Summary:

- The effective Indonesia Energy’s equity capitalization is over $150 million compared to only $2.45 million revenue in 2021.

- A major portion of their annual revenue is used just to pay their top executives.

- They had a loss of $6 million in 2021 and continue to burn cash.

- A large shareholder is trying to sell shares.

- This is another example of irrational meme trading.

ErikdeGraaf/iStock via Getty Images

Indonesia Energy Corp Ltd. (NYSE:INDO) is a tiny Indonesian oil company that got the attention of meme investors earlier this year as oil prices soared. Buyers of this stock clearly didn’t actually do any research before buying and were only looking at it as a vehicle to trade oil prices. At the yearly high in March, their total capitalization was $665 million and that does not even factor in shares potentially used for debt payments, compared to a loss of over $6.0 million on only $2.45 million revenue in 2021.

Irrational Trading

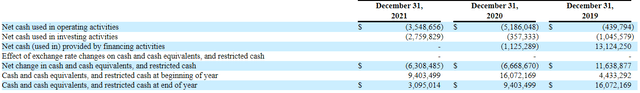

As oil prices surged in March, traders started buying any and all oil companies. As the price on Indonesia Energy’s stock rose some traders started shorting the stock. Because insiders own most of the stock, there is very little float and borrowing shares became a serious problem, which caused a short squeeze.

INDO Stock Price and WTI Oil Spot Price Year-to-Date

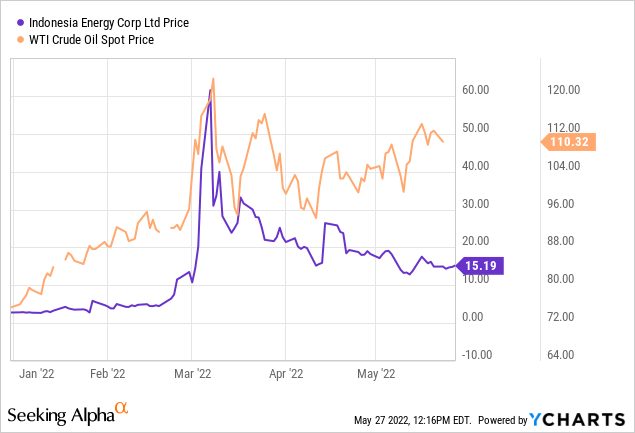

Corporate Business Structure

Indonesia Energy Corp is actually incorporated in the Cayman Islands, which owns another company in Hong Kong and that entity owns a number of different Indonesian oil companies. Being incorporated in the Cayman Islands is not really a problem, but given the increased issues in China, the Hong Kong ownership could become a future issue.

Ownership Structure

Business Ownership Structure (sec.gov)

Because it is a foreign company they are not required to make many SEC filings that investors often use when analyzing companies. For example, they are not required to file Section 16 insider trades and holdings with the SEC. When they have made required filings there have been issues with some of those filings. Their original IPO filing in November 2018, for example, did not become effective until late December 2019 because of many, many amendments required by the SEC.

Then there is the issue of Indonesia. I have been trading in Indonesia since the late 1990’s and I have become used to some rather unusual issues associated with investing in that country. Even in Indonesia Energy’s 20-F risk disclosure discussion they mentioned:

“We operate in Indonesia, which is a jurisdiction known to be challenged by corruption. As such, we are subject, however, to the risk that we, our affiliated entities or our or their respective officers, directors, employees and agents may take action determined to be in violation of such anti-corruption laws.”

So it looks like they are even admitting their officers might get into trouble. Indonesia Energy in their investor presentation noted in the biography of one of their directors that he “holds the Certified Anti Money Laundering Specialist (CAMS-ACAMS) credential”. Evidently they assumed that this was important for investors to know. A number of years ago for a different Indonesian company in their discussion of results mentioned that their margins were squeezed in that period because of much higher “consulting fee” payments.

Their IPO was on December 23, 2019 at $11.00 per share for 1,363,637 shares, which raised a gross amount of $15 million. They originally wanted to raise $23 million. There are currently 7,647,788 shares outstanding. MADERIC Holdings Ltd owns 68.27% of the stock and Indonesia Energy’s CEO Dr. Wirawan Jusuf controls MADERIC. Another insider, HFO Investment Group, owns 4.42%, which is down from 5.85% after they sold some shares right after the meme stock price surge.

Oil Operations

First, Indonesia Energy does not own their oil or even the oil reserves. The oil is owned by the Indonesian government. They are just operators that explore and produce oil. All their oil is delivered via a pipeline to the Plaju refinery, which is owned by Pertamina – a government owned oil company. The government also sets the prices.

Their contract with Pertamina for Kruh Block, which is their producing operations, was changed effective May 2020 to a KSO – Kerja Sama Operasi (Joint Operation Partnership) from a different contract type (Technical Assistance Contract). The reported income statements, therefore, before May 2020 can’t really be compared because the terms are so different. I have not been able to get an actual copy of the agreement, but there seems to be a baseline non-shareable amount that decreases as a well ages that is solely for Pertamina and only the amount over that is split. Their average revenue per barrel in 2021, based on their income statement and disclosed production numbers, was $40.05, which compares to the average Indonesia Oil price in 2021 of $67.02. It would seem that this would imply a total effective split of about 59.8%, which I assume factors in the non-shareable amount.

