Summary:

- PepsiCo is an incredibly stable company, with margins that have remained consistent despite inflation, regional conflicts, and supply chain issues over the last few years.

- While resilient, growth remains a question mark for the company.

- With an attractive looking entry multiple, selling put options on shares of PEP appears to be the best risk/reward way to play the stock.

- This trade idea sacrifices potential capital appreciation, but the resulting yield on capital far outpaces what you could make from the dividend, and simply appears too good to pass up.

burwellphotography

Last June, we wrote an article talking about PepsiCo (NASDAQ:PEP), titled: “Coca-Cola Vs. PepsiCo: Which Is Better Positioned To Sell Puts?“.

The purpose of the article was to highlight how selling put options on stable stocks like Coca-Cola (KO) and PEP could be a great way to earn better risk-adjusted yields than by simply buying the stocks outright – a premise which has borne itself out to be true since that piece.

Fast forward to the present, and we think PEP once again looks attractive for yield seekers targeting solid risk-adjusted returns.

With a less demanding valuation than a year ago and a number of positive business developments in the books, we think PEP is well set up to accommodate a short-put option trade that could yield 9.2% (annualized) to investors.

Today, we’ll take a deeper look at PEP, explore new developments with the company since last June, and drill down into our trade idea that might have conservative, income-oriented investors getting excited.

Sound good?

Let’s jump in.

Financials

As always, let’s start with PEP’s financials.

PEP has one of the most stable businesses in existence. As a seller of beverages and convenient, ‘snack’ style food (although this has begun to grow more and more into the ‘mini-meal’ and ‘meal’ category), the company has grown into a strong company within the sector, second in size only to competitor KO.

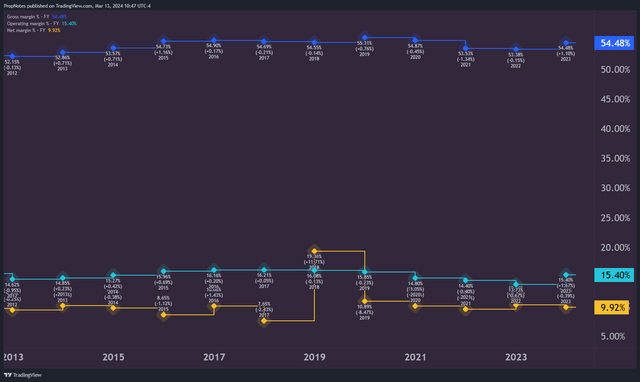

Margins have been rocksteady across the business over the last decade, which speaks to the sustainability of PEP’s business advantages:

Gross, Operating, and Net Income margins have all remained highly predictable over time, which is no mean feat. This is doubly true, considering the challenges that have sprung up in that time, including Covid and resulting supply chain snags, as well as regional conflicts in Ukraine and Israel.

This margin stability can largely be attributed to PEP’s ability to pass costs on through to consumers, as well as incredible scale advantages, which come in handy when negotiating contracts with suppliers.

However, while margins have been stable, growth has been choppier.

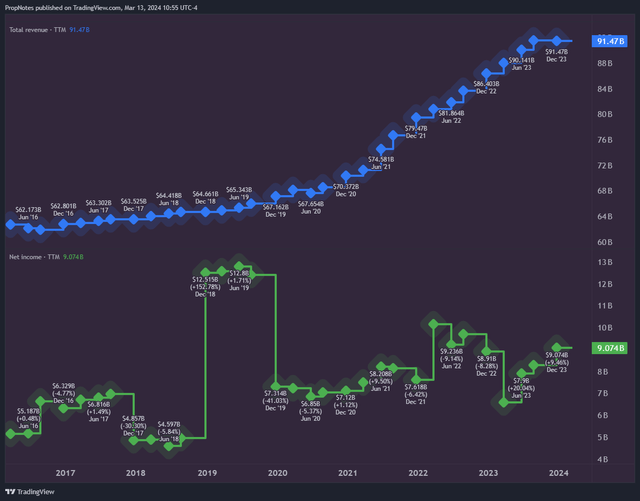

Revenue has grown as PEP has expanded its product offering over time and continued to bolt-on acquisitions, but net income growth has proven more elusive, which has caused the stock to lag behind peers as of late:

The culprit? Inflation, plus an ongoing end to end business transformation called pep+, with the goal of improving the business’s performance and sustainability along a few key principles over the long term.

Some of the investments that this transformation has made are new and haven’t yet borne fruit in the numbers.

