Summary:

- Nvidia Corporation stock is overbought with near-unanimous “buy” ratings.

- Insider selling raises concerns about potential for a correction.

- Nvidia’s current valuation metrics suggest future underperformance.

Noah Berger/Getty Images Entertainment

Nvidia Corporation (NASDAQ:NVDA) is the darling of the entire world, and that’s the problem.

This article dares to challenge the prevailing sentiment. While the company’s accomplishments are undeniable, a confluence of factors suggests a contrarian approach may be warranted. Firstly, the ubiquitous “buy” ratings paint a picture of a potentially overbought stock. Secondly, recent months have witnessed a concerning trend of heavy insider selling. Finally, the stock’s current valuation metrics raise questions about long-term sustainability.

I delve into these three factors in this article and argue that a “sell” rating for Nvidia is appropriate.

Full Boat

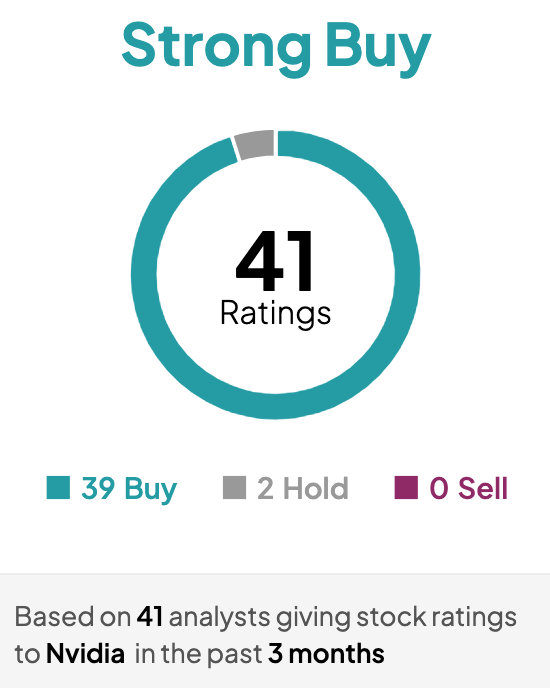

The summary of analyst ratings indicates that the Nvidia is overbought:

TipRanks

39 of the last 41 or 95 percent of the analyst ratings assigned to Nvidia stock in the last three months were “buy” ratings and exactly zero analysts assigned a “sell” rating.

While a unanimous “buy” rating from analysts might seem like a surefire sign to invest, it’s crucial to approach this situation with caution. This herd mentality can sometimes indicate a stock is already overbought, with the positive sentiment potentially baked into the current price.

Insider Selling

Nvidia Corporation stock began the most recent leg of its relentless surge in December or three months ago. Since then, NVDA has more than doubled:

Simultaneously, however, nine insiders at the company have sold more than $340 million worth of stock, cumulatively, as the following table illustrates.

When company insiders, like executives and major shareholders, start selling off their stock in significant quantities, it can be a red flag for investors.

For me, the weight of this signal intensifies if it coincides with other factors, such as if the stock exhibits high valuation multiples, like an elevated price-to-earnings ratio, if the stock has recently experienced a significant surge, and if multiple insiders are selling concurrently.

All three factors are relevant in the case of Nvidia stock, so let’s next dig into the company’s market valuation and valuation multiples.

Valuation

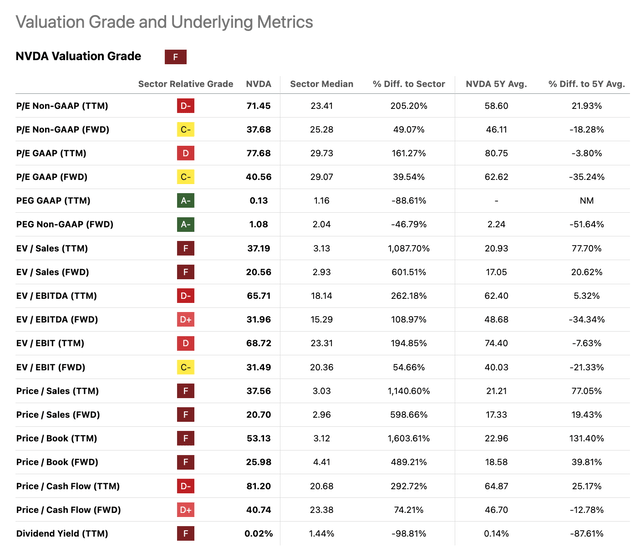

Seeking Alpha does an excellent job of summarizing valuation metrics for all companies, and I included the Valuation Metrics table for Nvidia below:

