Summary:

- Indonesia Energy has an equity capitalization of $64.7 million, but it only has 5 oil wells.

- Total revenue so far this year is just $2.33 million with an operating loss of $1.92 million.

- Their drilling program has been put on hold for 12 months.

- They are selling additional shares under an ATM deal to raise needed cash.

200mm/E+ via Getty Images

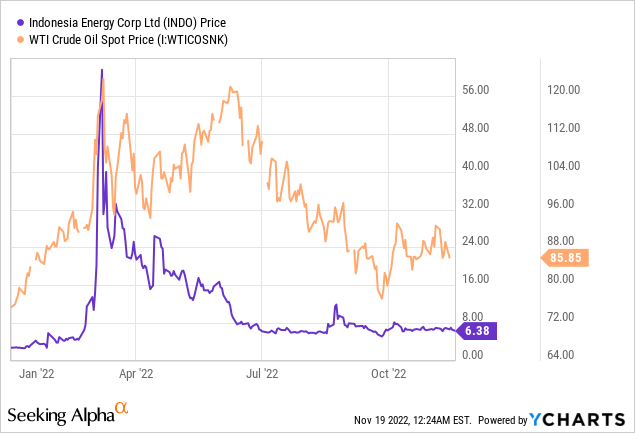

Indonesia Energy’s (NYSE:INDO) stock price has dropped about 65% since my article last May, but it is still way too high relative to their operations. The current equity capitalization is $64.7 million, which is completely irrational since they only have 5 low producing oil wells that generated $2.33 million in revenue for the first six months of this year and an operating loss of $1.92 million. They will need to continue to sell new stock in order to raise cash to cover their negative cash flow going forward. This is an update to my May article.

Update on Balance Sheet Activity

L1 Capital

First, I need to remind readers that Indonesia Energy Corp. Ltd. (Cayman Islands) is a foreign company that is not subject to normal SEC filings. Their disclosures are, therefore, very limited. As I covered in my prior article L1 Capital provided financing earlier this year via a convertible note. As of June 30, L1 Capital converted $9.6 million of the $10 million note in INDO stock at $6 per share. On August 18 they converted an additional $300,000 and exercised 185,000 warrants at $6 per share. On August 29 they exercised an additional 90,000 warrants. The company received a total $1.65 million cash via the warrants being exercised.

It is unclear if L1 Capital has sold any INDO shares because L1 Capital Global Opportunities Fund is a foreign hedge fund that does not report their holdings to the SEC. An amended F-1 was filed on May 20 and a prospectus was filed on June 2 covering the potential selling of the shares from converting the note and exercising the 767,240 warrants.

New INDO Stock Sales

Because of their distressed financial condition, they really can’t get conventional bank financing, so they are raising needed cash from selling additional INDO shares under a July 22 ATM with H.C. Wainwright to sell up to $20 million in new stock. On August 25 they sold 177,763 shares at $10.7407 and an additional 280,612 shares at $10.109. These sales brought in $4.55 million cash. Since these sales actually increased the book value per share, they really did not dilute the other current INDO shareholders. Collectively these ATM sales and the actions by L1 Capital have resulted in increasing the total number of INDO shares outstanding to 10,142,694 based on my calculations.

On September 19 they paid their $980,452 overdraft. This bank loan is unconventional in that it required INDO to have a $1.0 million deposit securing the overdraft. This is something similar to a secured credit card where a customer deposits a certain amount and then gets a credit line for the same amount. As of September 15, they had $7.87 million unrestricted cash. (See further below regarding future cash issues.)

Six Months Financial Results

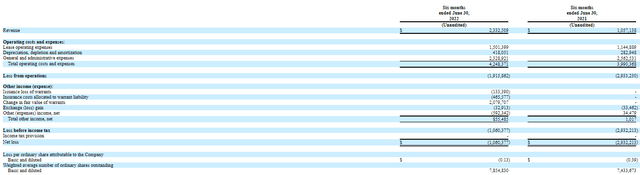

Since oil prices have been very high for much of the first six months of this year, their financial results for the first six months are very disappointing. As I covered in my prior article their executive pay is outrageous compared to revenue and actual oil operations. We don’t have the latest number on executive pay for 2022, but in 2021 the top executives’ pay was 41% of total 2021 revenue. We also don’t have actual oil production numbers.

The operating loss of $1.92 million is actually the key metric. The final bottom line numbers are significantly impacted by various warrant items that do not really reflect operations and are just bookkeeping items, in my opinion.

Six Months Income Statements 2022 and 2021

Six Months Income Statement 2022 and 2021 (sec.gov)

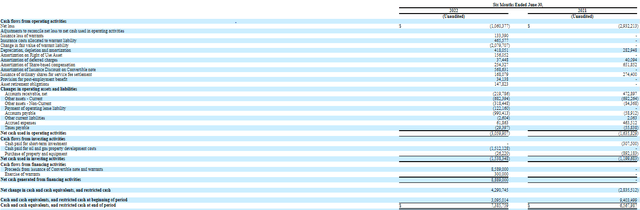

INDO burned $3.06 million cash from operations during the first six months. They used $1.512 million to drill two new wells and most of the other cash was used to pay overhead, especially executive pay. I assume that there were additional well drilling expenditures after June 30 because Kruh 28 drilling was not completed until September.

