Summary:

- In light of China’s ban on the use of Intel chips in government PCs, INTC stock is displaying incredible resilience.

- As I see it, Intel’s long-term future is not heavily reliant on sales in China due to its ambition of becoming the “Foundry of the West”.

- Intel’s strong Q4 performance and guidance for 2024 indicate a recovery. Given Intel’s reasonable valuation, I see it as a decent “Hold” at its current price.

JHVEPhoto

Introduction

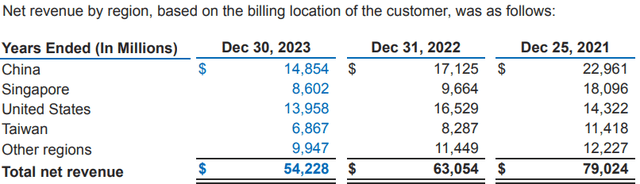

With 27% of Intel Corporation’s (NASDAQ:INTC) revenue coming from China, the news of a ban on using its chips in Chinese government computers is the kind of negative development that could create significant pressure on the semiconductor giant’s stock.

Intel Q4 2023 Earnings Release

However, after an initial 4% dip earlier this week, INTC stock has rebounded back up and is now trading higher than before this news broke out. Now, you’ll find multiple explanations for this resilience in the news media, including but not limited to overall end-market consumption of PCs in China being around 15% of total global consumption (and then government consumption being a fraction of that figure). According to Bernstein analyst Stacy Rasgon, the revenue impact of this ban will be in the low single digits, i.e., the top-line hit would be less than $1.5B for Intel.

With Pat Gelsinger’s “IDM 2.0 Strategy”, Intel aims to become the “Foundry of the West” (as discussed here), and given this ambition, I don’t think China necessarily fits in Intel’s long-term story. Don’t get me wrong, losing these sales (and consequent profits) will hurt Intel’s financial performance in the near term; however, this ban is immaterial to Intel’s long-term future.

An Update On My Investment Thesis For Intel

If you have followed my work on Intel, you know that before downgrading Intel to a “Hold” rating in June 2023, I held a “Buy” rating on the semiconductor giant starting in late 2021. My thesis for owning INTC stock as a multi-year play whittled down to Intel being the only “scaled” semiconductor manufacturer in the Western Hemisphere.

In light of the COVID pandemic, global semiconductor supply chains are reconfiguring, and Intel is well-positioned to benefit from this re-shoring activity. Intel is a company of national importance, and the US government’s $20B vote of confidence makes my case!

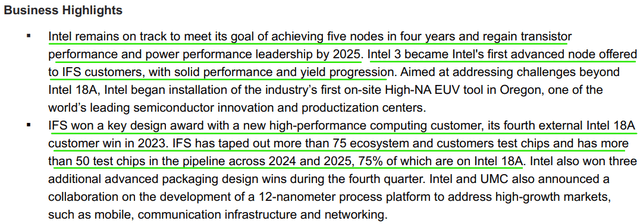

While Intel is still behind TSMC (TSM) on the process node technology, they are seemingly on track to achieve CEO Pat Gelsinger’s ambitious 5 process nodes in 4 years [5N4Y], i.e., regain process leadership by 2025-26.

Intel Q4 2023 Earnings Release

Now, TSMC could pull a rabbit or two out of its hat to maintain its lead, and there’s a chance Intel could hit delays with upcoming nodes [such as 18A and 14A] as it has done in the past. For me, Intel remains a multi-year play of national importance, and I am satisfied with the progress Intel is making on the Foundry (manufacturing) front.

