Summary:

- AbbVie is a pharmaceutical company with a strong history of growth and income generation for investors.

- The company has a robust pipeline of products in various stages of development, particularly in oncology, immunology, and neuroscience.

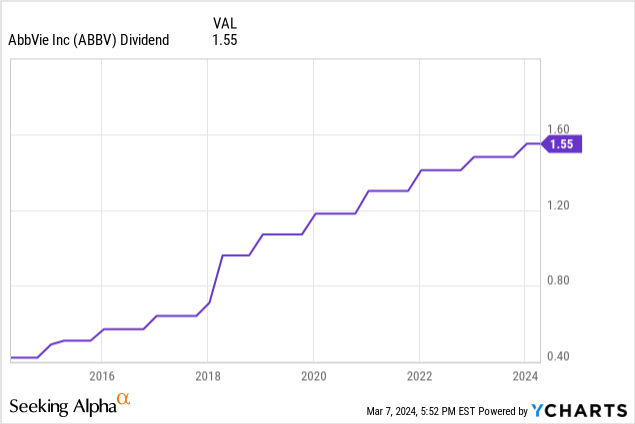

- AbbVie has a dividend yield of 3.4% and has an annualized dividend growth of 17% for the last decade.

- The company looks decently valued on a cash flow basis as well as non-GAAP figures.

vzphotos

Business Overview

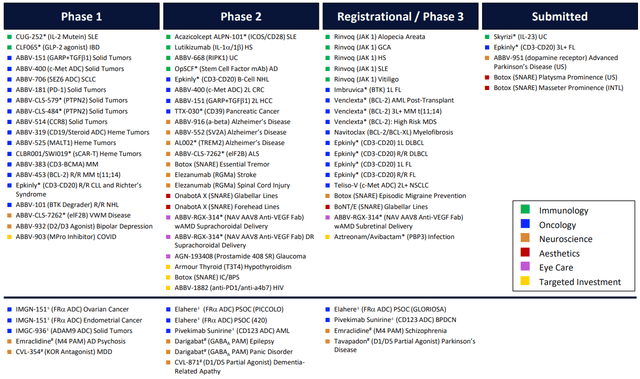

AbbVie Inc. (NYSE:ABBV) is a pharmaceutical with a strong history of growth and generating income for investors. In addition to having a number of highly lucrative products in the market such as Skyrizi and Rinvoq, the company also enjoys a pretty robust pipeline of many products in a variety of phases of development in several fields including oncology, immunology, and neuroscience. In 2025, the company expects to obtain FDA approval for a variety of products including Rinvoq for GCA, Venclexta for High-Risk MDS, and Botox for Episodic Migraine Prevention plus several others.

The company is also on its way to acquiring two companies (ImmunoGen and Cerevel Therapeutics) with a strong R&D focus. These acquisitions will serve two purposes. First, they will boost the company’s already rich product pipeline and second, they will help the company streamline its R&D spending in a more efficient way by combining the R&D expertise of these three companies. The acquisition of ImmunoGen will even allow AbbVie to enter a new solid tumor category which it didn’t have exposure to before. The acquisition of Cerevel is more geared towards bolstering the company’s exposure to the neuroscience field where Cerevel has some promising projects to tackle a variety of conditions such as schizophrenia, Parkinson’s disease, and mood disorders.

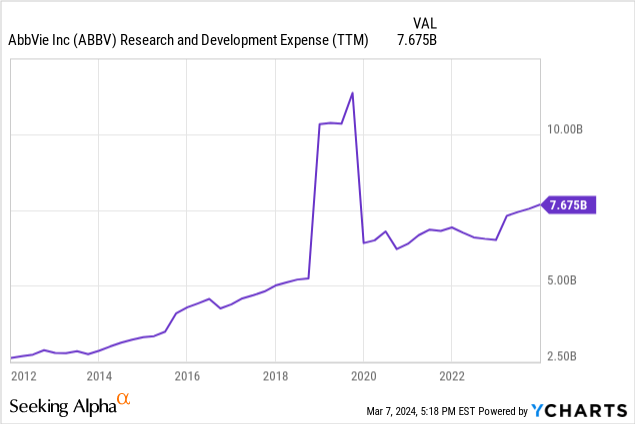

The biggest opportunity for pharmaceutical companies is also their biggest challenge because these companies will often have many exciting potential products in their pipelines some of which will eventually become blockbusters, but in order to find that one blockbuster, a company has to go through several unsuccessful product development cycles. Also, since drugs can only be patented for a limited amount of time, companies like AbbVie constantly have to develop new specialty drugs in order to survive and thrive. This puts a lot of pressure on the company, and it has to keep boosting its R&D spending in order to find the new big drug. Currently, the company spends about $7.7 billion annually on the development of new drugs and this doesn’t take into account the acquisitions that will be made by the company to boost its pipeline and R&D projects.

