Summary:

- While TDOC appears to achieve improved economy of scale, as observed in the expanding EBITDA profitability, it is apparent that the company is no longer recording high growth.

- The intensifying market competition has also contributed to the erosion in its membership base, with the stable ARPUs implying minimal monetization tailwinds.

- The only silver lining to TDOC’s investment thesis is (likely) its ability to survive the “natural culling of small, unprofitable players,” thanks to the positive Free Cash Flow generation.

- However, with TDOC missing out on the obesity/diabetes party, as LLY chooses a competitor as their telehealth partner, there appears to be minimal catalysts to its reversal.

Frank Armstrong/iStock via Getty Images

We previously covered Teladoc (NYSE:NYSE:TDOC) in November 2023, discussing the troubling signs of declining memberships and worsening profitability on a QoQ basis in FQ3’23, with it remaining to be seen if the downtrend might persist as market competition intensified.

Combined with the accelerating operating expenses worsening the decelerating top-line, we believed that the telemedicine company might remain unprofitable on a GAAP basis for the near to intermediate term.

In this article, we shall discuss why we maintain our Hold (Neutral) rating, as TDOC’s top-line growth further decelerates and performance metrics decline in FQ4’23.

Despite the positive free cash flow and decent balance sheet, we maintain our belief that TDOC does not offer a compelling investment thesis here, with its reversal mostly tied to the speculative turnaround story.

The TDOC Investment Thesis Remains Speculative Ahead – Minimal Tailwinds

For now, TDOC has reported a mixed FQ4’23 earnings call, with revenues of $660.52M (inline QoQ/+3.5% YoY) and adj EBITDA of $114.4M (+29.1% QoQ/+21.7% YoY), with FY2023 revenues of $2.6B (+8.3% YoY) and adj EBITDA of $328.1M (+33% YoY).

It appears that the telemedicine company has achieved improved operating scale, as observed in the improvement in the bottom line despite the minimal top-line growth.

Unfortunately, it is also apparent that the intensifying competition in the telemedicine/ primary care market has contributed to TDOC’s declining membership base, with lower US Integrated Care members of 89.6M (-0.6M QoQ/ +6.3M YoY) and BetterHelp Paying members of 425K (-34K QoQ/ -25K YoY).

As a result, we can understand why these headwinds have contributed to management’s underwhelming FQ1’24 revenue guidance of $637.5M (-3.4% QoQ/+1.3% YoY) and FY2024 guidance of $2.685B (+3.2% YoY) at the midpoint.

These numbers imply a further erosion in TDOC’s membership base, with the stable ARPUs of $1.42 (+0.7% QoQ/-1.3% YoY) also suggesting minimal tailwinds in its monetization cadence.

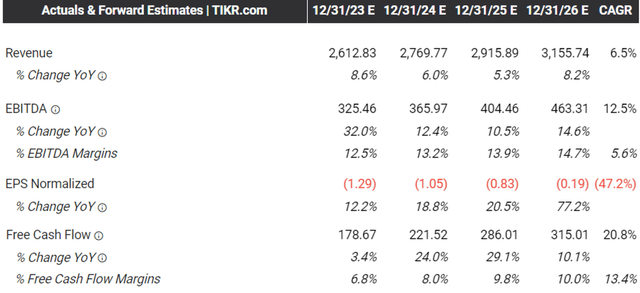

The Consensus Forward Estimates

Tikr Terminal

Based on management’s “low-to-mid-single-digit annual consolidated revenue growth over a three-year timeframe,” it is unsurprising that analysts have temporarily downgraded their forward estimates, with TDOC expected to generate a lower top/bottom line CAGR of +6.5%/+12.5% through FY2026.

This is compared to the previous estimates of +23.1%/+12.6% and historical growth of +54.7%/+89.2% between FY2016 and FY2023, respectively.

The only silver lining here is that TDOC likely has the capability to grow its operations sustainably without having to rely on additional debts, based on the FY2024 Free Cash Flow guidance of $225M (+16.1% YoY).

