Summary:

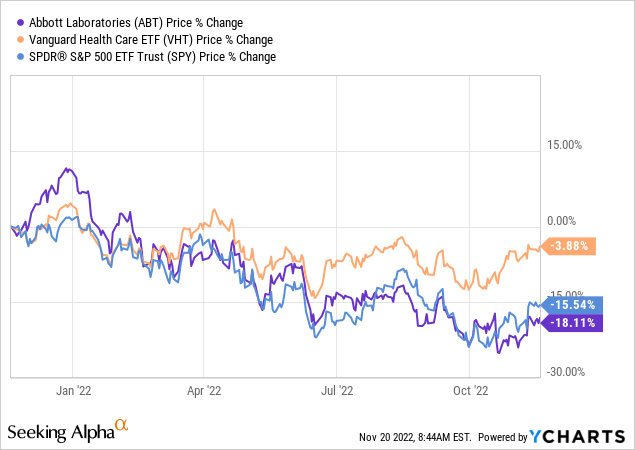

- The stock of Abbott Labs is down 18%+ over the past 12 months and has significantly underperformed the broad healthcare sector.

- This is likely not what investors expected – typically a healthcare stock like Abbott would outperform during an inflationary bear market.

- While Covid-19 test sales were a boon for the company last year, its medical devices segment and non-Covid-19 related diagnostics suffered as a result of the pandemic.

- Bottom line: Abbott appears poised for lower revenue & earnings next year while the current 1.81% yield is less than compelling given the two-year Treasury yield is currently 4.5%.

Sundry Photography

The stock of Abbott Labs (NYSE:ABT) had a long and very impressive run – that is, until it got mauled by the 2022 bear market (see graphic below). The stock peaked at the beginning of the year and YTD it is down 25% and has significantly under-performed the broad healthcare sector as represented by the Vanguard Health Care ETF (VHT), and also even the broad S&P500. That’s not what investors likely expected from the company, but given the fundamental backdrop, the stock’s decline appears to be perfectly rational. Today, I’ll explain why that is, and take a look at Abbott’s prospects moving forward.

Investment Thesis

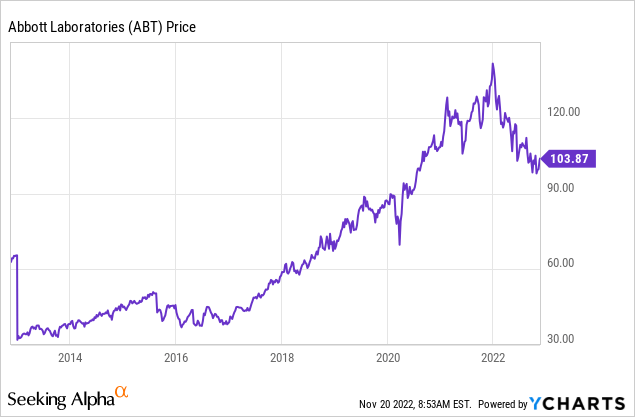

As previously mentioned, Abbott’s stock had a very strong run for years (see the long-term chart below). The company operates a diversified healthcare portfolio that includes diagnostics, nutritional care, generic drugs, and medical devices and generates strong free-cash-flow. Abbott’s strong balance sheet and consistent investment in R&D have led to a relatively low-risk growth opportunity for investors. Then the global pandemic hit.

Short-term, the pandemic was great for ABT, which saw Covid-19 test sales surge, driving revenue gains of 24% last year. Unfortunately, those sales will drop-off dramatically this year (~$5+ billion), and the pandemic’s negative impact on Abbott’s relatively high-growth medical devices segment and non-Covid related diagnostics have not been able to overcome that downdraft.

Going Forward

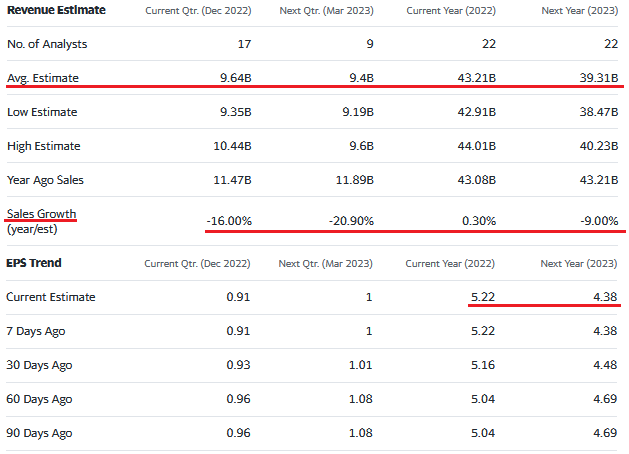

As a result of this fundamental backdrop, FY2023 revenue and earnings are expected to drop and have even been trending even lower of late:

Yahoo Finance

As can be seen from the graphic, FY2023 revenue is expected to fall 9% yoy while earnings are expected to be only $4.38/share, down 16% as compared to FY22 estimates. The stock closed at $103.87 on Friday, giving it an above market multiple of 23.7x. Given the relatively low 1.81% current yield, at this point ABT is a rather uncompelling investment in my opinion.

Indeed, the company’s recent Q3 results were a “beat” despite revenue falling 4.8% yoy and guidance for a rapid fall-off in Covid-19 testing revenue (to only $0.5 billion in Q4). That said, the mid-point of FY22 EPS guidance was raised to $5.20 from the previous $4.90.

However, over the longer-term ABT is likely to competently navigate the current environment and return to its previous growth trajectory driven by its historically innovative pipeline – which currently includes the Freestyle Libre 3 (U.S. sales rose 40% in Q3) one piece applicator in the company’s strong Diabetes Care medical device business, and expected new structural heart devices – of which ABT should benefit from the addition of the St. Jude portfolio of cardiac devices.

Risks

Risks include a slower than expected comeback in medical device procedures and an even faster and greater than expected downdraft in Covid-19 testing demand. In addition, investors should be concerned that the recent baby formula production problems at its Sturgis plant have been solved, once and for all, and will not resurface in the future (not ABT has announced plans for a new nutritional manufacturing facility at an unnamed location). In addition, ABT faces a relatively strong headwind due to the strength of the U.S. dollar and the company’s exposure to foreign exchange headwinds.

Upside risks include potentially better performance from its branded generic drug business which should benefit from strong growth in emerging markets (foreign sales of Established Pharmaceuticals grew 12% organically in Q3).

Summary & Conclusion

Abbott Labs currently finds itself in a rather precarious position in my opinion. The company faces multiple headwinds that will contract revenue and earnings in the coming year, yet the stock is still trading at a relative premium to the market. If I owned ABT, I would HOLD it. But I wouldn’t be a buyer here, and would wait for pull-back to $90, at which point the company would trade with a forward P/E of 20.5x, which is more reasonable considering the expected contraction in revenue and EPS next year.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am an electronics engineer, not a CFA. The information and data presented in this article were obtained from company documents and/or sources believed to be reliable, but have not been independently verified. Therefore, the author cannot guarantee their accuracy. Please do your own research and contact a qualified investment advisor. I am not responsible for the investment decisions you make.