Summary:

- Apple Inc. is vulnerable to a price decline based on analysis of price action, momentum, volume, and relative strength.

- Price is below the downward trending 30-week EMA, indicating weakness.

- Momentum is bearish in both the short-term and long-term, and volume patterns show higher levels of selling.

Nikada/iStock Unreleased via Getty Images

Apple Inc. (NASDAQ:AAPL) is one of the biggest companies in terms of market capitalization in the SP 500 Index. The maker of iPhones, iPad, Mac, Apple Watch, etc., while being large in market capitalization, is vulnerable to having its market capitalization shrink. In this article, I will outline why I think AAPL is vulnerable to a price decline using an analysis of price action, momentum, volume, and relative strength. I will also identify some areas of potential support for AAPL where buyers may be likely to step in after the anticipated decline.

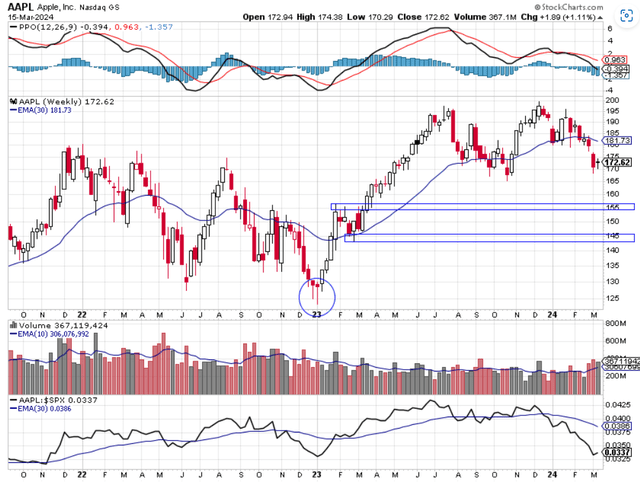

Chart 1 – AAPL weekly with 30-week EMA, Momentum, Volume, and Relative Strength

Looking at the price of AAPL in Chart 1 above you can see that AAPL had a nice run from the beginning of 2023 to mid-July 2023. AAPL shares went from $123.32 to $197.45 during that time. That is a 60% move in seven months. Price paused after crossing the 30-week exponential moving average (EMA) and that pause gave time for the 30-week EMA to flatten out and then begin to trend higher. If you’ve read some of my other articles you know that I like to buy stocks that are above an upward sloping 30-week EMA. After that 60% move, price declined which is normal after that type of gain. APPL did drop below its 30-week EMA was the first sign of weakness. AAPL then righted itself and went on to make a new high of $199.37 in December 2023. All looked good at that time. Since then, APPL struggled. AAPL failed to stay at new highs, which was the second sign of weakness. Nine weeks after making a new all-time high, AAPL closed below its 30-week EMA and has yet to recapture that EMA. That close below the 30-week EMA, AAPL’s failure to recapture that EMA and the EMA now showing a downward trend are clear signs of weakness and of a stock that is in decline. The price action of AAPL is bearish at this time and I would not be a buyer at this level.

Momentum is also bearish according to my analysis. Momentum is shown in the top pane of Chart 1 using the Percentage Price Oscillator (PPO). PPO shows momentum in two ways. When the black PPO line crosses below the red signal line that is a sign of short-term bearish momentum. The second type of momentum is long-term bearish momentum which is indicated when the black PPO line is below the zero level or centerline of the chart. I call this long-term because you can see that the black PPO lines normally stay above or below the zero level for long periods of time. It doesn’t normally oscillate back and forth above and below the zero level every few weeks. Also, note that PPO made a high in July 2023 when AAPL hit $197. However, when AAPL made a new high in December 2023 PPO made a noticeable lower high. This was another sign of momentum, this time fading bullish momentum. Right now, PPO is showing both short-term and long-term bearish momentum and I don’t want to own a stock that has that type of characteristic.

Volume shows higher levels of selling during the decline, which is bearish. Compare the difference in volume between the rise of AAPL in the first half of 2023 and the volume pattern since the beginning of 2024. During the advance in 2023, the black bars were the predominant larger bars shown compared to the red bars. Black bars indicate volume during a week where the price advanced for the week. Red bars show the volume, where price declined for the week. I want to own stocks where volume is higher during advancing weeks because that is a sign that institutions are buying the stock. In 2024 the volume picture is different. The red bars are higher meaning that institutions are selling the stock. I don’t want to buy stocks when the institutions are net sellers of the stock. My analysis of the volume pattern is bearish.

The bottom panel of Chart 1 shows the relative strength of AAPL to the SP 500 index. I want to own stocks that are outperforming the major index. When the black line is rising that means that AAPL is outperforming the SP 500. When the line is trending lower, as it is now, that means that APPL is underperforming the SP 500 index.

As I stated above, I think AAPL is vulnerable to a further decline from here. However, my analysis could be wrong for any number of reasons. Interest rates can change, good news from the company can come at any time, or there could be bullish economic reports on the horizon. AAPL can catch a bid at any time and start moving higher. That is why I wouldn’t short AAPL at this time and it’s also why I still have a small position in AAPL. Yet I still think the odds favor lower prices for AAPL instead of higher prices over the next several weeks or months. If that happens, I will consider increasing my position in AAPL if the price declines to one of two price levels identified by blue boxes on Chart 1. The $155 level is a level of past supply and is where buyers who sold at that level in early 2023 could reenter positions. Another such level is the $145 area which was a demand level in February 2023 and buyers could step in at that level. I would add to my position at the $145 level. That doesn’t mean I would go all in at that level, but I would be a buyer there.

In summary, AAPL is a stock that looks vulnerable to a further price decline when I analyze the price action, momentum, and volume. Price is below its downward trending 30-week EMA. Momentum is displaying both short-term and long-term bearish momentum. Volume shows bearish characteristics. If price continues to decline, I consider the $155 and $145 levels to be excellent price levels to add to my position.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.