Summary:

- PayPal Holdings, Inc. is implementing cost-cutting measures to achieve more profitable growth and streamline operations.

- The company’s fourth-quarter operating income increased by 11% to $1.9 billion, and full-year earnings improved by 24% to $5.10.

- PayPal faces stiff competition from Apple Pay and Google Pay, and it aims to enhance its competitive edge through improved checkout conversion rates and innovation.

- PayPal’s strategic shift in product mix, aiming for long-term market share growth at the expense of short-term margins, has not been fully recognized by the market.

hapabapa

Investment Thesis

As PayPal Holdings, Inc. (NASDAQ:PYPL) confronts the evolving digital payment landscape, marked by stiff competition and the rise of innovative payment solutions, it is reshaping its strategy through cost-cutting, operational efficiency, and strategic investments.

Market sentiment has trended bearish as investors wrestle with concerns about declining margins and a shrinking user base. The heart of the matter is PayPal’s strategic pivot in its product mix, a move that the market has not fully recognized. This nuanced shift aims to broaden market share over the long haul despite short-term margin sacrifices.

Investors, however, should note PayPal’s robust cost-cutting measures, including a significant workforce reduction of approximately 2,500 jobs. These strategies are poised to mitigate margin concerns with operational efficiencies from AI adoption and aggressive stock repurchase programs. These elements are pivotal in decoding PayPal’s valuation landscape and its path to future earnings growth.

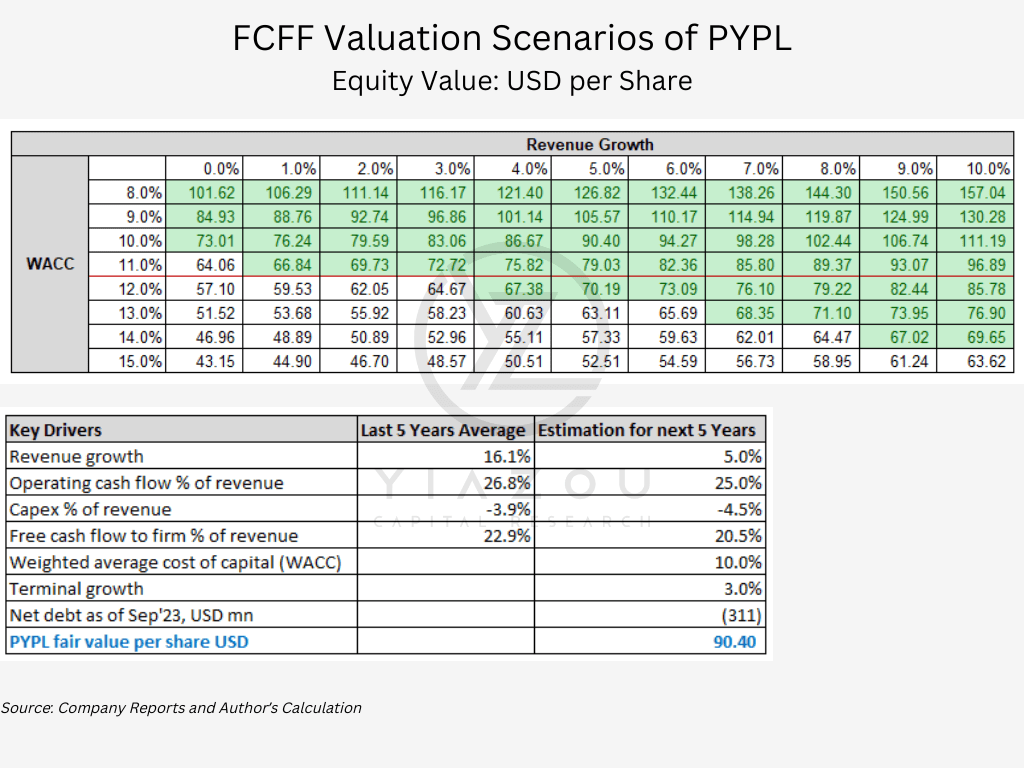

Following several upward trading sessions, PYPL is demonstrating increasing buying momentum, potentially leading to a rerating of the stock as we near its May earnings report. If the company reports significant progress in its cost-cutting initiatives, alongside improved margins, while sustaining its competitive edge and market share, it could surge to new highs above $70. Finally, such a performance would set PayPal on a firm path toward our target price of $90, indicating a bullish outlook based on its operational efficiencies and strategic market positioning.

