Summary:

- Apple Inc. is facing an antitrust lawsuit from the US DOJ that could damage its business fundamentals and create negative sentiment toward AAPL.

- From a technical perspective, Apple is already in a correction, and the selloff could become much uglier due to litigation overhang.

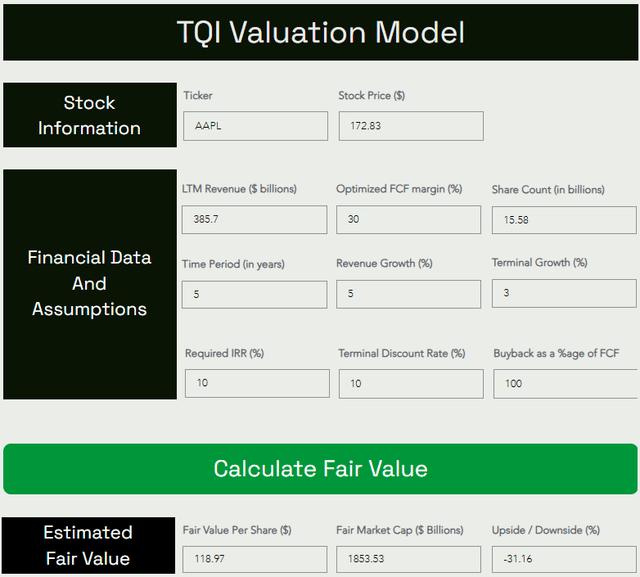

- With little to no top line growth, Apple’s trading multiple of ~26x forward P/E continues to look excessive. And our Valuation Model suggests an overvaluation of ~30-35%.

Justin Sullivan

Intro: Apple Caught In Antitrust Crosshairs

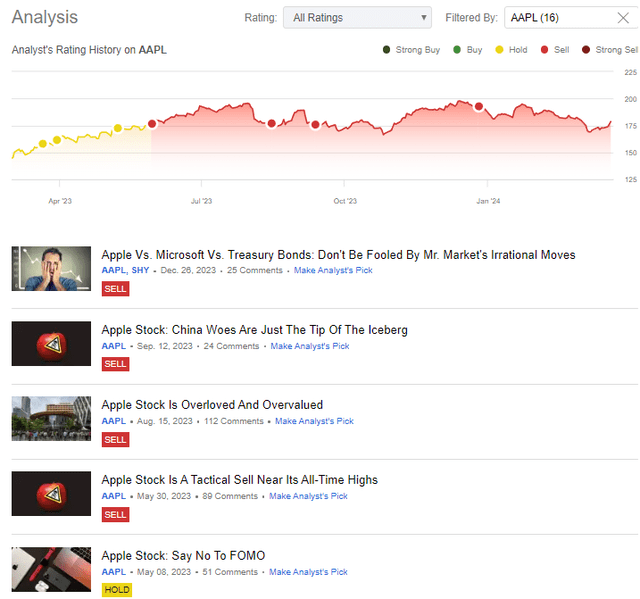

Since mid-2023, I have published multiple “Sell” ratings on Apple (NASDAQ:AAPL), but to be fair, the US Department of Justice (and 16 states) bringing an antitrust lawsuit against the big tech giant wasn’t even on my list of concerns.

Author’s Coverage of Apple (Seeking Alpha)

Author’s Coverage of Apple (Seeking Alpha)

Given that the Cupertino tech behemoth is struggling to achieve top line growth and apparently getting left behind in the AI gold rush, the timing of this antitrust lawsuit (complaint here) couldn’t have been worse. While the DOJ will likely fail to prove Apple has a smartphone monopoly in court, the ordeal will create further negative sentiment towards the stock – think Microsoft (MSFT) of the early 2000s. On the other hand, if the lawsuit succeeds, Apple is in for significant fundamental damage due to the wide breadth of this antitrust case.

And don’t take my word for it – this is coming directly from Apple:

This lawsuit threatens who we are and the principles that set Apple products apart in fiercely competitive markets. If successful, it would hinder our ability to create the kind of technology people expect from Apple—where hardware, software, and services intersect.

Source: Seeking Alpha, “Apple sued by Dept. of Justice in landmark antitrust case.

