Summary:

- Micron’s growth in memory and storage is driven by AI and HBM3 has exceeded expectations, with both the top line and bottom line above guidance.

- Strong demand for HBM products has led to pricing increases and supply shortages, positioning the Company for strong growth in the next two years.

- MU stock expects revenue to grow more than 75% YoY in Q3 and forecasts strong growth in FY24 and FY25 due to HBM production ramp-up and pricing increases.

JHVEPhoto

I highlighted Micron’s (NASDAQ:MU) growth in memory and storage driven by AI and HBM3 in my initiation report published in January 2023. They delivered an outstanding Q2 FY24 result on March 20th after the market close, with both the topline and bottom line above the high-end of their guidance range. It appears that the recovery of memory and storage markets is faster than the initial forecast. AI has presented a multi-year growth opportunity for Micron, and I reiterate the ‘Buy’ rating with a fair value of $135 per share.

Strong HBM Demands Drive Pricing Increase

As highlighted in my initiation report, High Bandwidth Memory (HBM), used in high performance computing, has been growing rapidly due to AI demands. Micron is one of the industry’s leading suppliers of HBM products. As disclosed in the earnings call, their HBM has been sold out for 2024, and the overwhelming majority of 2025 supply has already been allocated.

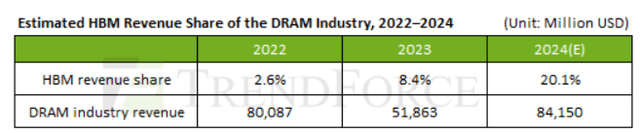

It appears that there is currently a shortage of HBM products, with the supply being constrained by industry manufacturing capacity. On March 18th 2024, TrendForce published their growth forecast for HBM, indicating that HBM’s revenue share within the DRAM industry is projected to increase from 8.4% in 2023 to 20.1% by the end of 2024. As such, they forecast a 260% YoY growth in HBM supply bit for 2024.

As one of the main players in HBM, Micron is poised to deliver strong growth over the next two years, in my view. In addition, Micron has already begun sampling their industry-leading HBM3E product offering, and their 8-high and 12-high HBM3E memory further fuel AI workloads at 30% lower power consumption than its competitors, as described in their product introduction. The biggest news is that HBM3E product will be a part of Nvidia’s (NVDA) H200 Tensor Core GPUs; therefore, their HBM3E demand will rise along with Nvidia’s GPU in the near future.

As disclosed over the call, Nvidia’s next-generation Blackwell GPU architecture provides a 33% increase in HBM3E content. As such, in my view, Micron’s HBM3E growth will outpace their HBM solutions due to the additional content growth, coupled with increasing spending on AI workloads.

Due to strong demands for their HBM, DDR5 and data center SSDs, the industry is experiencing a tightening supply for DRAM and NAND, as indicated over the earnings call. Because of the imbalance between supply and demand, Micron achieved robust pricing growth in the quarter, and they expect the pricing growth will continue throughout FY24 and FY25.

Explosive Revenue and Profit Growth

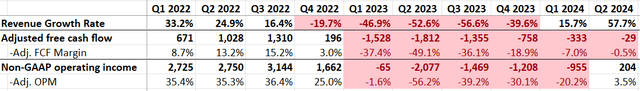

In Q2 FY24, they delivered 57.7% revenue growth with a 3.5% of adjusted operating margin, as depicted in the table below. Both topline and profit growth exceeded the high-end of their guidance range and market expectations.

Other than the strong HBM growth, my key takeaway from the earnings call is that their management expects the industry supply to fall below demand for both DRAM and NAND in 2024. The imbalance of supply and demand would drive the pricing even higher and reduce Micron’s inventory level, in my opinion. The management expressed strong confidence in the revenue growth for both FY24 and FY25.

FY24 Outlook

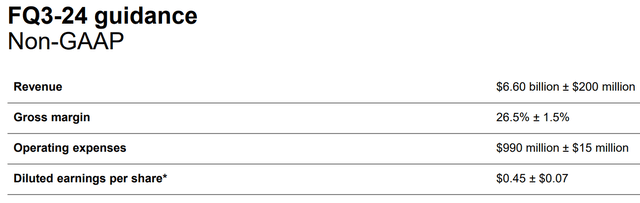

Micron expects their Q3 revenue to grow more than 75% year-over-year, as detailed in the table below. The strong growth guidance is primarily attributed to their ramp-up of HBM production, pricing increase due to supply shortages, as well as growth in DDR5 and data center SSDs.

Over the medium term, Micron expects bit demand growth CAGRs of mid-teens in DRAM and low-20s percentage range in NAND. To consider Micron’s FY24 growth, the following factors have been considered.