Author

PayPal’s Changing Product Mix

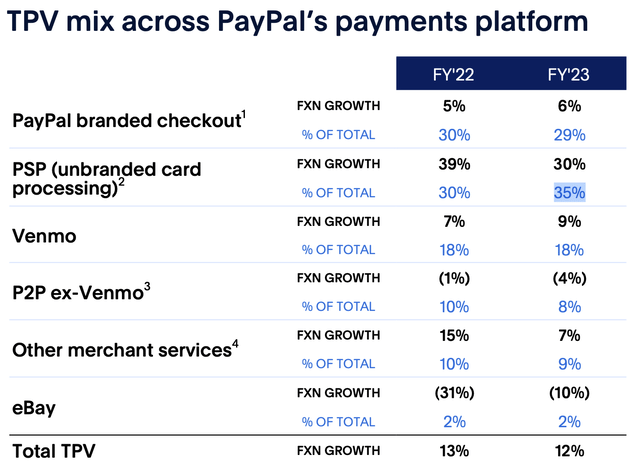

From 2021 to 2023, PayPal’s transaction volume distribution reflects strategic shifts in response to market trends and competition, notably from tech giants like Apple (AAPL) and Google (GOOGL). The share of PayPal Branded Checkout decreased from 33.0% to 29.0%, suggesting a strategic diversification to mitigate over-reliance on a single service.

Conversely, Unbranded Processing’s share grew from 24.0% to 35.0%, indicating a shift towards higher volume but lower margin transactions, possibly due to changing consumer preferences or as a strategy to capture more market share in unbranded processing.

Surprisingly, a marked profitability disparity exists between the two segments; for PayPal to match the profit from $1 in branded transactions, it must process $10 in unbranded transactions. This substantial discrepancy underscores the critical role of branded services in PayPal’s profit strategy.

Despite their lower margins, this strategic pivot towards unbranded transactions underscores PayPal’s adaptation to competitive pressures. PayPal aims to expand its market share even if it means margin contraction and potentially fewer active users. However, PayPal plans to offset these effects with cost reduction initiatives, including operational rationalization and adopting efficient technology, which is crucial for maintaining profitability during this strategic transition.

Moreover, P2P transactions excluding Venmo dipped from 11.0% to 8.0%, hinting at a possible shift towards Venmo or the impact of new competitors in the P2P space. Introducing features that encourage users to keep money within Venmo suggests a strategy to boost payment volume and, consequently, PayPal’s financial health.

Hence, the overall strategy reflects PayPal’s attempt to diversify its payment volume sources and decrease reliance on branded checkouts, navigating the competitive fintech landscape with agility.

PayPal Streamlines Operations and Cuts Costs

With prospects of slow growth amid stiff competition in the payment business, PayPal has embarked on a cost-cutting drive to seek more profitable growth. According to Chief Financial Officer Jamie Miller, the focus is on reducing cost structure through operational streamlining and reinvesting the same into the business.

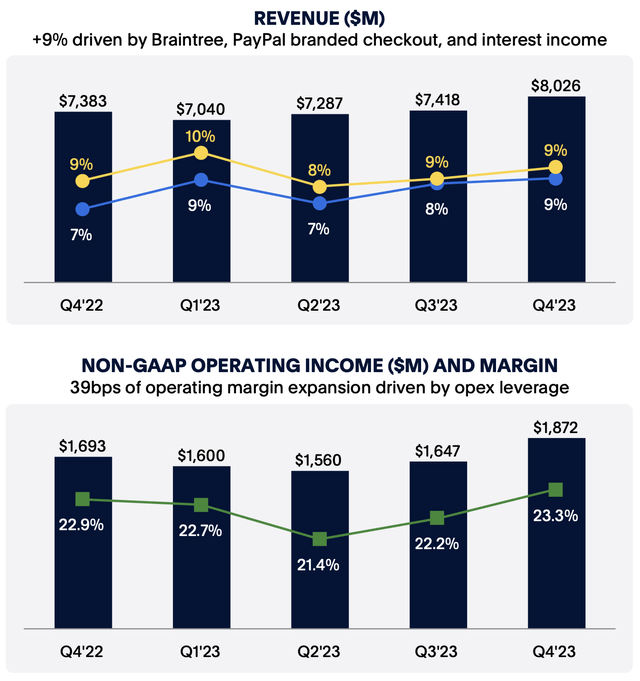

The cost-cutting drive is spearheaded by the push to lay off 9% of jobs, which is expected to affect nearly 2,500 jobs. The latest round of layoffs follows the company’s cutting 7% of its workforce last year. The cost-cutting drive is already bearing fruits, going by operating income in the fourth quarter of 2023, increasing by 11% to $1.9 billion. Operating margin in the quarter was up by 39 basis points to 23.3% as PayPal posted a 19% increase in earnings per share in Q4 to $1.48, with full-year earnings improving by 24% to $5.10.

The improvements in earnings came as the online payment company registered a 9% increase in revenues to $8 billion in the fourth quarter, as full-year revenue increased by 8% to $29.8 billion. The company also benefited from a 15% increase in total payment volume in the quarter to $409.83 billion and 13% for the entire year to $1.5 trillion.

Given the push to trim operating costs further, PayPal expects earnings per diluted share in the current quarter to increase by mid-single digits compared to $1.17 a share in the previous period. The company also expects full-year earnings per diluted share to align with $5.10 delivered the prior year.

PayPal in the Competitive Ring

Although PayPal managed year-on-year revenue growth, the growth percentage was less than that of the overall industry it was operating in, as the company faced intense competitive pressures in the online payment business. The biggest threat came from Apple and Google ramping up their payment options, thereby squeezing PayPal’s prospects of tapping the lucrative online payment business.

