Summary:

- The current operating environment remains favorable to Walmart as prices remain high.

- Valuation levels are still a concern since analysts are only expecting single digit growth moving forward.

- The company faces a number of risks moving forward, including increased online competition from companies such as Amazon.

Alexander Farnsworth

John Maynard Keynes famously stated that markets can stay irrational longer than you can stay solvent. While companies and assets are often overvalued, there often needs to be an event or piece of new information for the market to change their opinion on valuation levels.

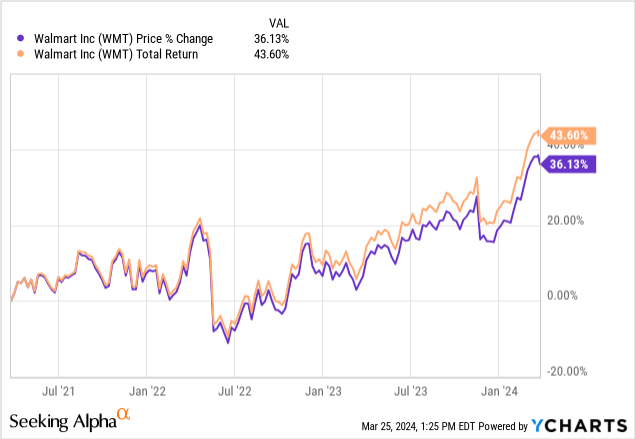

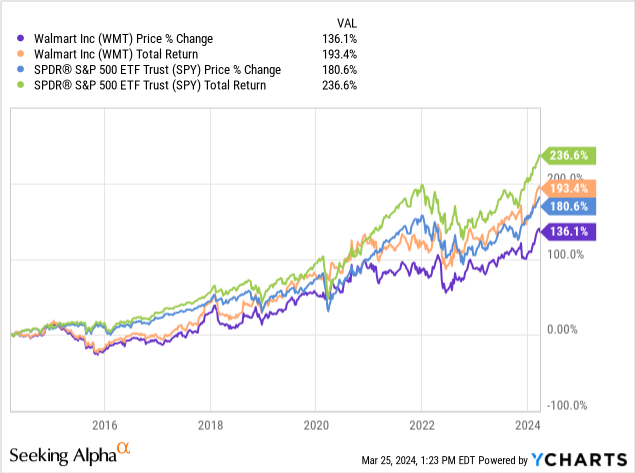

One of the companies that has benefitted significantly from rising prices and falling real income levels over the last several years is Walmart (NYSE:WMT). The leading discount retailer has done well since early 2021, even though the company has consistently and significantly underperformed the S&P 500 (SPY) over the last 10 years.

Walmart is up an impressive 43% over the last three years, but the company has still underperformed the S&P 500 by 40% over the last 10 years.

I last wrote about Walmart in August of 2023, and I rated the retailer a strong sell primarily because of valuation concerns and the impact falling prices would likely have on the company’s core business. Today I am upgrading the company to hold today, since valuation levels are more reasonable, and the favorable operating environment for Walmart should continue for some time.

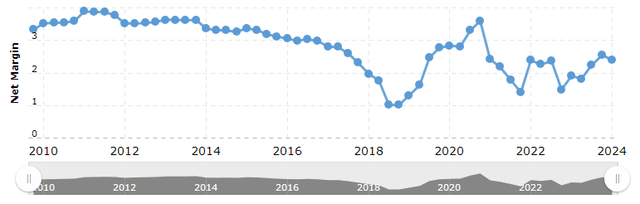

Walmart’s last earnings report showed impressive core domestic and international sales growth, even excluding fuel. The retailer reported normalized earnings per share of $.60 and revenues of $171.91 billion, which beat expectations of $.55 a share and $169.25 billion. Management also reported strong same-store sales growth excluding fuel of 5.6% in the US, and net sales growth of 10.6% overseas. The company reported that full-year revenues grew by 6% and full-year earnings-per-share by 5.7%. Management also stated that margins remained strong, with the company’s gross profit rate coming in near a three-year high of 23.7% and net margins were also near a three-year high of 2.39%.

