Summary:

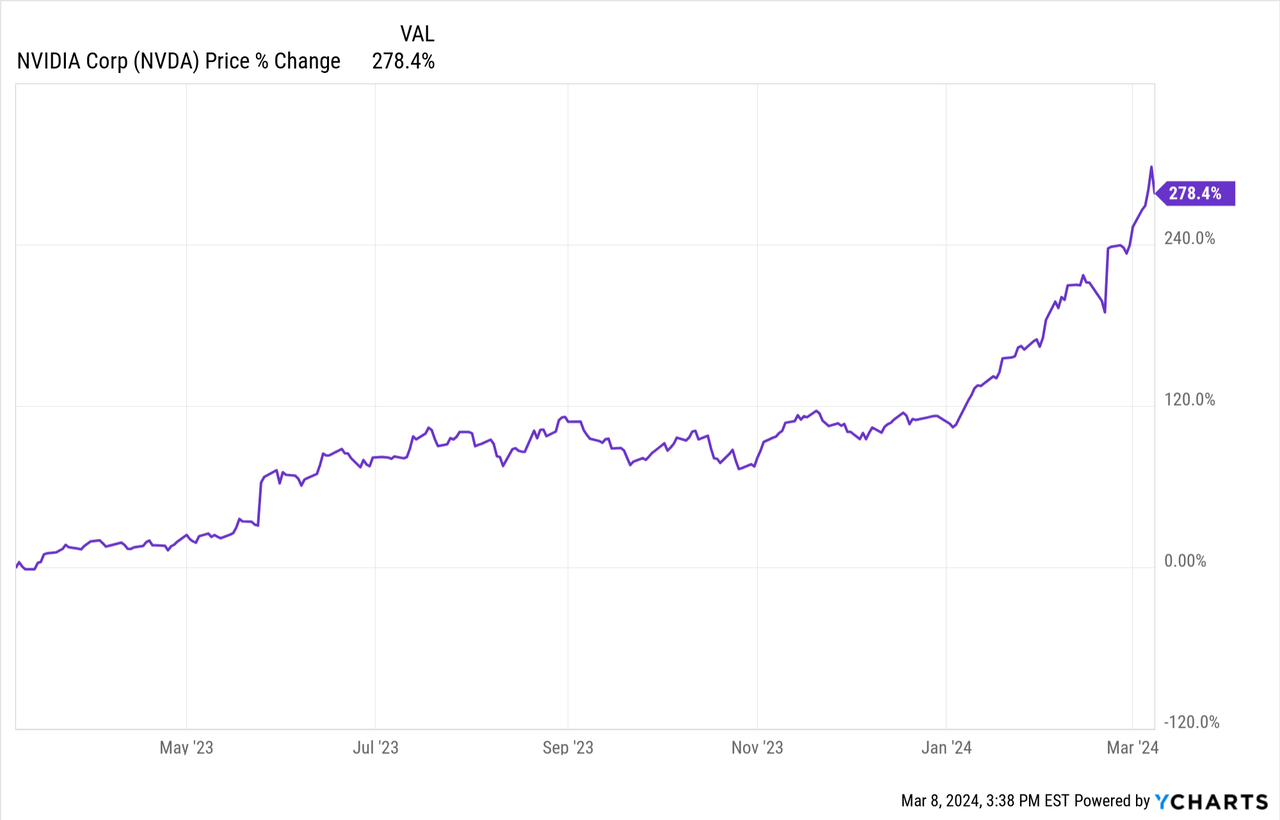

- Nvidia Corporation stock has experienced a meteoric rise, with a 1-year return of 278% and a market cap now in the $2 trillions.

- Artificial intelligence sentiment coupled with Nvidia’s market positioning and growth potential, has fueled the stock’s success.

- Despite the stock continuing to seemingly defy gravity, a closer look at Nvidia valuation helps justify its price as reasonable.