TrendForce forecasts a 50% NAND price increase throughout 2024, driven by the supply shortages. During the earnings call, Micron’s management also indicated that the pricing increase will persist throughout 2024 and 2025. Consequently, pricing increases are expected to remain a key growth driver for Micron.

As discussed previously, the rapid growth in AI has accelerated the industry’s demand for memory and storage. It is likely that more powerful GPUs are required greater amount of HBM content. TrendForce predicts a 17.3% annual increase in DRAM content per box in 2024. The growth in content per box will drive more demand for NAND and DRAM products in the near future, in my opinion.

In short, Micron should be able to benefit from both pricing and volume growth. Of course, their growth will be capped by their manufacturing capacity. The company continues to allocate $7.5-$8 billion cash towards capital expenditures in FY24, and they project the wafer capacity by the end of FY24 will be low-double-digit percentage less than their peak levels in FY22.

Considering the pricing dynamics, content per box trend and manufacturing constraints, I forecast they will deliver more than 50% revenue growth in FY24.

Valuation Revision

I have to acknowledge that the market demand and pricing increase have been quite stronger than I initially thought. I am quite optimistic with the future growth of HBM and HBM3E, driven by the rapid adoption of AI by enterprises and Hyperscalers.

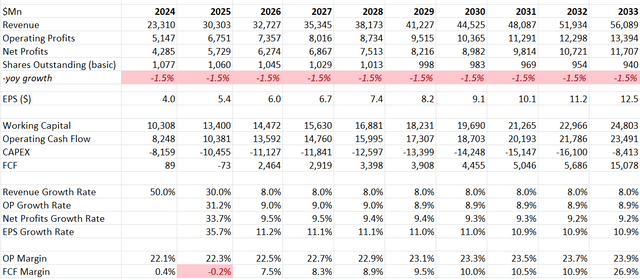

As discussed previously, I forecast their revenue will increase by 50% in FY24. Considering their FY25’s HBM capacity has already been pre-allocated to their customers, I believe Micron has a strong visibility for growth in FY25. I expect the content growth per box to continue into FY25, but anticipate less pricing growth as more manufacturing capacity is coming; therefore, I assume 30% revenue growth in FY25. For normalized growth, I estimate 8% revenue growth, in line with their historical average throughout market cycles.

Their operating margin will fluctuate with manufacturing utilizations. As disclosed over the call, the company is now fully utilizing their high-volume manufacturing nodes. I calculate that their normalized operating expenses will grow by 7.7% year-over-year, leading to 20bps annual margin expansion in the model.

As Micron has been repurchasing their own shares over the past few years, I assume they will allocate 8% of total revenue towards annual shares repurchases. Considering some shares dilutions from SBC, the total count of shares outstanding is calculated to decline by 1.5% year-over-year.

The key financial metrics in my DCF can be founded in the table below.

Micron DCF – Author’s Calculation

The cost of weighted average cost of capital (WACC) is calculated to be 11.3% for Micron, with the following assumptions:

-Risk free rate: 4.26%. U.S. 10-Year Treasury Yield

-Beta: 1.2. SA’s 24-month data

-Market risk premium: 7%

-Equity: $44.1 billion; Debt: $13.3 billion

After discounting all the free cash flow, the enterprise value is calculated to be $152 billion. Adjusting the debt balance of $13.3 billion and cash of $7.3 billion, the fair value of Micron’s stock price is projected to be $135 per share.

Key Risks

Micron is a highly volatile stock, operating in a highly volatile end-markets. For investors seeking stable earnings growth and dividend income, Micron might not be suitable candidate for investment.

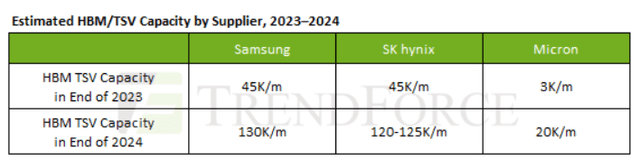

In addition, while HBM is facing rapid growth driven by AI in the near future, the market is highly competitive. Samsung (OTCPK:SSNLF) and SK Hynix are highly respectable competitors, and both companies have ambitious plans to expand their HBM capabilities in the near future, as illustrated in the table below.

The pricing of NAND and DRAM is inherently volatile due to supply and demand imbalances. During market upcycles, NAND/DRAM manufacturers tend to expand their manufacturing capacities excessively, leading to overcapacity and subsequent price drops in the future. For example, DRAM spot price dropped 40% in 2022 because of overcapacity, as reported by the media.

Verdicts

I believe Micron’s HBM and HBM3E will thrive in the AI era, and the industry is experiencing supply shortages due to super strong demand driven by AI. I expect Micron to deliver strong revenue growth in the next two years, thanks to both pricing growth and growing content per box. I reiterate the ‘Buy’ rating with a fair value of $135 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.