Summary:

- Some of the biggest and fastest-growing companies don’t pay dividends, but a combination of common stock and a single-stock ETF can provide price appreciation and monthly income.

- Advanced Micro Devices is on the verge of a heated battle against Nvidia in the data center GPU and accelerator market, which could drive growth for AMD.

- AMD’s profitability trends and projections, as well as its valuation, make it an attractive investment option, particularly when compared with Nvidia.

- The AMDY ETF offers handsome returns as long as AMD maintains its bullish momentum. This is a combination play.

Sundry Photography/iStock Editorial via Getty Images

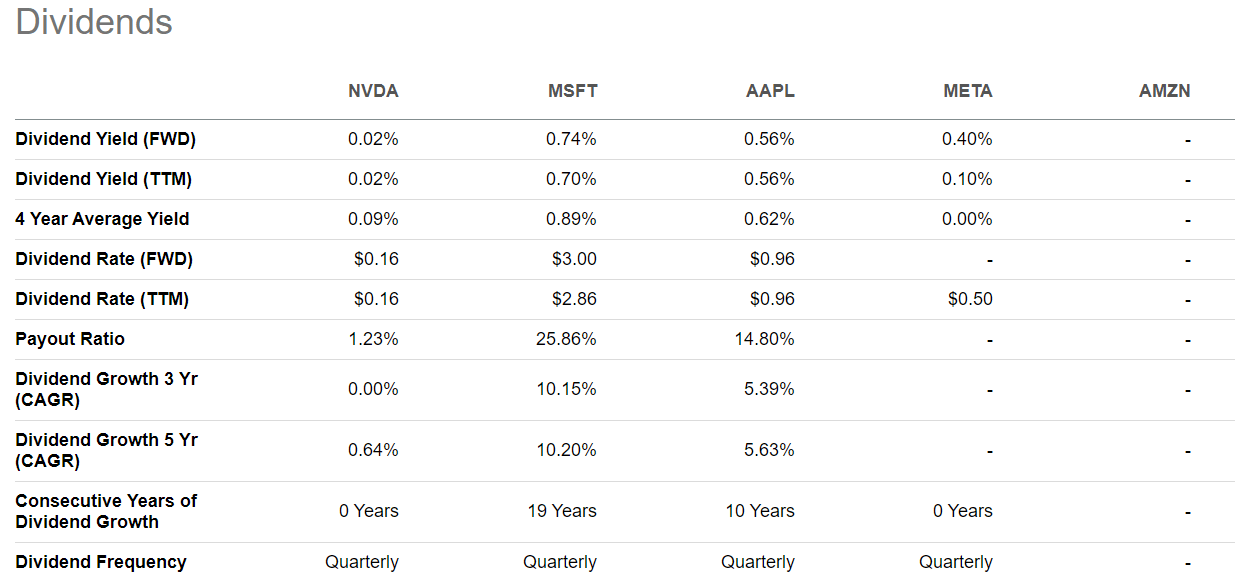

SA – Magnificent 7 Dividends

Some of the biggest and fastest-growing companies in the world don’t pay dividends; for those that do, you’ll see marginal yields and slow div growth for the most part. These companies generally return to shareholders via share buybacks, shareholder equity growth, and, of course, the market’s blessings in the form of price appreciation in a best-case scenario – the way we’ve seen over the past year for most of the Mag 7.

