Qualcomm: New Growth Opportunities As It Launches Competitive CPU/Smartphone Chipsets

Summary:

- With Mckinsey estimating a total economic benefits of up to $7.9T annually from Generative AI alone, it is unsurprising that the consortium hopes to “loosen NVDA’s 20Y lead.”

- It goes without saying that the intensified R&D investments may potentially trigger bottom line headwinds to QCOM, even though it remains relatively well capitalized thus far.

- Then again, QCOM’s 2021 acquisition of Nuvia has proven fruitful, attributed to the introduction of its custom Qualcomm Oryon CPU with X Elite chips in October 2023.

- The next-gen smartphone Snapdragon 8 Gen 4 chip is also rumored to exceed AAPL A18 chips’ capabilities in a single-core test, potentially sustaining its market leadership in the smartphone segment.

- As a result of the new growth opportunities, QCOM offers a relatively attractive risk/ reward ratio for growth and dividend oriented investors.

Eoneren

We previously covered QUALCOMM (NASDAQ:QCOM) in January 2024, discussing why it remained well poised to grow through the decade, thanks to the bottoming of the handset and automotive markets.

This was significantly aided by the renewed 5G modem contract with AAPL, its entry into the fiber broadband carrier market, and the upcoming super cycle for the next-gen spatial computing platform, resulting in our Buy rating despite the immense rally then.

In this article, we shall discuss why we are maintaining our Buy rating for the QCOM stock, with it currently trading near our fair value estimates while still offering a (prospective) dual pronged return through capital appreciation and dividend payouts.

In addition, readers may look forward to the exciting launch of its ARM-based CPU offerings by H2’24, which have been touted to offer improved performance and power efficiencies compared to its direct competitors.

This may potentially trigger a new phase of breakthrough for the company, usually touted as a mere smartphone chipset maker.

The QCOM Investment Thesis Looks Even More Promising Here

The generative AI hype is real indeed, given the massive boost observed in Nvidia’s (NVDA) sales by +125.8% YoY from $26.97B in FY2023 to $60.92B in FY2024, with much of the tailwinds attributed to its market leading GPUs and the CUDA software, with the latter often used to build AI and other apps.

With Mckinsey estimating a total economic benefits of up to $7.9T annually from Generative AI alone, it is unsurprising that multiple semiconductor and Big-Tech companies have come together in the hopes of “loosening NVDA’s 20Y lead on the CUDA software platform,” QCOM included.

As a result of the ambitious consortium, we may see QCOM’s R&D expenses grow moving forward, up from the $8.81B reported in FY2023 (+7.5% YoY) and the equivalent 24.5% of its revenues (+6 YoY), against the 24.5% reported in FY2023 and 22.2% in FY2019.

When compared to NVDA at 14.2% (-12.9 points sequentially), Advanced Micro Devices (AMD) at 25.8% (+4.7 points sequentially), and Intel (INTC) at 29.5% (+12.1 points sequentially) over the last twelve months, it is apparent that QCOM is not alone in its endeavor after all.

It goes without saying that the intensified R&D investments may potentially trigger bottom line headwinds to QCOM.

For now, QCOM appears to be well capitalized to embark on such a path, based on the growing cash on balance sheet at $12.05B (+6.4% QoQ/ +46.4% YoY) and moderating long-term debts of $14.56B (inline QoQ/ -5.6% YoY).

This naturally triggers its healthier debt-to-EBITDA ratio of 1.09x in FQ1’24, compared to 1.47x in FQ4’23, 1.31x in FQ1’23, and 1.41x in FY2019.

In addition, QCOM guided FQ2’24 revenues of $9.3B (-6.2% QoQ/ inline YoY) and adj EPS of $2.30 (-16.3% QoQ/ +6.9% YoY) at the midpoint, well exceeding the consensus estimates of $9.28B (-6.4% QoQ/ inline YoY) and $2.25 (-18.1% QoQ/ +4.6% YoY), respectively.

This implies that its Handset and Automotive headwinds may finally be behind us, with FY2024 further aided by the refresh cycle tailwinds as more upgrade their hardware with improved “on-device gen AI and copilot experiences.”

Readers must also note that QCOM’s 2021 acquisition of Nuvia has proven fruitful, attributed to the introduction of its custom Qualcomm Oryon CPU with X Elite chips in October 2023.

Early numbers appear to be rather promising, with the new X Elite chips supposedly outperforming the latest generation x86 processors from its direct competitors, namely INTC’s 13th generation Core i7-13800H and AMD’s Ryzen 9 7940HS, both released in early 2023.

For context, INTC’s 14th gen processors, Meteor Lake, was only officially launched on December 14, 2023.

In addition, X Elite chip’s ARM platform directly competes with Apple’s (AAPL) M2 series in performance and power efficiency, with it also offering consumers the long awaited ARM-based Windows chips.

Assuming that QCOM is able to deliver the market-leading performance at a competitive price point, we may see the company report excellent sales once the platform is launched by October 2024.