The Timing Couldn’t Be Worse

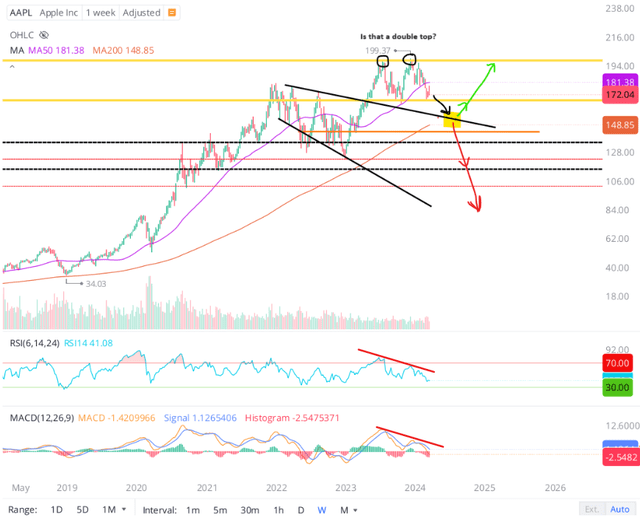

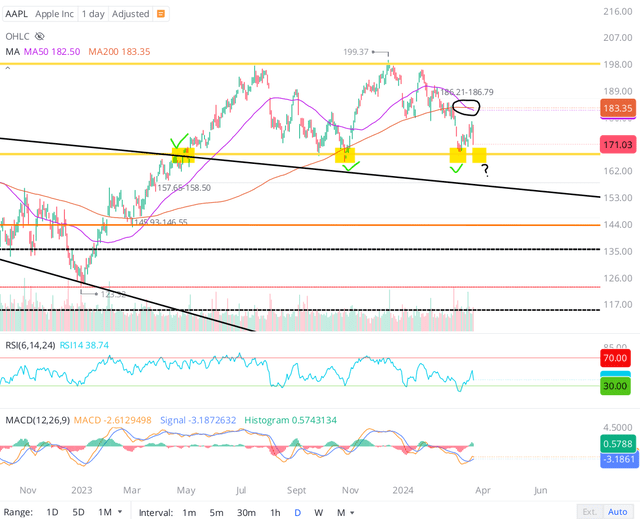

From a technical perspective, AAPL stock is currently undergoing a correction (down 10%+ from its recent highs), with its chart close to confirming a double-top pattern. A breakdown of the low-$160s (October 2023 low) in upcoming weeks would confirm a double top right under $200 and open up the possibility of a much deeper pullback!

As you can see on the chart above, momentum indicators like RSI and MACD have already rolled over and are trending down. Yes, the breakout level of the “bearish megaphone pattern” on AAPL [$165] has served as support twice (in October 2023 and February 2024), and it can do so again. However, this time around, AAPL has also formed a “bearish death cross” on the daily chart, with the 50-DMA sliding under the 200-DMA. Given the latest rebound in AAPL stock was rejected vehemently at the 50-week moving average, I think we are headed down to the mid-$100s in the near-term future.

With the already negative sentiment towards Apple likely worsening due to this new antitrust lawsuit headwind, I think it is fair to assume additional selling pressure in the near term.

That said, investing is a long-term endeavor, and so, we must base our investing decisions on long-term risk/reward. In today’s update, we will briefly review Apple’s latest quarterly report to gauge underlying business trends and reevaluate AAPL’s long-term risk/reward using our TQI Valuation Model.

Apple Is A Cash Printing Machine, But Growth Concerns Are Real

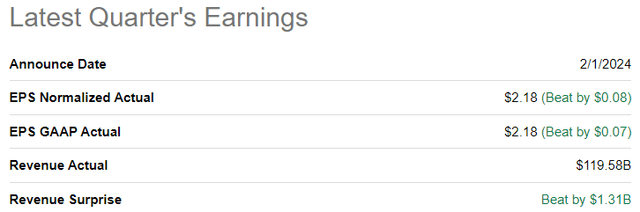

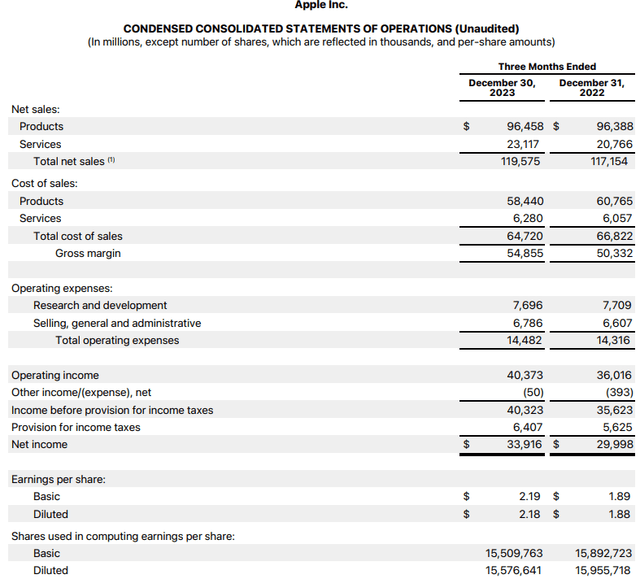

In Q1 FY 2024, Apple beat consensus expectations on both top and bottom lines, with revenues and EPS coming in at $119.58B (vs. est. $118.27B) and $2.18 per share (vs. est. $2.10 per share).