Zooming in, recent results have been mixed as well. EPS has actually grown significantly as of late, but revenue appears to be flattening somewhat, which are trends that lie in contrast with the bigger picture and are largely a result of abating inflation.

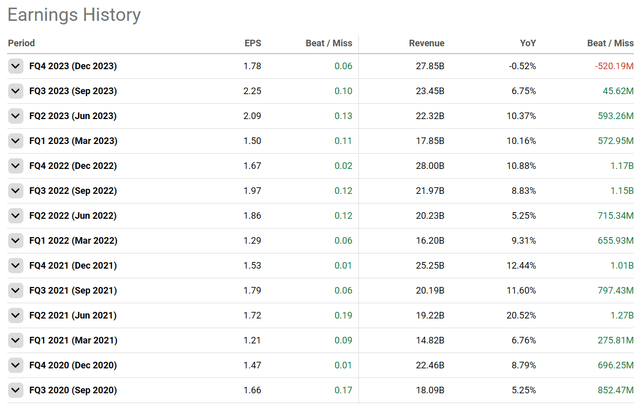

Last quarter, EPS came in well ahead of expectations, but top line sales missed for the first time in years, coming in more than half a billion short. When combined with an actual decline in YoY sales growth, and it’s clear that the company needs to think harder about where things are going:

For their part, management are bullish, calling the recent results ‘resilient’ in the face of ongoing consumer and macro pressures, although they did mention that they thought organic growth would likely slow in the coming quarters vs. the elevated level experienced throughout 2022 and 2023:

As we look ahead, we expect our global beverage and convenient food categories will remain resilient, but category growth rates will normalize and moderate versus the last few years. Consumers are likely to remain watchful with their budgets and choiceful with their purchases.

Therefore, we will elevate our focus on offering more convenience and value with greater precision and agility through our consumer-centric brand, flavor and package combinations and go-to-market distribution capabilities.

Analysts share a similar view, and see sales growth coming under pressure, but with a corresponding level of growth in AOE, targeting the high 7% range for EPS growth over the next three years, which seems in line with our expectations:

It remains to be seen how PEP’s business will fare in the short term when it comes to growth, but there’s no question about the company’s ability to continually adapt to the consumer and deliver stable results over time.

Value

It’s unclear whether PEP’s financial results will materially improve over the short term. And, to the extent that they do, it’s unclear whether that improvement will come more to the bottom line or the top line.

However, what is clear is that PEP shares are a significantly better deal right now vs. where they were when we first published on the company last year.

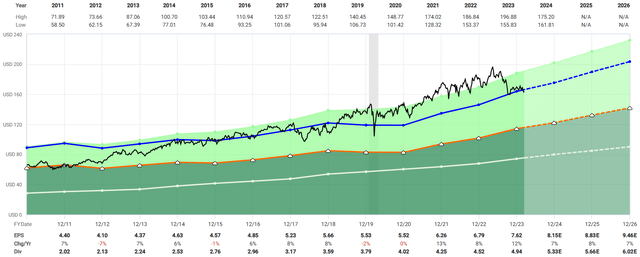

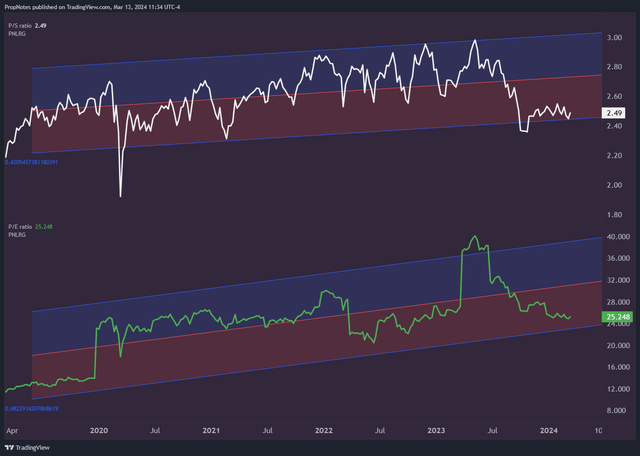

Top and bottom-line valuations have come into an attractive looking zone, towards the bottom of the standard deviation of a 5-year linear regression:

You can see this above, as the white and green lines both appear to be ‘resting’ on the bottom of the red channel. This indicates that shares are on the ‘cheaper’ side of things, which is something we agree with wholeheartedly.

