Summary:

- Fiverr’s outlook for 2024 is not promising, with growth rates fizzling out and projected single-digit revenue growth.

- The company has a strong balance sheet and generates meaningful free cash flow, but its increasing take rates may alienate successful freelancers.

- Despite its low valuation, the waning growth rates and potential risks make Fiverr a less compelling investment option.

lechatnoir/E+ via Getty Images

Investment Thesis

Fiverr (NYSE:FVRR) delivers a less-than-satisfying outlook for 2024. Even if the company looks cheap, I don’t believe this stock is a compelling buy.

And yet, to be clear, it’s not all bad. For one, Fiverr has a relatively strong balance sheet. Also, the business is evidently generating meaningful free cash flow.

But at the same time, the unavoidable fact is that its growth rates are fizzling out. Altogether, I find it difficult to cheer for this stock. Therefore, I’m sticking to the sidelines.

Rapid Recap

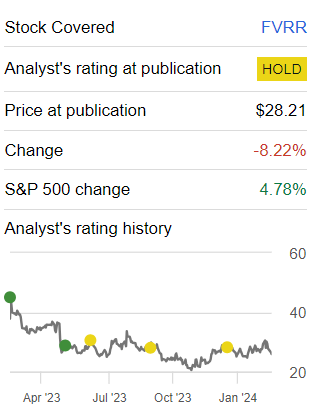

Back in December, I wrote a neutral analysis of Fiverr where I said,

What I find ironic is that I’m one of the only voices on Seeking Alpha that hasn’t got a buy rating on this stock. But I believe that, sooner or later, more analysts will come around to my side of the boat where it’s lonely and cold. At least for now.

Ultimately, the stock is very cheaply valued at 8x forward free cash flows. Few investors would argue the contrary. But I contend that a cheap stock isn’t good enough in and of itself. It needs to be able to grow its intrinsic value sustainably. And it’s on that latter aspect that I have an issue with this company’s stock, and I’m neutral on this name.

Author’s work on FVRR

Since I made those comments, the stock has underperformed the S&P 500 (SPY). And even if Fiverr’s share price has a relief rally in the coming days, over the next twelve months, I believe this stock will continue to underperform the S&P 500.

Fiverr’s Near-Term Prospects

Fiverr is a marketplace that connects freelancers (known as sellers) with clients seeking a wide range of digital services. The platform allows individuals and businesses to hire freelancers for a range of tasks such as building websites, graphic design, programming, and more.

Despite challenges such as a weak hiring environment, Fiverr innovated its products and expanded its market share. The platform’s fundamentals remained solid, with a 1% y/y growth in overall Gross Merchandise Volume (“GMV”) outperforming U.S. job openings.

Fiverr notes in its shareholder letter how it’s striving to move upmarket, resulting in growth in buyers with over $500 annual spend. The company has once again expanded its take rate through initiatives like Promoted Gigs and Seller Plus programs.

Incidentally, Fiverr’s addiction to increasing its take-rate puts it on the other side of the table to sellers. Even though Fiverr has pledged to moderate the pace at which it increases its take rates in 2024, ultimately this strategy ends up alienating its most successful freelancers, who end up opening up their online shops, without having to give Fiverr any of their take rates. In fact, as you can imagine, there is no shortage of alternative platforms.

Given this framework, let’s now discuss its fundamentals and why I’m neutral on this stock.

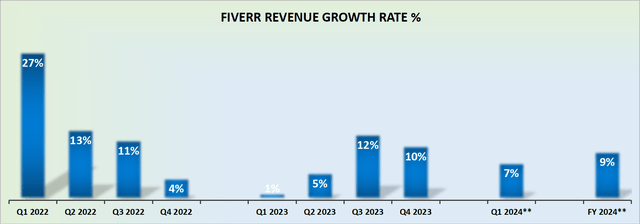

Revenue Growth Rates Moderate

Fiverr guides for 7% on the top line for the year ahead. Given that Fiverr missed analysts’ revenue estimates for Q4 2023 by approximately 1%, I’m inclined to believe that Fiverr won’t significantly outpace the high end of its guidance for 2024.

That being said, to further substantiate my contention, let’s presume that throughout 2024 Fiverr’s prospects improve and it actually delivers 9% y/y growth for 2024.

Since the bar for 2024 was already low, given that Fiverr’s revenues only grew by 7% y/y in 2023, one would have at least expected Fiverr to grow its revenues in the low teens. But this doesn’t appear to be the case, and the best that investors can realistically expect is single-digit growth rates.

It now appears to be in the distant past the times when Fiverr was a crowd-favorite that could be counted on to deliver strong revenue growth rates.

With this backdrop in mind, let’s now turn to discuss its valuation.

FVRR Stock Valuation — 12x Forward EBITDA

On a positive note, not only did Fiverr’s adjusted EBITDA increase by 143% y/y in 2023 compared with 2022, but its outlook for 2024 points to an approximately 36% y/y increase to approximately $80 million of adjusted EBITDA.

On the surface, this looks terrific. But then two critical considerations surface. Firstly, the pace at which Fiverr’s EBITDA is increasing appears to be rapidly slowing down.

Secondly, on the other side of the coin, there’s only so far Fiverr can increase its underlying EBITDA profitability without strong supportive topline growth.

Therefore, even though paying 12x forward EBITDA looks cheap, I have to wonder where this stock is, in fact, offering investors an attractive risk-reward? I don’t believe that to be the case.

The Bottom Line

In my assessment, Fiverr’s 2024 outlook doesn’t inspire confidence, leading me to view the stock as less than compelling despite its apparent low valuation. While the company does exhibit a robust balance sheet and generates notable free cash flow, the waning growth rates concern me.

Fiverr’s initiatives to expand market share are noteworthy, but the increasing take rates with the potential alienation of successful freelancers raises yellow flags.

Further, the projected single-digit revenue growth rates for 2024 reinforce my cautious stance.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.