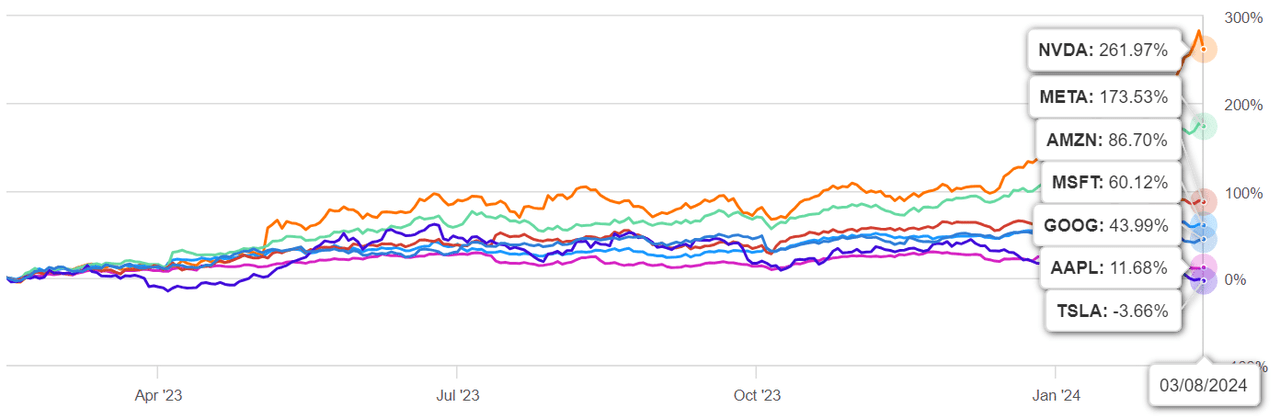

SA – Mag 7 1-Y Price Chart.

There are a few exceptions such as Microsoft Corporation (MSFT), which has yielded a ten-bagger total return over the past decade AND a div growth rate average of about 11% during that same period, but what if you could create a portfolio unit that not only gave you the price appreciation of such companies but also paid you a handsome monthly income so your ‘true’ total return is far above normal?

Of course, you’re immediately thinking covered calls, but rather than a direct options play on top of your holding – the way I described in my (NVDX) article – I’m going to showcase a combination of common stock and a single-stock ETF that essentially gives you very similar results. The stock in question is Advanced Micro Devices (NASDAQ:AMD), and the ETF is the YieldMax AMD Option Income Strategy ETF (NYSEARCA:AMDY).

To be clear, this is not a leveraged ETF like (NVDX), which utilizes options as well as other derivatives to generate 2x the underlying security’s returns; AMDY uses a different – and, I believe, far less risky – options strategy to first establish a long position in AMD and then trade options on that position. You won’t see that kind of leverage here, and the long position is first set up as a synthetic one, as opposed to an actual holding of AMD.

I’m running ahead of myself at this point. First, I need to make a strong case to invest in AMD itself, because AMDY works much better when you DO NOT have the options play on your synthetic long position put your actual AMD holding at risk.

In other words, there’s no need to worry about your shares being called away because your AMD holding has virtually nothing to do with your AMDY holding other than to serve one specific purpose: to create a base of unrealized gains for a very attractive total return. It’s the company itself and its stock that give you the ‘substrate’ on which you ‘grow’ your additional returns from AMDY, all the while keeping your core AMD holding protected. As you can imagine, the bulk of the risk comes from the company’s performance and the market’s willingness to price its stock appropriately.

That’s why I think this is a great play; Advanced Micro Devices is now on the verge of a heated battle against Nvidia (NVDA) for a share of the highly lucrative and in-demand data center GPU and accelerator market, each brandishing its own newly minted offerings of graphics processors and AI accelerator platforms to woo the world’s biggest cloud vendors, AI combatants, OEMs, and other elite clientele, primarily in the enterprise space. AMD has a bit of a timing edge with the most recent quarter already reporting healthy growth from the elevated demand for its MI300 family, while Nvidia is now champing at the bit to get out of the gate with its own H200 and the Grace-Hopper offerings.

As such, I should first justify an investment in AMD before I get into how to complement the potential upside from such a holding. So, let’s get started.

First Leg – Why AMD?

