our platform to a deeper set of partners and system integrators to deliver our more advanced solutions to customers and drive further growth.

Further, we plan to ignite more demand gen and pipeline development programs to reach even more customers and prospects, doubling down in key verticals, such as financial services, life sciences, healthcare, and the public sector, honing our focus on key international markets and more.

We are focused on taking advantage of the market opportunity in front of us and these focused go-to-market investments and initiatives are being made to accelerate the future revenue growth of Box.

As you can tell, we are incredibly excited about the innovation we will be delivering to our category-defining content cloud platform in FY’25. Our robust product roadmap combined with our investments in strategic go-to-market initiatives positions us well for the megatrends that are driving IT decisions and for when a more normalized IT spending environment returns.”

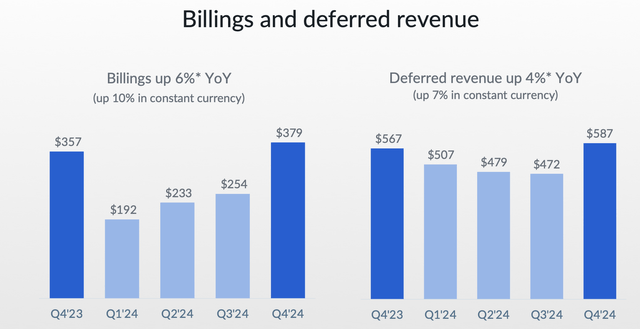

We note that Q4 billings returned to growth, accelerating to 6% y/y or 10% y/y growth on a constant-currency basis as shown in the chart below. Note that investors panned box last quarter for seeing billings fall to -2% y/y.

Box billings trends (Box Q4 earnings deck)

Multi-product attach continues to be a driver for large deals, with the company noting that 81% of new deals featured Box Suites, up from 72% last year. The multi-product customers on Box Suites plans now represent 55% of Box’s revenue. The company has also flexed its pricing power, noting that price per seat is up since last year.

The company also notched a 26.7% pro forma operating margin, up 70bps y/y. Savings have come from the company’s strategic decision to relocate many teams to cheaper locations: for example, the company notes that the bulk of its R&D hiring going forward will be in Poland, where it already has 300 engineering employees.

Valuation and key takeaways

Despite its strengths, Box still remains modestly valued. At current share prices near $29, the company trades at a $4.16 billion market cap. After we net off the $480.6 million of cash and $370.8 million of debt on the company’s most recent balance sheet, the company’s resulting enterprise value is $4.05 billion.

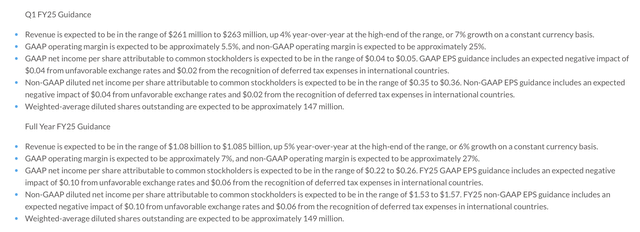

Meanwhile, for the current fiscal year, Box has guided to $1.08-$1.085 billion in revenue, representing 5% y/y growth (6% in constant currency), and pro forma EPS of $1.53-$1.57.

Box outlook (Box Q4 earnings release)

This puts Box’s valuation multiples at:

- 3.7x EV/FY25 revenue

- 18.6x FY25 P/E

Note as well that there are $0.16 of “non business” headwinds embedded in Box’s EPS forecast for next year, with $0.10 coming from currency headwinds and $0.06 from recognition of international deferred tax expenses. If we normalize for these items, Box’s P/E is closer to ~17x.

All in all, Box remains quite a compelling buy, especially after Q4 results showcased a re-ignition of billings momentum and continued margin gains. Stay long here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BOX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.