Summary:

- Unity Software stock dipped after reporting earnings in spite of surpassing consensus estimates.

- The problem is that Unity’s results included a one-time transaction and results were disappointing excluding this line-item.

- 2024 guidance was disappointing as investors were caught off-guard by the magnitude of the restructuring.

- The plunging stock price has created an opportunity: it is time for a ratings upgrade.

imaginima

Unity Software (NYSE:U) saw its stock dip after reporting earnings results on Monday after the close. The 3D development software company continues to see struggling top-line growth numbers, though it has made solid progress in boosting profitability. Management’s guidance shows that 2024 is likely to be a transition year as the company digests the impact of focusing on its core businesses. While management is upbeat about exiting 2024 with a double-digit top-line growth rate, it is clear that consensus estimates are too high, as the investor community underestimated the magnitude of the divested businesses. The post-earnings plunge may have made the stock cheaper, but the new implied revenue run rate appears to explain the discrepancy. While the near term is likely to be messy, I am now upgrading the stock to buy.

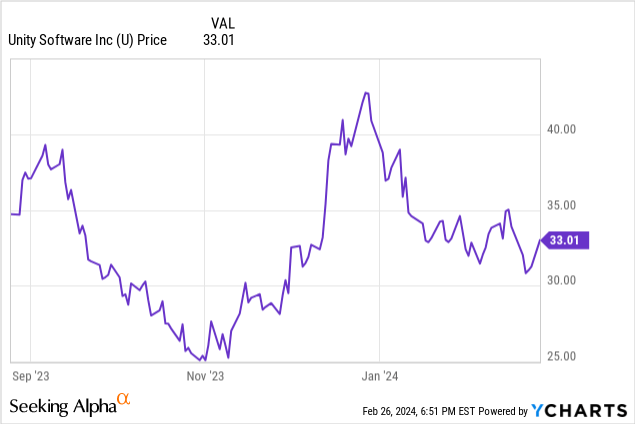

Unity Software Stock Price

U stock briefly levitated higher amidst the most recent tech sector melt-up but has since come back down to earth.

I last covered U in December, where I explained why I was moving to the sidelines. That turned out to be fortuitous timing, as even I did not anticipate the impact of the restructuring to be this significant.

Unity Stock Key Metrics

In this past quarter, U generated $609 million in revenue, representing 35% YoY growth and comfortably surpassing consensus estimates of $560 million. Before investors get too excited, I must note that Unity and Weta mutually decided to terminate their agreement, instead ending up with a perpetual license. That boosted revenue by $99 million. Excluding this one-time arrangement, revenue would have come in at $510 million, representing 13% YoY growth and falling short of consensus.

U saw Create Solutions revenue decline 4% YoY and Grow Solutions revenue comes in roughly flat YoY on a pro-forma basis. Recall that Create Solutions refers to the use of U’s software products, whereas Grow Solutions refers to monetization products.