Cash Flow 2022 and 2021

Cash Flow (sec.gov)

Drilling Update

Management keeps kicking the can down the road regarding their drilling program. In March 2021 they announced a program to drill 18 wells – 5 in 2021, 6 in 2022, and 7 in 2023. According to their October 20 press release they now expect the 18 new well drilling program will be completed by the end of 2025. They also announced that they are planning some seismic testing, which is expected to last 12 months. After this testing is completed, they are then planning to restart the drilling. Earlier this year they stated they plan to start drilling another Kruh well in June – July, but it that never happened. I feel very comfortable about these changes. Is there the potential for more oil or is this a delaying tactic to avoid a reality check? (I have been investing in Indonesia for decades and I have learned to be very cautious about statements from management. Their rules/regulations are not as strict as in the U.S.)

They finally finished Kruh 28 on September 16 at a depth of 3475 feet. They did discover oil and stated they expect product to start by the end of November. They also claim they “found evidence of a potential natural gas bearing reservoir”. There was no mention if this could be economically productive natural gas production or just some nominal amount. The money spent of the two Kruh wells drilled this year as of June 30 was $1.512 million. I am “guesstimating” that they spent about another $500,000 to finish Kruh 28, which implies about $1.0 million to drill a well in that field.

They have never actually stated production numbers and only stated “as previously disclosed, wells drilled that average production of 100 barrels of oil per day over the first year of production…” and continued on about covering costs of drilling. They never stated that their wells actually average 100 barrels per day. I also have not been able to find any updated information about Kruh 25 that was damaged by flooding. Using $60 as an average oil price, their six months total revenue figure would imply an average of 215 barrels of oil per day total production and using $80 the implied average would be 161.

Since they have very limited disclosure in their filings, it seems that Kruh 26 and Kruh 27 are currently producing, but no metrics have been given. As can be seen from the income statements, they are not even close to breakeven based on current production. Some other Indonesian oil companies do report proved (P1), probable (P2), and potential (P3) reserve numbers. I assume that INDO can’t afford to pay for professionals to estimate these figures.

Future Cash Needs

If the stock price remains significantly over $6 per share to make the exercise of the remaining 442,240 warrants at $6 profitable, they should raise an additional $2.65 million cash. Plus, there is $15.45 million potential cash, before the sales agent commission, from selling shares under the ATM deal. This cash should be sufficient to cover negative cash flow from operations in 2022 and 2023, especially if they do not restart their drilling program until 4Q 2023. If they launch a major drilling operation in 2024 that is when they may have a cash problem trying to finance those wells.

If INDO stock traders finally become rational and the stock price drops, then they will not get cash from the warrants and selling additional shares under the ATM could depress the stock price even more. Unless management is willing to sell additional shares at very low prices, they could face a cash problem late in 2023. In addition, it is expected they will also continue to report losses going forward. At this point I just do not see when they will ever report any actual earnings and if they do, it will be just a token amount per share given their already large number of shares outstanding that is expected to continue to increase.

Comparing INDO to Another Indonesian Oil Company

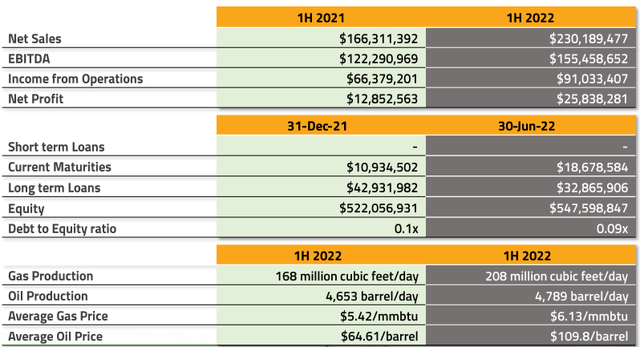

There is a small Indonesian oil & gas company, Energi Mega Persada Tbk PT (ENGR.JK), that is an interesting comparison to INDO. ENGR currently has an equity capitalization of about $531 million, which is about 8x INDO’s $64.7 million. (ENGR last trade was 338 Rupiah on the Jakarta Stock Exchange.) Look at their first six months financials below.

Energi Mega Persada Six Months Financial Data 2022 and 2021

ENGR 6 Months Financials 2022 and 2021 (www.emp.id)

ENGR is an established oil and gas company that had an average production of 4,789 barrels of oil per day and 208 million cubic feet of natural gas per day in 2022. Readers can compare the various metrics between these two companies and see that INDO’s equity capitalization should be much less than 1/8 the amount of ENGR. I would compare revenue and equity capitalization. ENGR’s six months revenue of $230.2 million is almost 100x INDO’s revenue of $2.33 million. Would the appropriate equity pricing mean that INDO should be 1/100 of the $531 million? This $5.31 million would mean that INDO stock should sell at about $0.52 per share instead of $6.38.

Trading in Indonesia also is sometimes very irrational, but eventually the market again fairly values a company. ENGR traded over 11,000 Rupiah about 15 years ago, but the world’s Great Recession of 2008-2009 brought the stock back to earth. I expect reality will also eventually hit INDO stock trading.

Conclusion

The reality is that Indonesia Energy is still significantly overpriced even after dropping sharply since my May “sell” article. They only have very limited current oil production and since they have put their drilling program on hold for 12 months, it is unlikely production will increase significantly anytime over the next couple of years. The company has been able to take advantage of irrational meme trading to raise needed cash from selling additional shares at high prices and being able to raise cash via a convertible note since they can’t get conventional bank financing.

I consider INDO a “sell”, but because the borrowing rate is often over 150%, I would not consider it a short sale idea.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I often trade ENGR.IJ, but I currently have no positions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.