Summary:

- SNOW has dramatically lost -32.2% or the equivalent -$24.42B of its Enterprise Value, despite the double-beat FQ4’24 earnings call.

- This is unsurprising, given the introduction of tiered storage pricing in FQ4’24 and the increased adoption of the open-source Iceberg Table formats triggering the underwhelming FY2025 guidance.

- The silver lining to SNOW’s investment thesis is its inherent lack of debts and the highly liquid balance sheet, implying its ability to weather the growth deceleration ahead.

- However, with the management guiding “increased commission expense” from the consumption-based pricing model, we may see its SBC further grow from here.

- As a result of the near-term uncertainty during the transitionary period, we believe that SNOW remains expensive here.

FotografieLink

The Snowflake Investment Thesis Is Still Too Expensive Despite The Recent Meltdown

Snowflake (NYSE:SNOW) is a company offering Data Cloud, a data network with the ability to “consolidate data into a single source to drive meaningful business insights, build data applications, and share data products.”

Its cloud-native ecosystem supports a wide variety of use cases bridged across different target audiences, allowing customers to code using Copilot, run interactive queries, extract structured information from documents, and build chatbots/ help desks/ customer support cases, to name a few, based on highly secured and governed data.

It is unsurprising then that SNOW has been a beneficiary of the ongoing generative AI boom, as more companies adopt its Data Cloud platform as part of their AI and computing strategies.

The same has been observed in its double beat FQ4’24 earnings call, with product revenues of $738.1M (+5.6% QoQ/ +32.9% YoY), adj EPS of $0.35 (+40% QoQ/ +150% YoY), and Free Cash Flow of $324.3M (+192.6% QoQ/ +50.6% YoY).

At the same time, FY2024 brought forth excellent numbers of $2.66B (+35.9% YoY), $0.98 (+292% YoY), and $810.2M (+55.6% YoY), respectively.

Combined with the growing multi-year remaining performance obligations of $5.2B (+40.5% QoQ/ +42% YoY/ +1119.7% from FY2020 levels of $426.3M), it is apparent that SNOW’s data analytic offerings are highly sticky with a Net revenue retention rate of 131% (-4 points QoQ/ -27 YoY).

This is further aided by the management’s ability to attract new consumers, with 9.43K total customers (+0.53K QoQ/ +1.61K YoY) and 461 customers with TTM product revenue greater than $1M (+25 QoQ/ +131 YoY).

Unfortunately, SNOW’s introduction of the tiered storage pricing in FQ4’24 and the increased adoption of the open-source Iceberg Table formats have triggered headwinds to the company’s ability to sustain the high growth trend.

This is because the Iceberg Table formats typically offer “additional flexibility/ interoperability while also simplifying customers’ data landscapes,” on top of being highly cost-effective.

Combined with the lumpy consumption-based pricing business model, it is unsurprising that SNOW has offered a relatively underwhelming FY2024 guidance with revenues of $3.25B (+22.1% YoY) and adj Free Cash Flow of $942.5M (+16.3% YoY).

These numbers are notably decelerating from FY2023 levels of +35.9%/ +55.6% and FY2022 levels of +105.9%/ +309.2%, respectively, perhaps marking the end of its high growth stage despite the generative AI tailwinds.

The silver lining to SNOW’s investment thesis is its inherent lack of debts and the highly liquid balance sheet at $3.84B (-4% YoY/ +786.1% YoY from FY2020 levels of $434.05M) in FY2024, implying its ability to weather the growth deceleration ahead.

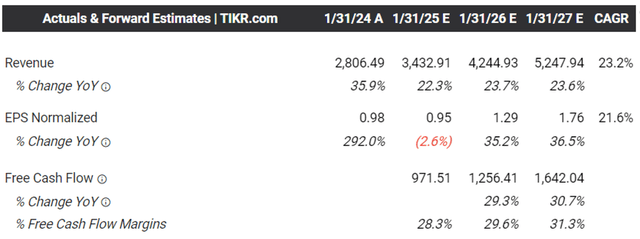

The Consensus Forward Estimates

Tikr Terminal

At the same time, the consensus has estimated that SNOW may generate an accelerated bottom-line expansion at a CAGR of +21.6% through FY2027 (CY2026), sustaining its improved operating scale since it first reported adj EPS profitability in FY2023.

