Summary:

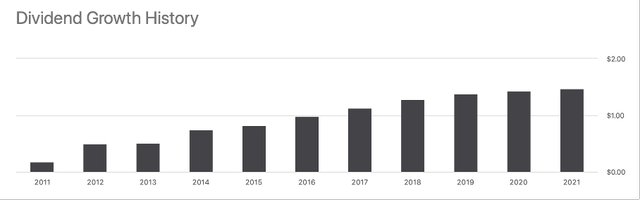

- Cisco Systems is a true dividend compounder that has shown strong dividend growth for years.

- Cisco Systems expects strong macro-economic growth in IT, driven by multi-year megatrends in hybrid cloud, hybrid work, security, IoT, 400G and beyond, 5G and Wi-Fi 6.

- The free cash flow margin of 25% provides a massive amount of cash which is fully distributed to shareholders in the form of dividends and a share repurchase program.

- The high buyback yield of nearly 5% including the dividend yield of about 3.5% makes the stock very interesting to invest in. Measured from 2012, dividends per share increased 12.7% annually.

- Cisco is a well-established company in the networking, communications and IT industry. Smaller companies in the industry are following suit, making them now a threat to Cisco.

Sundry Photography

Introduction

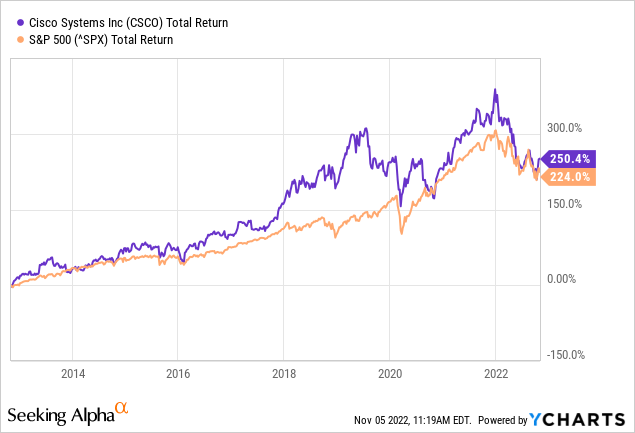

Cisco Systems (NASDAQ:CSCO) is a true dividend compounder that has shown strong dividend growth for years. The free cash flow margin of 25% provides a massive amount of cash which is fully distributed to shareholders in the form of dividends and a share repurchase program. The high buyback yield of nearly 5% including the dividend yield of about 3.5% make the stock very interesting to invest in. The valuation of the stock is favorable now that the share price has fallen. Looking at the total return over 10 years, it is on par with the S&P500 with an average return of about 13.3%.

The high free cash flow margin, expected revenue growth, the shareholder-friendly management and the cheap stock valuation make the stock worth buying.

Company Overview

Cisco Systems is a networking equipment provider that sells Internet Protocol-based networking and other products related to communications networks and IT internationally.

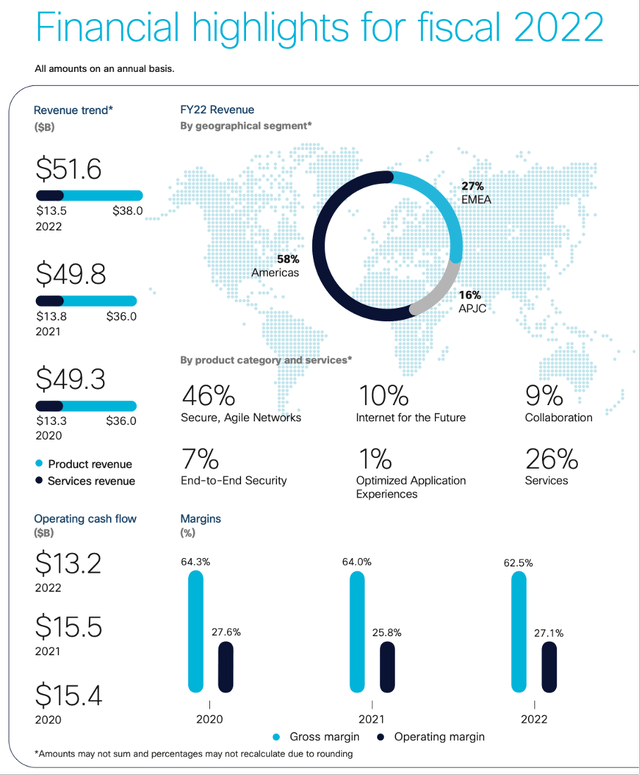

Most of the revenue comes from their Secure, Agile Networks business segment, this segment accounts for 46% of fiscal year 2022 revenue. Next, Cisco’s Services account for 26% of total revenue. The third major business segment is Internet for the Future, which accounts for about 10% of revenue. The following figure provides a brief overview of the financial highlights for fiscal 2022.