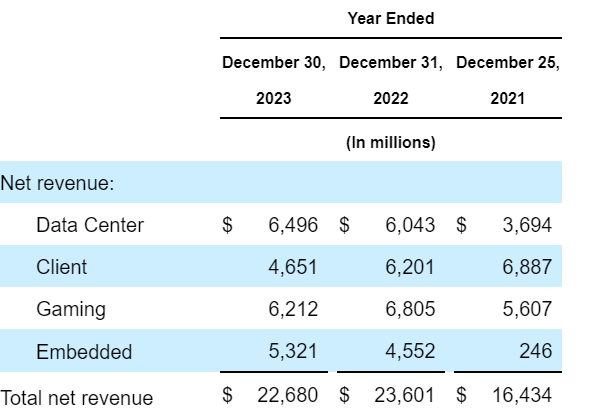

Despite its sizeable enterprise value, AMD is still among the smaller semiconductor players in the Top 10 publicly traded firms in this space by revenue. Founded in the late 60s before the term ‘Silicon Valley’ was even coined, AMD today is a $330+ billion enterprise with its fingers in AI, gaming, automotive intelligence, data centers, and several other domains where it doesn’t always dominate but is a significant player nonetheless. The company reports in four different segments: in order of highest to lowest revenues for FY 2023, these are Data Center, Gaming, Embedded, and Client, with revenue contributions of approximately 29%, 27%, 23%, and 21%, respectively.

You can see straight away that there’s minimal concentration risk, but it should be noted that not all segments are growing at a healthy rate – or even growing. Data Center revenues have overtaken Gaming inflows to become the largest segment, while the Client segment has been losing ground steadily over the past two years, and Gaming revenues are also heading in the wrong direction.

AMD 10-K Filing for FY 2023

Total revenues were down this past year, by about 4% overall, with Data Center and Embedded revenue growth unable to fully offset the slowdowns in the other two segments.

But those other segments aren’t part of my thesis. The real driver of growth will be the Data Center segment, in my opinion, and I’ll explain why I think so.

Bull Argument #1: What’s Driving Growth at AMD?

Nvidia is currently the undisputed king of data center compute power and high-performance computing or HPC, with $47.5 billion in data center revenues alone for the last reported fiscal year ended January 28, 2024, which is more than 200% up from the prior year. Pointedly, the frenzy for large language models and generative AI has spurred a demand spike for their Hopper series of server chips for AI, which leverage Taiwan Semiconductor Manufacturing Company’s (TSM) 5nm technology or N5. Side note: TSM includes the N4 in their N5 family since the former is essentially an “enhanced version” of the N5 process, so you’ll see NVDA’s literature call it the “4N process” even though it’s part of the N5 lineage.

Meanwhile, AMD’s Data Center revenues came in at $6.5 billion for FY 2023, or less than 14% of its largest competitor in this space. The growth rate hasn’t been as impressive, either, at just 7.5% year over year. AMD’s performance in that segment has been driven by its AMD Instinct™ GPU series and its EPYC CPUs (4th gen.), but one significant growth driver in the coming quarters should be the recently launched MI300 Series of data center accelerators and APUs, the MI300A and MI300X, respectively. These are built on TSM’s N5 and N6 processes, the N6 being a similarly enhanced version of N7, or a “half-node ‘shrink’.”

This is the biggest driver of my AMD thesis because the MI300 is a fitting rival to NVDA’s H100 and H200 GPUs, the latter of which ships in the second quarter, per the company’s November 2023 press release. The Grace Hopper Superchip, a combined powerhouse of H200 GPUs and Grace CPUs, will certainly put a damper on AMD’s MI300 Series’ growth prospects, but AMD’s strategy of lower pricing could give it a fair amount of market share to further accelerate its Data Center revenues and overall topline performance.

The way I see it, AMD lost a lot of ground by pitting the earlier MI250X against the H100; while the former was excellent at high-precision workloads, the latter was more suited to the low-precision loads typically used for “AI training and inference”:

The MI250X was capable of hitting just shy of a 100 teraFLOPS at FP64 but could only manage 383 teraFLOPS of FP16 or BF16, putting it just ahead of Nvidia’s A100 — if you ignore sparsity of course. Next to the H100, however, the MI250X came up short. At FP8, Nvidia’s flagship could top 1,979 teraFLOPS in its SXM form factor and with sparsity its closer to four petaFLOPS of performance.

The MI300 seems to be a whole other ball game, already helping AMD’s data center GPU business generate over $400 million in revenues over the last quarter, as highlighted by CEO Su at the earnings call in January. The reason? Rapid and aggressive adoption by “multiple large cloud providers, all the major OEMs and many leading AI developers.” Ms. Su also talked about “overwhelmingly positive” response from customers, showcasing ongoing deployments of the Instinct GPUs in cloud as well as with OEMs.