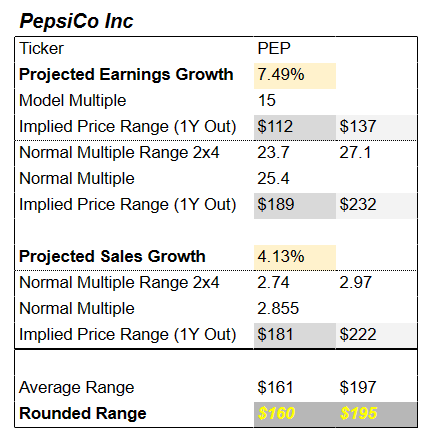

When it comes to valuing the shares based on growth, we think that PEP is potentially undervalued a little bit, or perhaps trading at the bottom of what could potentially be called a ‘Fair Value’ range:

www.propnotes.co

Right now, shares are trading at ~$165, which is a much better entry point into the stock than last June, when the stock was trading closer to $185 per share.

The Trade

So, to summarize the situation, PEP’s outlook is highly stable, but there are questions around growth. And, while the valuation appears relatively attractive to where it has been in years’ past, the prospect of capital appreciation appears murky given the aforementioned questions surrounding the company’s financial results into 2024 and 2025.

In situations like this, we often are attracted to the prospect of selling put options on the underlying stock.

In case you’re unfamiliar, selling a put option is essentially like selling insurance on the stock.

When you sell a put option, you trade upside appreciation potential for an immediate return that comes in the form of cold, hard cash to your brokerage account.

Then, if the stock dips, put sellers need to be prepared to purchase a position in the underlying shares.

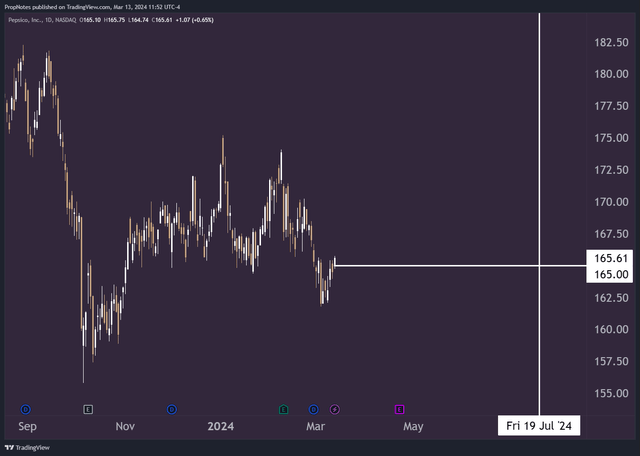

At the moment, we like the July 19th, $165 strike options, which are at-the-money currently:

In return for selling these options, traders can earn a $515 cash premium per contract, which represents a 3.2% return on capital over the next 127 days. This is significantly more yield per day than one would make in dividends holding the stock, as this yield annualizes to a rate of 9.2%.

Then, one of two things can happen – either PEP stock finishes above $165 per share by mid-July – in which case your broker would return your collateral back to you – or PEP stock finishes below $165 per share, in which case you could be assigned the stock at $165, regardless of where it’s trading at that time.

This price is functionally the same price as where the stock is trading currently, but the benefit of selling a put right now comes in the form of a higher yield which dwarfs the well covered dividend payout.

Thus, if viewed that way, you either get to earn a highly competitive yield on your cash over the next 4 months, or you get to earn a highly competitive yield on your stock over the next 4 months.

To us, it really does appear to be a win-win.

Risks

As always, there are risks with any strategy.

The key risk to be aware of here is that selling a put means that you could be assigned shares of the stock at an extremely poor price vs. the market if shares crash in the coming months. This is the same risk profile as simply holding the stock, but it’s worth mentioning.

Another risk is opportunity cost. If we’ve underestimated PEP’s potential to produce capital appreciation over the next 4 months, then any returns in excess of the option cash premium represent a cost to investors that could have otherwise invested in the stock.

Finally, earnings are in about 41 days, which promises to be a volatile event. Plus, earnings are also likely to come again before the option we mentioned expires in July, which could send shares lower on bad results. Something to think about.

Summary

While there are some risks to the trade idea we’ve outlined, the prospect of earning such a high annualized yield on such a stable company at a such a solid price is simply too much to pass up.

Sure, one could simply buy the stock, but with an unclear growth picture ahead as inflation-based top line growth continues to abate, and it appears that trading upside in PEP for a best-in-class yield by using options could be the best way to go.

Cheers!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PEP over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.