Ambarella: Not Ready To Roll, Just Yet

Summary:

- Ambarella cut guidance for current quarter revenues by a sizable amount due to supply chain issues.

- The chip company continues to have a large order book in the auto tech sector.

- The stock isn’t exceptionally cheap at 7x FY24 sales, but the auto tech market potential makes Ambarella a buy.

Sundry Photography/iStock Editorial via Getty Images

While Ambarella (NASDAQ:AMBA) was ready to roll last quarter, the Chinese covid lockdowns further dented supplies and demand. The computer vision company still has a massive auto order book warranting investor interest as the stock dips. My investment thesis remains Bullish on the stock, but the summer months will remain rocky due to supply chain issues and extended auto tech orders.

Focus On Auto Tech

Ambarella reported decent enough FQ1’23 results with revenue squeezing past targets and EPS easily beating estimates by $0.07. The fear heading into the FQ2’23 guidance was a rather predictable slowdown considering the company has a huge China connection with a large employee base located in Asia (focused on China) and 15% of customer demand from China.

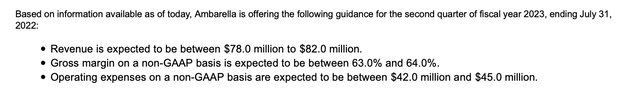

The company didn’t disappoint in this regards with guidance for the July quarter substantially below expectations. The market expected flat revenues in the quarter at $91.6 million, but Ambarella guided to revenues of only $80.0 million at the midpoint.

Source: Ambarella FQ1’23 earnings report

The chip company guided down to a massive sequential decline of $11.4 million in a traditionally strong period. The April quarter is traditionally the low revenue quarter in the cycle after a big holiday season with a traditional business focus on consumer IoT products.

On the FQ2’23 earnings call, CEO Fermi Wang had the following to say about the covid disruptions in the last quarter impacting forward exceptions:

During Q1, the pandemic flared-up in China and the resulting lockdown disrupted customer production schedules and orders placed on us, as well as logistics in the greater Asia supply-chain. A majority of our customers’ products are manufactured in this region and subject to impacts from China related supply-chain disruptions. We are seeing a similar degree of impact across both our automotive and IoT businesses, further complicating the pre-existing kitting issues we have discussed before.

While the numbers are disappointing, the Chinese lockdowns are the problem and only impact short term results. Ambarella didn’t provide any update on the auto tech back log, but the company previously guided to a massive back log of $700 million with another pipeline of up to $1.1 billion. In addition, the computer vision chip expects to reach 45% of total revenue this year setting up Ambarella for a material run to a higher revenue base in future years.

Ambarella has several deals with OEMs ramping up providing in-cabin monitoring systems. The auto sector offers new opportunities where Ambarella sells chips with ASPs 5x to 20x current chips that go into cameras for viewing. The new computer vision chips sense, collect data, then make decisions providing a much more valuable product to customers.

The automotive sector was 25% of revenues in the April quarter. Ambarella only has an auto tech business producing $22 million in quarterly revenues. One of the big keys to the future size of the business is whether the company can keep an IoT business with $250 to $300 million in annual sales and stack the auto business on top of this sector.

Slow Ramp, But Big Ramp

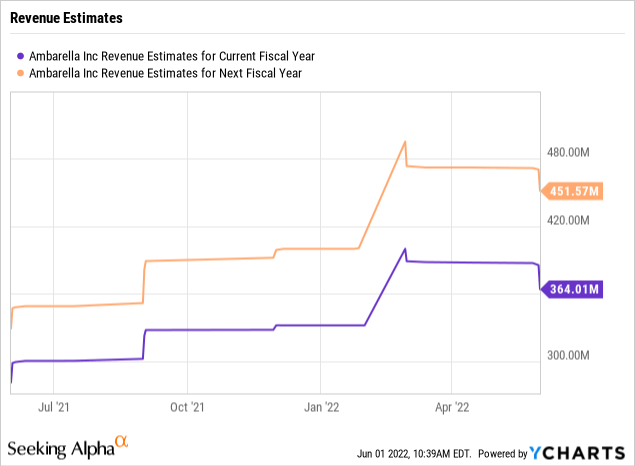

The supply chain issues are hurting a lot of customer demand, especially in the auto sector where vehicles just can’t be produced. Even with the guidance cut for the current quarter, the revenue target for the year is $364 million. The FY24 revenue target is up at $452 million for 24% growth next year.

The numbers appear conservative based on the opportunity in the auto sector, but a lot of the major contracts could end up generating revenues in 2024 and beyond with L3 and L4 autonomous programs launches requiring the higher value CV chips from Ambarella.

The stock still has a market cap of $3.3 billion highlighting how Ambarella got caught up in the tech craze early this year when the stock topped $225. The stock still trades at 7x FY24 (2023 year) revenues. The chip company definitely needs to start hitting revenue targets along with growing the auto tech order book to justify these valuations in the current environment. Ultimately, the market will love the story of profitable growth in the auto tech sector with Ambarella still generating an impressive $34 million in operating cash flows in the last quarter.

Takeaway

The key investor takeaway is that Ambarella isn’t exceptionally cheap in the current market climate. Regardless, the chip company is ready to roll with a growing auto tech order book.

Investors should buy the stock on weakness knowing Ambarella would trade volatile over the next months and quarters until the auto tech order book leads to growing revenues.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market during 2022, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.