Combined with its cash position of $1.12B on the balance sheet (+8.7% QoQ/+23% YoY) and only $550.7M of its debts maturing by Q2’25, it appears that the company may be able to survive the “natural culling of small, unprofitable players.“

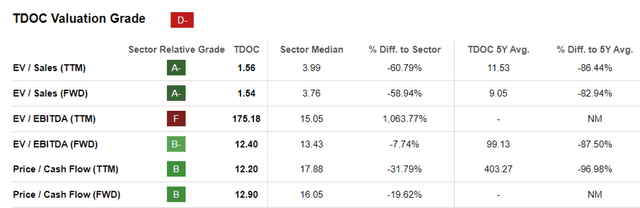

TDOC Valuations

Seeking Alpha

On the one hand, as a result of the decelerating growth trend, it is unsurprising that TDOC trades at a relatively discounted FWD EV/ EBITDA valuation of 12.40x and FWD Price/Cash Flow of 12.90x.

This is compared to its 1Y mean of 13.42x/15.50x, hyper-pandemic heights of 232.67x/50.84x, and sector median of 13.43x/16.05x, respectively.

However, when compared to its primary care legacy peers, such as CVS (CVS) at 8.42x/7.89x and Walgreens Boots Alliance (WBA) at 11.80x/4.90x, or telehealth peers, such as Hims & Hers Health, Inc. (HIMS) at 43.42x/33.89x and UpHealth (UPH) at 6.60x/NA, it is apparent that the market still awards TDOC with relatively premium valuations.

On the other hand, based on TDOC’s FY2023 adj EBITDA generation of $328.12M (+33.1% YoY) and the latest share count of 166.05M, the company appears to consistently generate improved profitability at adj EBITDA per share of $1.97 (+29.6% YoY).

Combined with its FWD EV/EBITDA valuation of 12.40x, the stock seems to be trading below our estimated fair value of $24.40, implying a -16% undervaluation at current levels.

Assuming that TDOC is able to sustain its premium valuations, we may see a fairly optimistic upside potential of +46.9% to our long-term price target of $30.10 as well.

This is based on a similar calculation method and the consensus FY2025 adj EBITDA estimates of $404.46M, with an estimated adj EBITDA per share generation of $2.43 then.

So, Is TDOC Stock A Buy, Sell, or Hold?

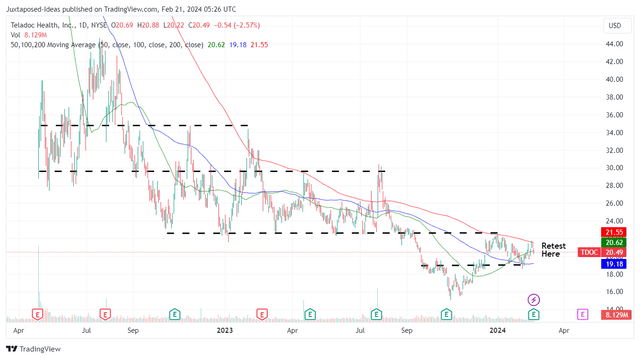

TDOC 1Y Stock Price

Trading View

For now, TDOC has returned part of its recent gains, thanks to the mixed FQ4’23 earnings call and underwhelming forward guidance. In early trading this morning (February 21), the stock is testing the October low.

Even if the support at ~$15 holds, it doesn’t mean that we are rerating it as a Buy. Unfortunately, with management guiding for underwhelming top-line growth ahead, it is apparent that TDOC is not a growth stock.

With no moat and intensifying telehealth/primary care competition from multiple healthcare players, we are uncertain if it is right to award TDOC with the premium EV/EBITDA valuations compared to its peers.

This is especially due to its lack of GAAP profitability, elevated stock-based compensation of $46.84M (-11.5% QoQ/-7.7% YoY) and growing share dilution to 166.05M (+0.93M QoQ/ +3.88 YoY) thus far.

Even if we are to look at TDOC’s potential as a value play, it is also painfully apparent that the current stock price of $20.49 is higher than the estimated book value per share of $14 (+1% QoQ/-1.1% YoY). This is based on the total stockholders’ equity at $2.32B and last quarter’s share count.

We believe that only a major turnaround in its profitability and/or growth may eventually reverse its prospects. Even so, with the pandemic being a once-in-a-lifetime event, it is unlikely that the stock may reach its all-time highs again, barring another major global event.

While TDOC management has previously talked up the possible tailwinds from the whole person approach towards weight loss medications, including GLP-1s, we believe that it is uncertain how successful those ambitions may be, with Eli Lilly (LLY) already launching its own digital platform, LillyDirect, while partnering with FORM for telehealth services.

With minimal near-to-intermediate-term growth tailwinds, we believe that it may be more prudent to maintain our Hold (Neutral) rating for the TDOC stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.