Readers must also note that the management is aiming to launch the next-gen smartphone Snapdragon 8 Gen 4 chip then, with it rumored to exceed AAPL A18 chips’ capabilities in a single-core test, potentially sustaining its leadership in the smartphone market in the long-term.

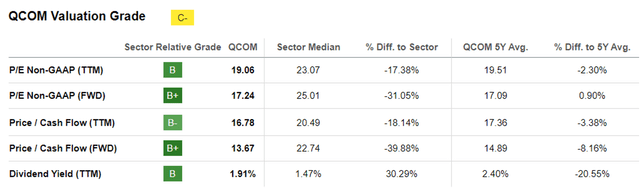

QCOM Valuations

Seeking Alpha

As a result of the new growth opportunities through CPUs and sustained market leadership in the smartphone segment, we can understand why QCOM at a FWD P/E of 17.24x and FWD Price/ Cash Flow of 13.67x has been re-rated closer to its 3Y pre-pandemic mean of 16.78x/ 17.5x and the sector median of 25.01x/ 22.74x, respectively.

Even so, we believe that QCOM is merely fairly valued here, especially in comparison to other connectivity semiconductor stocks such as Broadcom (AVGO) 28.60x/ 29.22x and ON Semiconductor (ON) at 17.14x/ 10.60x, respectively.

It goes without saying that QCOM appears undervalued compared to its CPU peers, namely INTC at 30.74x/ 11.85x and AMD at 48.79x/ 94.14x, respectively.

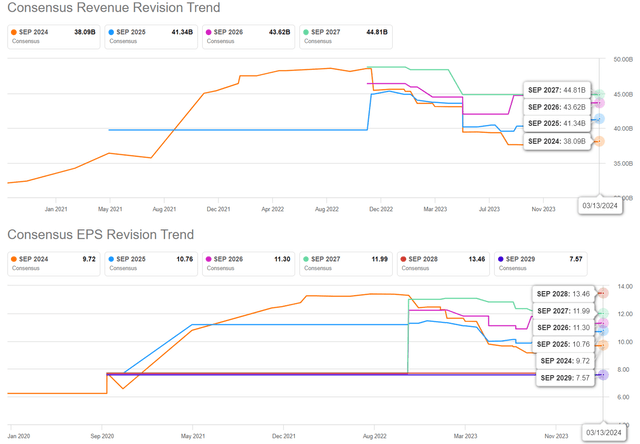

The Consensus Forward Estimates

Seeking Alpha

The same upgrade has also been reflected in the consensus forward estimates, with QCOM expected to report an accelerated top/ bottom line expansion at a CAGR of +6.8%/ +10.3% through FY2026.

This is compared to the previous estimates of +5.4%/ +8.8% and the historical expansion at a CAGR of +6.2%/ +9.6% between FY2016 and FY2023, respectively.

It is apparent from these numbers that the market is also optimistic about QCOM’s intermediate term prospects, naturally underscoring why the stock’s valuations have been upgraded from the October 2023 bottom P/E of 12.43x and Price/ Cash Flow of 10.35x.

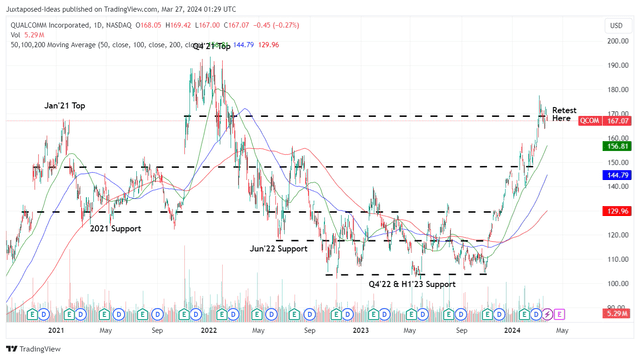

So, Is QCOM Stock A Buy, Sell, Or Hold?

QCOM 3Y Stock Price

TradingView

For now, QCOM has further rallied by +21.9% since our previous article, breaking out of its 50/ 100/ 200 day moving averages while outperforming the wider market at +10.6%.

Based on the LTM adj EPS of $8.79 and the FWD P/E valuation of 17.24x, the stock appears to be trading near our fair value estimate of $151.50. Based on the consensus FY2026 adj EPS estimates of $11.30, there seems to be an excellent upside potential of +16.5% to our long-term price target of $194.80 as well.

While QCOM may not the typical dividend stock, with its forward yields of 2.03% being lower than the US Treasury Yields of between 4.22% and 5.35%, readers must also note that the management recently raised their quarterly payouts by +6.3% to $0.85 per share.

Combined with the consistent share repurchases to balance the growing share based compensations, we believe that the stock remains shareholder friendly for those looking to add.

As a result of the relatively attractive risk/ reward ratio, we are maintaining our Buy rating for the QCOM at every dips.

Interested investors may consider waiting for a moderate pullback to its previous support levels of $150s for an improved margin of safety.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of QCOM, NVDA, INTC, AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.