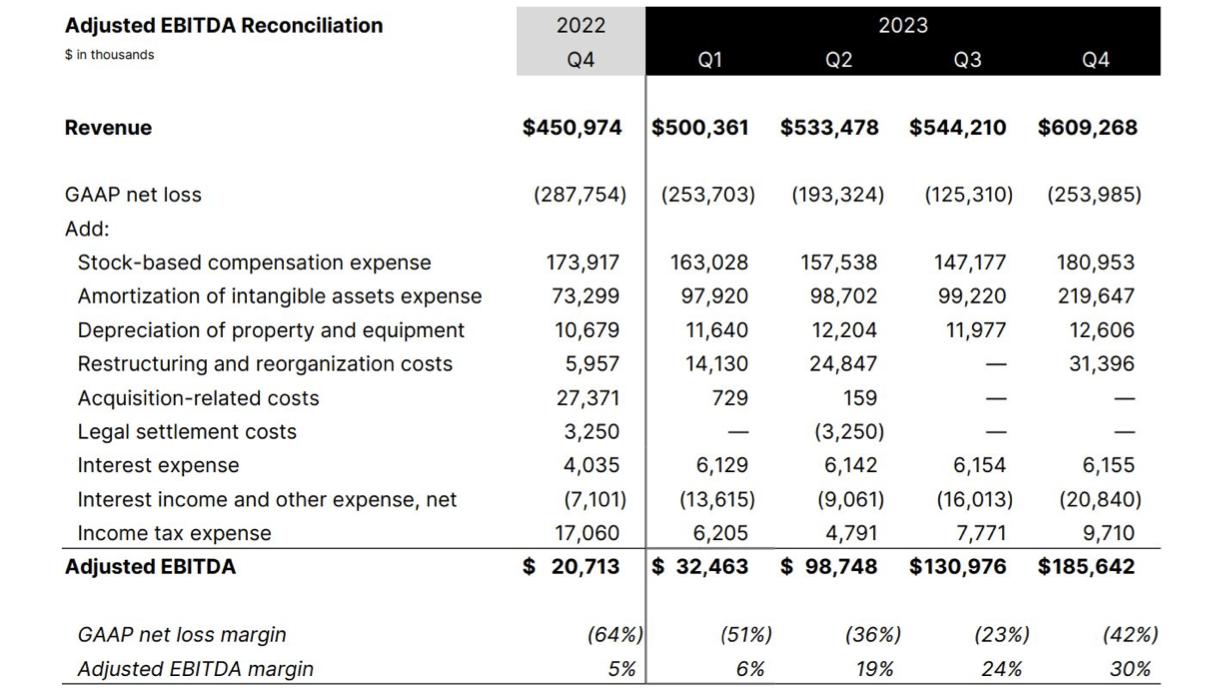

U has engaged in aggressive cost rationalization, including a layoff affecting 25% of the workforce. These actions have helped the company deliver impressive adjusted EBITDA margin expansion.

2023 Q4 Shareholder Letter

It is worth noting that in spite of the company having $1.1 billion in net debt, it still generates positive net interest income due to its convertible notes carrying an average 0.74% interest rate. These notes mature in 2026 and 2027, meaning that U can enjoy this cheap financing for several years longer.