Financial Highlights For Fiscal 2022 (Cisco’s Fiscal 2022 Annual Report)

Analysts Expect Growth In The Near Future

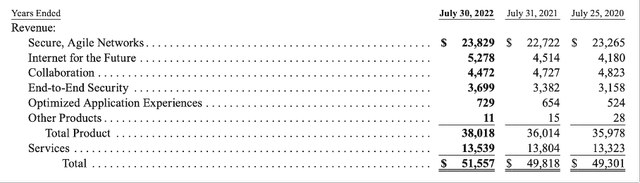

Annual sales for fiscal year 2022 increased 3% compared to fiscal year 2021. The operating margin remained stable at 27%. The high operating margin ensures little fluctuation in earnings in the face of potentially declining sales. Earnings per share increased 4.3%, thanks in part to share repurchases.

In the fourth quarter of fiscal 2022, revenues from their product category increased 6% year over year. Which was driven by growth in their largest business segment Secure, Agile Networks (which increased 5% YoY). Internet for the Future also saw strong revenue growth of 17%, End-to-End Security was up 9% and Optimized Application Experiences revenue was up 11% YoY. Revenue from the Collaboration product category fell 5% year over year, and revenue from the Services segment also fell slightly by 2%.

Revenue By Business Segment (Cisco’s Fiscal 2022 Annual Report)

Cisco Systems expects strong macro-economic growth in IT, driven by multi-year megatrends in hybrid cloud, hybrid work, security, IoT, 400G and beyond, 5G and Wi-Fi 6. Cisco Systems expects supply chain issues in fiscal 2023 but expects gradual improvements over the year.

Analysts on the Seeking Alpha Cisco ticker page expect revenue growth of 5% year-on-year in FY2023. Adjusted earnings per share are also expected to grow 5% year-over-year.

Cisco’s Financial Results (SEC and Author’s Own Graphical Representation)

High 5% Share Buyback Yield And Strong Dividend Growth

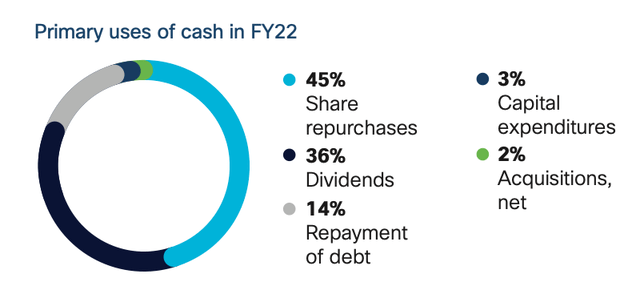

Cisco’s high free cash flow margin of 25% generates a lot of cash. Cisco distributes excess cash to its shareholders by paying dividends and repurchasing shares. Repurchasing shares increases dividends per share and decreases the supply of outstanding shares. Cisco repurchases shares in the open market, allowing the share price to rise. Share repurchases are a tax-efficient way to return money to shareholders.

Primary Uses Of Cash in FY22 (Cisco’s FY22 Annual Report)

Due to the recent decline in the share price, the dividend yield increased compared to the dividend yield during the stock’s peak. The dividend yield is currently 3.45% and is $1.52 per share.

Stock buybacks increase dividends per share when dividend payments remain at least the same for 2 consecutive years. Measured from 2012, dividends per share increased 12.7% annually.

Dividend Growth History (Cisco’s Seeking Alpha Ticker Page)

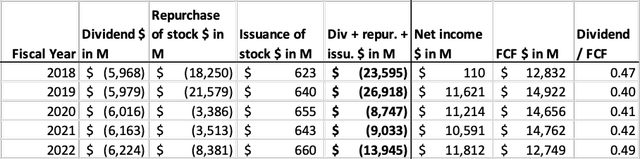

Looking at dividend payments and share repurchases; it can be said that the management of Cisco has been very shareholder-friendly in recent years. In 2018 and 2019, it returned almost 2 times more cash to its shareholders as it generated in free cash flow. At the moment, Cisco is pursuing a more conservative policy. In fiscal year 2022, the company repurchased $8.3B worth of shares, representing a buyback yield of nearly 5%. Cisco has a strong net cash position of $9.7B, giving it ample cash on hand.

Cisco’s Cash Flow Highlights (SEC and Author’s Own Calculations)

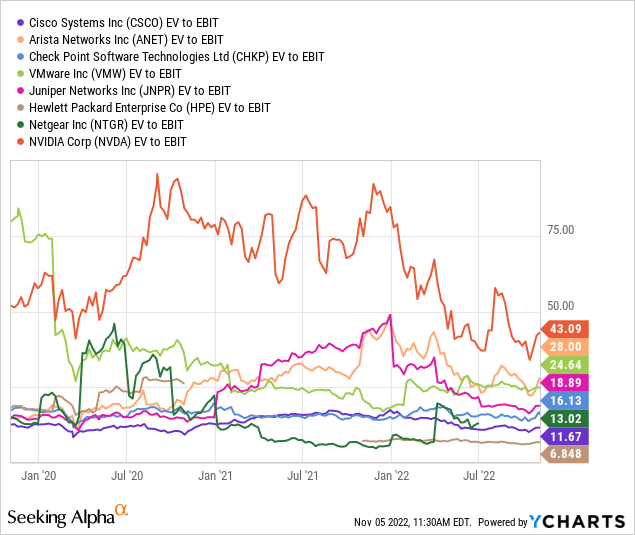

EV/EBIT Ratio Is Attractive Compared To Competitors

I charted stock valuation by comparing enterprise value to EBIT. Large share repurchases and dividend payments reduce Cisco’s cash position. This makes the enterprise value/EBIT ratio perfect for comparing with companies in the same industry, such as Arista networks (ANET), Check Point Software (CHKP), VMware (VMW), Juniper Networks (JNPR), Hewlett Packard Enterprise (HPE), Netgear (NTGR) and NVIDIA (NVDA).