An active installed base of 2.2B devices generated a new record-high Services revenue in Q1, with Apple’s EPS growing by 16% y/y. However, solid (gross & operating) margin expansion and stock buybacks were the driving forces behind this healthy earnings growth since total net sales y/y growth was a meager 2%!

Yes, Apple finally broke a streak of four negative y/y growth prints this quarter, which is a slight positive. But, management’s guidance for Q2 during the conference call isn’t inspiring (emphasis added):

The color we are providing today assumes that the macroeconomic outlook doesn’t worsen from what we are projecting today for the current quarter. And we expect foreign exchange to be a revenue headwind of about 2 percentage points on a year-over-year basis.

As a reminder, in the December quarter a year ago, we faced significant supply constraints on the iPhone 14 Pro and 14 Pro Max due to COVID-19 factory shutdowns. And in the March quarter a year ago, we were able to replenish channel inventory and fulfill significant pent-up demand from the constraints. We estimate that this impact added close to $5 billion to the March quarter’s total revenue last year. When we remove this impact from last year’s revenue, we expect both our March quarter total company revenue and iPhone revenue to be similar to a year ago.

For our Services business, we expect a similar double-digit growth rate to what we reported in the December quarter. We expect gross margin to be between 46% and 47%. We expect OpEx to be between $14.3 billion and $14.5 billion. We expect OI&E to be around $50 million, excluding any potential impact from the mark-to-market of minority investments and our tax rate to be around 16%.

Apple’s March quarter 2023 sales were $95B, so in Q2 FY2024, management expects revenues of $90B, which implies a top-line growth rate of -5.3% y/y. Now, I understand the argument that sales growth for Q2 FY2024 is going to be inadequate due to pent-up demand experienced in the March quarter of 2023, but by that logic, Q1 FY2024 growth of +2% y/y would have been a negative number if adjusted for supply constraints experienced in Q1 FY2023.

Digging deeper into Apple’s top line, we can observe a significant -13% y/y sales decline in China and solid performance in other geographies. While heightened competition from Huawei and outright deflation (economic doldrums) are hurting demand for Apple’s products and services in China, I believe that “Apple’s China Woes Are Just The Tip Of The Iceberg.”

With Apple heavily reliant on “financed” consumer spending, rising consumer debt levels, interest rates, and delinquencies paint a grim picture for near-to-medium-term sales performance at the Cupertino tech giant.

