Summary:

- Halliburton reported record free cash in Q4 2023 and expects a 10% boost in 2024, leading to a 10% rally in the stock.

- The company’s shift towards high-tech AI has increased its profitability and resilience, generating more cash per share.

- The potential catalyst for Halliburton stock is its position as the number one provider of fracturing services in North America, with the demand for Zeus frac spreads rapidly increasing.

- We rate the company as a buy at current levels.

Qi Yang/Moment via Getty Images

Introduction

Halliburton Company (NYSE:HAL), also known as “Big Red” reported record free cash in its fourth quarter, and year-end 2023 investor call, and expects a 10% boost in 2024. They gave an optimistic outlook for the year ahead. The stock rallied nearly ~10% on this news over the next couple of days. Then the laws of the physical universe reasserted themselves, and gravity pulled Halliburton stock back down to earth. Why? People aren’t paying attention to the real fundamentals of the company, as I will explain in this article.

Halliburton Price Chart (Seeking Alpha)

This has been a repetitive cycle since the middle of 2022, when it became clear that the Russian/Ukrainian conflict was not going to widen into Western Europe anytime soon. Halliburton has tagged the low $40’s three times since that period, and then crashed to the $30 level twice, each time ignoring progressively better reporting metrics. It is now within a few dollars of tagging $30 again. The question before us is this a buying opportunity?

The analysts are nearly unanimous that Big Red is a buy. Price targets range from $32 to $54, with a median of $48, suggesting that the bulk of these worthy folks think Halliburton stock has some room to run.

The company has been on a roll the last few quarters, beating EPS estimates for the last 4 earning periods. The forecast for Q-1, 2024 is for $0.75, a five cent reduction from Q-4, or ~6%. Where does all of this put an entry point for Big Red? And, more importantly, is there a catalyst on the horizon to deliver growth in the upper range of the analyst’s estimates.

The changing oilfield landscape

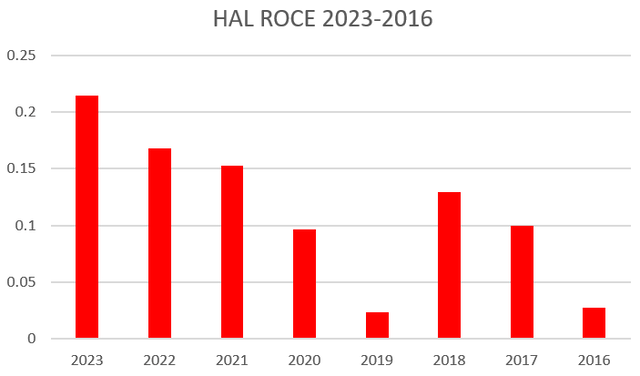

For the big, integrated oilfield service companies, of which Halliburton is one of a select group, there has been a shift in business models away from low tech big iron to high-tech AI. AI is in just about everything, and it makes a huge difference in the company’s profitability. One of the impacts on HAL is that this shift has dramatically increased their ROCE as the graph below indicates.

Halliburton ROCE (Seeking Alpha- Chart by author)

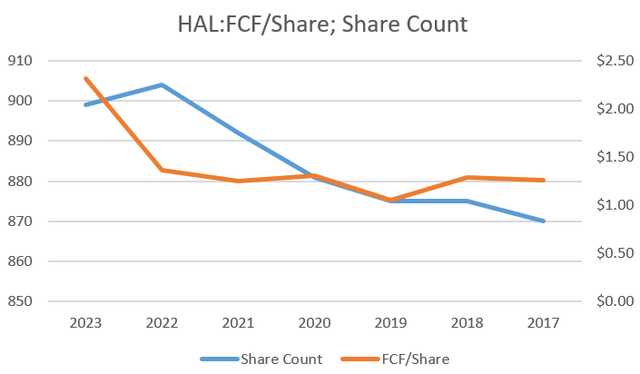

The point of the graph above is to establish that Halliburton has a resilient business model that is and will continue to generate heaps of cash-even in market downturns. This turn for the better also shows up in the free cash generated per share. The share count has remained much the same for the period covered. Free cash per share has nearly doubled in that time.

