Summary:

- Verizon’s long-term recovery remains constructive, with VZ surging higher and revisiting levels seen in July 2022.

- Verizon’s consumer wireless segment is expected to perform well in 2024, barring an economic recession.

- Verizon’s CapEx cadence has likely bottomed out, sustaining improved free cash flow generation.

- I explain why VZ’s rally seems far from over, supported by a cheap valuation and attractive forward dividend yield.

- With VZ consolidating at the $40 level, buyers should consider buying before it potentially surges higher.

hapabapa

I encouraged Verizon Communications Inc. (NYSE:VZ) investors in December 2023 to continue holding on to their shares even as I downgraded VZ to a Hold after it delivered a sharp recovery. I assessed that the long-term recovery in VZ seems to remain constructive, although I preferred a more attractive entry point. VZ has continued to surge higher, slightly trailing the S&P 500 (SPX) (SPY) since my December update. However, I believe VZ investors who hung on to their positions are likely satisfied, as it last revisited levels seen in July 2022. As a result, I think it is clear why investors who leveled bearish bets on VZ at its late 2023 lows have likely realized their mistakes as VZ reached peak pessimism.

Verizon posted its fourth-quarter earnings release in late January 2024. The market was likely pleasantly surprised with its wireless segment performance. Accordingly, Verizon posted wireless service revenue of $76.7B, up 3.2% YoY. Its FWA momentum has remained robust, delivering a full-year growth of more than 31% in net adds. As a result, Verizon’s consumer growth has shown promise as it launched its myPlan offering, bolstering its premium offerings.

Accordingly, Verizon achieved a subscriber base of more than 3M in FWA subscriptions, and it is on track for Verizon’s 2025 target of 4.5M subscribers at the midpoint. Verizon management emphasized at a recent conference, articulating the confidence of its recent recovery. Verizon believes its infrastructure can still support long-term growth ahead of the 4.5M midpoint target it telegraphed as it looks to scale up.

With the leading telco players rationalizing their spending, I believe it should lessen the competitive intensity. As a result, Verizon’s CapEx cadence has likely bottomed out in 2023, as management articulated a lower CapEx outlook of between $17B and $17.5B in 2024. It’s a marked reduction from 2023’s $18.8B in CapEx spend and well below 2022’s $23.1B CapEx metric. As a result, it should provide more confidence for Verizon to focus more on shareholder accretive capital allocation priorities as cash outflow needs are mitigated. Verizon management also highlighted that the company will continue to focus on deleveraging in 2024 as it looks to lower its leverage ratio toward Verizon’s long-term model of between 1.75x and 2x.

With the Fed expected to lower interest rates three times in 2024, I believe the market has justifiably lifted VZ’s valuation multiple in anticipation of less intense debt headwinds. Furthermore, the company’s focus on premium customers should further boost its ARPU, helping to lower the impact of its pricing actions on unexpected churn. Verizon didn’t highlight significant challenges in 2024, although its consumer wireless revenue growth is expected to slow. Accordingly, Verizon guided to a growth range of between 2% and 3.5%, down from last year’s 3% full-year increase. As a result, we shouldn’t expect a significant downturn in consumer spending in 2024, barring an economic recession (which isn’t my base case).

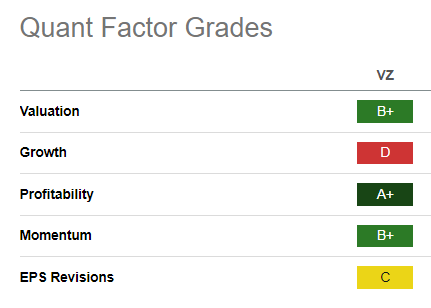

VZ Quant Grades (Seeking Alpha)

Notwithstanding its surge from VZ’s 2023 lows, the stock isn’t aggressively valued relative to its sector peers. Seeking Alpha Quant assigned VZ a “B+” valuation grade, while it’s supported by a fundamentally robust business model (“A+” profitability grade).

Its improved buying momentum “B+” corroborates my conviction that the worst selling downside in VZ is likely over. Therefore, I believe significant pullbacks in VZ should be assessed for dip-buying opportunities to gain more exposure.

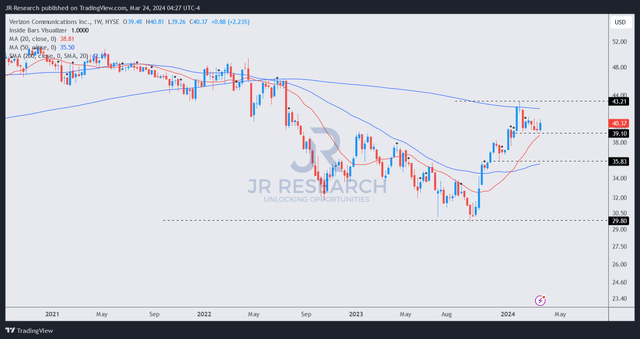

VZ price chart (weekly, medium-term, adjusted for dividends) (TradingView)

VZ is still valued at a forward dividend yield of 6.7%, well above its 10Y average of 5%. Therefore, given the battering it received in 2022-23, the market has not fully re-rated VZ’s multiples.

Notwithstanding the market’s caution, I gleaned that VZ has regained its medium-term bullish bias, as seen above. Therefore, it’s essential to consider that VZ’s bearish momentum has already turned around, allowing buyers to pick their spots.

I assessed near-term resistance at the $44 level. However, buying sentiments have remained robust, helping VZ to consolidate constructively at the $40 level. With VZ likely gaining favor from income investors looking to partake in its recovery, I assessed its fundamentally strong thesis should also attract value investors to capitalize on its upside potential. Therefore, VZ’s improving momentum appears to have robust support from buyers, with the $44 level expected to be breached after its current consolidation.

Rating: Upgrade to Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!