Justin Sullivan

What has fueled NVDA’s meteoric rise?

It’s not news to investors how well Nvidia Corporation (NASDAQ:NVDA) stock has performed. Share prices recently crossed the $900 mark, carrying the stock’s 1-year return to 278% and the company’s market cap to $2.26 trillion.

Before addressing the question of valuation, it’s helpful to understand the catalysts behind Nvidia’s rocketing share price and assess their rationality.

Artificial Intelligence Sentiment

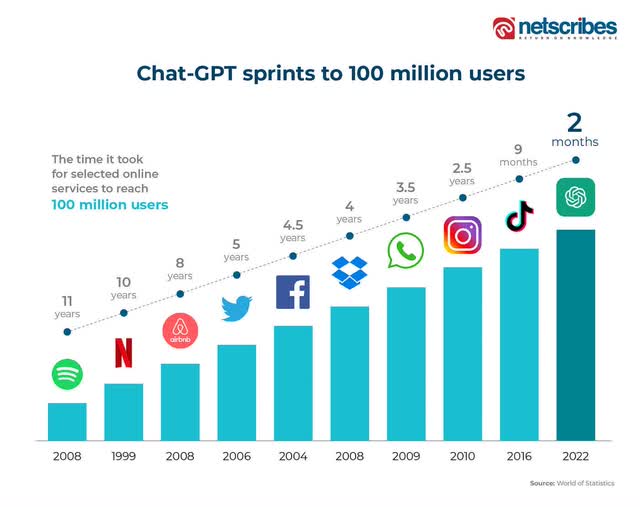

Artificial intelligence (“AI”), Machine Learning (“ML”), and Large Language Models (“LLM”) have been under development for decades now. But only recently has there been an amplifying of consumer awareness for the technology and its use cases, in large part thanks to OpenAI’s generative AI chatbot, ChatGPT. GPT launched its first demo in November of 2022 and within 60 days reached 100 million users, signaling the inception of the market’s AI craze.

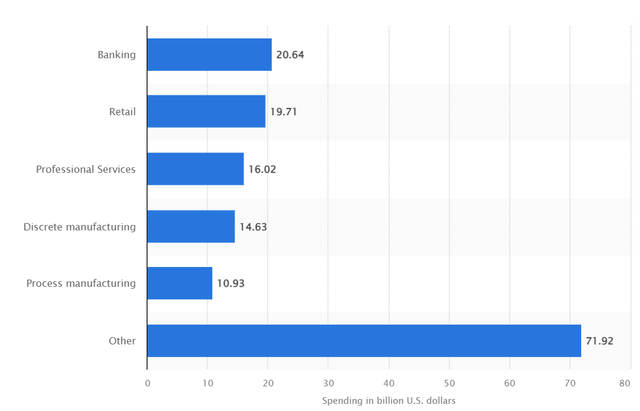

What followed in 2023 was 30,000 uses of the word “AI” in earnings calls market-wide and a massive jump in AI-centric investment. The global artificial intelligence market crossed $150B in 2023 and is expected to register a 36% CAGR through 2030. But chatbots are only a small piece of the vast and expanding AI-puzzle. Here’s a breakdown of AI spend in 2023 by industry, according to Statista.

Companies across the spectrum have started ramping up investment in AI seeking to develop products, increase labor productivity, reduce costs. A C-suite level study by McKinsey on found the following:

One-third of all respondents say their organizations are already regularly using generative AI in at least one function—meaning that 60 percent of organizations with reported AI adoption are using gen AI. What’s more, 40 percent of those reporting AI adoption at their organizations say their companies expect to invest more in AI overall thanks to generative AI, and 28 percent say generative AI use is already on their board’s agenda.

Economists also predict AI could add 4-6% of growth to global GDP annually and raise productivity by 2%.

It’s hard to overstate the potential of AI to reshape entire industries and the broader economy. The market clearly has high expectations for the technology, with the S&P 500 recently reaching all-time highs, led by Nvidia and other AI-related tech stocks.