HAL FCF/Share (Seeking Alpha-chart by author)

OFS companies like Hally run real businesses now, unlike most of the period where I was active in the industry. For most of that time, capex and hiring would increase to meet perceived demand, with cash commitments that went on even when business declined. With the new capital lite, and capital restraint models, expansion comes only with iron-clad customer commitments-often for multi-year deals. The shift to subscription Software as a Service-SaaS AI further insulates the company from sudden revenue and cash flow declines. You can see it in the graph above. This comment from Jeff Miller, CEO, sums up the new paradigm fairly well-

We see an increase in service intensity everywhere we operate. Whether it’s longer laterals in North America, smaller and more complex reservoirs in mature fields or offshore deepwater, customers require more services to develop their resources, not fewer. For our international business, we expect low double-digit growth driven by the power of our value proposition, global competitiveness across all product lines and our profitable growth strategy. In North America, we expect a continued strong business driven by stable activity, our differentiated technical position with our Zeus electric frac solution and the increasingly contracted nature of our business.

A near term catalyst for Hally

The Zeus electric frac solution is a strong potential catalyst for Halliburton stock. According to my industry sources, the company is the number one provider of fracturing services in North America, with nearly a quarter of the North American frac footprint. Demand by customers for Zeus frac spreads is rapidly displacing their legacy diesel and even Tier-4 DGB fleets. It comes with a decidedly different marketing model. Zeus’ fleets are now comprising 40% of their footprint, and going to 50% in 2025, Jeff Miller describes the role Zeus will play as it becomes a larger portion of the entire fleet-

Number one, that the pricing is sticky, but it’s sticky because it’s contracted over time and the value is thought about. And so sophisticated procurers can look at that and model that, and we can model it as well and comfortable with the value created.

But I think the second thing, as we think about what types of customers look at e-fleets, these aren’t a spot market solution. I mean the companies that are interested in e-fleets are those that have steady programs, work through cycles, have a clear vision of where their business needs to go and are willing to commit to the technology to deliver that over the long term.

And so — and really, it’s an entire system. If we think about an electric fleet, it’s — obviously, it’s an efficient, lowest-TCO electric solution, but it’s also automated, which drives the level of precision around fracking that I’ve never seen before. And so the clients know that they’re delivering what they expect to deliver, and then finally, the subsurface measurement. Finally, we don’t build fleets until we have contracts for fleets. And so that’s a different — completely different environment than maybe we would have seen in prior cycles from Halliburton

The fracturing business is undergoing consolidation with Patterson-UTI Energy, Inc., (PTEN), absorbing NexTier last year after a long list of prior acquisitions-Alamo, Keene, C&J Energy Services, Rockpile, and Trican U.S. The year before ProFrac Holding Corp., (ACDC) took out FTSI, and U.S. Well Services. This will have the effect of further tightening a market where no one builds new equipment, except for displacing older, hard to market diesel fleets. Barriers to new entrants-extreme cost and high-performance specs of the E-Fleets, will assist frac service providers in maintaining pricing.

This year the frac spread count has gone from 234, to 260 with the 10 spread rise of last week, as reported by Primary Vision in the American Oil and Gas Reporter. With 23% of the market, this adds another 6 spreads in the field for Halliburton, and puts another $12-15 mm per spread on the company’s top line on an annualized basis. Minimum.

Q4, 2023 and full year

Halliburton’s total revenue for the fourth quarter of 2023 was $5.7 billion, flat when compared to the third quarter of 2023. Total revenue for the full year of 2023 was $23.0 billion, an increase of $2.7 billion, or 13% from 2022. Halliburton generated about $2.3 billion of free cash flow during the year, retired approximately $300 million of debt, and returned $1.4 billion of cash to shareholders through stock repurchases and dividends. Net debt now stands at 1X EBITDA. Hally also raised their dividend to $0.17 for the fourth quarter.

Operating Segments

Completion and Production

Completion and Production revenue in the fourth quarter of 2023 was $3.3 billion, a decrease of $170 million, or 5%, sequentially, while operating income was $716 million, a decrease of $30 million, or 4%. Margins remained flat to the third quarter. These results were driven by reduced stimulation activity in U.S. land and Mexico, lower artificial lift activity in U.S. land, and decreased completion tool sales in Latin America. Partially offsetting these declines were higher year-end completion tool sales in the Gulf of Mexico, Africa, and the Middle East.

Drilling and Evaluation

Drilling and Evaluation revenue in the fourth quarter of 2023 was $2.4 billion, an increase of $105 million, or 5%, sequentially, while operating income was $420 million, an increase of $42 million, or 11%. These results were driven by improved software sales in the Middle East/Asia, Africa, and Latin America, along with increased fluid services in the Western Hemisphere and Africa. Partially offsetting these improvements were weather related reductions in drilling-related activity in Norway.

Guidance

In 2024, Hally expects international E&P spending to grow at a low double-digit pace and foresees multiple years of sustained activity growth. The MEA region was a bright spot in 2023, rising 7% YoY. The company believes the Middle East/Asia region will likely experience the greatest increases in activity, with other regions closely behind.