Their KSO is for only 10 years. I often read that many KSOs are for 20 years. I am not sure if there is an issue here or not, but these can be renegotiated with Pertamina. Anytime there are negotiations with the Indonesian government, directly and indirectly, there are potential “issues”, in my opinion based on my experiences investing in the country.

Indonesia Energy also has a contract for a different field, Citarum Block. This is under a PSA (Production Sharing Contract) with the government that goes until 2048, but there are a number of conditions that require continued expenditures on exploration. Currently they have no wells/production in this field.

They only have 5 producing oil wells. In their 2020 20-K filed in June 2020, they stated they planned to drill 11 wells in 2021. That never happened. Their oil production in 2021 decreased to 60,637 bbl from 72,524 bbl in 2020. One of the two wells they are planning on drilling this year did encounter oil sands according to a May 11 press release. There is some tables in a filing that indicated they were planning on drilling 4 wells in 2022, but I do not see where they would get the cash to drill a total of 4. The problem is this field is old and oil production drops quickly after the first month’s production and therefore, does not generate a lot of cash flow over a long period of time.

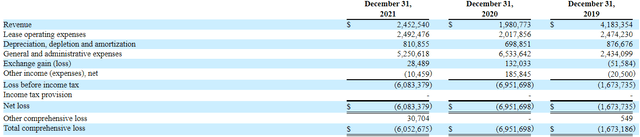

Income Statements

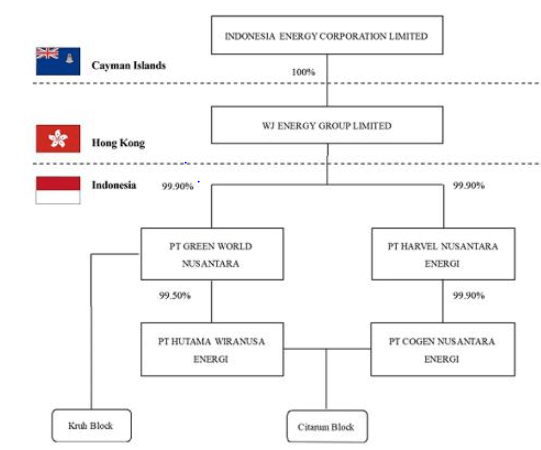

Given the INDO stock price and total market capitalization, their income statements are shocking, in my opinion. They are also burning cash. At the end of 2019 they had over $16 million cash, but according to their recent 20-F, they had only $1.91 million cash as of April 26, 2022 and this even after raising new money earlier this year (see below) and much higher oil prices.

Income Statements

Annual Cash Flow

A major red flag, in my opinion, is that the top executives’ pay collectively in 2021 was 41% of revenue, which was actually an improvement from 75% in 2020. What does the CEO do to be paid $297,000? The chief investment officer (he is not the CFO – that is a different person) gets paid $240,000. Where are Indonesia Energy’s “investments”? This is in Indonesia where the cost of living is much cheaper than the U.S., which makes these payments even more shocking. They only have 5 wells and their drilling and exploration activities are tiny.

Dilution Problem

There is some confusion over a pending F-1 registration to sell up to 9,100,574 shares. At first glance one would think that Indonesia Energy is trying to raise about $135 million using the latest INDO stock price. Wrong! None of the proceeds from the sale of INDO shares would go to the company. This registration would enable a shareholder to sell their shares.

The number of shares is also confusing. The number is “up to” 9,100,574. L1 Capital, a Miami Beach based fund, wants to be able to sell INDO shares that they will receive over the next 14 months from multiple financing deals earlier this year and to sell shares from 767,240 warrants. The loans are being paid back by either cash or stock. Since Indonesia Energy does not have the cash, it is expected INDO stock will be used to back the $10 million loans. The value of the stock is the lessor of $6 per share or 90% of the stock price, subject to a $1.20 floor. So the lower the stock price, the more shares will be used to pay off the loans.

In theory, they could get up to 8,333,334 shares for their loans, assuming the $1.20 minimum value per share. Since INDO is trading around $15, it would currently seem that they would get 1,666,667 shares using the $6 per share figure. In addition, L1 Capital would get 767,240 INDO shares for their warrants. This totals to be 2,433,907 shares worth $36.5 million using the latest INDO price of $15. That is a very nice profit on a $10 million financing deal. This would create significant dilution for the current 7,647,788 shares outstanding, but converting the warrants at $6 per share would raise about $4.6 million for the company.

This sale of these INDO shares could result in a total of more 10 million shares outstanding, which would have a $150 million capitalization using the latest trading price. This compares to only $2.45 million in total revenue in 2021. This begs the question about what happened to efficient markets?

Conclusion

I looked at Indonesia Energy as a possible oil investment over the years, but their payments to their executives was a red flag. It seems they exist just for a select group of executives, in my opinion. I understand that Indonesian businesses have their own set of standards that are different than in the US and I understand that “consulting fees” are frequently paid to get things done. I do not, however, see how they can drill enough new wells to justify the current stock price. I also question where they would get the cash to finance these drilling projects.

I think that just buying an oil stock because of the expectation of higher oil prices without actually doing some basic due diligence is completely irrational. While meme traders don’t care, real investors should care. I rate Indonesia Energy a sell, but because of the very small float I would not consider selling short.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.