Here’s my research coverage (investment thesis) for your perusal:

- Nvidia Vs. Intel: Which Stock Is A Better Buy? [Jun 20th, 2023]

- Intel’s Bumpy Ride To Glory Just Got Bumpier [Jan 31st, 2023]

- Intel Stock: Mobileye IPO Could Be A Masterstroke [Dec 14th, 2021]

- Intel: Gearing Up For A Bumpy Ride To Glory [Oct 25th, 2021]

- Intel Stock Has 3 Big Advantages Over Nvidia & AMD [Aug 23rd, 2021]

- Intel: Gearing Up For A Bumpy Ride To Glory [25th October 2021]

As I have said in the past, Nvidia (NVDA) and AMD (AMD) have gazumped Intel; however, the Generative AI boom could yet bring a lot of success to the “Foundry of the West”!

A Recovery Is Already Underway At Intel

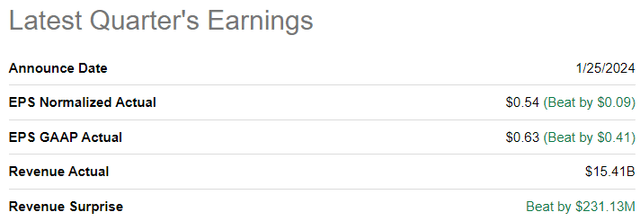

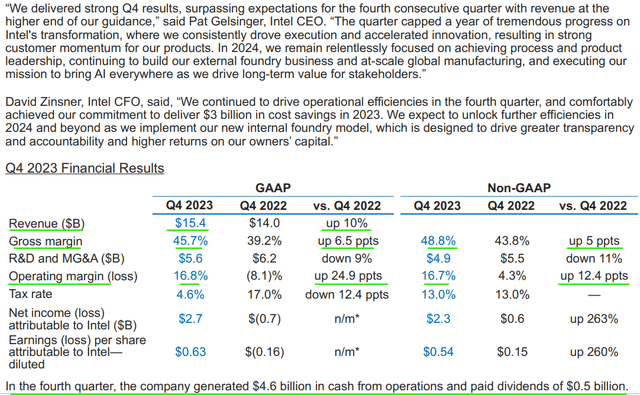

In Q4, Intel’s revenues and earnings came in well ahead of management’s guidance and consensus street estimates, with cash flow from operations jumping to $4.6B.

SeekingAlpha Intel Q4 2023 Earnings Release

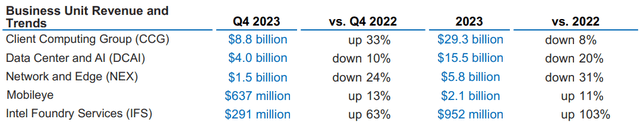

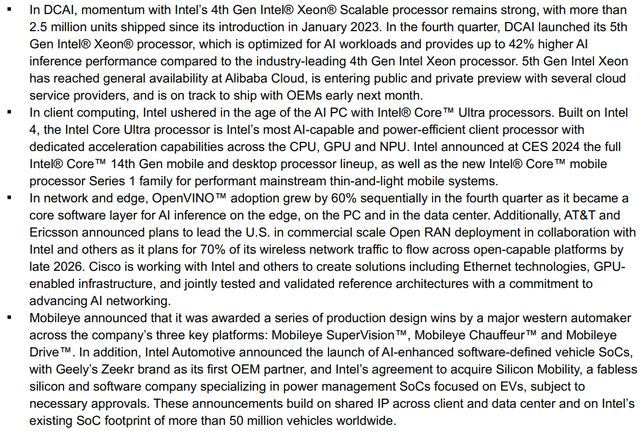

With the PC slump nearing an end, Intel’s Client Computing Group [CCG] revenues jumped +33% y/y to $8.8B, offsetting continued weakness in Data Center & AI [DCAI] (-10% y/y) and Network & Edge [NEX] segments (-24% y/y). Given its stronger-than-expected financial performance, Intel is now firmly in recovery mode.