Operating Metrics

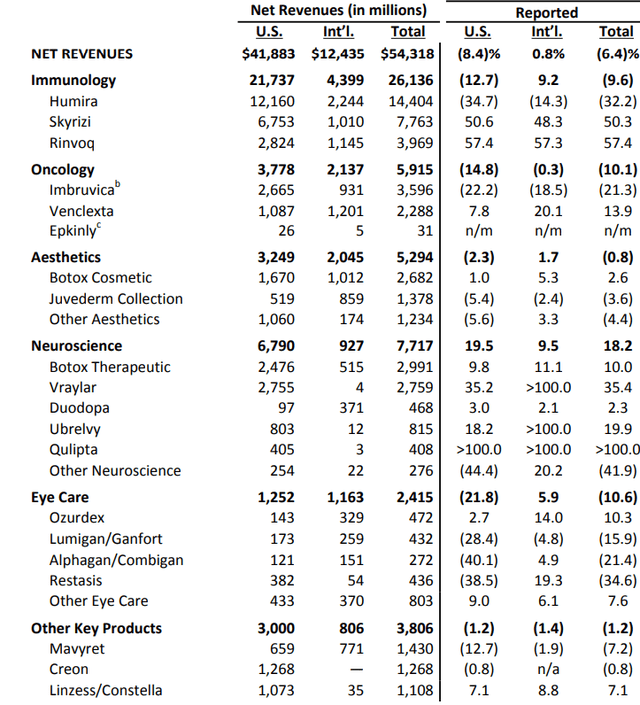

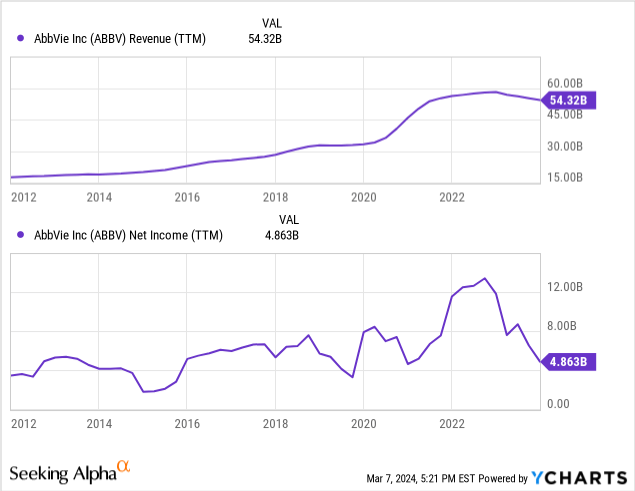

As of the end of 2023, the company was having some challenges in growing its revenues for some product types. For example, the company’s arthritis therapy Humira sales dropped -32% globally and -34% in the US, but this was largely expected due to the availability of biosimilars and explains why the company is creating new avenues of growth by bolstering its pipeline. The company’s non-Humira immunology drug sales were up about 53% with Skyrizi posting 50% growth and Rinvoq posting 57% growth. At this rate, these two drugs will fill the gap from declining sales from Humira fairly quickly. The company’s Oncology products declined by -10% while its Neuroscience grew by 18%.

Historically, the company posted strong growth in both revenues and profits ever since it was spun off from Abbott Laboratories (ABT) in 2012 with one exception being last year. As I mentioned above, a sharp drop in Humira sales hurt the company’s overall revenues and profits significantly, but this may be a temporary problem as the company keeps reducing its dependency on Humira with new products. To be fair, Humira wasn’t the only product that saw a decline last year, but it was surely the biggest one. Also, keep in mind that last year’s profits were also hurt from a pretty large write-down as the company wrote down $5 billion of assets last year in addition to close to $9 billion in Depreciation & Amortization. The long-term trend still shows growth for the company even though its forward growth is likely to be slower in mid to high low digits (5% to 9%) unless one of its drugs performs exceptionally well.