The challenge now will be the inevitable head-on collision with Nvidia’s H200 and the GH200 CPU/GPU package, but my bullish view for AMD is that even a much smaller share of the overall market will be a significant boost to its top line by way of the Data Center segment.

Will NVDA’s new Tensor Core GPU and AI accelerator now come in and eat AMD’s market share? Very likely, yes. It still remains to be seen, but AMD’s lower-cost approach also means AI workloads will get cheaper to run, which I think is a significant decision-driver as companies continue to tighten their belts in this high cost-of-capital environment, which I spoke about in my recent article on (DFAS), a smallcap ETF from Dimensional ETF Trust.

As such, I believe AMD’s data center revenues are primed to grow at much higher YoY rates once the product line is fully rolled out and deployed strategically across the cloud offerings and data centers of the aforementioned companies as well as other large enterprise clients. Moreover, since this segment is already the largest and the fastest-growing one, it should help move the needle significantly on top-line growth, something AMD sorely needs at this point.

Bull Argument #2: Revenue, Profitability and Valuation

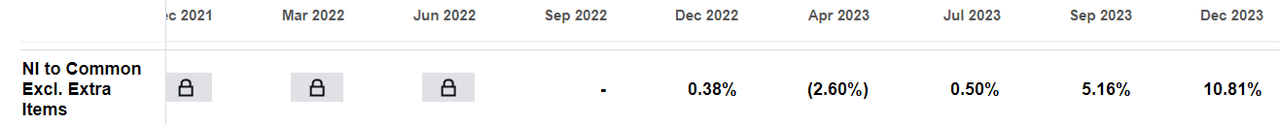

SA – AMD Net Income Margin

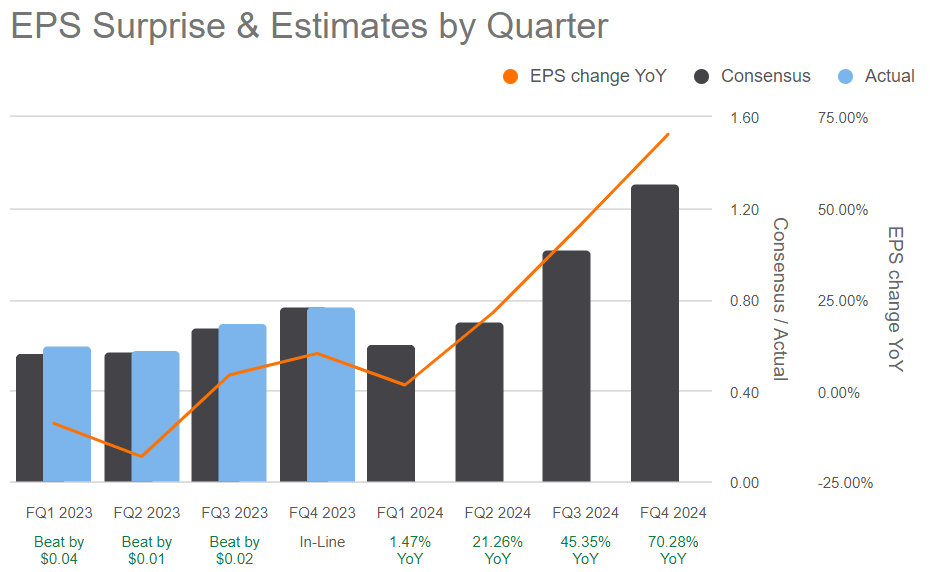

My second point about AMD is the cadence of its profitability trends and projections. Over the past four quarters, AMD has posted increasingly higher profit margins, but the real kicker is the impressive consensus estimates over the next several quarters.

Street analysts seem a little too optimistic about AMD’s forward revenues to suit my taste. Per SA’s data on consensus estimates from 41 analysts, we can see a strong 14% growth projection at the top for FY 2024; further out, it’s even steeper at 26% YoY to hit the midpoint of $32.55 billion. Strangely, there seem to be 29 downward revisions and only 10 upward revisions on revenue estimates from 39 of these analysts. That tells me a smaller number of analysts are optimistic about revenue growth, but the ones that are have really strong projections that go as high as $30 billion for FY 2024 and $43.8 billion for FY 2025. Effectively, in two years, AMD’s total revenues could start to look like NVDA’s current Compute & Network segment that we discussed earlier.