Implications for Nvidia’s Business

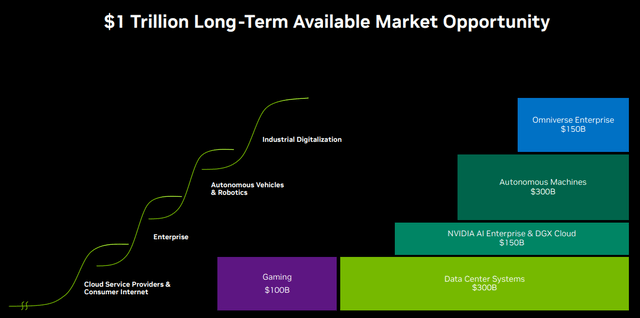

AI hype has lifted a multitude of stocks since the beginning of 2023, but what makes Nvidia the poster child of the movement? Nvidia was founded in the 90’s by three leading engineers from IBM, AMD, and Sun Microsystems who tapped into a higher level of computing through the creation of the graphics processing unit (“GPU”). The company focused its innovative tech on the gaming sector, eventually going public in 1999 as the leader in graphics processing. While staying top of the heap in gaming, management continued to innovate the GPU and foray its high-performance computing core-competency into a wide range of applications. The GPU eventually became the backbone of Accelerated Computing and the modern day Nvidia. Nvidia’s operations now span a host of industries including AI, supercomputers, edge-to-cloud computing, software, and more, culminating to an estimated $1 trillion addressable market.

With this expansive base of operations centered around accelerated computing comes plenty of competitive benefits and growth potential. The primary diver of Nvidia’s success has been continuous innovation around a key technology with wide application. On top of disrupting the computing industry with the GPU, Nvidia has poured billions into sustaining its technological edge through optionality. Each new use case has generated new growth verticals for the company in addition to its expanding core business. And within each of its respective operating categories, Nvidia is leading by a mile.

As of late 2023, Nvidia dominates more than 80% of the global GPU market vs. AMD’s near 20% share, thus powering the vast majority of AI applications globally. Additionally, Nvidia is #1 in PC Gaming graphics, hosts a leading cloud gaming platform, holds a 95% market share in graphics for workstations (professional visualizations), and has an autonomous driving business that recently crossed $1 billion of revenues in FY24. Lastly, Nvidia has leveraged its AI capabilities into an enterprise/developer AI cloud software platform, CUDA. Should Nvidia continue to gain share in software, switching costs will add to its competitive durability.

Nvidia’s moat and growth potential have been key fundamental drivers of its stock price. And I suspect the trend to continue, with the market viewing Nvidia as a primary beneficiary of tailwinds in AI – correctly in my view.

Exceeding Expectations

The final contributor to Nvidia’s rocketing share price has been revisions in the market’s expectations. Stock prices are largely driven by performance expectations of market participants. When those expectations are revised up or down, the stock price tends to follow. Through fiscal year 2023, Nvidia was generating near zero revenue growth in large part thanks to a cyclical downturn in its Gaming segment and other macroeconomic headwinds. But as the fiscal year turned, so did market sentiment for Nvidia. The company began handily beating analyst estimates for revenue and earnings as demand for its AI GPUs skyrocketed. Nvidia’s Data Center revenue surged from $3.8 billion to $18.4 billion in just two short years (A 120% CAGR).

