Summary:

- Cisco’s revenue growth is being impacted by weak macroeconomic conditions, inventory destocking, and weak demand from the telco/cable industries.

- The company’s portfolio mix, with a focus on traditional IT spending rather than high-growth areas like AI and cloud computing, is contributing to their sluggish growth.

- Cisco’s lack of technology advantages in high-growth markets and weak order growth indicate subdued revenue growth in the future. A ‘Sell’ rating is recommended, with a fair value of $47 per share.

raisbeckfoto

In my previous coverage, I pointed out Cisco’s (NASDAQ:CSCO) diminishing competitive advantage in both the network and security markets. The company has revised down their full-year revenue growth guidance, attributing it to weak macro, inventory destocking and sluggish demands from Telco/Cable markets. These challenges appear to be more internal to Cisco rather than the market reality. I reiterate a ‘Sell’ rating with a fair value of $47 per share.

Weak Macro; Inventory Destocking; Weak Telco/Cable Demands

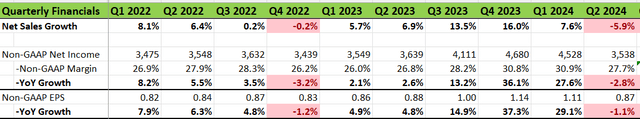

In Q2 FY24, Cisco delivered -5.9% revenue growth and -2.8% adj. net income growth, which was a notable declaration in growth compared to their previous quarters. During the earnings call on February 14th, their management attributed the weakness to several headwinds, including macro, inventory and weakness in telco/cable market.

They indicated the challenging macroeconomic environment led to intensified customer caution and increased scrutiny of IT spending. In addition, inventory destocking persisted longer than initially anticipated, and the company is experiencing a weak demand in the telco/cable industries.

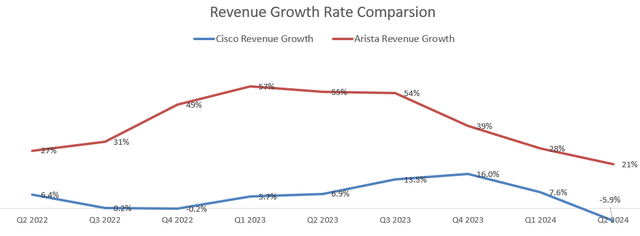

While some of the headwinds cited by their management may hold some truth, Cisco’s sluggish growth might be caused by their portfolio mix: high exposure to traditional IT spending workloads, and less exposure in high-growth areas such as AI, cloud computing and data center networking. As emphasized in my previous coverage, Cisco was dominant in the traditional on-premises network IT market, and their advantages have begun to erode in the new AI and cloud computing era. The chart below illustrates the revenue growth between Cisco and Arista (ANET), showing that Arista has been gaining tremendous market shares from legacy players like Cisco.

Cisco and Arista Quarterly Earnings

In the most recent quarter, Arista guided 10%-12% revenue growth for FY24, primarily driven by AI and data center networking businesses. In short, it appears to me that Cisco lacks the strong portfolios in the high-growth markets, which is the real reason for their sluggish growth.

Despite these challenges, Cisco maintains a robust balance sheet, with $25.7 billion in cash and cash equivalents and $11.5 billion in debts. For the first two quarters, they generated $3.179 billion in cash from operations, representing 63% YoY decline. The decrease in cash flow was primarily caused by the timing of federal tax payments and other transition tax payments, as disclosed over the earnings call. During the quarter, the company paid out $1.6 billion in dividends, and spent $1.3 billion for shares repurchase, a consistent capital return policy.

Weak Orders Indicate Sluggish Revenue Growth Ahead

Due to the weak Q2 result, Cisco lowered their full-year revenue growth guidance, indicating around 8.8% decline in revenue for FY24. Their management anticipates that the inventory destocking will near completion at the end of the fiscal year. However, they lack visibility into market growth in telco and cable industries. My biggest disappointment from the earnings call was that their management did not have insight when the telco/cable markets will recover.

As discussed previously, Cisco lacks the technology advantages in high-growth markets such as AI, cloud, and data centers. The legacy of their product portfolio would continue to pose growth headwinds for the company in my opinion.

Cisco is aiming to achieve $1 billion in AI-related orders; however, it would only represent less than 2% of group revenue. Cisco’s growth will primarily be driven by their legacy products for the on-premises networking, a structural decline market. Their orders in Q2 were down 12% YoY, despite some improvement from Q1. The weak order growth is expected to translate into subdued revenue growth over the next few quarters. Assuming 15% decline in revenue over the next two quarters, their full-year revenue would reach $52.7 billion in total, slightly higher than the upper range of their guidance.

Valuation Update

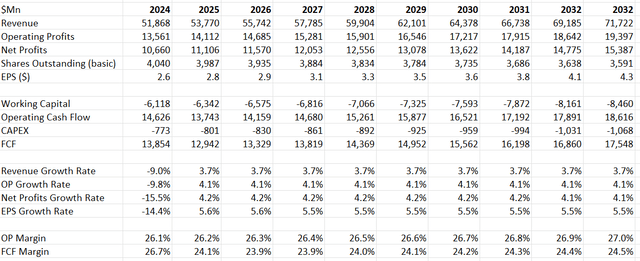

To be conservative, I assume Cisco’s revenue will decline by 9% in FY24, aligning with the low end of their guidance. As discussed above, I forecast that their growth rate will be primarily driven by their legacy portfolios. For the normalized growth, I assume 3% organic revenue growth and 0.7% acquisition growth, consistent with their historical averages. The sluggish growth assumptions reflect their eroding advantages in the new AI and cloud computing world.

In FY24, their operating margin is more likely to decline due to the operating leverage. Assuming their operating expenses decline by 8%, their operating margin would decrease by 30bps in FY24, as per my calculations. For the normalized periods, I estimate their operating expenses will grow by 3.5% YoY, leading to 10bps margin expansion per year.

Discounting all the free cash flow from the firm, the enterprise value is calculated to be $160 billion in the model. Their net cash for FY24 is estimated to be $20 billion; therefore, the equity value is projected to be $190 billion, and the fair value is $47 per share, as of my calculations. Cisco’s current stock price is only trading at 14 times free cash flow. It looks like a very cheap multiple; however, we should acknowledge that the market won’t assign a high multiple to a legacy IT company.

Cisco DCF – Author’s Calculation

Other Risks

During the earnings call, they announced a new plan to cut 5% of the global workforce, with estimated pretax charges of $800 million in total. While these charges won’t affect their non-GAAP figures, the layoff might indicate that the company is struggling for business growth.

In terms of the competitive landscape, Nvidia (NVDA) and Broadcom (AVGO) are the current leaders for the 51.2T switching systems, which are powerful ASIC-powered switches to connect multi-thousands of GPUs. In order to capture the rapid growth, Cisco launched their G200 switch last June, trying to compete against Nvidia and Broadcom. It may be too early to judge if Cisco can catch up with Nvidia and Broadcom. Nevertheless, Cisco is late to the game, again!

Conclusion

Cisco’s growth will primarily be driven by their legacy portfolios, as their AI related businesses represent a very small portion of total revenue. Their competitive advantage has begun to erode in the cloud computing and AI era. I reiterate a ‘Sell’ rating with a fair value of $47 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.