While I do find that overly optimistic, I also recognize that at those revenue levels, AMD’s current share price looks a lot more attractive at 13x and 10x forward revenues for the two fiscal years ahead, compared to the current 14.8x on a TTM basis.

SA – AMD Earnings Per Share

Coming back to profitability, once again I see a very optimistic 38% growth consensus for EPS in FY 2024 and an even stronger 50% in FY 2025, but yet again it’s a smaller number of analysts with very optimistic upward revisions going all the way to $4.89 in FY 2024 and over $9.00 in FY 2025. There’s a little more balance here with 16 up and 21 down from 37 analysts in the last 90 days, but these are still moonshot estimates if all doesn’t go well with the MI300 Series, which is arguably AMD’s sole claim to fame against the mighty Nvidia in the AI accelerator game. That bears watching, to say the least.

Again, I do recognize that if AMD meets these lofty expectations over the next two years, you’re not really overpaying at a current 15x sales valuation. By comparison, you’d have to pay more than double that at 35x for NVDA at a time when both companies are essentially vying for share in the same fast-growing market with comparable products. I don’t know if NVDA is a good buy at that price, to be honest, but I do know that I like what I see for AMD because of the potential to eventually own it at a 10x or lower sales multiple. That’s value, and the market will eventually have to price in that kind of growth, the obvious caveat being AMD now needs to execute in terms of getting its products into as many data centers and cloud environments as it can. At lower prices for its products, it’ll need to play the volume game.

As the market starts to price in this potentially strong growth at the top and bottom, if the current valuation holds at 14.8x at the projected $44 billion in revenues and we assume a share dilution of 8% each for the next two years (5-year average), we’re looking at a two-year price target of roughly $343 for a potential upside of 65% ($44 billion in sales with 1.9 billion shares outstanding, or $23.15 of revenue per share, times 14.8x.)

That’s why I deemed it a little too optimistic, but even at a 12x sales multiple, there’s a 35% upside to today’s (at the time of writing) $207 against a presumed price target of $278 by FY 2025. Let’s CAGR those figures down to a 16% to 29% range of possible annualized returns – and that’s just on the appreciation on your AMD position. That’s the price when I started writing this piece, but it’s since dropped on news that China is starting a $27 billion chip fund to counter U.S. export restrictions. I think that’s just a knee-jerk reaction from a sensitive market, and we should see an upward slope as the longer forward trend.

Bull Argument #3: AMD Less Risky Than NVDA

Right now, AMD seems to offer more value and lower risk. For one, AMD’s 150% run-up over the past year is half NVDA’s near-300% return, but in EV terms you’re still paying only about 14x to 15x forward earnings for AMD but will have to shell out a heftier 19x to 20x for NVDA’s forward sales. If you look at it from a market cap perspective, that divergence in value is even starker, as we’ve already seen – 15x vs 35x.

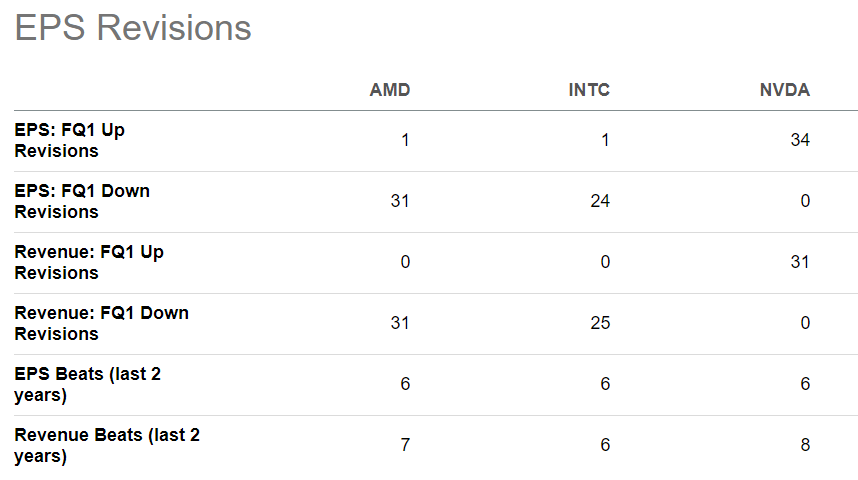

The reason is that the market has extremely high expectations for NVDA, and that’s almost comically apparent in this snapshot of Street analysts’ EPS revisions for AMD, Intel (INTC) and NVDA.

