Summary:

- QFIN’s Q4 2023 top line exceeded the consensus estimate by +6%, and the company has guided for a +20% YoY growth in its bottom line for Q1 2024.

- Qifu Technology has announced a new $350 million share repurchase program that will be in effect for a year beginning in April 2024.

- There is the potential for QFIN to command a higher P/E multiple, considering its above-expectations fourth quarter revenue and its aggressive capital return initiatives.

VM_Studio

Elevator Pitch

Qifu Technology’s (NASDAQ:QFIN) stock is awarded a Buy investment rating. My earlier December 22, 2023 write-up drew attention to Qifu Technology’s “fundamentals and valuations.”

I analyze QFIN’s latest quarterly performance and the company’s new shareholder capital return initiatives in the current update. I have a positive view of Qifu Technology’s 6% top-line beat and its latest $350 million share repurchase plan. QFIN’s stock is attractively valued at a mid-single digit P/E multiple, and I think that the company’s above-expectations quarterly revenue and its willingness to return a meaningful amount of capital to shareholders will allow Qifu Technology to trade at a higher P/E metric in the future. Therefore, I have chosen to raise my rating for QFIN from a Hold to a Buy.

Focus On Above-Expectations Top Line

QFIN published a media release on March 12, 2024 after the market closed, which detailed its financial results for the fourth quarter of the prior year. The company’s recent quarterly top-line performance and operating metrics were good.

Revenue for Qifu Technology increased by +15% YoY and +5% QoQ to RMB4,496 million in Q4 2023. QFIN’s latest fourth quarter top line turned out to be 6% better than the sell side’s consensus revenue projection of RMB4,259 million (source: S&P Capital IQ).

Its normalized net profit grew by +25% YoY to RMB1,154 million for the final quarter of last year, and this was roughly in line with the market’s consensus bottom-line estimate of RMB1,156 million as per S&P Capital IQ data. Looking forward, QFIN anticipates that its bottom line will expand by 20% YoY to RMB1,175 million (mid-point of guidance) in Q1 2024, which seems reasonable considering its good Q4 2023 results.

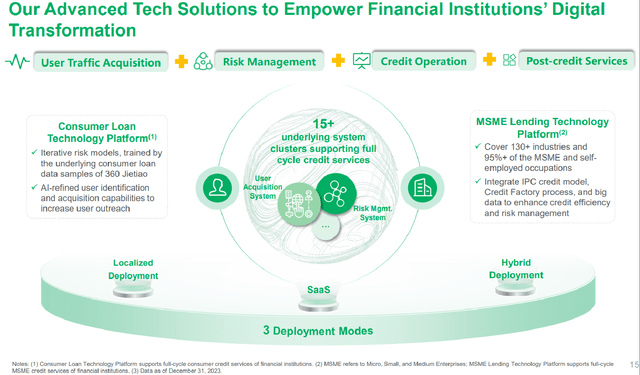

An Overview Of QFIN’s Technology Solutions Business

QFIN’s Q4 2023 Results Presentation Slides

The key driver of QFIN’s Q4 2023 revenue beat was its technology solutions business. At its fourth quarter results briefing, Qifu Technology highlighted that its technology solutions business “continued to make solid progress” last year as it “further optimized our product offerings and entered into partnerships with a number of financial institutions.” Specifically, the company’s loan facilitation volume with respect to technology solutions expanded by +13% QoQ from RMB26,353 million in Q3 2023 to RMB29,705 million for Q4 2023, which was superior to its overall top-line growth of 5% QoQ during the same time frame.

Separately, two of Qifu Technology’s key operating metrics caught my attention. The company’s net take rate improved by 40 basis points YoY from 2.8% for Q4 2022 to 3.2% in Q4 2023. In its results presentation, QFIN defines net take rate as “Non-GAAP net income, divided by the average outstanding loan balance of the beginning and the end of the quarter.” On the other hand, Qifu Technology’s proportion of capital-light loans as a percentage of total loans increased from 55.9% in Q4 2022 and 56.5% in Q3 2023 to 57.3% for the most recent quarter.

It was unsurprising that QFIN’s share price jumped by +12.6% on the day after its results announcement (March 13, 2024), taking into consideration its above-expectations revenue and favorable operating metrics. Also, Qifu Technology’s new shareholder capital return initiative was another positive for the stock, which I will detail in the next section.

New $350 Million Buyback Program Is A Positive Move

In its March 12, 2024, results release, Qifu Technology revealed that it has initiated a “new share repurchase plan” to potentially “repurchase up to US$350 million worth of its American depositary shares or Class A ordinary shares over the next 12 months starting from April 1, 2024.” In my late December 2023 article, I indicated that “there is a good chance of further upside relating to the company’s future dividends and share buybacks”, and this has materialized with QFIN’s latest buyback plan.

This new share buyback program is significant, taking into account two key points.

Firstly, QFIN’s new $350 million share repurchase plan is +133% larger than the company’s existing $150 million share buyback program, which it expects to be completed by end-March 2024. In other words, there is a substantial increase in the amount of capital that Qifu Technology is willing to commit to share buybacks, which sends a positive signal about the company’s focus on shareholder capital return.

Secondly, Qifu Technology’s $350 million share repurchase program translates into a potential buyback yield (share repurchases divided by market capitalization) of 11.8%. The stock’s consensus FY 2024 dividend yield is 6.5%. This implies that QFIN’s forward shareholder yield (sum of dividend yield and buyback yield) could be as high as 18.3%.

More importantly, the company appears to have the intention of returning capital to shareholders in an aggressive manner beyond 2024. QFIN stressed at its Q4 2023 earnings call that “we view that returning to shareholders is a very important long-term tool to the company, and so we’ll continue to do that year by year.” It also emphasized at the most recent quarterly earnings briefing that “the intensity of this kind of (shareholder capital) return program (for the future) will probably be similar to what we see in 2024 we just announced.”

It would be realistic to expect the market to reward Qifu Technology for its meaningful shareholder capital return initiatives in the form of share price appreciation, if it completes its new $350 million buyback program within a year and distributes a decent 20%-30% of its earnings as dividends as per its dividend policy.

Final Thoughts

Qifu Technology’s shares are cheap, taking into account its current consensus next twelve months normalized P/E of 4.3 times (source: S&P Capital IQ) and its potential shareholder yield of 18.3% as outlined in the previous section. In my view, QFIN’s Q4 2023 revenue beat and its new buyback program should serve as catalysts supporting a favorable re-rating of its valuations.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Asia Value & Moat Stocks is a research service for value investors seeking Asia-listed stocks with a huge gap between price and intrinsic value, leaning towards deep value balance sheet bargains (i.e. buying assets at a discount e.g. net cash stocks, net-nets, low P/B stocks, sum-of-the-parts discounts) and wide moat stocks (i.e. buying earnings power at a discount in great companies like “Magic Formula” stocks, high-quality businesses, hidden champions and wide moat compounders). Sign up here to get started today!