This is compared to the previous top/ bottom line estimates of +32.8%/ +10.9% and the historical top-line growth at +96.14% between FY2019 and FY2024.

Combined with the positive Free Cash Flow generation, it appears that SNOW may be able to sustain its profitable growth without having to rely on expensive debt or dilutive capital raise.

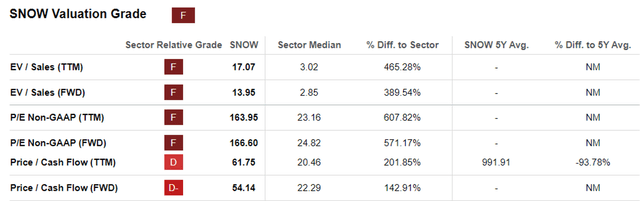

SNOW Valuations

Seeking Alpha

While the consensus forward estimates seem to be promising, SNOW is rather expensive at FWD EV/ Sales of 13.95x, FWD P/E of 166.60x, and FWD Price/ Cash Flow of 54.15x.

This is compared to its 1Y mean of 16.44x/ 232.23x/ 72.68x and sector median of 2.85x/ 24.82x/ 22.29x, respectively.

Even if we compare SNOW’s valuations other AI-related data analytics SaaS peers such as C3.ai (AI) at FWD EV/ Sales of 8.69x and BigBear.ai Holdings, Inc. (BBAI) at 2.89x, it is apparent that the former is priced rather closely to the market darling, Palantir (PLTR), at 18.72x.

Readers may also want to note that SNOW is a company with immense Stock-Based Compensations, with the $1.16B reported in FY2024 (+35.5% YoY/ +1389.8% from FY2020 levels of $78.40M) naturally leading to the bloat observed in its share count at 328M (+9.27M YoY/ +283.15M from FY2020 levels of 44.85M).

As a result of the sustained shareholder erosion, we are not certain if it is wise to chase SNOW here, especially given the projected slowdown in its top-line expansion.

So, Is SNOW Stock A Buy, Sell, Or Hold?

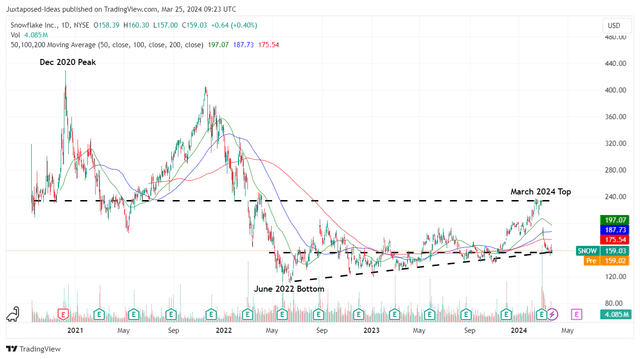

SNOW 3Y Stock Price

TradingView

For now, SNOW has dramatically returned much of its YTD gains while losing -32.2% or the equivalent -$24.42B of its Enterprise Value since the release of its FQ4’24 earnings call, partly also attributed to the key management’s sudden departure.

It is apparent from these developments that with elevated valuations come great expectations, with the underwhelming forward guidance already bringing forth painful corrections.

At the same time, it remains to be seen if SNOW is able to maintain its (still) premium valuations, with the impacted forward guidance implying slowing Storage/ Compute consumption and declining market share to competitors.

Readers must also note that the management expects to see “increased commission expense” from the consumption-based pricing model, with it expected to trigger an approximate “$30M impact to its P&L” and, very likely, the increase of its SBC expenses.

As a result of the near-term uncertainty during the transitionary period, we prefer to rate the SNOW stock as a Hold here.

It may be better to observe its execution for a few more quarters before jumping in, since the stock may very well trade sideways as it grows into its premium valuations.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.