The EV/EBIT ratio only charts current valuation metrics. In the case of Nvidia, this ratio will give a distorted picture because Nvidia’s EBIT is expected to grow strongly in the coming years. If this growth stops abruptly NVIDIA’s shares will be overvalued, this could lead to a crash in the share price.

Cisco’s EV/EBIT ratio is listed at 11.7, one of the lowest among its industry peers. Hewlett Packard Enterprises’ stock rating is listed lower with an EV/EBIT ratio of 6.8. It is certainly worth taking a closer look at this stock. Cisco is very attractively valued in the market.

An Overview On Cisco’s Competitors

Cisco is a well-established company in the networking, communications and IT industry. Smaller companies in the industry are following suit making them now a threat to Cisco. Cisco itself has not been inactive in innovation and is known for its Catalyst LAN switch, Nexus data center switch, Silicon One networking equipment and innovated heavily in security and software. A small list of Cisco’s (potential) competitors:

Arista Networks is a sharp competitor at the high-end, as Arista’s data center technologies have greatly expanded. The acquisitions of Mojo and Big Switch give Arista Networks the expertise in wireless technology and software-defined networking that is a direct threat to Cisco.

Check Point Software specializes in cloud security and recently formed alliances with SD-WAN vendor Aryka to be competitive in cloud security.

Dell (DELL) could become a major competitor as it already has 20,000 data center customers. Dell’s PowerSwitch, Cumulus and SONiC will make campus networking and cloud-scale data center networking easier. Dell’s new service, called Apex, can be deployed in companies’ own data centers, peripheral locations or colocation facilities, and companies pay for capacity according to their needs.

Juniper Networks is a long-term competitor to Cisco, and with the purchase of Apstra and 128 Technologies, it has an opportunistic asset for use in automated networks by acquiring a valuable operating system and its AI-based management system.

Hewlett Packard Enterprises has taken a big step into the SD-WAN market by buying networking vendor Silver Peak for $925 million. HPE Aruba aims to become a major player in this area. Combined with the Edge Services Platform, HPE has tools to shake up Cisco.

NetGear is a close competitor to Adtran, D-Link and Dell, but the company has been providing networking equipment since 1996 and specializes in equipment for small- and medium-sized businesses, retail and home networking. NetGear competes with Cisco Meraki with its wired and wireless products.

Nvidia has developed strongly in data centers over the past 2 years. Nvidia is not easily recognized as a strong player in the data center market, but the company is making every effort to become a major player. Driven by its powerful processor technology and through its strategic acquisitions of Mellanox and Cumulus, and strategic alliances with VMware, Check Point and Red Hat, Nvidia’s goal is to deliver a complete hardware/software product that brings the power of AI to enterprises to modernize their data centers.

VMware is a strong competitor to Cisco in SD-WAN, this technology is the basis of the growing market for Secure Access Service Edge that connect enterprises and multi-cloud systems. Both VMWare and Cisco have signed agreements with major cloud providers such as AWS, competition between the two companies will become even stronger in the future.

Key Takeaway

- Cisco Systems is a true dividend compounder that has shown strong dividend growth for years.

- In the fourth quarter of fiscal 2022, revenues from their product category increased 6% year over year. Which was driven by growth in their largest business segment Secure, Agile Networks (which increased 5% YoY).

- Cisco Systems expects strong macro-economic growth in IT, driven by multi-year megatrends in hybrid cloud, hybrid work, security, IoT, 400G and beyond, 5G and Wi-Fi 6.

- Cisco Systems expects supply chain issues in fiscal 2023 but expects gradual improvements over the year.

- Analysts on the Seeking Alpha Cisco ticker page expect revenue growth of 5% year-on-year in FY2023. Adjusted earnings per share are also expected to grow 5% year-over-year.

- The free cash flow margin of 25% provides a massive amount of cash which is fully distributed to shareholders in the form of dividends and a share repurchase program.

- The high buyback yield of nearly 5% including the dividend yield of about 3.5% make the stock very interesting to invest in. Measured from 2012, dividends per share increased 12.7% annually.

- EV/EBIT ratio is attractive compared to competitors. The valuation of the stock is favorable now that the share price has fallen.

- Cisco is a well-established company in the networking, communications and IT industry. Smaller companies in the industry are following suit making them now a threat to Cisco.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in CSCO over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.