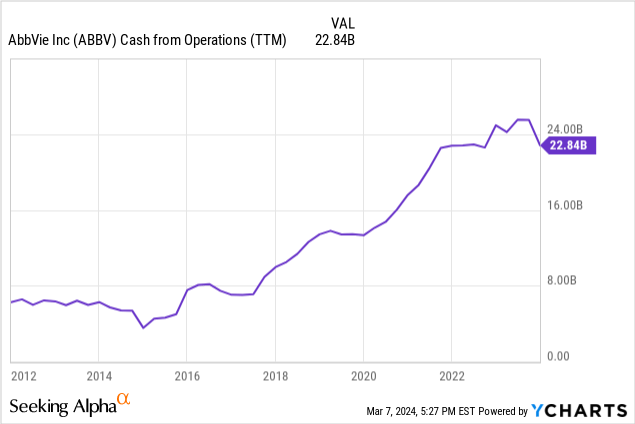

In order to have a better idea about the company’s current profitability as well as long-term profitability trends, we must look at its cash flow figures, especially operating cash flow. Last year the company generated $22.8 billion from its operations which was only slightly down from the previous year and significantly up from a few years ago even with sharply declining Humira sales which is encouraging. Between 2018 and 2023, the company’s operating cash flow was up more than double, and from 2016 to 2023 it almost tripled. Also considering the fact that the company generated $54 billion in revenues, its current cash flow of $22 billion gives it an operating cash flow margin of 41%. Basically for every $1 AbbVie generates in revenues, it generates 41 cents in operating cash flow which is pretty impressive considering that many investors seem to think that this company is in trouble due to declining sales of some of its drugs.

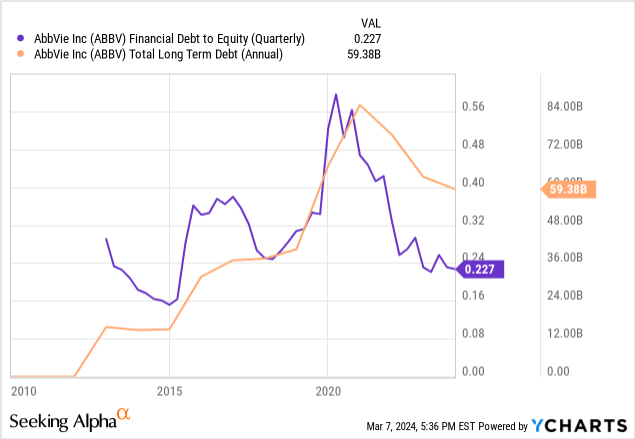

In recent years the company has been paying off its debt and reducing its leverage. Since 2020, AbbVie’s long-term debt is down from $85 billion to $59 billion while the company’s leverage (measured by Debt to Equity) is down by almost half as it fell from almost 0.59 to 0.23. This may allow the company more flexibility and more opportunities to make acquisitions in the future or return more cash to investors.

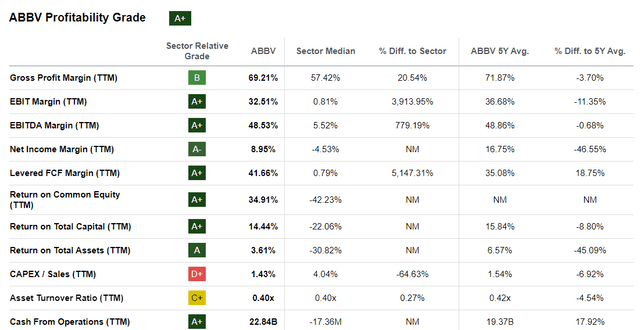

The company’s profitability metrics mostly look pretty impressive as compared to its competitors even though some of these metrics are down slightly as compared to the company’s own historical averages. For example, AbbVie has a gross margin of 69% which looks good against the sector median of 57%, but it’s down from AbbVie’s own 5-year average of 72%. The company’s EBIT margin of 32% is solid but not as good as its 5-year average of 37%. On the other hand, the company’s EBITDA margin of 48.3% is mostly in line with its 5-year average which came in at 48.8%. All in all, there is no question about AbbVie’s ability to generate strong profits at the moment even with some of its drugs selling less.