Looking out to 2025, Hally expects Africa and Europe, among others, to demonstrate above-average growth. Jeff Miller, CEO, noted in the call-

Beyond 2025, there is an active tender pipeline with work scopes extending through the end of the decade, which gives me confidence in the duration of this multiyear upcycle. We expect asset-intensive offshore activity to increase, which will further tighten the market. As offshore represents over half of our business outside North America land, we expect this activity to drive improved pricing and higher margins for our business.

Noteworthy announcements in the press release

Halliburton introduced EquiFlow® Density autonomous inflow control device (AICD). This first-of-its-kind device addresses reservoir fluid uncertainties and allows the operator to enhance hydrocarbon recovery in wells where current autonomous technologies are limited. EquiFlow Density uses an innovative density amplifier designed to differentiate reservoir fluids. It incorporates a fluid selector to magnify density forces by creating artificial gravity while making the device completely orientation neutral. The fluid selector opens or closes autonomously to restrict water without any surface intervention. The tool provides a meaningful reduction in water influx, which is typically treated at the surface.

This is a big deal. Read the above quotation carefully. This device can selectively produce hydrocarbons, and leave connate water in the reservoir. This avoids prematuring watering out of the reservoir-blocking oil production, and eliminates treating and disposal issues at the surface. What would you pay for a tool like this? Millions? Yep.

Halliburton and Core Laboratories Inc. announced a strategic collaboration in the U.S. to compress the delivery time of cutting-edge comprehensive digital rock data solutions from months to weeks, even while full petrophysical laboratory measurements are in progress. This collaboration combines Core Lab’s industry-leading expertise in reservoir description and optimization technologies with Halliburton’s specialization in pore-scale digital rock analysis. The collaboration facilitates the seamless integration of best-in-class digital rock characterization at a nano, micro and macro level, which will enable U.S. clients to run pore-scale simulations in parallel with physical laboratory experiments. These enhancements will drive the accuracy and innovation of new and existing digital rock characterization workflows.

This is an area of specialization for me. I’ve spent hours pouring over geophysical results. These investigations look to find, among other things, damage mechanisms. There is no doubt this alliance with Core Laboratories Inc., (CLB) will pay off in the offshore upcycle.

Halliburton, and AIQ, joined with ADNOC to successfully launch an AI-enabled Autonomous Well Control solution, RoboWell, across the ADNOC’s North East Bab asset in Abu Dhabi, United Arab Emirates. The project, which is the first ever AI-supported Advanced Process Control solution for gas lifted wells, enables autonomous wells that can self-adjust to maximize production within specified operating conditions. The RoboWell system utilizes real time data to continuously react to changing oil field dynamics, and to optimize production processes, as well as ensure operation within safety parameters to minimize well instability and reduce the risk of stoppages or other incidents.

It’s coming. Someday soon, you will walk out to the driller’s cabin on the rig floor, with a cup of coffee for the driller, and find Robby the Robot. I hope he likes it black.

Risks

Halliburton is beaten down at this level, and other than dead money, I don’t see a lot of risk in the stock.

Your takeaway

Halliburton’s stock is trading at 7.2X EV/EBITDA, just a little out of our normal comfort zone. Depending on what markets do in Q-1 we might see slightly better pricing, but that could go the other way as well.

Let’s have a little fun with numbers and drag out our Rockwell calculator again. Hally grew EBITDA 23% between 2022 and 2023. Let’s give them 15% growth for 2024 and see where the share price should adjust toward. ($36 bn / $5.85 bn = 6.2X). To keep their multiple at 7.2X the shares would need to reprice to ($5.85 bn x 7.2X =$42,120 bn/ 902 mm shares = $46 per share. Pretty close to the analyst’s $48 midpoint consensus.

I think Hally is in the buy zone at current prices and represents a reasonable risk/reward thesis. Given the current flux in oil and gas prices, I am not adding at present levels-I may kick myself later on, but I am hoping we might see the low $30’s again. At something under $32, I would pull the trigger with an incremental buy for growth and increasing shareholder returns.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of HAL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is not advice to buy or sell this stock or ETF in spite of the particular rating I am required to select in the SA template. I am not an accountant or CPA or CFA. This article is intended to provide information to interested parties and is in no way a recommendation to buy or sell the securities mentioned. As I have no knowledge of individual investor circumstances, goals, and/or portfolio concentration or diversification, readers are expected to do their own due diligence before investing their hard-earned cash.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.