My three key takeaways from the above table are the following:

- Seeking Alpha Premium Tool assigns an F-rating to the Nvidia stock;

- Nvidia’s unfavorable rating is primarily driven by NVDA’s elevated price-to-sales and price-to-book ratios, both on a historical and a forward-looking basis, and it is widely supported by most of the valuation metrics, including the company’s elevated price-to-earnings ratios; and

- The company’s high growth rate is notable but does not make up for the elevated ratings across the rest of the table.

High valuation multiples can be a red flag for future performance. Stretched multiples suggest the market is already expecting significant future growth from the company. If this growth doesn’t materialize, investors may be disappointed and the stock price could fall, leading to underperformance. This is especially true in the current environment of elevated interest rates, as higher rates can make expensive stocks even less attractive.

Next, let’s discuss competitive threats to Nvidia’s future growth.

Competition

Nvidia’s respectable growth faces two types of potential threats:

First, the dominance of Nvidia in the graphics processing unit (“GPU”) market could face a significant challenge from its top customers, like Microsoft (MSFT) and Amazon (AMZN). These companies are increasingly designing custom application-specific integrated circuits (“ASICs”) for their cloud services and artificial intelligence workloads. Unlike Nvidia’s general-purpose GPUs, custom ASICs can be fine-tuned for specific tasks, potentially offering superior performance and efficiency at a lower cost. If Microsoft and Amazon find success with their custom chips, it could eat into Nvidia’s market share and profitability in the data center segment, which has been a key driver of its recent growth.

Second, Nvidia’s dominance in the high-performance computing (“HPC”) arena with their H100 and H200 GPUs could be challenged by the arrival of the Advanced Micro Devices (AMD) MI300 chip, which promises significant performance improvements over its predecessor. If AMD delivers on these promises, it could upend the status quo and entice potential customers away from Nvidia’s offerings. This competition could lead to a price war or force Nvidia to innovate further to maintain its leading position in the HPC market.

Closed-Sourced vs Open-Source

Nvidia’s success today in part stems from CUDA, a closed-source programming platform that offers great performance but locks developers into their ecosystem.

On the other hand, open-source platforms, such as AMD’s ROCm, foster collaboration and possibly wider adoption, but lag behind CUDA in optimized performance.

Both approaches have pros and cons, but in short, Nvidia could see its dominance slide if AMD starts closing the performance gap and developers embrace open-source platforms.

One More Thing

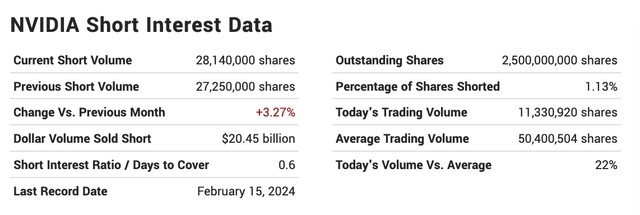

Despite the recent surge in the Nvidia stock price, the percentage of shares shorted as of the most recent data was a surprisingly low 1.13 percent:

The above table supports my earlier point that NVDA stock is heavily tilted towards a bullish sentiment and that a correction could be in the cards.

Risks To My Analysis

I present two primary risks to my “sell” rating:

- Even though Microsoft and Amazon are pouring significant resources into developing their ASICs aimed at replacing Nvidia’s GPUs, if these attempts falter and fail to produce viable alternatives, demand for Nvidia’s products could stay robust for the next five to ten years; and

- If the Fed cuts interest rates to combat a potential economic slowdown, it could trigger a surge in investor confidence, often referred to as “animal spirits.” This could lead to a broad market rally, buoying technology stocks like Nvidia.

Conclusion

While Nvidia Corporation boasts undeniable achievements, a closer look reveals a confluence of warning signs. The overabundance of “buy” ratings suggests potential overvaluation, and the recent trend of heavy insider selling raises concerns. Finally, the stock’s current valuation metrics cast doubt on its long-term sustainability. Given these factors, a contrarian approach may be prudent, and a “sell” rating for Nvidia Corporation shares seems justified.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in NVDA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.