Intel Q4 2023 Earnings Release Intel Q4 2023 Earnings Release

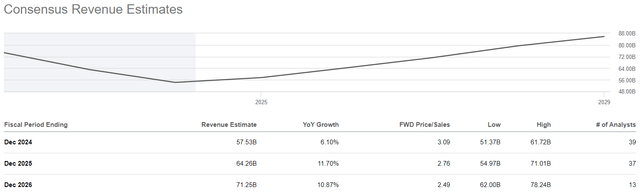

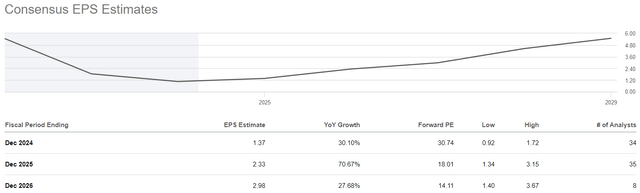

For 2024, Intel is expected to grow revenues by mid-single-digits, with EPS growing ~30% y/y to $1.37 per share. While Intel’s growth pales in comparison to the Nvidias and AMDs of the world, a sales and earnings re-acceleration is a huge positive.

Is Intel Stock A Buy, Sell, Or Hold?

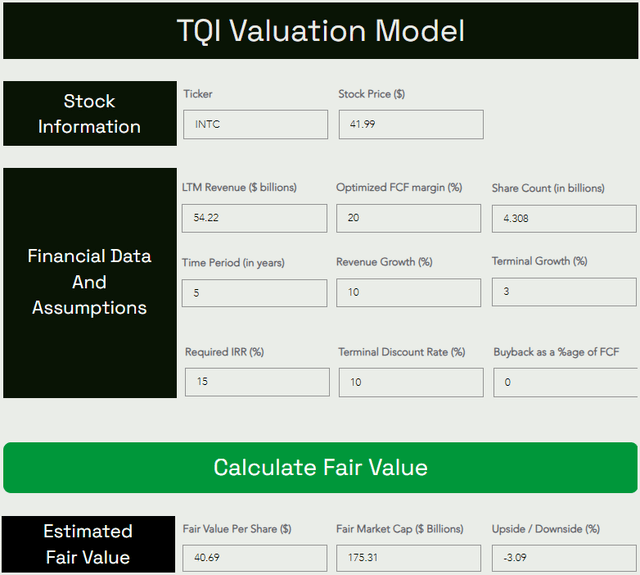

In my view, the reset in Intel’s business is now complete, so instead of using a revenue base of $50B, I am using TTM revenue in building my valuation model for the company. The rest of the assumptions are straightforward; however, if you have any questions, please share them with me in the comments section below.

TQI Valuation Model (TQIG.org) TQI Valuation Model (TQIG.org)

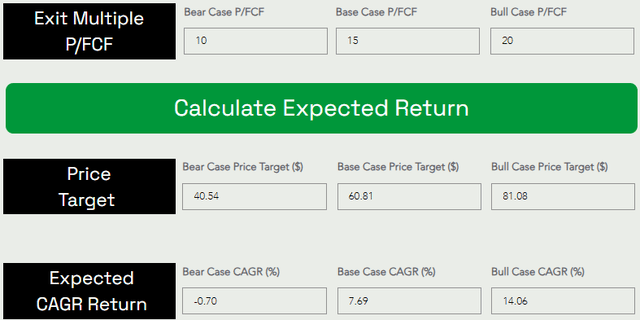

As per these results, Intel is fairly valued at current levels; however, if one were to buy Intel at today’s price of ~$42 and hold the stock for five years, they could expect a CAGR return of ~7.7% (market-like returns). That said, since these returns fall short of the hurdle rate (10%) of our Buyback-Dividend portfolio, I continue to rate Intel a “Hold” at current levels.

Key Takeaway: I rate Intel a “Hold” at $42 per share

Thanks for reading, and happy investing. Please share your thoughts, concerns, and/or questions in the comments section below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are you looking to upgrade your investing operations?

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why we designed our investing group – “The Quantamental Investor” – to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.

At TQI, we are pursuing bold, active investing with proactive risk management to navigate this highly uncertain macroeconomic environment. Join our investing community and take control of your financial future today.