Summary:

- My investment strategy is to fill my portfolio with remarkably reliable dividend growers.

- Abbott Laboratories posted fourth quarter net sales and non-GAAP EPS results ahead of and in line with the analyst consensus, respectively.

- The healthcare titan enjoys an AA- credit rating from S&P on a stable outlook.

- Abbott Laboratories’ shares look to be priced 2% under fair value.

- The Dividend King could be positioned to match the total returns of the S&P 500 in the coming decade.

Scientists working in a laboratory. sanjeri

Since I began investing in September 2017, my investing strategy has predominantly been dividend growth-focused. To be clear, there are plenty of non-dividend stocks that have been excellent investments. I even own some of the premier non-dividend stocks like Amazon (AMZN) and Alphabet (GOOG)(GOOGL). There are also others that I am considering.

But I have found that the dividend growth investing strategy more easily filters for quality. Why is this my argument?

That’s because a dividend that grows year after year and decade after decade tends to prove the quality of the underlying business. After all, a steadily rising payout usually means that earnings are also growing. This generally translates into capital appreciation for shareholders as well.

The Dividend King, Abbott Laboratories (NYSE:ABT), is one holding within my 99 stock portfolio, comprising 0.6% of my portfolio. When I last covered Abbott last December, I liked it for its proven track record of innovation, the safe and growing dividend, and the robust balance sheet.

In that time, Abbott has since shared what I believe to be positive fourth-quarter earnings. Today, I will review those results and the valuation to highlight why I am holding my buy rating for now.

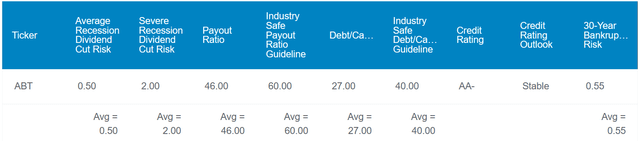

Dividend Kings Zen Research Terminal

Abbott’s 2% dividend yield is moderately higher than the healthcare sector median of 1.6% per Seeking Alpha’s Quant System. That’s likely why it is awarded a B- grade on dividend yield from the Quant System. As a Dividend King, it’s also no surprise that Abbott’s grade for dividend consistency is an A.

Better yet, the company’s payout should have more room to run higher in the years to come. Abbott’s 46% EPS payout ratio is well below the 60% EPS payout ratio that rating agencies prefer from the MedTech industry.

If that wasn’t enough, the company is also well-capitalized. This is supported by a 27% debt-to-capital ratio, which is far less than the 40% that rating agencies have as the industry-safe guideline. That’s how Abbott’s long-term debt is rated AA- on a stable outlook by S&P. This pegs the 30-year risk of bankruptcy for the company at 0.55%. In other words, this credit rating suggests that Abbott could survive 181 out of 182 30-year simulations.

In the Zen Research Terminal, the odds of a dividend cut in the next average recession at estimated at 0.5%. That likelihood rises to 2% in the next severe recession. These respective probabilities are the minimum values within the Zen Research Terminal.

Dividend Kings Zen Research Terminal

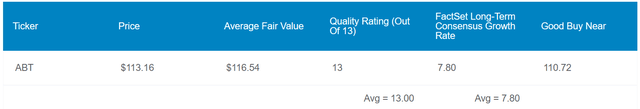

Abbott’s valuation is arguably reasonable from the current $111 share price (as of March 20, 2024). The stock’s 13-year average dividend yield of 1.8% according to the Automated Investment Decision Score Tool spreadsheet could mean shares are worth $122 each.

The nine-year normal P/E ratio of around 24 could indicate shares are fairly valued at $109 apiece. Given Abbott’s fundamentals, I believe such a valuation multiple can be maintained in the future.

My inputs into the dividend discount model could mean shares are worth $110 each. These inputs include a $2.20 annualized dividend per share, a 10% required annual total return rate, and an 8% annual dividend growth rate. This dividend growth rate would be high for most companies. However, I think it’s fair for a company of Abbott’s caliber as I will discuss further in the dividend section of this article.

Blending Dividend Kings’ fair value and my fair value, I get an average fair value of $113 a share. This is equivalent to a 2% discount to fair value.

If Abbott reverts to fair value and can match the growth consensus, here are the total returns that it could generate in the next 10 years:

- 2% yield + 7.8% FactSet Research annual growth consensus + a 0.2% annual valuation multiple upside = 10% annual total return potential or a 159% 10-year cumulative total return versus the 10% annual total return potential of the S&P 500 index (SP500) or a 159% 10-year cumulative total return

Product Launches Are Driving A Revitalization Of Growth

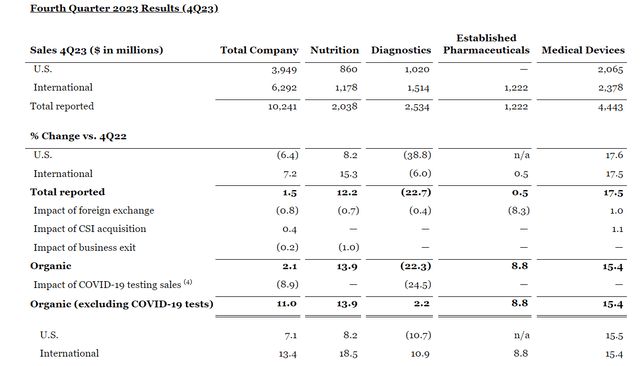

Abbott Q4 2023 Earnings Press Release

When Abbott reported its fourth quarter results on Jan. 24, it didn’t disappoint. The company’s net sales edged 1.5% higher year-over-year to $10.2 billion during the quarter. This was $50 million ahead of the analyst consensus according to Seeking Alpha.