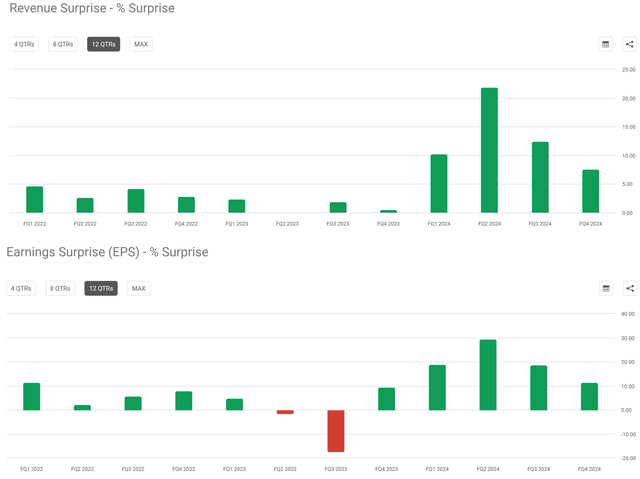

Management would beat estimates, then significantly increase guidance each quarter of FY24, which drove huge upward revisions in the market’s expectations and generated tons of stock price momentum. This chart showing Nvidia’s revenue and earnings surprise illustrates how much expectations shifted in FY24:

Even with a better idea of the potential drivers of Nvidia’s stock price performance, it gets harder and harder to imagine such momentum is justified as the stock continues to defy gravity. But taking a more detailed look at the company’s valuation paints a different picture.

Valuation

Valuation is almost always an educated guess. An effective method is ensemble valuation, which is using a mix of valuation techniques to arrive at a reasonable conclusion of value. We’ll use three approaches:

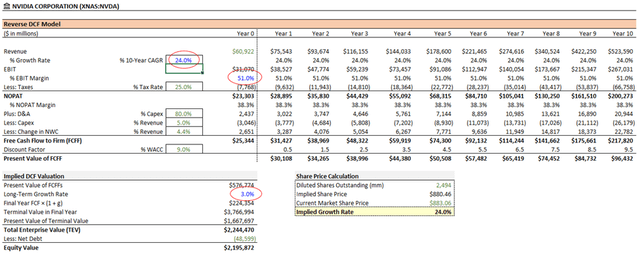

1. Reverse DCF

A reverse discounted-cash-flow analysis allows us to leverage Nvidia’s current stock price to assess the market’s implied fundamental expectations. Knowing what’s baked into the current stock price enables us to take a price-agnostic view of value and avoid the common pitfalls of forecasting cash flows.

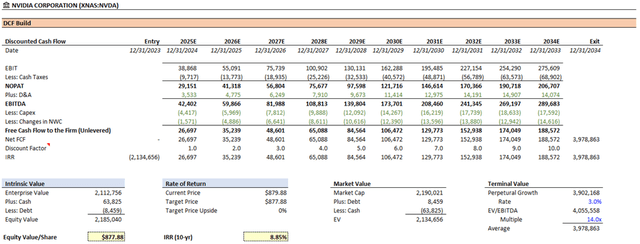

To justify the current stock price, Nvidia needs to achieve the following over the next 10 years:

- 24% annual revenue growth

- 51% EBIT margin

- 3% terminal FCF growth rate.

This assumes a weighted average cost of capital (“WACC”) of 9%, a tax rate of 25%, stable shares outstanding, and reinvestment rates (working capital, fixed capital, and depreciation) near historical averages.

These required hurdles look entirely achievable in my view. Despite its cyclicality, Nvidia has churned out a 10-year average revenue growth rate of just over 30%. Though it’s true the bigger a company is, the tougher it is to continue cranking out such strong growth – and $560+ billion of revenue in 10 years seems like a stretch – it’s not entirely impossible considering expectations for the AI market (36% annual growth). Nvidia has been, and I believe will continue to be, the major beneficiary of AI tailwinds given its market positioning and moat.

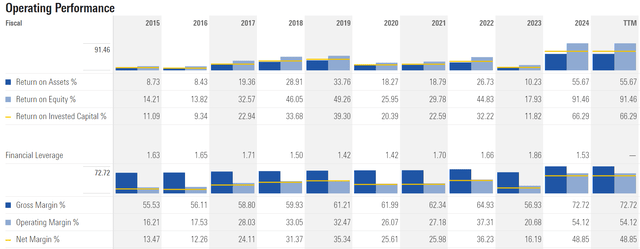

On operating margin, Nvidia recently stepped on the operating leverage pedal, reaching a 54% operating margin in 2024.