ABBV Profitability (Seeking Alpha)

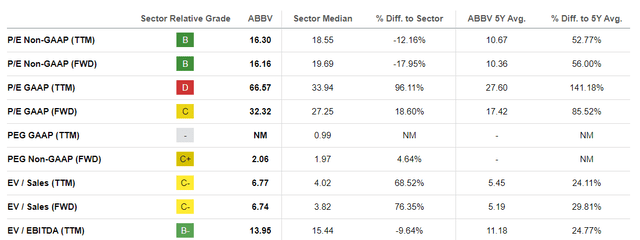

Valuations

Whether one might consider AbbVie’s valuation cheap or expensive depends on which metric one looks at. For example, if you look at the company’s non-GAAP P/E its multiple of 16 looks slightly cheap as compared to the sector median of 18 even though it’s significantly higher than AbbVie’s own 5-year average of around 11. On the other hand, the company has a GAAP P/E of 66 which is double the sector median, but as I explained above, this is partly driven by one-time charge-offs and depreciation expenses. If you look at price to operating cash flow, the company has $22 billion from operating cash flow against its market cap of $320 which gives you a multiple of 14.5, so the company is not that expensive based on its operating cash flow. Furthermore, the company has an operating cash flow yield of 6.89% which easily supports its dividend of 3.42%.

ABBV Valuations (Seeking Alpha)

Dividends

The company has a decent dividend yield of 3.42% but what’s more impressive is its history of dividend growth. In the last 10 years, the company increased its dividends by close to 300%. This indicates an average annual dividend growth rate of 14% for the last decade. Let me put it this way, if you bought the stock 10 years ago, your yield on cost would be 12% even without reinvesting dividends. If you reinvested dividends, your yield on the original cost would be closer to 17%.

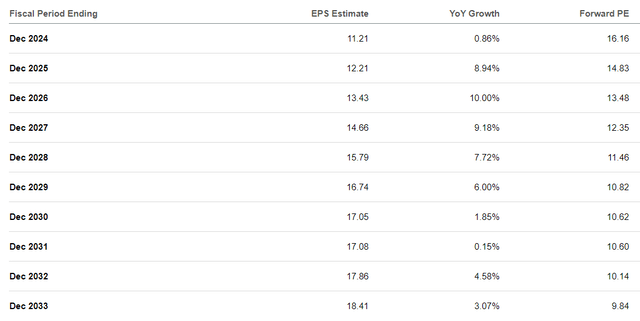

Analyst Estimates

Analysts expect the company to post single-digit growth ranging from 1% to 10% for the foreseeable future which is in line with the company’s own estimates. If the company can meet analyst estimates, it should generate $11 this year, $12.21 next year, $13.43 in 2026 followed by $14.66 in 2027, and so on. This would give the company a forward P/E of 16 for this year, 15 for next year, and 13 for 2026. This should be fairly achievable if the company can grow its revenues by 4-6% while keeping its margins constant. This could even receive a boost if the company were to start buying back its shares, but AbbVie isn’t known to have an aggressive buyback policy. The company typically prefers hiking dividends aggressively over spending too much on stock buybacks.

Analyst Estimates (Seeking Alpha)

Risks

There are several risks with this company. First, as I mentioned above, it has to keep developing new drugs and its pipeline needs to keep producing blockbusters as its patents will keep expiring, and generic biosimilars will take away its profits over time. Developing new drugs (especially highly specialized ones) is a very long and costly process, and it’s not uncommon for companies to spend 10-15 years on a project while it goes nowhere. Luckily, a company of this size has many products in its pipeline, and it only needs a fraction of its pipeline projects to turn into a blockbuster for it to be wildly profitable.

A second risk is regulations. The pharmaceutical industry is a highly regulated industry and as if it wasn’t enough the industry also has to work with other highly regulated industries such as healthcare and insurance industries. Since this is a global company, it has to watch out for regulations in many different countries, and it is very possible that in the future we will have even more regulations that may curtail the profitability of big pharma companies.

Conclusion

AbbVie is a good company that enjoys strong cash flow generation and its dividend growth history should also catch the attention of those investors that are focusing on dividend growth. Meanwhile, the company is facing some short-term challenges as Humira sales are declining, and it has to rely on other products for growth. The valuation of the company is not exceptionally cheap, but it looks compelling if you look at cash flows instead of GAAP figures.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.