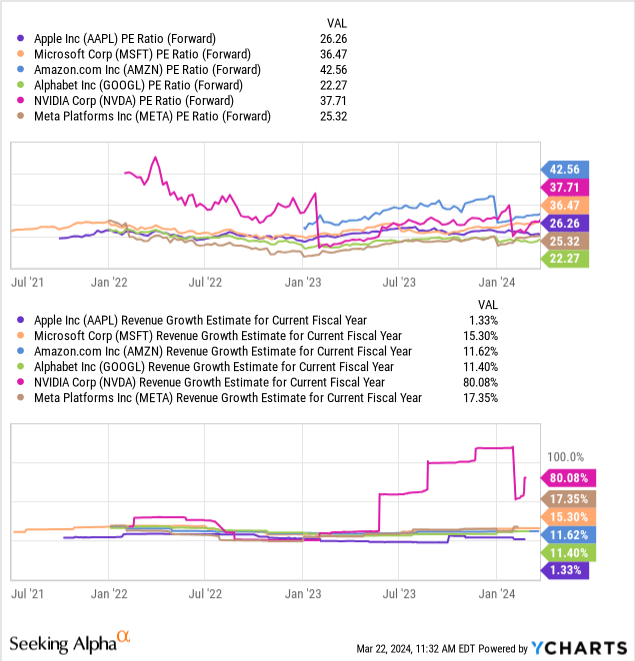

AAPL’s Valuation Remains Unjustified

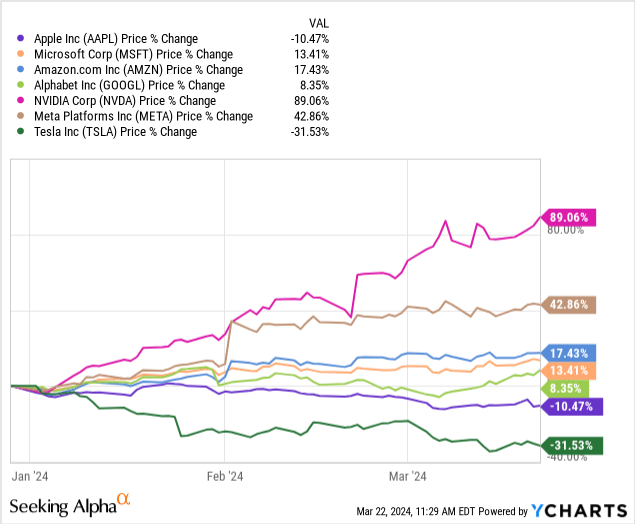

Now, Apple is an incredible consumer products and services company that will continue to make billions of dollars in free cash flow every year; however, in the absence of growth, justifying a premium valuation such as the one commanded by AAPL stock is becoming increasingly difficult for investors. And in my view, this is why AAPL stock has massively underperformed its big tech peers so far this year.

Now, a high-moat business like Apple can certainly command an above-market multiple through a temporary growth slump; however, Apple’s future growth trajectory is a blur at this point due to the lack of a clear needle-mover. With Sam Altman (OpenAI’s CEO), Jony Ive (legendary iPhone designer), and Tang Tan (former Chief of Design at Apple) reportedly working on a new consumer AI device, for the first time in a very long time, there are questions around Apple’s dominance getting gazumped by the AI revolution. As you may know, Apple recently canceled its autonomous EV project to focus its efforts on GenAI, and now Apple is apparently in talks with Google to license Gemini AI for the next iPhone! Given Google’s botched AI product launches over the past year, Apple’s decision to partner with them reeks of desperation.

Under CEO Tim Cook’s leadership, Apple’s business and stock have gone from strength to strength, with incremental improvements across products and services, but Apple’s innovative DNA seems to have been lost with the loss of Steve Jobs. While Apple can still play a vital role in the fourth industrial revolution [AI], the Cupertino giant needs to get the house in order quickly and start delivering disruptive innovation again. The Vision Pro is a good start, but we still need to see a lot more data to trust the face computer as the next needle-moving product or platform for Apple!

Concluding Thoughts

As of today, Apple’s hardware and software ecosystem is unbeatable; however, the DOJ lawsuit against Apple is a wildcard that threatens this sustained competitive advantage. Now, this lawsuit will probably take years to play out, but I expect the overhang to impact both the business and the stock in the meantime. Given Apple’s lousy growth numbers, I think we are about to get an opportunity to buy Apple at or below fair value within the next 12-24 months.

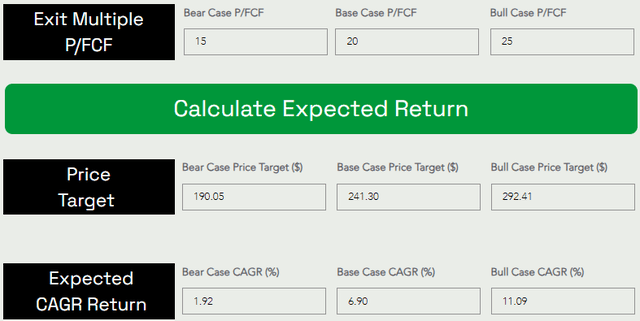

TQI Valuation Model (TQIG.org) TQI Valuation Model (TQIG.org)

In light of recent developments, our fair value estimate for AAPL stock stands at $119 per share. Assuming a base case exit multiple of 20x P/FCF, I see Apple rising to $240 per share by 2029 at a CAGR rate of ~7%. Since Apple’s expected CAGR return is lower than our investment hurdle rate and long-term S&P 500 (SP500) return of 8-10%, we will continue to avoid Apple for now.

Hopefully, the antitrust overhang will accelerate Apple’s journey to its fair value – creating a worthwhile buying opportunity for long-term investors.

Key Takeaway: I continue to rate Apple’s stock a tactical “Sell” in the $170s.

Thank you for reading, and happy investing! Please share any questions, thoughts, and/or concerns in the comments section below or DM me.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are you looking to upgrade your investing operations?

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why we designed our investing group – “The Quantamental Investor” – to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.

At TQI, we are pursuing bold, active investing with proactive risk management to navigate this highly uncertain macroeconomic environment. Join our investing community and take control of your financial future today.