A chart of Walmart’s net margins (Statista)

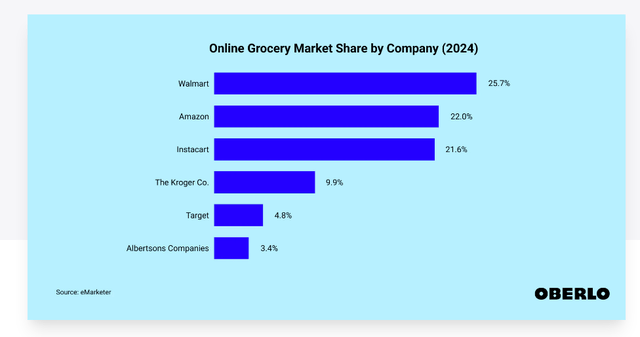

Walmart has been able to consistently take significant market share since early 2021 when prices began to rise significantly. Even though the rate of inflation has fallen to nearly 3% over the last year, prices remain high across the board. Walmart’s market share of the US grocery business has grown from 23.7% in 2021, to just over 25% this year. The leading retailer also has 25.7% of the online grocery business, with Amazon second at 22%.

A chart of the market share of companies in the online US grocery market (Berlo)

Walmart has been consistently able to grow core sales and take market share without compromising margins since 2021 primarily because of consumers’ tendency to look harder for discounts in an inflationary environment. The current favorable operating environment the retailer has thrived in should also persist for some time, since many of the factors driving inflation such as higher labor costs and increased government spending are not likely to change anytime soon.

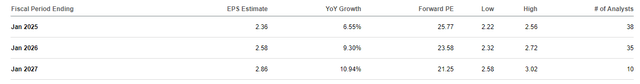

Still, Walmart’s stock is not cheap. The company currently trades at 26.03x forecasted forward GAAP earnings and 5.3x predicted forward book value, and The retailer’s five-year average valuation is 4.7x forecasted forward book value, and while Walmart’s five-year average forward PE using GAAP is 25.41x predicted earnings, analysts are only expecting earnings growth to be between 8-9% on average per year over the next three years.

A chart of earnings estimates in the US (Seeking Alpha)

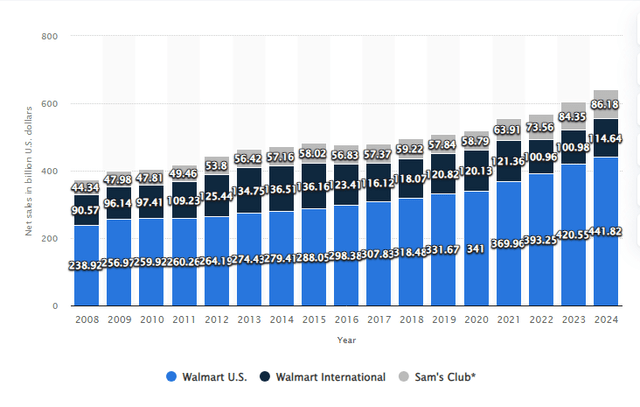

The company faces significant risks as well. The retailer has struggled to grow earnings overseas over the last decade despite some progress in the retailer’s recent earnings report, and the company’s store count is already very high in the United States.

A breakdown of Walmart’s revenues since 2008 (Statista)

If the war between Russia and Ukraine were to end or if labor pressures ease, and prices fell, the company would also likely lose much of the market share gains that management has made in the last three years as well. The War between Russia and Ukraine has caused grain, food, and energy prices to rise, and if inflation and overall price levels were to fall significantly, many consumers who have traded down in this inflationary environment would likely consider trading up if that happened. A stronger economy would also likely put pressure on Walmart’s recent market share gains as well since consumers with more income would also likely consider the value of the retailer’s discount based model less appealing in my view.

Amazon also has significantly more resources and a better understanding of the technology landscape to compete with Walmart in the online grocery business as well. Amazon has nearly $90 billion in cash and ST investments, and the company’s recent acquisition of Whole Foods shows the tech company is focused on further expanding into the online grocery business. Amazon has a whole fleet of trucks and the company also already has a huge customer base, so I believe Walmart will likely struggle to compete with this industry leader as the grocery business and retail industry increasingly move online.

Walmart has been somewhat slow to adopt to the grocery and retail business increasingly moving online, and companies that are retail and technology companies that are exclusively focused on the online side of the business such as Amazon and Instacart have been able to gain significant market share in this part of the industry. Online retail should only grow more moving forward too, and Walmart’s management team has been slow to adapt and compete in this space in my opinion.

Walmart has done a good job of taking advantage of a favorable operating environment over the last three years, and prices may remain elevated for some time, but the stock has already priced in very high expectations, and the core business model of this retailer still faces risks moving forward. While Walmart should continue to do reasonably well, individuals should be able to find better value in alternative investments.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.