SA – AMD INTC NVDA Street Analyst Revenue and Earnings Revisions

I’ll certainly admit that Nvidia’s new super-duper-graceful-grasshopper doohickey for data centers has a lot to do with the market’s enthusiasm for NVDA, and that may well bear out in the future as the coming quarters once again witness eye-popping data center revenues and overall topline growth.

On the strength of that assumption, Wall Street seems almost afraid of being bearish on NVDA.

That puts AMD in a very attractive position because the market has almost fully priced in the risk that it won’t perform as well in the data center GPU and accelerator market. That’s where the hidden upside exists. The CEO is confident of this, and whether or not that’s simply a valiant public vocal effort to one-up NVDA, the fact is that it gives AMD much more potential upside as the underdog in the data center game. The odds are clearly more attractive because AMD isn’t the expected winner in this game.

Regardless, the real-world performance of the MI300 family and its lower pricing strategy will help run AI workloads at lower costs, and that’s what I’m counting on for forward growth. I might not be as optimistic as the Street on AMD, but my view is directionally the same.

Risks to My Bull Case

The only downside I see to an AMD investment is the slow rate at which it builds shareholder equity, and the quality of that equity. Make no mistake, AMD’s balance sheet is strong, with relatively low long-term debt (about $1.7 billion) against a cash, equivalents, and short-term investments position of $5.7 billion and a current ratio of 2.5. However, the bulk of their common equity of around $55.9 billion is intangibles and goodwill amounting to about $45.7 billion, which only leaves a little over $10 billion in TBV. Yes, their IP is strong and more than 70% of their patents are active, but at the end of the day you want to see a mature company do better with common shareholder equity accrual over time.

Another downside is the extremely low return on this equity – less than 2% against Nvidia’s +90%. The company is not as profitable as I’d like, either, although we saw that showing an uptrend that the MI300 family could make even stronger. The problem here is that it’s nowhere near as profitable as NVDA, but since we’re not looking at the better stock pick here, that’s irrelevant to this discussion. The improvements in profitability should be the main focus.

The biggest risk of all is what I’ve already discussed – failure to gain share in the data center GPU market despite having a strong product on the market. That risk is only mitigated by how well the company executes on deployment and how the MI300 family performs with real-world workloads. Customers seem to be receiving it very well, so there’s a lot of hope riding on this putting AMD back on the map as a serious mover in the enterprise AI hardware market.

Now that I’ve hopefully convinced you that AMD is worth a look at this price despite the risks, let’s move to the next leg of this strategy – maximizing your gains using a simpler version of the options game. This is where it gets really exciting!

Second Leg – Why AMDY?

YieldMaxETFs

AMDY Holdings and Strategy

YieldMax ETFs offer a range of option income funds with a reasonable 0.99% gross expense ratio, among which AMDY plays to the strengths of AMD through the use of derivatives. By using a long/short options strategy, AMDY has managed to post a current 30-day SEC yield of more than 4% – not a bad “dividend” on your non-dividend-paying AMD holding. Wait, though. The best is yet to come!

AMDY holds mostly treasuries, amounting to about 97% of total holdings against an AUM of about $104 million. Liquidity is fairly low at $3.74 million on a three-month average daily basis, but I was surprised to see that it’s double the median for all ETFs combined. That, I did not know. Still, it might be hard to match your AMDY position to your AMD holding if the latter is fairly large. I discuss other risks further down.