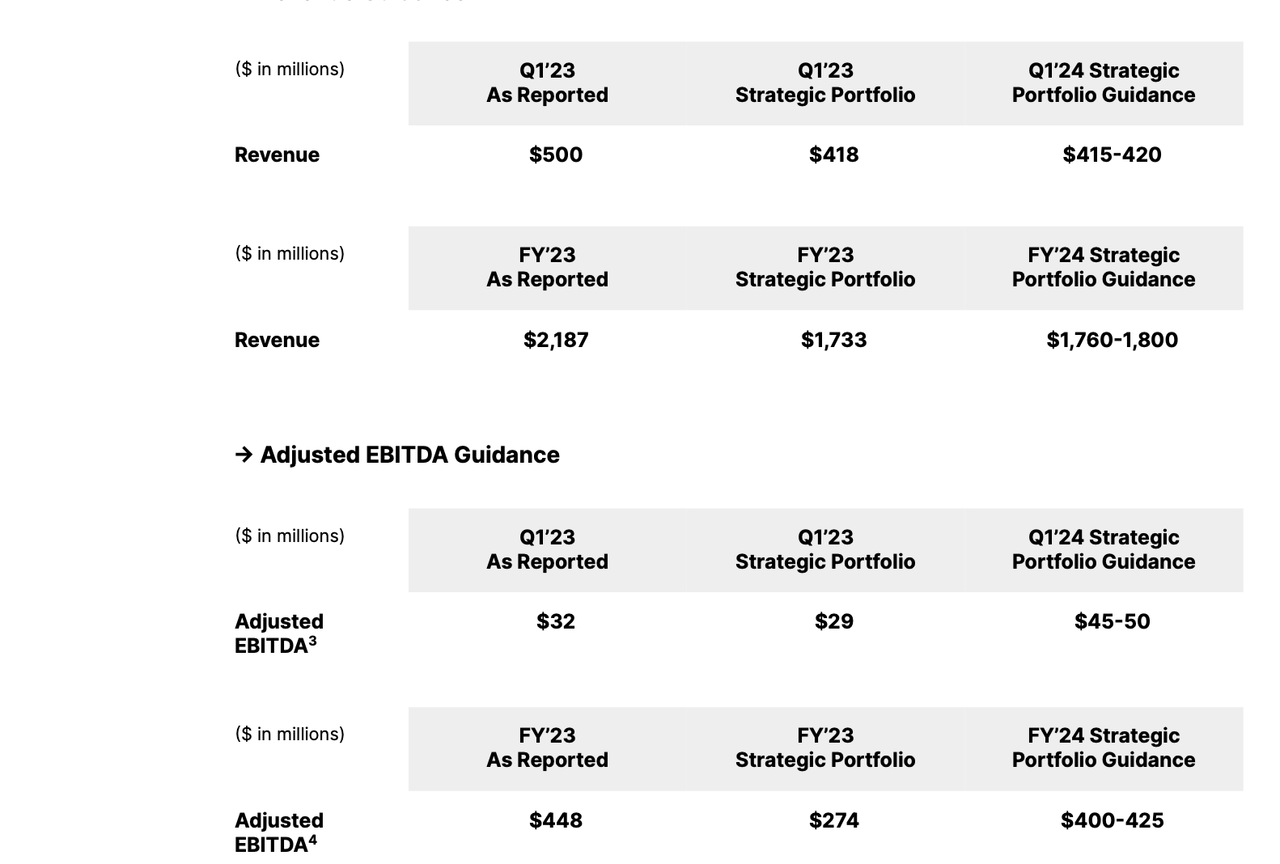

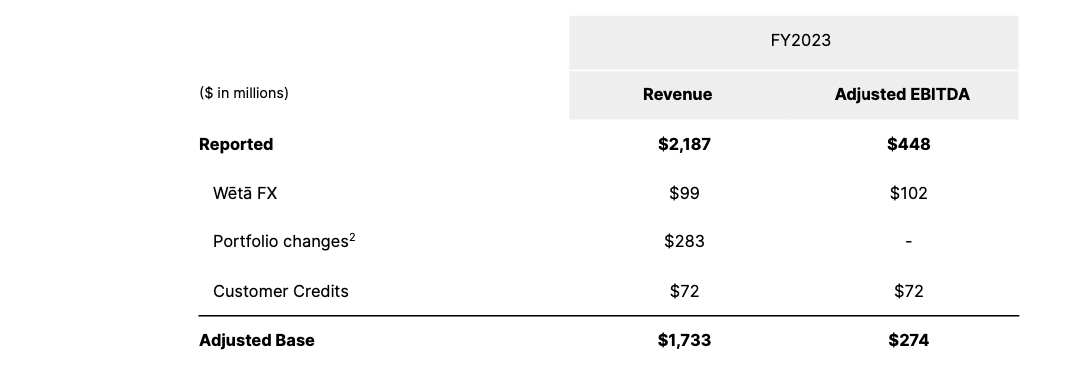

The company generated a $0.09 non-GAAP EPS loss versus projections for positive $0.23 non-GAAP EPS. The real reason why the stock is down (in my opinion) is due to the new “adjusted base,” which refers to the resulting core portfolio following the divestitures of non-core assets. While the company generated $2.2 billion in 2023 revenue, management sees only $1.733 billion as being associated with core operations. The expectation is for non-core operations to generate a minimal amount of revenue exiting 2024.

2023 Q4 Shareholder Letter

Management is guiding for 2024 to see up to 4% YoY revenue growth against that lower number. Management also gave expectations to exit 2024 with adjusted EBITDA margins over 25% and double-digit top-line growth.

While the expectations for sequentially improving fundamentals a positive, investors may have been surprised by the magnitude of the divestiture impact as well as feeling some impatience given that this has been a “show me” story for quite some time now.

Is Unity Stock A Buy, Sell, or Hold?

It bears remembering that U may play a critical role in the newly released Apple Vision Pro (AAPL), as Unity is one of the early supported engines.

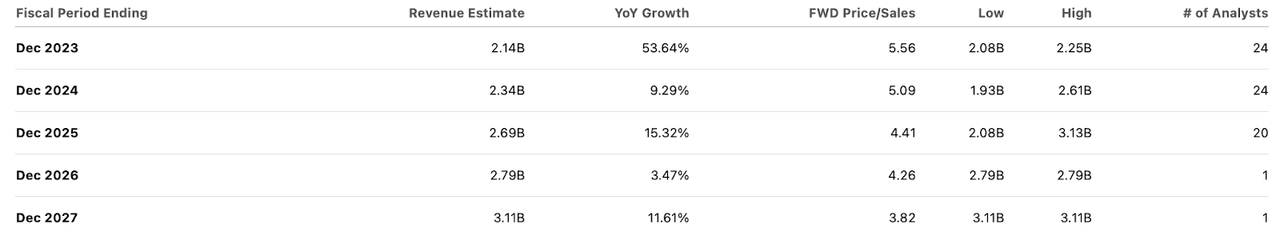

During a period in which it seems like the 2021 tech stock bubble has returned, it is notable that U still trades at “normal” valuations. Yet consensus estimates did not expect this latest set of guidance, as analysts were expecting $2.34 billion in revenue this upcoming year (as compared to $1.8 billion).

The stock’s weak price action heading into the print might indicate that some investors were already predicting this disappointment. Based on the $27 after-hour price, the stock trades at roughly 5.7x 2024e sales. That is still arguably a reasonable valuation, especially given that management has shown a strong committed focus on expanding profitability. Based on 30% long-term net margins, the stock is trading at around 19x long-term earnings. I could see this name trade up to 9x sales if the company can reignite growth to the 15% to 20% level over time, but it is clear that the near term will be messy. The company not only has to work through its restructuring, but it may also need to rebuild developer trust after its runtime fee fiasco.

What are the key risks? It is possible that Unity never reignites top-line growth. While I see great growth prospects if the company can add more monetization levers, its developer base appears to have chosen the Unity platform largely due to the lower fees. This means that any increase in take rates might negatively impact overall growth rates. The company has a leveraged balance sheet and will need to deal with maturing debt within 2 to 3 years. I am hopeful that the company pays down the debt with cash, as a more conservative balance sheet may help to earn a higher valuation multiple, but management has not given indication that this is their intention. It is admittedly easier to invest alongside a “working” investment thesis as opposed to a turnaround story like Unity, though the valuation appears to offer enough reward to justify the risk.

I am upgrading the stock to “buy” given the post-earnings plunge, but would not be surprised to see better entry points over the next week or two as investors fully digest the impact of the lower guidance.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of U either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service "Best of Breed Growth Stocks"

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!