Operating margins in the 50’s do not come easily, though. Competition will inevitably put pressure on these margins, but Nvidia’s business is scalable with a wide moat. I don’t see 51% as entirely out of reach.

The expectations implied by Nvidia’s current price are more reasonable than many would expect and aren’t extreme enough to claim NVDA is wildly overvalued in my view.

2. Traditional DCF

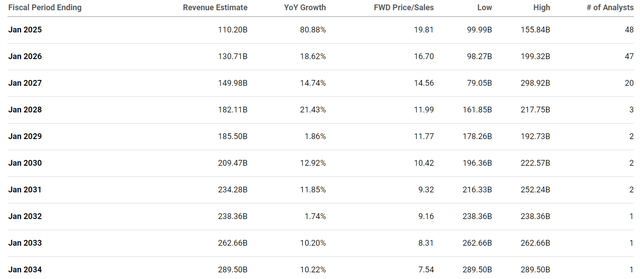

With the market’s expectations in mind, we can independently forecast Nvidia’s cash flows and discount them to arrive at a fair value for shares. My base case has revenues growing at similar rates to the market’s expectations of 25% annually, mainly driven by continued AI tailwinds, numerous growth verticals across Nvidia’s suite of products, and the company’s clear leadership and competitive durability. Nvidia’s history is also laden with examples of management finding ways to innovate and generate topline growth. As a gut-check, analysts recommend an average near 20% growth through 2034:

Though I see Nvidia’s operating margins as durable, my base case holds operating margins averaging high 40’s, lower than implied by the stock price, due to inevitable competitive pressures. Additionally, I expect reinvestment and depreciation to remain fairly close to recent levels as the company will require working capital to support surging demand while also investing in long-term growth capacity and product development. Here are the assumptions:

- Capex at 3% of revenues.

- Depreciation & Amortization averaging 80% of capex.

- Change in Net Working Capital averaging 4% of revenues.

Using these assumptions, a long-term WACC of 9%, a tax rate of 25%, and a terminal growth rate of 3%, my base case produced an intrinsic value per share of $878.

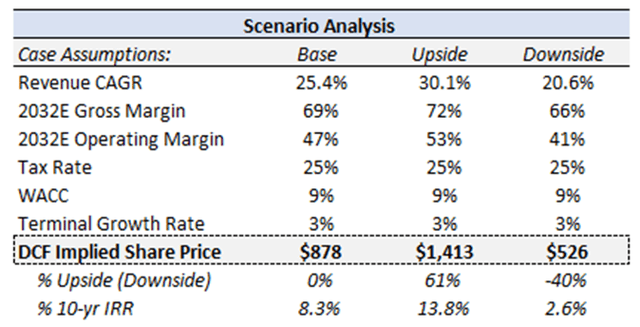

Lastly, I introduced an upside and downside case to capture asymmetry. Nvidia carries a bit more upside potential based on my assumptions.