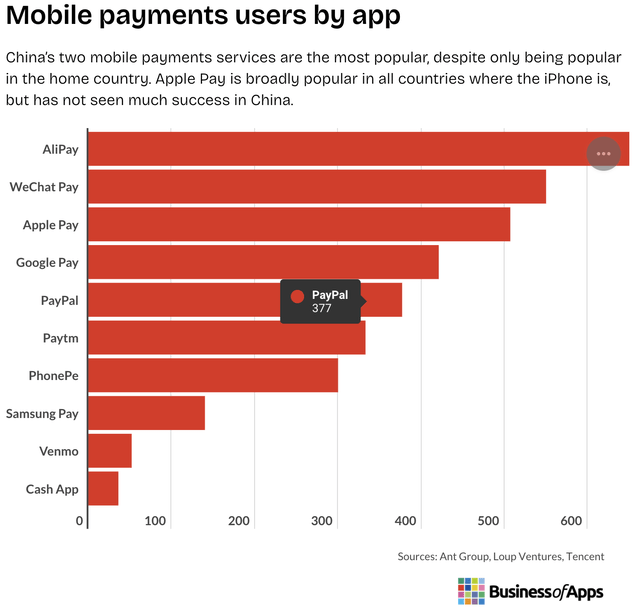

Although its name is associated with online payments, PayPal has been trying to keep its head above water in the struggle with its embedded smartphone system rivals, like Google Pay and Apple Pay. These make Alipay and WeChat remain two major mobile payment services worldwide, of which Alipay has 650 million and WeChat has 550 million users. Behind is Apple Pay, with 507 million users, and Google Pay’s following of 421 million, while PayPal brings its (relatively) modest population of about 377 million.

Apple Pay and Google Pay are the preferred modes of payment in countries where iPhones and Android devices are popular. Specifically, in the U.S., Apple Pay remains the dominant mobile payment service with a user base of about 43.9 million people, and Google Pay comes in at a close third with about 25 million users.

Chart showing mobile payment services’ global dominance (PayPal)

Amid the stiff competition, it is doubtful that PayPal will ever return to the growth rates registered at the height of the pandemic when gross margins ballooned to 55.9%. Nevertheless, the new CEO, Alex Chris, has reiterated the need to become leaner, more focused, and more efficient with new initiatives to stem any decline in profit margins.

One of the strategies that could help PayPal strengthen its competitive edge amid stiff rivalry from Apple, Google, and the like is focusing on improving checkout conversion rates. Thus, the company can maintain its loyal customer base by helping large enterprises enjoy fast checkout conversions.

Finally, the company plans to increase its investment in innovation to launch new products and services that have the potential to enhance customer satisfaction. The company has relied on cutting-edge marketing strategies, including collaborations with high-profile brands like Google and Adidas, to strengthen its competitive edge.

PayPal’s Adaptation Imperative Amid Emerging Payment Networks and Mobile Wallet Expansion

PayPal may be one of the oldest payment systems in the world, but it’s no longer the only one gunning for consumers’ dollars. The sector is becoming increasingly saturated with the emergence of new payment networks designed to address specific needs in niche markets. As consumers gravitate toward new payment networks, PayPal and other established networks should be vigilant and adjust their strategies.

For instance, in Brazil, PayPal is facing its biggest test in the name of Pix, which has emerged as one of the most extensive payment networks, commanding more than 29% of the volume share in e-commerce. UPI has already taken over in India, accounting for over 70% of retail digital payments volume.

Additionally, the emergence of new payment systems is related to the growing demand for new ways of sending and receiving money. Recent trends are increasingly encouraging new technologies to reboot the sector, as new systems wish to simplify business trade and lock in customers. Similarly, the globe’s payment background is growing at a compound annual growth rate of 8.9% and is expected to be worth$847.59 billion by 2027.

One of the two new trends increasingly shaping the global payment sector is the development of mobile wallets. Another aspect increasingly reshaping the global payment industry is mobile commerce.

Just last year, there were around 1.31 billion transactions in the world of mobile payments, quite a leap from 950 million back in 2019. Smartphone wallets, which constitute a virtual locker that allows users to tender instant pay while on the move and through which they can access their cash conveniently using their handheld electronic devices, are increasingly putting the likes of PayPal under real pressure.

Bottom Line

PayPal has underperformed, as evidenced by the 70%-plus selloff over the past three years. The selloff has come against the backdrop of the COVID-19-fueled boom fading and the company’s growth metrics coming under pressure amid stiff competition. While the stock trades at a record-low valuation of just 2.5x times sales, it has started showing signs of bouncing back as investors take note of new strategies aimed at reinvigorating long-term prospects.

The cost-cut drive spearheaded by the new management is already bearing fruits, depicted by revenue and earnings growth. Likewise, the company has started reinvesting for the future, setting sights on new technologies such as AI in the race to strengthen its competitive edge.

Finally, free cash flow levels increasing by double-digit percentage points affirm the company’s ability to return value through buybacks. While PayPal is unlikely to return to its former growth rates experienced at the height of the pandemic, the company can maintain its competitive position while becoming leaner and more cost-efficient.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.