What makes these results especially impressive is that this topline growth came despite continued COVID-19 testing volume headwinds in the fourth quarter. Due to diminishing demand, COVID-19 testing volumes were down substantially over the year-ago period. That resulted in a 73.1% year-over-year plunge in COVID-19 testing net sales to $288 million for the quarter.

Backing out its COVID-19 testing business, Abbott’s organic net sales surged 11.6% higher over the year-ago period during the fourth quarter. These results were driven by strength throughout each of the company’s segments.

Abbott’s nutrition segment net sales climbed 12.2% year-over-year to just over $2 billion in the fourth quarter. This was due to robust growth in Canada and several Latin American countries, as well as market share recovery in the U.S. This comes following the voluntary recall of some infant formula products last year and subsequent relaunch.

Diagnostics net sales were down 22.7% over the year-ago period to $2.5 billion for the fourth quarter. But again, factoring out the COVID-19 testing headwinds, organic net sales were up 2.2%. This comes as many of the company’s other diagnostic products have seen an uptick in demand with more patients returning to hospitals for routine labs.

Established pharmaceuticals net sales edged 0.5% higher year-over-year to $1.2 billion during the fourth quarter. These results were fueled by growth in the cardiometabolic, gastroenterology, and respiratory therapy areas in key emerging markets.

Lastly, medical devices net sales rose by 17.5% over the year-ago period to $4.4 billion in the fourth quarter. Solid continued growth from FreeStyle Libre and structural heart launches like Amulet, TriClip, and Navitor, each powered these results.

Working down to the bottom line, Abbott’s non-GAAP diluted EPS grew by 15.5% year-over-year to $1.19 for the fourth quarter. This was in line with the analyst consensus per Seeking Alpha. Thanks to disciplined cost management, the company’s non-GAAP net profit margin expanded by 250 basis points to 20.4% during the quarter. Combined with a 0.3% lower share count from share repurchases, that is how Abbott’s non-GAAP diluted EPS growth outpaced net sales growth in the quarter.

As the company’s recent product launches gain momentum and additional product launches are executed, Abbott’s growth prospects should remain promising. This is why I believe that the FAST Graphs consensus of 4% non-GAAP diluted EPS growth for 2024 to $4.60, 12% growth for 2025 to $5.15, and 10% growth for 2026 to $5.68 are realistic projections (unless otherwise noted or hyperlinked, all details in the previous paragraphs were sourced from Abbott’s Q4 2023 Earnings Press Release).

Abbott’s net debt load (cash and cash equivalents plus investments minus the current portion of short-term debt and long-term debt) to end 2023 was $7.4 billion. Against the $10.2 billion in EBITDA generated during that time, this is a manageable net debt to EBITDA ratio of 0.7 (info according to pages 44, 46, and 47-48 of 259 of Abbott’s 10-K filing).

Expect More Healthy Dividend Growth From This Dividend King

In the last five years, Abbott has cumulatively compounded its quarterly dividend per share by 71.9% to the current rate of $0.55. For context, this works out to an 11.4% compound annual growth rate.

Moving forward, I believe dividend growth can be almost as strong. This is because, in 2023, Abbott generated $5.1 billion in free cash flow. Compared to $3.6 billion in dividends paid, this is a 70.3% free cash flow payout ratio (page 46 of 259 of Abbott’s 10-K filing).

The company is on an upswing with research and development and capex to launch more products. Yet, free cash flow was enough to finance the dividend and share repurchases, with almost $300 million in leftover free cash flow.

Risks To Consider

Abbott is a high-quality company, but it still has risks that are worth highlighting.

The company’s competitive advantages depend on the protection of its sensitive proprietary data. If Abbott’s IT networks are breached, its fundamentals could be hurt by the loss of trade secrets and lawsuits.

Additionally, the company’s continued success also relies on a steady stream of successful new product launches. Abbott spent $2.7 billion or nearly 7% of net sales on research and development in 2023, so the commitment to innovation is there. If Abbott’s R&D doesn’t keep yielding fruit, though, its growth prospects could be diminished.

The company’s financial success via its exceptional profit margins could eventually result in legislative overhauls to its product pricing in major markets. If that happened, Abbott’s margins could contract.

Summary: A Winning Business For A Sensible Valuation

Abbott’s reputation of 52 consecutive years of dividend growth as a Dividend King makes it one of the best businesses on the planet from my perspective. After being dragged down by the rise and fall of its COVID-19 testing business, the company’s operating fundamentals appear to be improving. Abbott’s free cash flow could support further dividend growth. Not to mention that the balance sheet is admirable. The slight undervaluation is what seals the deal for me to make Abbott stock a continued buy in my view.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABT, AMZN, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.