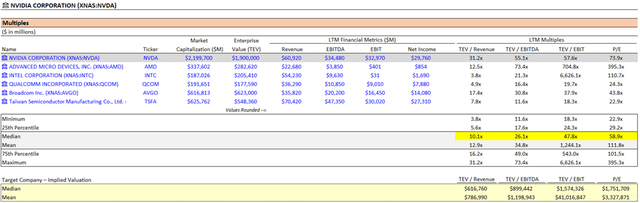

3. Relative Multiples

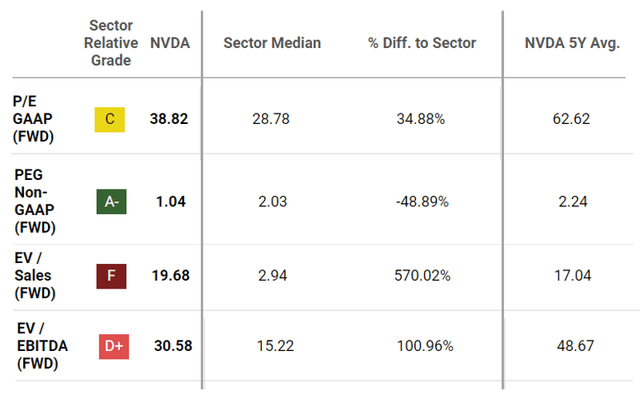

The final piece to understanding Nvidia’s current valuation is through relative valuation. Compared to the median last-twelve-month (“LTM”) multiples of close peers, Nvidia appears overvalued:

But if we look at comparative forward multiples, which capture Nvidia’s estimated growth, its relative valuation looks much more reasonable.

Risks & Uncertainty

Nvidia’s operating and competitive environment introduce significant risk and uncertainty. The artificial intelligence landscape is rapidly evolving, almost on a weekly basis. We don’t have to look too far back in history to observe market booms and busts. Excitement around particular companies or industries can contribute to a market anomaly called the momentum effect, where a well-performing stock continues to be bid-up, eventually into a bubble. Behind the momentum effect are often behavioral biases such as herding, availability bias, and overconfidence.

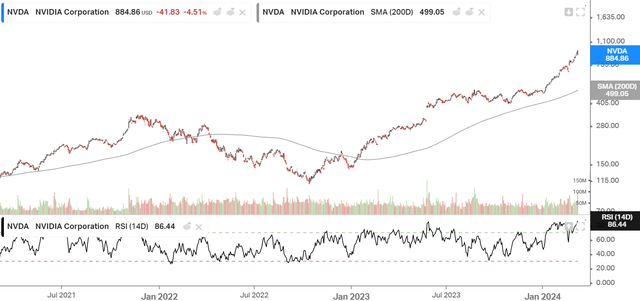

Momentum in a stock can be a powerful driver of near or medium-term returns but collapsing momentum can be disastrous. Currently, the stock is well above its 200-day moving average and is closing in on 90 RSI, which indicates it is technically overextended.

Though I’m not confident Nvidia has reached bubble territory yet, given its reasonable implied expectations, investors should probe themselves for biases and seek to make rational decisions in euphoric markets.

Looking at Nvidia itself, the primary risks I see are external, namely competition, industry, and macro. Nvidia holds clear market leadership across its product suite, but direct competitors like AMD are a threat, specifically on price, as AI use-cases continue to expand. Another threat is mega-tech firms like Google (GOOG) (GOOGL), Amazon (AMZN), Meta Platforms (META), and Microsoft (MSFT) developing internal chip capabilities, which may be more tailored for enterprise-specific workloads. This would also pull revenue away from Nvidia as these large companies seek less reliance on the firm. Given Nvidia’s current footprint, best-in-class chips, and growing software business, I see both threats as longer-term and believe Nvidia is taking the right steps to fortify its existing moat.

On an industry and macro level, demand for chips in the near-term could outpace supply, especially if supply chains are threatened. Current and potential geopolitical conflicts are threats to global supply chains. Specifically, tensions in the South China Sea and Taiwan represent a huge risk to Nvidia’s chip supply, of which 90% comes from Taiwan.

Conclusion

Nvidia’s surging stock price has many investors scratching their heads. Market sentiment for AI, Nvidia’s positioning and moat, revisions in expectations, and perhaps some market euphoria have all contributed. Nonetheless, a closer look at its valuation and baked-in expectations makes a case that it is a least near fair value, especially when considering the company’s quality. Nvidia has arguably never traded at low or even moderate multiples, and yet it’s been a stellar investment. Oftentimes, paying a premium for a high-quality company pays off. Ultimately, Nvidia’s valuation remains highly uncertain but worth the price in my view.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.