Note that the fund itself doesn’t buy or hold any AMD shares. It uses a long call short put strategy to establish a ‘synthetic’ long position against which the option is contracted, with the treasuries as collateral. This strategy is usually considered risky in a bear market

Now for the booster-shot. The monthly distributions are also extrapolated into a Distribution Rate, which shows you the yield for the next year assuming the most recent distribution continued uninterrupted at the same level. That’s not likely to happen, of course, but even a baseline average, as shown in the next section, looks attractive. The current distribution rate for this fund is about 72%, which might be confusing until you realize that the SEC yield does not calculate what the fund makes in options income, just what you get from the upside participation on the short OTM calls and the added income from the treasuries.

Looking at Hypothetical Gains

That additional options income is not just the icing on the cake, it’s the biggest part of the cake! That’s the distribution rate right now after the March 2024 payout, but if you look at the past five months of distributions and take that average, the average monthly distribution has been around $1.2 per month, which works out to an annualized rate of about 63%. In absolute terms, that’s $14.40 per year on a starting NAV of about $22.99. A handsome payout, wouldn’t you agree?

As an example, if you buy 100 shares of AMDY to complement a core holding of 100 AMD shares, we’re potentially looking at a one-year price return of 16% to 29% per share on the stocks (our upside calculations above), PLUS a gain of $14.40 per ETF share that gets added on top of that capital appreciation. At this point, you should also know that monthly distributions aren’t guaranteed and could be zero in some months. That’s a risk you’re going to have to be aware of, but since it’s over and on top of the SEC yield, you still make a good return – just not as high as you wanted, perhaps.

I don’t think it gets any better than this, but it could definitely get worse.

Risks: Are the Stock and the ETF Likely to Continue to Perform at this Level?

One of the reasons I like this strategy for AMD, specifically, is its relatively low valuation against the mighty NVDA. Yes, there’s a lot of risk here because, as I said, it still remains for AMD to execute on the grand plan to take Nvidia head-on in the data center segment. Any revenue or EPS miss at this critical juncture would put paid to the whole plan of owning AMD, and you could be left holding a stock that struggles to keep up with its current valuation, let alone justify higher multiples. We’ve already seen that the majority of analysts are still cautious and have revised their estimates downwards on both revenue and earnings per share, so it’s a very real risk.

The second concern is related, because under normal circumstances, if you were playing the options strategy directly rather than through an ETF, you’d run the risk of the underlying security’s valuation running well ahead of any revenue or profitability growth. In that scenario, a covered call would actually be a good thing because you can offload your overvalued stock when they’re called away. Your gain is capped but there’s still some amount of capital appreciation to walk away with. The risk with using an ETF strategy is that your stocks aren’t going to get called away in that situation because you’re not directly trading in their derivatives – so, once again, you’re stuck with an expensive stock that’s not going anywhere and a bunch of ETFs that aren’t making meaningful distributions because the stocks themselves are no longer that attractive. This is also a real risk that’s worsened by the ETF options play.

The third risk is that you don’t control the options play itself, neither the long nor short of it! You trust the fund managers to make the right decisions on several fronts. Looking at the monthly distribution and how it’s been averaging as AMD went by over $100 a share between September 2023 to its current price, nearly doubling in that time, you can see why the ETF has a handsome return that further complements your AMD capital gains and gives you a monthly cash flow. It’s not the same as a less risky fixed-income play like I described in the article on (IBTE) to build ETF-based bond ladders, but at these levels of return, it’s only fair that you take an equal measure of risk.

On the plus side, you get to control the amount of risk based on your tolerance. You can give up the potentially high ‘extra’ returns from the ETF by using a more conservative AMDY to AMD share ratio to reduce exposure to the options play, or you can go into overdrive in an attempt to squeeze every last drop of alpha this strategy can provide.

To Summarize…

As a final note, this strategy works best with high-momentum stocks that have strong fundamentals and attractive options premiums for the long and short components, and in this case, you can leave it to the fund managers to actively ensure they’re on the ball with respect to legging into each options play. For now, we’re looking at contracts stretching no further than May 2024, which will subsequently be rolled over to the next set of contract expirations, and so on. In my opinion, AMD fits the bill perfectly for an options play, just as NVDX fits perfectly into the NVDA growth narrative.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.